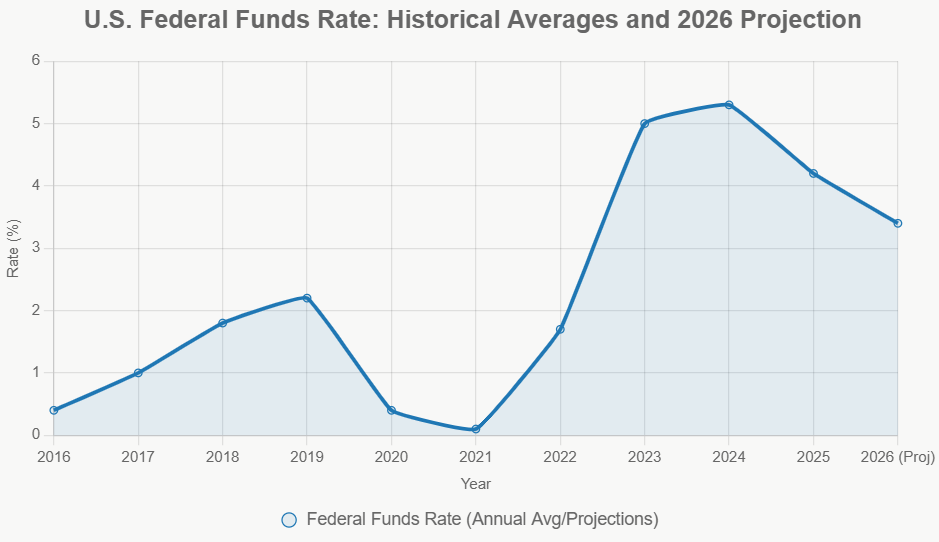

Well, it looks like that recent jobs report has thrown a bit of a wrench into the plans for any quick interest rate cuts by the Federal Reserve this year. The latest numbers showed a significantly healthier job market than anyone expected, which means the Fed is likely to stick to its guns and keep rates higher for longer.

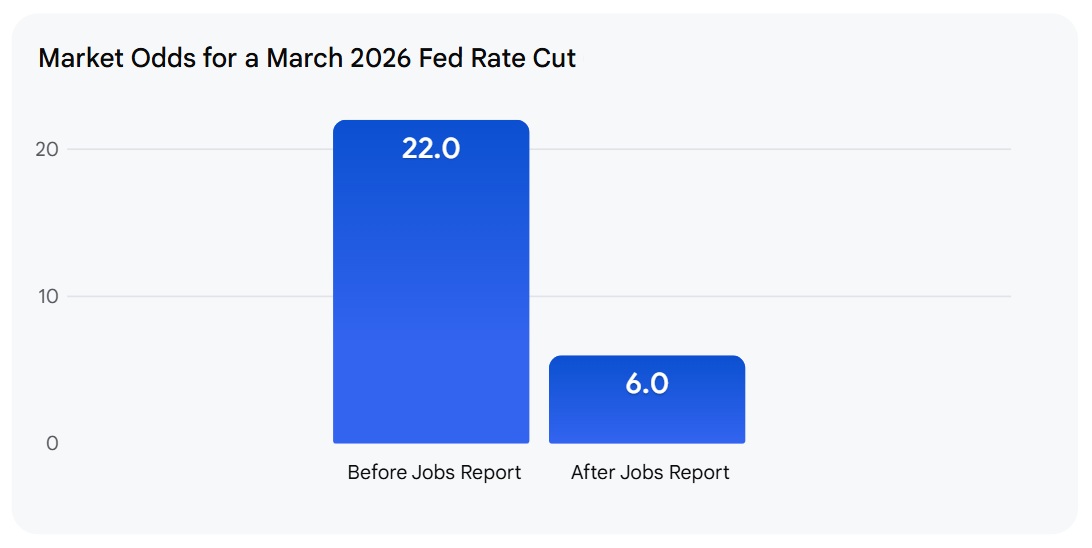

This jobs report is a classic example of how one set of data can completely change the narrative. Before this news, the market was pretty much betting on the Fed starting to lower interest rates sooner rather than later. Now? Those bets have been significantly scaled back, and everyone's talking about an “extended pause” in cutting rates. It’s a real swing, and it means the cost of borrowing money might stay higher for much of 2026.

