Have you ever wondered what's going on with home prices? Are they going up, down, or sideways? We'll break down the current housing market insights & predictions, so you know what to expect. We'll dive deep into the data, but don't worry; I'll explain everything in a way that's easy to understand, even if you're new to this whole real estate thing.

Housing Market Insights & Predictions – September 2024

Home Price Growth Moderates as Sales Remain Slow

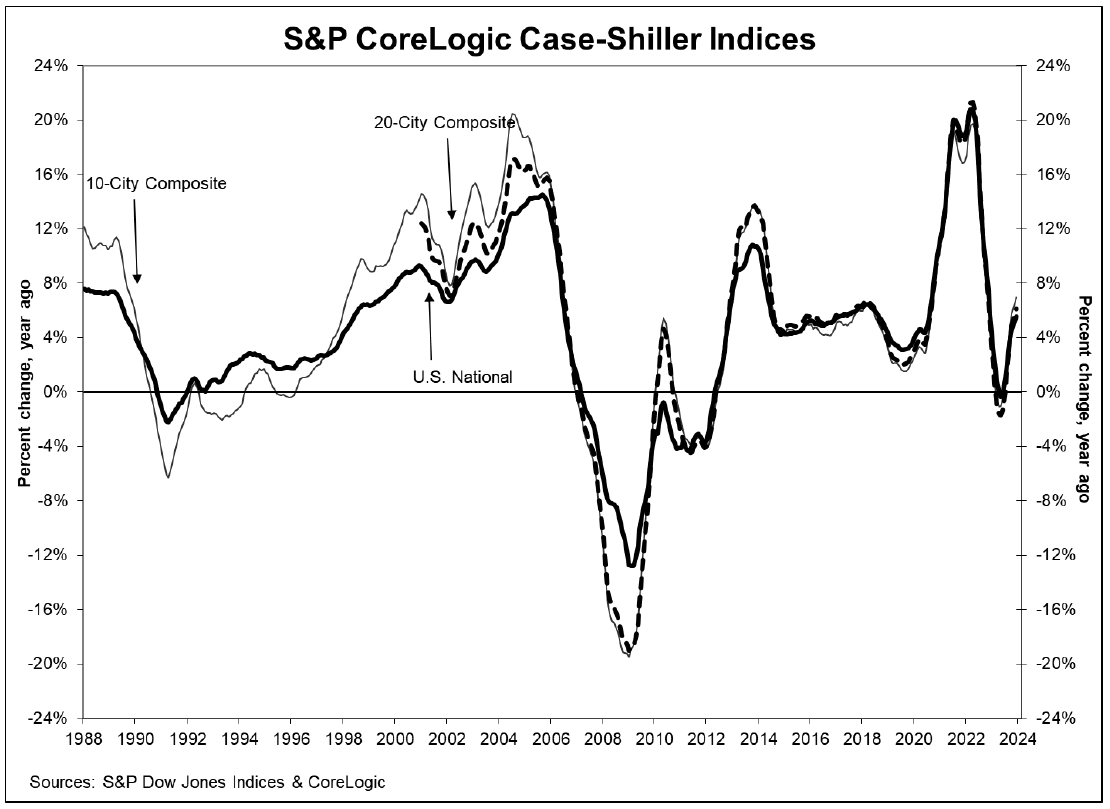

For a long time, home prices seemed to be on a one-way trip to the moon! But things are starting to change. While prices are still up compared to last year, they're not skyrocketing like they used to. In fact, according to CoreLogic, home prices across the U.S. went up by 4.3% in July 2024 compared to July 2023. That might seem like a lot, but it's actually slower growth than what we've seen recently.

Why the Slowdown?

One word: interest rates. They've been going up, making it more expensive for people to borrow money to buy a home. This has made some buyers hesitant, leading to fewer sales. However, there's a glimmer of hope! The Federal Reserve (the big guys who control interest rates) might lower them soon. This could make buying a home more affordable and give the market a little boost.

Dr. Selma Hepp, Chief Economist for CoreLogic, puts it this way: “Housing demand continued to buckle under the pressure of high mortgage rates and unaffordable home prices, leading to a considerable slowing of home price gains during the summer.”

What About the Future?

