With the surge in median sales prices and a robust number of closed sales, the question arises: is the current Utah housing market more favorable for buyers or sellers? The competitive nature of the market, coupled with a limited inventory, leans towards being a seller's market. In a seller's market, demand outpaces supply, giving sellers the advantage in negotiations.

How is the Utah housing market doing currently?

The Numbers Speak: Closed Sales

Closed Sales: According to the Utah Association of REALTORS®, in the first month of 2024, Utah recorded a total of 2,216 closed sales. This statistic, representing the culmination of various transactions, reflects the vibrancy of the state's real estate market.

Median Sales Price Surge

Median Sales Price: A critical factor for both buyers and sellers, the median sales price witnessed a substantial increase of 9.9%. In concrete terms, the median sales price rose from $455,000 to $485,950, marking a significant 6.8% uptick. This surge in median prices highlights the demand for housing in Utah.

Utah Housing Market Dynamics

Behind these figures lie several factors influencing the Utah housing market. While it's clear that the demand for homes is robust, it's essential to understand what is driving this surge in prices.

Factors at Play:

- Economic Momentum: Utah's strong economic foundation continues to attract new residents, contributing to increased housing demand.

- Low Inventory: The limited supply of homes plays a pivotal role in driving up prices, creating a competitive market for potential buyers.

- Interest Rates: Favorable interest rates as compared to last year stimulate homebuying activity, enticing individuals to make their move into the housing market.

Utah Real Estate Market Report by UtahRealEstate

Here's how the housing market performed, according to UtahRealEstate.com.

- In January 2024, around 2219 homes were sold on MLS, up 9.7% from last year.

- No. of single-family homes sold was 1625.

- No. of multi-family homes sold was 594.

- The median days on market were 46, up from 40 days last month.

- The median selling price was $535,000 for single-family homes, up 4.9% year-over-year.

- The median selling price was $391,000 for multi-family homes, down 0.3% year-over-year.

Utah Real Estate Market Trends for Q3 2023

According to the report by Windermere Real Estate Chief Economist Matthew Gardner, after a promising second quarter, year-over-year employment growth has experienced a slight setback. Utah added 39,000 jobs over the past 12 months, representing an annual growth rate of 2.3%. Notably, the Salt Lake City metro area led job growth with a rise of 2.7%, followed by Ogden and Provo metro areas with 2.4% and 1.7%, respectively.

Despite the positive job growth, Utah’s unemployment rate edged up to 2.5% in August, a 0.1% increase year over year. The county-level analysis reveals the lowest jobless rate in Morgan County (2.5%) and the highest in Weber County, where 3.1% of the workforce faced unemployment. Overall, the unemployment rate within the counties covered in this report averaged 3%.

Utah Home Sales

In the third quarter of 2023, 6,675 homes were sold in the analyzed areas, marking a 9.5% decrease compared to the same period in 2022. Although total sales volumes dropped, Wasatch, Summit, and Morgan counties experienced growth in both the third quarter of 2022 and the second quarter of this year.

Listing activity surged by 28.7% in comparison to the second quarter of 2023, indicating increased market choices. However, pending sales fell by 8.9%, suggesting potential lackluster closings in the fourth quarter.

Utah Home Prices

The average sale price in Utah grew by 4% from 2022 to $651,913. Regionally, median list prices remained flat in the third quarter compared to the second quarter of the year. However, Morgan County saw a significant price increase due to its smaller market size.

Price growth has been slowing, influenced by a substantial rise in mortgage rates. With the anticipation of limited price growth for the remainder of the year, market dynamics are impacted by both higher financing costs and increased market choices.

Mortgage Rates

Mortgage rates continued their upward trend in the third quarter of 2023, reaching levels not seen since the fall of 2000. Tied to the interest rate on 10-year treasuries, mortgage rates are influenced by economic factors. Despite a positive economy, mortgage rates are expected to remain elevated, with forecasts suggesting a potential downtrend in the spring of next year.

Utah Days on Market

The average time to sell a home in the analyzed counties increased by 17 days compared to the same period in 2022. Notably, Salt Lake County witnessed the fastest sales, while Wasatch County had the slowest. Despite the rise in market time, the third quarter saw a modest 3-day reduction compared to the second quarter of 2023.

