The current state of the Salt Lake City housing market leans towards a seller's market. The competitive nature, multiple offers scenario, and a significant percentage of homes selling above the list price indicate favorable conditions for sellers. However, with variations in market dynamics, buyers can still find opportunities, especially with the average homes selling slightly below the list price.

Salt Lake City, nestled amidst the Wasatch Mountains, has become a booming metropolis in recent years. This vibrant city offers a unique blend of outdoor recreation, cultural attractions, and a thriving job market. With its growing popularity, the Salt Lake City housing market has also seen a surge in activity, making it an attractive destination for both homebuyers and investors.

Salt Lake City Housing Market Trends 2024

In February 2024, the median home price in Salt Lake City surged by 3.0% compared to the previous year, reaching a noteworthy median price of $530,000, according to Redfin. This upswing in prices reflects a vibrant market and hints at the city's desirability among homeowners.

Rapid Sales and Increasing Demand in Salt Lake City

The pace of home sales in Salt Lake City has notably accelerated, with properties spending an average of 54 days on the market, a marked improvement from the 75 days recorded last year. Moreover, there's been a considerable uptick in the number of homes sold, with 159 homes changing hands in February, compared to 124 during the same period in the previous year.

Interestingly, Salt Lake City's housing market showcases a competitive edge, with homes typically selling in approximately 52.5 days. Additionally, it's not uncommon for certain properties to receive multiple offers, underscoring the high demand and limited inventory in certain segments of the market.

Salt Lake City Price Trends and Market Competitiveness

Compared to the national average, Salt Lake City's median sale price stands at a significant 30% higher, highlighting the city's appeal and robust housing market. On average, homes in Salt Lake City are sold for about 1% below the list price, with a quick turnaround time of approximately 53 days from listing to pending.

Furthermore, hot properties in Salt Lake City can fetch prices approximately 1% above the list price, going pending in a mere 16 days. These figures reflect the competitive nature of the market and the willingness of buyers to invest in desirable properties.

Migration Patterns and Relocation Trends

Understanding migration and relocation trends is crucial in assessing the dynamics of Salt Lake City's housing market. From December '23 to February '24, 29% of homebuyers in Salt Lake City explored opportunities outside the city, while 71% preferred to remain within the metropolitan area.

Interestingly, there's a notable influx of homebuyers from outside metros, with 0.57% of individuals nationwide expressing interest in relocating to Salt Lake City. Notably, cities such as Los Angeles, San Francisco, and Seattle emerge as the top origins for individuals eyeing a move to Salt Lake City, underscoring the city's allure and appeal among diverse demographics.

Overall, Salt Lake City's housing market remains dynamic, with prices on the rise, swift sales, and a diverse pool of buyers contributing to its vibrancy. Whether you're a prospective buyer, seller, or investor, keeping abreast of these trends is essential for making informed decisions in the ever-changing real estate landscape.

What is the Future Market Outlook for Salt Lake City?

With its strong economic fundamentals, attractive lifestyle, and limited housing supply, the Salt Lake City housing market is poised for continued growth. For investors, Salt Lake City presents a promising opportunity for stable returns and potential appreciation. However, it's important to remember that the market is competitive, and careful planning and preparation are essential for success.

Factors Affecting the Salt Lake City Housing Market

- Strong job market: Salt Lake City's economy is diversified, with major industries like technology, healthcare, and tourism contributing to steady job growth. This influx of jobs attracts new residents, pushing up demand for housing.

- Limited housing supply: The Salt Lake City area has faced challenges in keeping up with the growing demand for housing. This limited supply puts upward pressure on prices, as buyers compete for available properties.

- High quality of life: Salt Lake City boasts stunning natural beauty, diverse cultural offerings, and a strong sense of community. This high quality of life attracts residents willing to pay a premium for a piece of the city's charm.

