The housing market in 2026 is shaping up to be a period of welcome, albeit measured, improvement for most people involved. While mortgage rates are likely to stay a bit higher than we've become accustomed to historically, better income growth and a gradual increase in available homes mean things will become more affordable for buyers and offer more options for renters.

Housing Market Predictions 2026 for Buyers, Sellers, and Renters

As we look ahead to 2026, the whispers about the housing market are growing louder, and the picture is becoming clearer. After a few years that felt like a rollercoaster – exciting for some, terrifying for others – I'm sensing a shift. It’s not going to be a sudden drop in prices or a return to the ridiculously low mortgage rates of the past, but it will be a move towards more balance. Think of it as the market catching its breath.

According to the economic research team at Realtor.com®, we're likely to see mortgage rates averaging around 6.3% in 2026. That's a slight dip from the expected 6.6% for 2025, but still higher than the 4% we saw between 2013 and 2019. But here's the key bit: home prices are still predicted to grow, by about 2.2% nationally by the end of next year. This might sound alarming, but the good news is that incomes and inflation are expected to climb faster than home prices. This widening gap is what will bring a much-needed boost to affordability.

As Realtor.com Chief Economist Danielle Hale put it, 2026 “should offer a welcome, if modest, step toward a healthier housing market.” I personally feel this is spot on. It’s a gradual return to a more sensible market, not a boom or bust.

Let’s break down what this means for you, whether you’re dreaming of owning a home, looking to sell, or currently renting.

For the Homebuyers of 2026: A Bit More Breathing Room

I know many of you have been feeling the pinch. High prices, low inventory, and soaring mortgage rates have made buying a home feel like an impossible task lately. The good news for 2026 is that it's going to get easier.

This video explainer breaks down housing market predictions for 2026—for buyers, sellers, and renters.

You’ll benefit from a few key things:

- Slightly Lower (but still elevated) Mortgage Rates: That predicted 6.3% average for mortgage rates is a real sigh of relief compared to recent spikes. While not historically low, it makes a difference in your monthly payments and overall borrowing costs.

- Improving Affordability: This is the big one. The typical monthly payment for a home is projected to fall by about 1.3% compared to this year. For the first time since 2022, the monthly payment for the average home is expected to be less than 30% of a household's income. This is the magic number for affordability, and hitting it means more people will be able to qualify for mortgages and afford their payments without stretching too thin. I've seen firsthand as a professional how breaking that 30% mark can really impact a buyer's life.

- More Homes on the Market: Inventory is set to grow by a healthy 8.9% in 2026. This means more choices for you! You won't have to rush into a decision or settle for the first thing you see. The market is moving closer to pre-pandemic levels of supply, which is fantastic. By the end of 2026, inventory levels should be only about 12% below pre-2020 averages.

- New Construction Helping Out: Expect about 1 million new single-family homes to be built. This adds even more options to the market, especially for those looking for brand-new spaces.

Table: Key Factors for Homebuyers in 2026

| Factor | 2026 Forecast | Impact on Buyers |

|---|---|---|

| Mortgage Rates | Average 6.3% (vs. ~6.6% in 2025) | Lower monthly payments than 2025, but still historically higher. |

| Affordability | Monthly payment < 30% of median income | Improved access to homeownership, less financial strain. |

| Home Prices | +2.2% national growth | Modest gains, but incomes growing faster means real affordability improves. |

| Inventory | +8.9% growth (closer to pre-pandemic levels) | More choices, less competition, more negotiation power. |

| New Construction | +3.1% single-family starts | Adds to overall supply, offering new and modern options. |

| Unemployment | Expected to stay below 5% | Generally stable job market supports buyer confidence, though lower-income groups may be more vulnerable. |

While the unemployment rate is expected to tick up slightly, staying below 5% is a good sign for the overall economy and supports buyer confidence. However, I do agree with the Realtor.com® report – those with lower incomes or who are younger might still find parts of the market challenging as the labor market cools.

Ultimately, for buyers, 2026 looks like a year where you can breathe a little easier. The market will still require smart decisions and realistic expectations, but the overwhelming pressure should start to ease.

For the Home Sellers of 2026: Patience and Pragmatism are Key

If you're thinking about selling your home in 2026, it's crucial to understand that the market is shifting away from the red-hot seller's market we saw a few years ago. This isn't a bad thing, but it does mean adjusting your strategy.

