The Palm Beach housing market is poised for continued growth, fueled by ongoing demand from both local and out-of-state buyers. Despite challenges such as inventory constraints and rising mortgage rates, the market remains resilient, supported by factors such as the allure of the Florida lifestyle and the area's economic stability.

Looking ahead, market stakeholders anticipate a balanced market between buyers and sellers, with opportunities for both parties. While inventory levels may continue to be a concern in the short term, initiatives to boost housing supply and meet growing demand are underway, offering hope for a more balanced and sustainable market in the future.

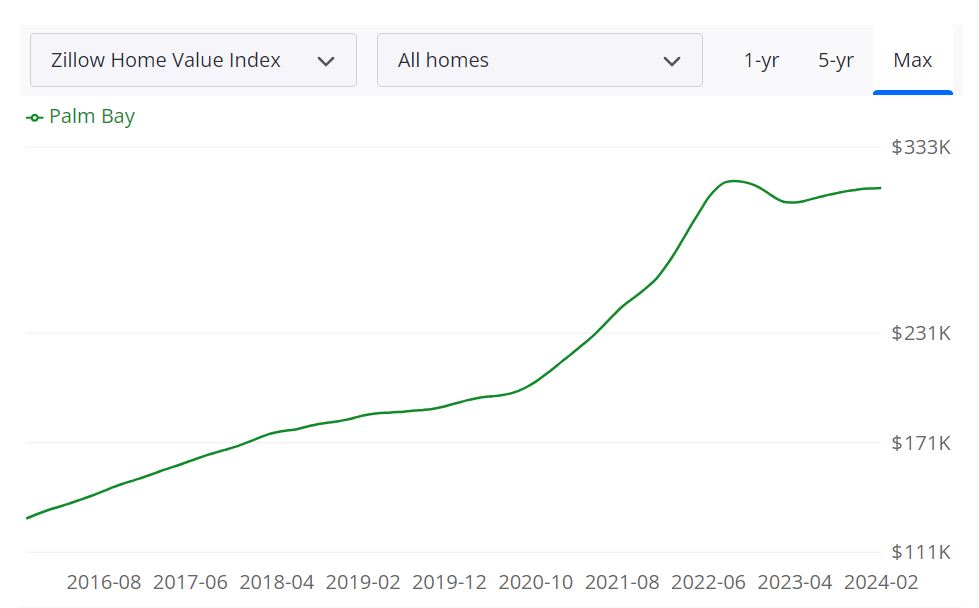

Palm Bay Housing Market Trends 2024

Key Takeaways

- Home Prices: As of August 2024, the median home price in Palm Bay is approximately $330,000.

- Home Sales: Homes are selling slower, averaging around 69 days on the market.

- Housing Supply: While there are fluctuations, recent data shows a decrease in the inventory of certain types of homes.

- Market Trends: Year-over-year trends indicate mixed signals, with slight decreases in price and changes in demand.

Home Sales

The Palm Bay housing market has seen varying trends in home sales. As of August 2024, homes in Palm Bay sold for an average of $330,000, which is a 1.5% decrease compared to the previous year. This decline can suggest a slight cooling in what was once a robust seller’s market. A noteworthy point is that homes are taking about 69 days to sell, which is an increase from the faster turnover rates observed in prior years.

This slowdown can be attributed to several factors including rising interest rates, which have made financing a home purchase less attractive for many buyers. Moreover, the inventory of homes on the market has fluctuated. For instance, in August 2024, there has been a decrease of about 12.5% in the inventory of one-bedroom homes, indicating a tighter market for smaller properties (Redfin).

Home Prices

In the Palm Bay housing market, prices have remained relatively stable over recent months, although current data indicates some downward pressure. The average home value stands at around $312,765, representing a 0.3% decrease from the previous year. Moreover, the median listing price in August 2024 was reported to be approximately $349,900, which is flat compared to the previous year (Realtor.com).

The stability in home prices can be somewhat reassuring for both buyers and sellers. For sellers, it means there is still demand in certain price brackets, while buyers may find opportunities due to prices not showing rapid escalation as seen in past years. However, potential buyers should remain cautious, as fluctuations in home prices can significantly impact affordability and investment potential.

Housing Supply

The housing supply in Palm Bay has demonstrated interesting trends, particularly as various segments of the market react to shifting demands. In August 2024, there was a notable decrease in inventory for one-bedroom and two-bedroom homes, while the overall inventory for all types of homes has had mixed results (Rocket Homes).