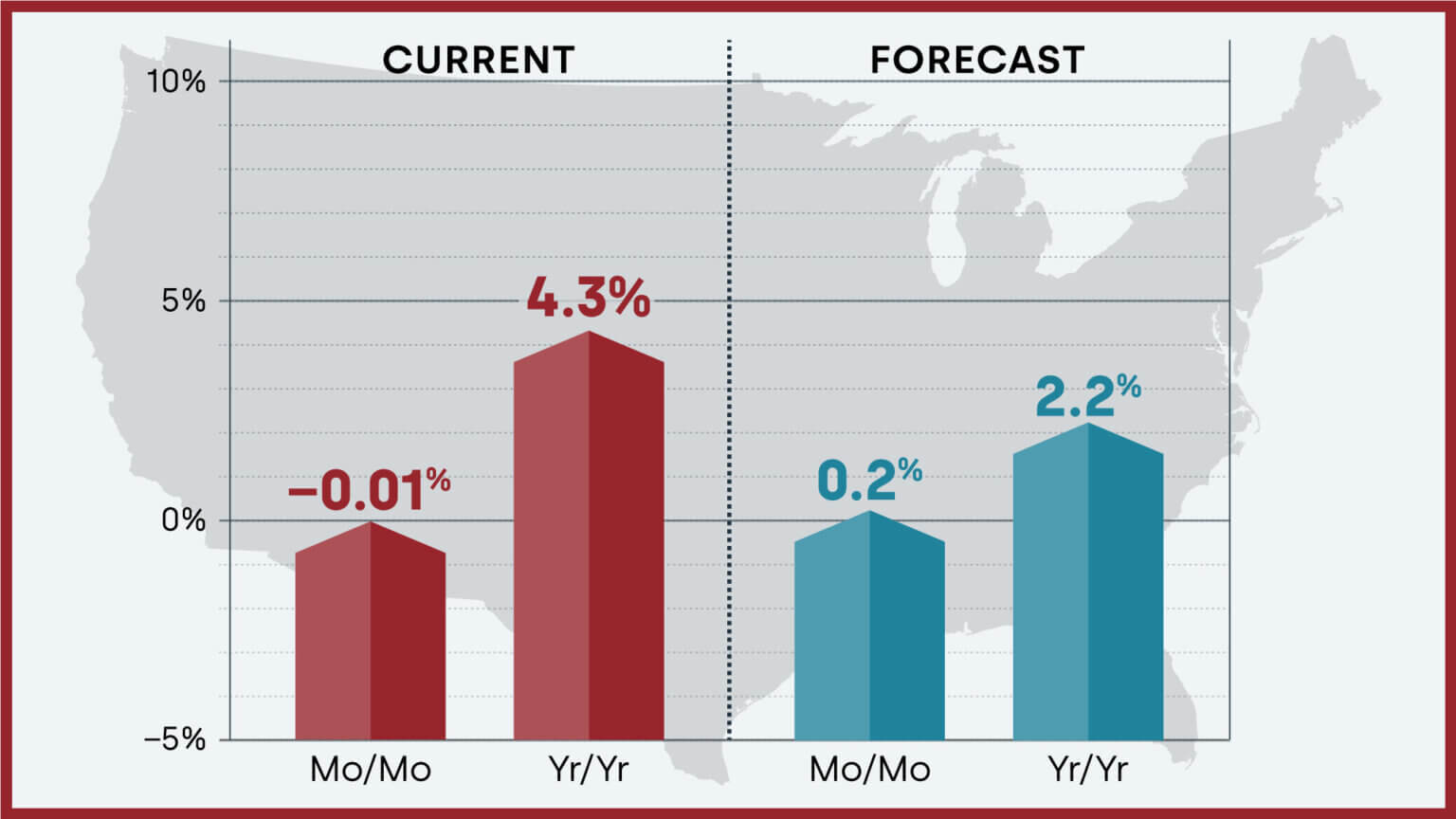

CoreLogic's housing market predictions suggest that prices will likely rise by just 0.2% from July 2024 to August 2024. Looking further ahead, they predict an increase of 2.2% between July 2024 and July 2025. These are just predictions, though, and things could change.

Here’s a quick look at the national forecast:

- July 2024 to August 2024: Home prices expected to rise by 0.2%.

- July 2024 to July 2025: Home prices expected to rise by 2.2%.

Regional Differences

It's important to remember that the housing market isn't the same everywhere. Some places are hot, while others are cooling down. Here's a look at some interesting regional data:

States with the highest year-over-year home price increases (July 2023 to July 2024):

- Rhode Island: 10.6%

- New Jersey: 9.7%

- Connecticut: 8.3%

- South Dakota: 8.1%

- Illinois: 7.5%

Metro area with the highest year-over-year home price increase (July 2023 to July 2024):

- Miami: 9.1% increase

- Chicago: 7.2% rise

- Las Vegas: 7.0% growth

- Boston: 5.5% uptick

- Washington D.C.: 5.0% increase

- San Diego: 6.2% jump

- Los Angeles: 4.0% increase

- Phoenix: 3.5% growth

- Houston: 2.0% rise

- Denver: 1.4% increase

Markets at high risk of home price declines:

- Gainesville, FL

- Palm Bay-Melbourne-Titusville, FL

- Atlanta-Sandy Springs-Roswell, GA

- Lakeland-Winter Haven, FL

- Ogden-Clearfield, UT

What Does It All Mean?

The housing market can be confusing, but understanding the basics can help you make informed decisions. Here are a few key takeaways:

- The market is cooling down: Home price growth is slowing, and sales are down.

- Interest rates are a big factor: High rates make buying more expensive, which impacts demand.

- Location matters: Some areas are seeing strong price growth, while others are at risk of declines.

Keep an Eye Out for…

- Changes in interest rates: Lower rates could stimulate the market.

- The economy: A strong economy usually means a strong housing market.

- Inventory levels: More homes for sale could ease price pressure.

ALSO READ:

- Housing Market Predictions for the Next 4 Years: 2024 to 2028

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- Is the Housing Market on the Brink in 2024: Crash or Boom?

- 2008 Forecaster Warns: Housing Market 2024 Needs This to Survive

- Housing Market Predictions for the Next 2 Years

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?

- Housing Market Predictions for Next 5 Years (2024-2028)

- Housing Market Predictions 2024: Will Real Estate Crash?

- Housing Market Predictions: 8 of Next 10 Years Poised for Gains

- Trump vs Harris: Which Candidate Holds the Key to the Housing Market (Prediction)