From my perspective, sellers will need to be more strategic and go into the process with realistic expectations. Here’s what you should keep in mind:

- Competition is Growing: With more inventory available, buyers will have more options. This means your home will be competing with others on the market.

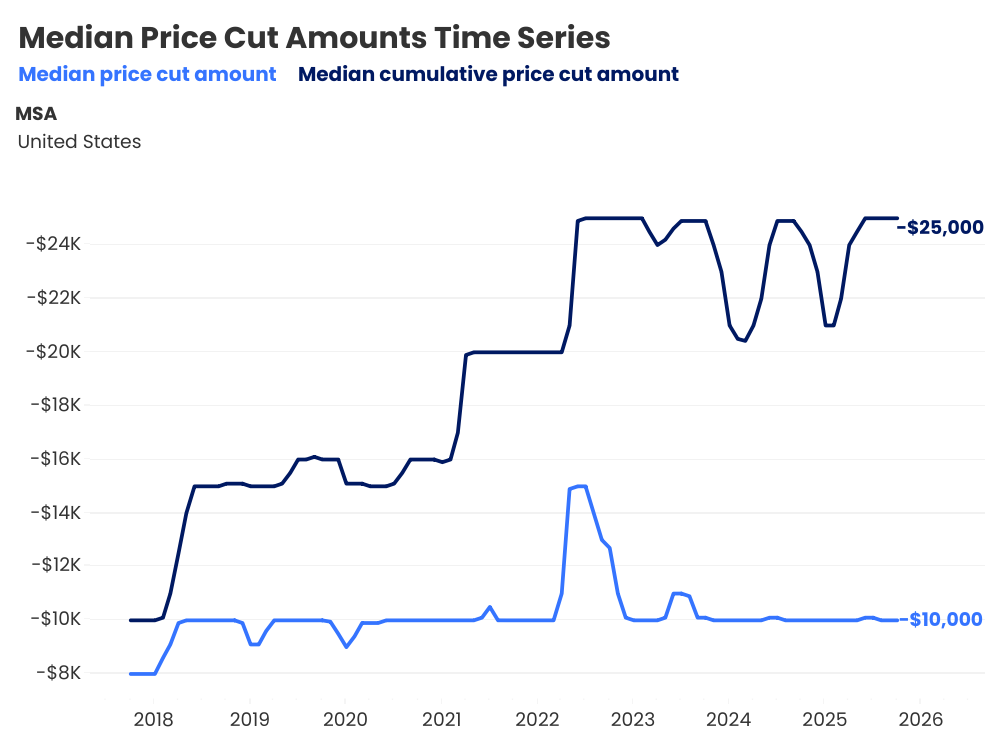

- Pricing is Crucial: Setting the right price from day one will be more important than ever. Overpricing your home will likely lead to it sitting on the market longer, requiring price reductions later. I've seen too many sellers lose out by being too stubborn on price initially. You'll need to pay close attention to comparable sales in your area.

- Flexibility is Your Friend: Be open to negotiation. Buyers might come in with offers that aren't exactly what you dreamed of, but a “good enough” offer that closes the deal might be your best bet. Consider offering seller concessions if needed to help a buyer with their closing costs or to buy down their interest rate.

- Market Variations Matter: The Realtor.com® forecast notes that markets in the Northeast and Midwest have been stronger recently, and this trend is expected to continue in 2026. Conversely, some markets in the South and West might see price declines. It’s essential to understand the local market dynamics where your home is located.

- Price Point Influences: Homes at lower price points have seen more price cuts lately, while homes above $1 million are still seeing solid activity from wealthy buyers. This suggests that if you have a high-end property, you might face less immediate pressure than if you have a starter home.

Chart: Seller Considerations for 2026

| Aspect | Outlook | Recommendation |

|---|---|---|

| Market Balance | Shifting towards buyers | Be prepared for more negotiation and longer selling times. |

| Pricing | Critical, needs to be accurate | Research thoroughly, price competitively from the start, and be ready for adjustments. |

| Offers | May less aggressive | Be flexible and consider all offers, especially those with good terms and a motivated buyer. |

| Location/Price | Varies by region and segment | Understand your specific market and its trends; don't assume national trends apply perfectly everywhere. |

| Staging/Condition | Important | A well-maintained and attractively staged home will stand out against the competition. |

In short, sellers in 2026 should prepare for a more balanced market. It’s still possible to sell and make a profit, but the easy days of multiple offers above asking price might be less common. Your success will hinge on smart pricing, good marketing, and a willingness to be flexible.