This tightening of supply can create a competitive environment, particularly for entry-level homes and condos that appeal to first-time buyers. On the other side, larger single-family homes have seen a different response, with some segments showing slower sales. This can be indicative of shifting buyer preferences, moving away from larger spaces due to lifestyle changes or financial constraints.

Another aspect to consider is the impact of new construction in the area. Although new developments are in progress, they often take time to materialize fully, which means that existing homes could remain in higher demand until new options become available.

Palm Bay Housing Market Forecast

Moving beyond the numbers, the broader market trends in Palm Bay are reflective of economic shifts occurring both locally and nationally. As of late 2024, economists have noted stability regarding future price increases in Palm Bay, with predictions indicating a moderate growth of just 0.8% by August 2025. This sentiment can impact buyer confidence and lead to more negotiations in the sale process.

There's also a larger conversation about demographic shifts as people migrate to Florida, drawn by the favorable climate and lifestyle. This influx has created a blend of demand, affecting all layers of the housing market. However, the rising interest rates and economic uncertainties have tempered the once-hot demand, suggesting that today's market requires a careful evaluation by all parties involved.

In summary, while the Palm Bay FL housing market trends signal certain challenges like decreasing prices and increased days on the market, there are still opportunities for both buyers and sellers to make informed decisions. Regardless of personal circumstances, understanding these factors can provide essential insights to navigate the current real estate scene effectively.

This graph illustrates the growth of home values in the region over the past year, along with a forecast suggesting this trend will likely continue for the next year.

Investing in Palm Beach Real Estate Market

1. Population Growth and Trends

Investors eyeing the Palm Beach real estate market can find promise in the city's population growth and trends. The region has experienced sustained population growth, driven in part by in-migration from states like New York, California, and New Jersey. This influx of residents contributes to a robust and expanding housing market, offering a potentially lucrative landscape for real estate investors.

2. Economy and Job Opportunities

The city's economy and job market are critical factors for real estate investors. Palm Beach County boasts a diverse and flourishing economy, with a particular emphasis on a robust luxury market. Additionally, the presence of jobs in various sectors, including real estate, healthcare, and tourism, provides a stable foundation for the real estate market. The economic vitality of the region enhances the potential for property appreciation and sustained rental demand, making it an attractive prospect for investors.

3. Livability and Quality of Life

Livability is a key consideration for real estate investors. Palm Beach offers a high quality of life, featuring beautiful beaches, cultural attractions, and a pleasant climate. The city's desirability as a place to live can positively impact property values and rental demand. As investors evaluate potential markets, the overall livability and attractiveness of Palm Beach contribute to its investment appeal.

4. Rental Property Market Size and Growth

The size and growth of the rental property market are crucial for investors seeking long-term returns. Palm Beach County's surging interest in mid-market homes, coupled with sustained population growth, contributes to a growing rental market. Investors can tap into this demand by providing rental properties catering to diverse segments of the population. The city's popularity among both permanent residents and seasonal visitors further enhances the potential for a thriving rental market.

5. Other Factors Related to Real Estate Investing

- Mortgage Rates: While mortgage rates have risen, understanding the current rates and their potential impact on buyer behavior is essential for investors. The bifurcated growth in the housing market, as highlighted by MIAMI REALTORS® Chief Economist Gay Cororaton, emphasizes the importance of recognizing these trends for strategic investment decisions.

- Inventory Dynamics: Palm Beach's inventory challenges, with a significant decrease from pre-pandemic levels, create a seller's market. Investors should consider the supply-demand dynamics when assessing investment opportunities.

- Market Appreciation: The historical appreciation in median home prices and the city's attractiveness for wealth migration contribute to the potential for real estate market appreciation, providing a favorable environment for investors seeking capital appreciation.

- Economic Impact: The real estate market's contribution to the local economy, as reflected in the economic impact of home sales, adds another layer of consideration for investors evaluating Palm Beach. A thriving real estate market can have a positive cascading effect on various industries, further supporting investment prospects.

Considering Palm Beach's population growth, economic vibrancy, livability, rental market dynamics, and various other factors, the city presents a compelling case for real estate investors. The sustained demand for properties, coupled with the region's overall desirability, positions Palm Beach as an attractive destination for both short-term gains and long-term investment success.