How Yesterday’s Jobs Report Shifted 2026 Fed Rate Cut Odds

The Jobs Report That Shook Things Up

Let's break down what happened. The report for January showed the economy added a whopping 130,000 jobs. Now, most economists were only expecting around 70,000. That's nearly double what was predicted! This is a big deal because it tells the Fed that the economy is chugging along pretty well on its own. It doesn't feel like it needs a big jolt from lower interest rates right now.

What this means for Fed rate cuts:

- March Meeting: Before this report, there was a decent chance, about 22%, that the Fed would cut rates at its March meeting on the 18th. Now? That probability has crashed down to just 5-6%. It's almost as if the market is saying, “Nope, not happening.”

- When will the first cut come? Traders are now pushing back their predictions for the first rate cut of 2026. Instead of early in the year, July is looking like the more likely starting point. This is a pretty significant shift.

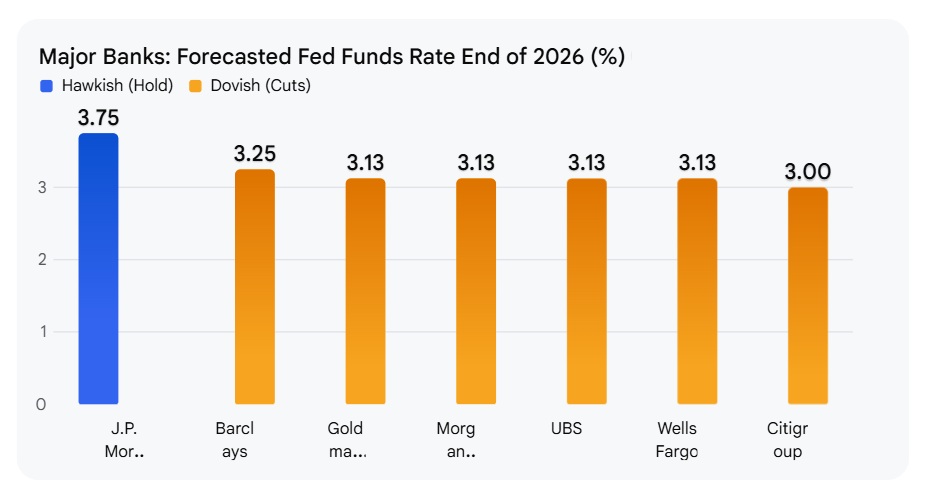

- How much will rates fall? Even though folks still think interest rates might end up around 3% by the end of the year, the speed at which they get there is now expected to be much, much slower.

Digging Deeper into the Numbers

Why did this report have such a big impact? It comes down to a few key details:

- Unemployment Rate Dips: The unemployment rate actually went down a tiny bit, from 4.4% to 4.3%. While it might seem like a small change, for the Fed, this is more “cover” to keep rates where they are. A falling unemployment rate signals a strong labor market that doesn't need urgent help.

- Where the Jobs Are: It’s interesting to see where these new jobs are coming from. A huge chunk came from healthcare (82,000 new jobs) and construction (33,000 new jobs). These are areas that often reflect ongoing demand. On the flip side, some white-collar sectors, like financial activities, are still showing slow growth or stagnation. This hints at a mixed economic picture, but the overall job growth is undeniable.

- Markets React: You could see the impact on the bond market almost immediately. The yield on the 10-year Treasury note, which is a big indicator of future interest rate expectations, jumped to 4.16%. This tells you investors are adjusting their expectations, betting on that “higher-for-longer” scenario for interest rates.

What Does the Fed Even Want? Understanding the Dual Mandate

To really get why this jobs report matters, it helps to remember the Fed's main goals. They have what's called the “dual mandate” from Congress. It means they are tasked with two primary economic objectives:

- Maximum Employment: This is about having as many people working as possible without causing prices to shoot up too much. It's not a fixed number, like saying unemployment must be exactly 3.5%. It changes based on how the economy is doing.

- Stable Prices: This is what most people think of as controlling inflation. The Fed aims for inflation to be around 2% over the long run, usually measured by a price index called the PCE.

