Nestled on the eastern shores of Lake Washington, Kirkland has emerged as a vibrant and dynamic hub for discerning homebuyers and investors. Renowned for its picturesque waterfront setting, exceptional schools, and proximity to employment centers like Seattle and Redmond, Kirkland offers a compelling blend of urban convenience and suburban charm.

Kirkland's housing market has experienced remarkable growth in recent years, driven by its strong economic fundamentals, appealing lifestyle, and limited land availability. Kirkland's housing landscape encompasses a diverse range of properties, catering to a wide spectrum of buyers. From charming single-family homes to luxurious condominiums, there's an ideal residence to suit every taste and budget.

Currently, the Kirkland housing market overwhelmingly favors sellers. With homes selling rapidly and often above the list price, sellers hold the upper hand in negotiations. Buyers must act swiftly and decisively to secure their desired properties in the face of intense competition.

Factors Fueling Kirkland's Appeal

- Exceptional Schools: Kirkland boasts a top-rated public school system, consistently ranking among the best in the state.

- Thriving Economy: Kirkland is home to a diverse array of businesses, including major tech companies like Amazon and Google.

- Abundant Amenities: Kirkland offers a wealth of amenities, including parks, trails, waterfront attractions, and a vibrant downtown core.

- Proximity to Seattle: Kirkland's convenient location provides easy access to Seattle's world-class attractions and employment opportunities.

As Kirkland continues to attract new residents and businesses, its housing market is poised for continued growth. With its strong economic foundation, desirable lifestyle, and limited housing supply, Kirkland remains an attractive destination for homebuyers and investors seeking a thriving and dynamic community.

Kirkland Housing Market Trends in 2024

How is the Housing Market Doing Currently?

According to Redfin, in February 2024, the Kirkland housing market exhibited remarkable growth, with home prices soaring by 56.0% compared to the previous year. The median price for homes reached an impressive $1.4 million, reflecting a substantial increase. Notably, homes in Kirkland are selling at a much faster rate than before, spending an average of 6 days on the market compared to 18 days last year. This surge in demand is evident from the 93 homes sold in February 2024, marking a notable increase from 82 sales during the same period in the previous year.

How Competitive is the Kirkland Housing Market?

Kirkland stands out as one of the most competitive housing markets in the region. Homes are flying off the market at an astonishing pace, with the majority selling within just 5 days. Moreover, the competition is fierce, with most homes receiving multiple offers, often accompanied by waived contingencies. The average selling price also exceeds the list price by approximately 3%, with homes typically going pending in about 5 days. For properties deemed as hot commodities, they can sell for approximately 6% above the list price and go pending in a mere 3 days.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the high demand, the Kirkland housing market faces challenges in meeting the needs of eager buyers. While the market is bustling with activity, the supply of available homes is not keeping pace with the demand. This scarcity is reflected in the high level of competition and the rapid pace at which homes are being snapped up. Additionally, data shows that only 14.5% of homes experienced price drops, indicating a limited inventory and a seller's market scenario.

What is the Future Market Outlook?

Looking ahead, the future of the Kirkland housing market appears promising yet challenging. The current trend of soaring prices and fast-paced sales is expected to continue, driven by robust demand and limited supply. However, there may be concerns regarding affordability and accessibility for prospective buyers. The market may witness slight adjustments as it strives to maintain equilibrium between supply and demand.

Examining migration and relocation trends provides further insight into the Kirkland housing market. In the first quarter of 2024, 21% of homebuyers expressed interest in moving out of Kirkland, while the majority, constituting 79%, sought to remain within the metropolitan area.

Interestingly, Kirkland continues to attract attention from individuals relocating from outside metros, with 3% of homebuyers searching to move into the area. Among these, San Francisco emerges as the primary source of incoming homebuyers, followed closely by New York and Washington.