Utah Housing Market Forecast for 2024 and 2025

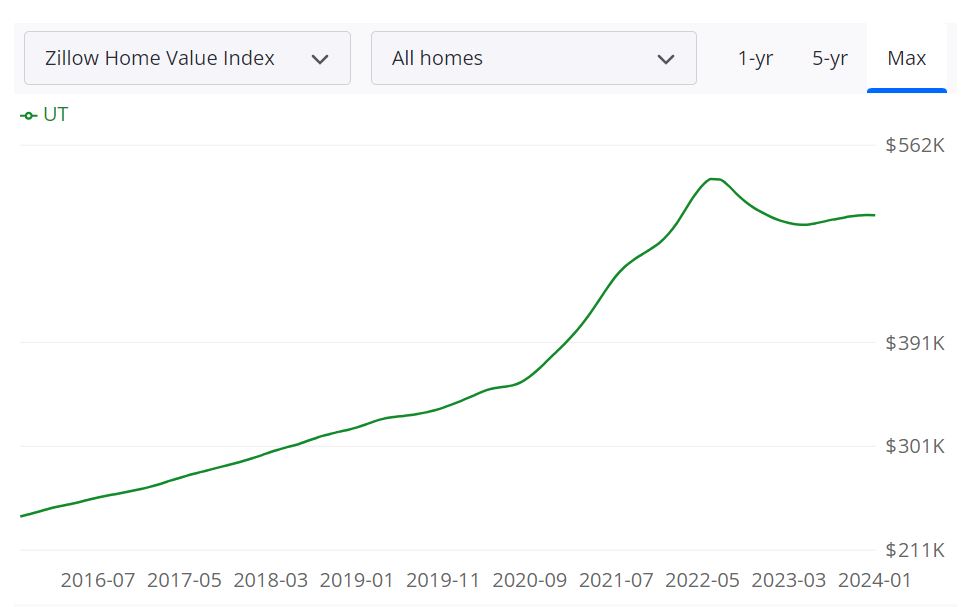

Average Utah Home Value:

According to Zillow, as of January 31, 2024, the average Utah home value stands at $501,653, reflecting a 0.3% increase over the past year. Homes in Utah are garnering attention, and understanding the underlying metrics can provide valuable insights for prospective buyers and sellers.

Days on Market:

Homes in Utah are moving swiftly, with an average of 37 days from listing to pending. This indicates a dynamic market, showcasing the demand for residential properties in the state.

Inventory Overview:

As of January 31, 2024, there are 10,404 homes available for sale in Utah. This extensive inventory offers a diverse range of options for potential buyers, contributing to the competitive nature of the housing market.

New Listings:

In January 2024 alone, there were 2,274 new listings. This influx of fresh properties into the market adds to the choices available for buyers, potentially impacting overall market dynamics.

Median Sale Price:

As of December 31, 2023, the median sale price in Utah reached $476,821. Understanding this metric provides a snapshot of the affordability and value of homes in the state.

Median List Price:

The median list price as of January 31, 2024, is $547,967. This figure represents the midpoint of all listed prices, influencing buyer expectations and market competitiveness.

Sale to List Ratio:

As of December 31, 2023, the median sale to list ratio stands at 0.991. This ratio reflects the percentage of the final sale price compared to the original list price, offering insights into negotiation dynamics in the Utah housing market.

Market Dynamics:

Examining the percent of sales over list price (21.7%) and percent of sales under list price (57.4%) as of December 31, 2023, provides a nuanced understanding of market competitiveness. These percentages indicate the prevalence of bidding wars and negotiated deals, shaping the overall market landscape.

Are Home Prices Dropping in Utah?

Contrary to concerns about declining home prices, the data indicates that, as of January 31, 2024, the average Utah home value has experienced a modest 0.3% increase over the past year. While this may not represent a substantial surge, it suggests a stability in prices rather than a significant drop. The market appears to be leaning towards a seller's market. With a relatively low inventory of homes for sale, buyers may face increased competition, potentially leading to higher prices and quicker sales. Sellers, on the other hand, might find favorable conditions for getting competitive offers for their properties.

Will the Utah Housing Market Crash?

As of the current analysis, there is no indication of an impending housing market crash in Utah. The market has shown resilience, with steady growth in home values and a competitive landscape. However, predicting market fluctuations can be challenging, and external factors may influence future trends. It's advisable for stakeholders to stay vigilant, keeping an eye on economic indicators and market dynamics.

Is Now a Good Time to Buy a House in Utah?

Considering the current conditions, it appears to be a mixed scenario for potential homebuyers. While the market leans towards sellers, opportunities still exist for buyers who act strategically. Factors such as low mortgage rates and a diverse inventory contribute to a favorable environment for those looking to purchase a home. However, individual circumstances, financial readiness, and specific goals should guide the decision-making process.