Salt Lake City Housing Market Forecast for 2024 & 2025

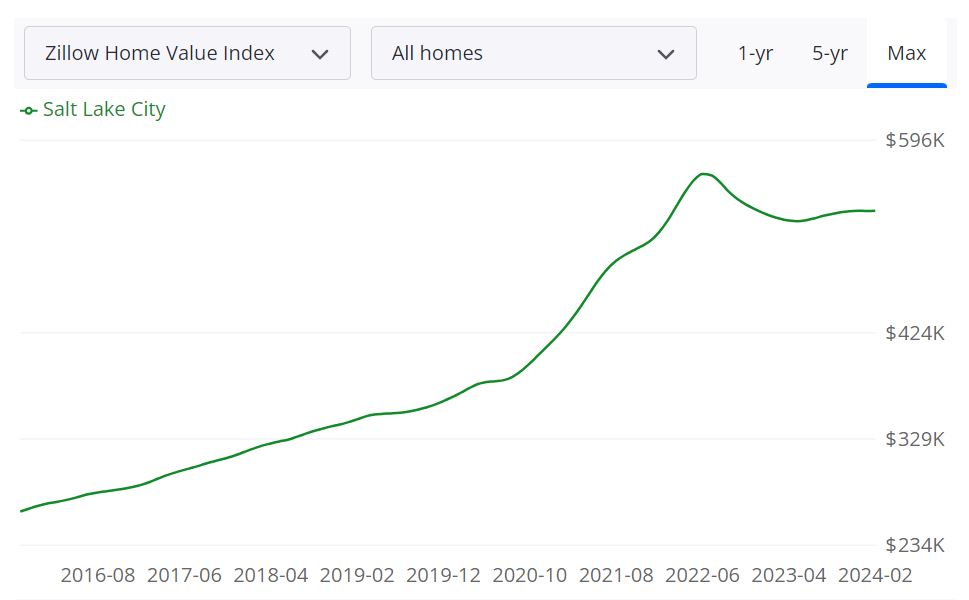

According to Zillow, the average home value in the Salt Lake City metro area stands at $533,354, marking a 0.9% increase over the past year. Homes in this area typically go pending within 27 days. The forecast for the next year suggests a modest 1.8% increase in the housing market, reflecting the data as of February 28, 2024.

Housing Metrics Explained

Let's delve into the various housing metrics to gain a deeper understanding of the Salt Lake City metro area:

- For Sale Inventory: As of February 29, 2024, there are 2,489 properties listed for sale in the Salt Lake City metro area.

- New Listings: In February 2024, 791 new listings entered the market, contributing to the inventory available for potential buyers.

- Median Sale to List Ratio: This metric, recorded as 0.991 as of January 31, 2024, indicates the relationship between the sale price of a home and its listed price.

- Median Sale Price: The median sale price for homes in the Salt Lake City metro area was $492,001 as of January 31, 2024.

- Median List Price: The median list price, standing at $559,982 as of February 29, 2024, reflects the average listing price for properties in the market.

- Percent of Sales Over List Price: As of January 31, 2024, 22.9% of home sales in the Salt Lake City metro area were transacted above the listed price.

- Percent of Sales Under List Price: Conversely, 56.6% of home sales during the same period were below the listed price, highlighting variations in market pricing.

The Salt Lake City metro area encompasses several counties, including Salt Lake County, Utah County, Davis County, and Weber County, among others. This metropolitan statistical area (MSA) boasts a diverse and expansive housing market, catering to a range of homebuyers and investors.

The housing market in the Salt Lake City metro area is characterized by steady growth and competitive dynamics. With a median sale price nearing the half-million mark, the market caters to various segments of buyers, from first-time homeowners to seasoned investors.

Is Salt Lake City a Buyer's or Seller's Housing Market?

In the current Salt Lake City metro housing market, the balance between buyers and sellers is crucial in determining whether it leans towards being a buyer's or seller's market. With low inventory levels and high demand driving competition, particularly in certain price ranges, the market tends to favor sellers. Multiple offers and bidding wars are not uncommon, putting sellers in a favorable position to negotiate terms and prices.