Kirkland Housing Market Forecast for 2024 and 2025

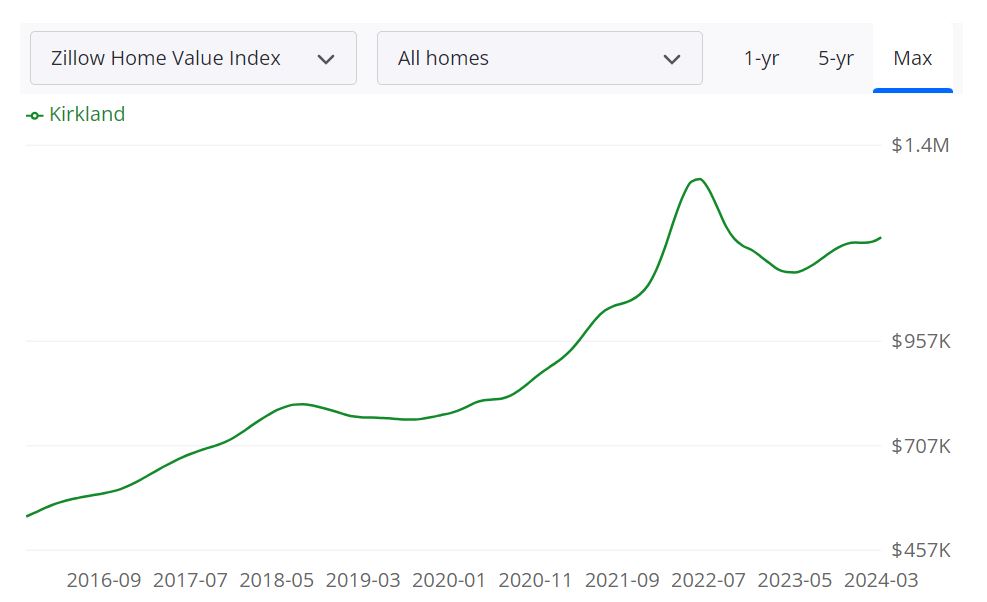

According to Zillow, the average home value in Kirkland stands at $1,205,929, reflecting a 55.4% decrease over the past year. Additionally, homes in Kirkland tend to go pending in a remarkably swift 6 days, underlining the competitive nature of the market.

Key Housing Metrics Explained

Let's break down some essential housing metrics to gain a deeper understanding of Kirkland's real estate market:

- For Sale Inventory (March 31, 2024): This metric indicates the total number of homes available for sale in Kirkland as of March 31, 2024. It serves as a barometer of market activity and inventory levels.

- New Listings (March 31, 2024): The number of newly listed properties in Kirkland provides insights into the market's growth and the influx of available inventory. It signals potential opportunities for buyers and increased competition among sellers.

- Median Sale to List Ratio (February 29, 2024): This ratio represents the median percentage of the sale price compared to the listing price. A higher ratio indicates that homes are generally selling closer to or above their listed prices, reflecting a competitive seller's market.

- Median List Price (March 31, 2024): The median list price denotes the midpoint of all listed home prices in Kirkland as of March 31, 2024. It provides valuable insights into pricing trends and market affordability for potential buyers.

- Percent of Sales Over List Price (February 29, 2024): This percentage indicates the portion of home sales in Kirkland that closed above the listed price. It underscores the competitiveness of the market and the willingness of buyers to pay premiums for desirable properties.

- Percent of Sales Under List Price (February 29, 2024): Conversely, this metric reflects the percentage of home sales in Kirkland that closed below the listed price. It can indicate negotiation leverage for buyers and potential pricing adjustments by sellers.

Are Home Prices Dropping in Kirkland?

Despite the 55.4% decrease in the average home value over the past year, it's important to note that this figure can be influenced by various factors such as market fluctuations, inventory levels, and economic conditions. While individual property prices may experience fluctuations, Kirkland's overall housing market remains competitive, with prices generally reflective of the high demand and limited supply.

Will the Kirkland Housing Market Crash?

Forecasting a housing market crash requires a comprehensive analysis of various economic indicators, market trends, and external factors. While Kirkland's housing market has experienced fluctuations in the past, including the recent decrease in home values, there is currently no definitive indication of an imminent crash. However, it's advisable for buyers, sellers, and investors to stay vigilant and monitor market conditions closely.

Is Now a Good Time to Buy a House in Kirkland?

Whether now is a good time to buy a house in Kirkland depends on individual circumstances, financial readiness, and long-term goals. Despite the competitive nature of the market and rising prices, favorable mortgage rates and potential investment opportunities may make it an attractive time for some buyers. However, it's essential to conduct thorough research, consider affordability, and consult with real estate professionals to determine the best course of action.