For the Renters of 2026: A Glimmer of Relief

Renters have faced their own set of challenges with rapidly increasing rents in recent years. The good news for 2026 is that the tide is beginning to turn in your favor.

I've been watching the rental market closely, and the prediction of rents declining slightly is a welcome development. According to Realtor.com®, we can expect rents to fall by about 1% nationally in 2026. This follows an estimated 1.6% decline in 2025.

Why the change? Simply put, supply is catching up to demand. More new apartment buildings are coming online, which increases the number of places available to rent. This increase in supply is what typically pushes rents down or at least stabilizes them.

Here’s what this means for renters:

- More Affordable Rents: That extra breathing room in your budget can make a significant difference, especially after years of rising costs.

- Increased Mobility: With more units available and possibly lower prices, you might find it easier to move to a different neighborhood or a larger apartment if you need to. It also gives you more leverage when negotiating with your current landlord about renewing your lease.

- Renting Remains a Viable Option: For many, especially younger adults or those new to homeownership, renting will continue to be a more cost-effective option than buying in the short term. This trend allows more time to save for a down payment while enjoying relatively stable housing costs.

Key Takeaways for Renters in 2026

- Rent Declines: Expect a further 1% drop in asking rents nationally.

- Increased Supply: More new apartment construction is entering the market.

- Renter Mobility: More options and better affordability make moving or finding a new lease easier.

- Cost-Effective Choice: Renting likely remains more affordable than buying for many.

While these rent declines aren't a dramatic crash, they represent a meaningful shift back towards balance in the rental market. It’s a chance for renters to regain some financial footing and have more choices when it comes to where and how they live.

Looking Ahead: A Balanced Market Awaits

My overall take on the 2026 housing market forecast is one of cautious optimism. Realtor.com®'s predictions paint a picture of a market that is slowly but surely moving towards a healthier equilibrium. For buyers, it means more opportunity. For sellers, it means adapting to a more competitive environment. And for renters, it signifies a much-needed breather.

The journey back to pre-pandemic housing market norms is still a gradual one, but 2026 is shaping up to be a solid step in the right direction. The key themes are improving affordability, increasing inventory, and a more balanced power dynamic between buyers and sellers. It won't be perfect, and there will still be regional differences and individual challenges, but for many, 2026 promises a more accessible and stable housing market.

2026 Housing Market Forecast for Investors

Experts forecast steady but modest price growth, shifting affordability, and evolving rental demand in 2026—creating unique opportunities for each group.

Rising demand keeps rental markets competitive, but turnkey investors benefit from strong cash flow.

Norada Real Estate helps you navigate these shifts with fully managed rental properties—so whether you’re buying, selling, or renting, you can position yourself for success in 2026.

🔥 HOT NEW Investor Deals JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More About the Housing Market Trends?

Explore these related articles for even more insights:

- Why Are Home Prices Dropping in Over Half of Major US Cities in 2025?

- Redfin's Bold Predictions About The Great Housing Market Reset in 2026

- 5 Most Expensive Housing Markets Are Now Seeing the Biggest Price Cuts

- Housing Market Predicted to See Strong Growth in 2026: Expert Forecast

- Housing Market Predictions for the Next 12 Months by Zillow

- Housing Market Regains Ground as Falling Mortgage Rates Unlock Buyer Savings

- Hidden Costs of Homeownership Now Add Up to Nearly $16,000 a Year

- Small Investors Dominate the Housing Market From Detroit to Vegas

- Housing Market Predictions for the Next 4 Years: 2025 to 2029

- Housing Market 2025 Splits Between Wealthy Buyers and First-Timers

- Housing Markets at Risk of Double-Digit Price Decline Over the Next 12 Months

- Will the Housing Market Shift to a Buyer’s Market in 2026?

- Mid-Atlantic Housing Market Heats Up as Mortgage Rates Go Down