However, it's essential to note that market conditions can vary within different neighborhoods and price segments. In some areas or price ranges, there may be more inventory available, providing buyers with more options and potentially greater negotiating power. Overall, consulting with a local real estate expert can provide valuable insights into whether it's currently more advantageous to be a buyer or a seller in the Salt Lake City metro area.

Are Home Prices Dropping in Salt Lake City?

As of the latest data available, there is no indication that home prices in the Salt Lake City metro area are dropping. While real estate markets can experience fluctuations over time, the prevailing trend in recent years has been one of appreciation and modest growth. Factors such as population growth, economic stability, and housing demand contribute to supporting home prices in the region.

Will the Salt Lake City Housing Market Crash?

The prospect of a housing market crash is a concern for many prospective buyers, sellers, and investors. While it's impossible to predict future market movements with certainty, current indicators suggest a stable and resilient housing market in the Salt Lake City metro area. Factors such as a diversified economy, job growth, and favorable demographics contribute to the market's overall strength.

Is Now a Good Time to Buy a House in Salt Lake City?

For individuals considering purchasing a home in the Salt Lake City metro area, the question of whether now is a good time to buy is multifaceted and depends on various factors, including personal circumstances, financial readiness, and long-term goals. While market conditions may favor sellers in terms of competition and pricing, low-interest rates as compared to last year and a growing economy may present opportunities for buyers.

Salt Lake Real Estate Market: Should You Invest Here?

Salt Lake City, the capital of Utah, has garnered attention as a potential hotspot for real estate investment in recent years. A combination of demographic trends, long-term real estate appreciation, cost of living, quality of life, a thriving rental property market, landlord friendliness, population growth, and a robust local economy all contribute to the city's appeal as a real estate investment destination.

Demographic Trends

Salt Lake City's demographic trends are among the most promising factors for real estate investment. The city has experienced a steady influx of newcomers, including young professionals and families. These demographic shifts contribute to a growing demand for housing, making it an attractive market for real estate investors.

Long-Term Real Estate Appreciation

Long-term real estate appreciation in Salt Lake City has been substantial. The city has seen consistent growth in property values over the years. While there can be short-term fluctuations, the overall trend points towards a positive appreciation rate, making it an appealing prospect for investors seeking long-term gains.

Cost of Living & Quality of Life

Salt Lake City boasts a reasonable cost of living compared to other major metropolitan areas in the United States. The combination of affordable housing, competitive utilities, and accessible transportation options contributes to a more budget-friendly living environment. Additionally, the city offers a high quality of life with an abundance of outdoor recreational opportunities and a vibrant cultural scene.

Salt Lake City Rental Property Market

The rental property market in Salt Lake City is robust, driven by the city's population growth and the demand for housing. Real estate investors can benefit from steady rental income, especially in neighborhoods that attract young professionals and students attending local universities.