These two goals are like a balancing act. If the economy is weak and people aren't getting jobs, the Fed might lower interest rates to make it cheaper for businesses to borrow money and hire more people. But if the economy is running too hot and prices are going up too fast (inflation), the Fed will raise interest rates to make borrowing more expensive, which cools down spending and helps bring inflation back under control.

Looking Ahead: What's Next?

So, where do we go from here? The Fed is always watching the economic data closely, and the next big piece of information to look out for is the Consumer Price Index (CPI) report, which is due out soon. Economists are saying that if the CPI shows a significant drop in inflation, or if there's some other kind of “emergency message” coming out of the labor market data, then we might start to see the case for immediate rate cuts get stronger again.

But based on this latest jobs report, it seems like the Fed has a good reason to hold its breath and maintain the current interest rate policy. My take is that they'll want to see a few more months of solid data confirming this strong employment trend and, critically, a continued moderation in inflation before they feel comfortable enough to start cutting rates. It’s important to remember that the Fed is cautious by nature; they've been burned before by cutting rates too soon and reigniting inflation. This jobs report just gives them more reason to be on the safe side.

It’s a reminder that the economy doesn't always move in a straight line, and sometimes strong positive news in one area can create headwinds in another, like pushing back those eagerly awaited rate cuts.

The Fed’s rate decisions can create market volatility, but turnkey rentals continue to deliver reliable cash flow and appreciation. Investors in 2026 are focusing on real estate as a hedge against uncertainty.

Norada Real Estate helps you secure turnkey properties designed for immediate income and long‑term growth—so your portfolio stays strong regardless of Fed policy shifts.

Want to Know More?

Explore these related articles for even more insights:

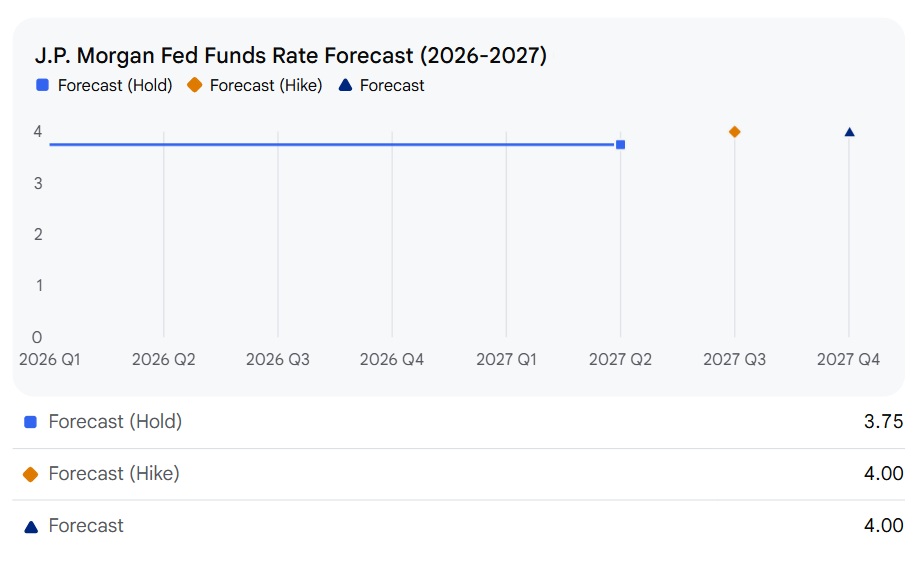

- J.P. Morgan Predicts No Fed Rate Cuts Before 2027 as Inflation Persists

- No Fed Rate Cut: Interest Rates Remain Unchanged in January 2026

- Fed Interest Rate Predictions for the Next 3 Years: 2026-2028

- The Fed After Jerome Powell: Who Could Drive Rate Cuts in 2026?

- Why Your Loan Payment Isn’t Budging Despite Recent Fed Rate Cut

- How Does the Recent Fed Rate Cut Impact Your Personal Finances

- How Will Today's Fed Rate Cut Impact Mortgage and Refinance Rates

- Fed Interest Rate Decision Today: Latest News and Predictions

- Fed Interest Rate Forecast for the Next 12 Months

- When is Fed's Next Meeting on Interest Rate Decision in 2025?

- Market Reactions: How Investors Should Prepare for Interest Rate Cut

- Impact of Interest Rate Cut on Mortgages, Car Loans, and Your Wallet