Regional Housing Market Forecast in Utah:

Examining the regional housing market forecast provides a more granular understanding of how different areas within Utah are expected to perform in terms of real estate. The data, as of January 31, 2024, presents projections for specific regions within the state, shedding light on potential trends and opportunities.

Salt Lake City, UT:

In Salt Lake City, the metropolitan statistical area (msa), the forecast indicates a modest growth of 0.1% by February 29, 2024, with a more substantial increase of 1.4% anticipated by April 30, 2024. The projection extends to January 31, 2025, forecasting a significant rise of 5.4%. This suggests a positive trajectory for real estate values in the state's capital, making it an area of interest for potential investors and homebuyers.

Ogden, UT:

Ogden, another msa in Utah, demonstrates a slightly more optimistic outlook. The forecast predicts a growth of 0.2% by February 29, 2024, followed by a notable 1.8% increase by April 30, 2024. Looking further ahead, the projection for January 31, 2025, stands at a substantial 6.5%. This indicates a potentially flourishing real estate market in Ogden, attracting attention for its growth potential.

Provo, UT:

Provo, with its own msa designation, anticipates a growth of 0.1% by February 29, 2024, and a further 1.3% increase by April 30, 2024. The long-term forecast for January 31, 2025, suggests a robust 5.2% growth. Provo's real estate market appears to be on a positive trajectory, making it a region worth considering for those involved in the real estate sector.

St. George, UT:

St. George's msa, as of January 31, 2024, shows a relatively stable forecast, with no change expected by February 29, 2024. However, a modest growth of 0.7% is projected by April 30, 2024, and a more substantial 5.3% increase is anticipated by January 31, 2025. The market in St. George may present opportunities for those seeking steady and consistent growth.

Logan, Heber, Cedar City, Vernal, and Price, UT:

Other regions, including Logan, Heber, Cedar City, Vernal, and Price, each have their unique forecasts. Logan projects a slight decrease of -0.2% by February 29, 2024, followed by positive growth. Heber anticipates a robust 2.2% increase by April 30, 2024, and an impressive 8.2% by January 31, 2025. Cedar City, Vernal, and Price also show positive growth trends, indicating diverse opportunities within Utah's regional real estate markets.

Why Are Home Prices So High in Utah?

Utah boasts the nation’s strongest pace of job growth, along with rock-bottom unemployment, ultra-low mortgage rates, few mortgage delinquencies, and low state and local taxes. All those factors pushed Utah into first place in Bankrate’s Housing Heat Index for the fourth quarter of 2020. Utah's home values increased by 15.39% in the 12-month period that ended Dec. 31, third-best among U.S. states, according to the Federal Housing Finance Agency.

Since 1991 Q1, HPI for Utah has increased by 414.95%. Idaho ranked #1 in FHFA State House Price Indexes. The HPI is a broad measure of the movement of single-family house prices. It is measured by reviewing mortgage transactions on single-family properties whose mortgages have been purchased or securitized by Fannie Mae or Freddie Mac. According to a Bankrate analysis of Labor Department data, Utah also posted the second-strongest job growth in the nation from December 2019 to December 2020.

Even if inventory is significantly higher than it has been in the previous two years, it still does not address what has been a problem in Utah for years. There are still not enough houses. Even though homebuilding soared in Utah in 2021, putting the state on the national map for its housing boom. It made a decent dent in Utah’s housing shortage, but not enough to erase it.

Rapid population growth and job growth are the two most important drivers of housing demand in Utah right now. According to local real estate agents, there aren’t enough single-family homes to meet the rising housing demand. A balanced market has roughly a six-month supply of houses, which means that if we stopped listing new properties, we'd still have about six months before we ran out. And right now, Utah is down to about four weeks of supply of homes.

As a result, finding a dream house in this market is challenging for buyers, making it extremely competitive. Utah's employment landscape is also one of the most impressive in the country. It has had the most rapidly growing job market in the country for the past decade. Utah's population grew by 18.4% over the past decade, making it the fastest-growing state. It's now the 30th most populated state, with nearly 3.28 million people, according to U.S. Census Bureau data.

A large number of Californians are relocating to Utah, putting extra pressure on the supply side. In-migration to the Salt Lake metropolitan area is still at an all-time high. The issue is that demand is so strong that inventory can't reach a level that indicates a sufficient supply. People are also coming from New York, Boston, Vermont, Austin, Texas, and other cities, according to local real estate agents. They also think that people who are first-time homebuyers in Utah will be priced out of the market by people moving in from other states.

References:

- https://utahrealtors.com/

- https://www.zillow.com/home-values/55/ut/

- https://www.fhfa.gov/DataTools/Tools/Pages/House-Price-Index-(HPI).aspx