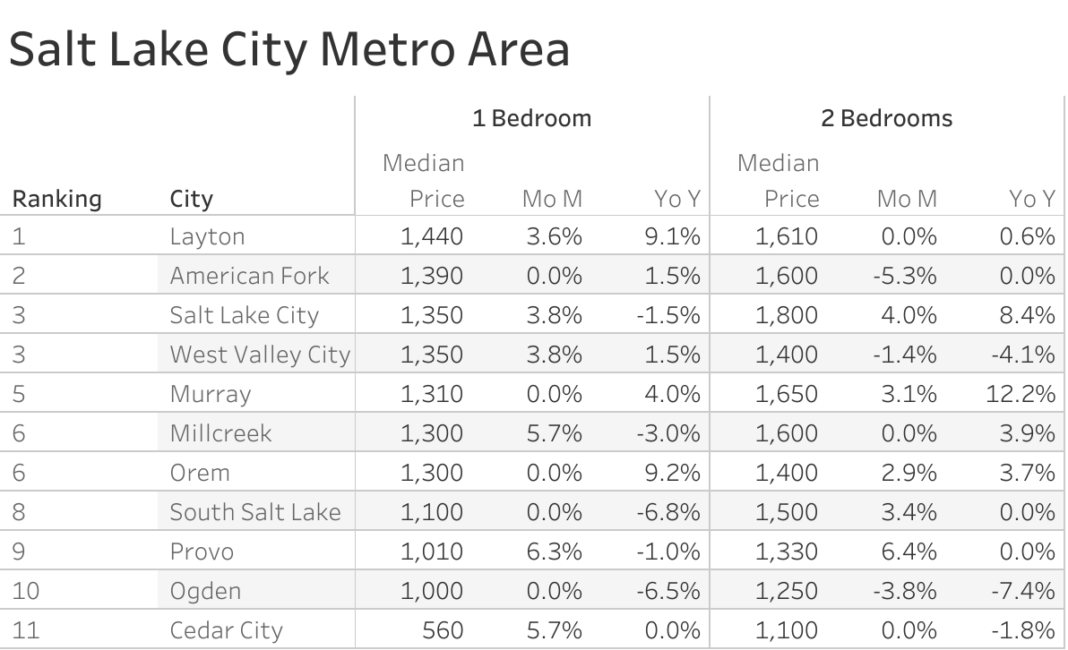

The Zumper Salt Lake City Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The Utah one bedroom median rent was $1,309 last month. Layton is the most expensive city with one-bedrooms both priced at $1,440. Salt Lake City & West Valley City were tied for third with rents both at $1,350.

The Fastest Growing Cities For Rents in the Salt Lake City Metro Area (Y/Y%)

- Orem had the fastest growing rent, up 9.2% since this time last year.

- Layton rent climbed 9.1%, making it second.

- Murray was third with rent increasing 4%.

The Fastest Growing Cities For Rents in the Salt Lake City Metro Area (M/M%)

- Provo had the largest monthly growth rate, up 6%.

- Cedar City & Millcreek were tied for second with rents both climbing 5.7%.

- West Valley City & Salt Lake City tied for third with rents both growing 3.8% last month.

Landlord Friendliness

Salt Lake City is known for its landlord-friendly regulations. The state of Utah generally offers a favorable legal environment for property owners, including efficient eviction processes and fair property tax rates. These factors create a secure and attractive setting for real estate investment.

Population Growth

The population of Salt Lake City and the surrounding areas has been steadily increasing, driven by both natural growth and in-migration. The city's strong economy and diverse job opportunities have been a magnet for individuals seeking employment and a better quality of life. This population growth enhances the potential for real estate investments, as more residents require housing solutions.

Economy of the Region

The economy in Salt Lake City and the wider region is thriving. The city has become a hub for various industries, including technology, healthcare, finance, and outdoor recreation. Its diversified economy provides stability, reducing the risk associated with single-industry towns. A strong job market and higher income levels contribute to increased housing demand and, consequently, a healthy real estate market.

In conclusion, Salt Lake City presents an enticing opportunity for real estate investment due to its positive demographic trends, long-term appreciation, cost of living, quality of life, flourishing rental property market, landlord friendliness, population growth, and a resilient local economy. However, as with any investment, it's crucial for potential investors to conduct thorough research, consider their financial goals, and work with local real estate experts to make informed decisions.

References:

- https://slrealtors.com/

- https://www.zillow.com/salt-lake-city-ut/home-values/

- https://www.zillow.com/salt-lake-city-metro-ut_r395053/home-values/

- https://www.bankrate.com/mortgages/housing-heat-index/

- https://www.fhfa.gov/DataTools/Tools/Pages/House-Price-Index-(HPI).aspx

- https://www.fhfa.gov/DataTools/Tools/Pages/FHFA-HPI-Top-100-Metro-Area-Rankings.aspx

- https://slrealtors.com/wp-content/uploads/2021/01/2021-Housing-Forecast-Report.pdf