Looking for the best mortgage rates this July? If you're trying to buy a home or refinance, understanding where the lowest mortgage rates are is essential. As of Monday, the states with the cheapest 30-year new purchase mortgage rates were New York, New Jersey, California, North Carolina, Florida, Tennessee, Virginia, and Washington. These states saw average rates hovering between 6.75% and 6.87%.

Mortgage Rates Today: The States Offering Lowest Rates

Why do mortgage rates vary so much anyway? It's something I've often wondered myself. Let's dive in.

Mortgage rates aren't uniform across the country. A variety of factors conspire to create differences from state to state. Here's a more in-depth look:

- Lender Presence: Not all lenders operate everywhere. Regional and local lenders will have different business strategies and cost structures that influence rates.

- Credit Score Averages: States with higher average credit scores might see slightly better rates overall.

- Average Loan Size: Loan amounts can influence rates. Larger loans might carry slightly different terms.

- State Regulations: Mortgage regulations vary from state to state, affecting the cost of doing business for lenders.

- Risk Management: Each lender has its own approach to assessing risk and setting rates accordingly.

States With the Lowest Mortgage Rates (July 29, 2025)

As mentioned earlier, according to Investopedia's report and Zillow's data, here's a quick view of the states with the lowest rates as of Monday:

- New York

- New Jersey

- California

- North Carolina

- Florida

- Tennessee

- Virginia

- Washington

States With the Highest Mortgage Rates (July 29, 2025)

Conversely, these states had the highest rates:

- Alaska

- West Virginia

- Kansas

- Mississippi

- North Dakota

- Washington, D.C.

In these areas, average rates ranged from 6.98% to 7.10%. That may not seem like much, but it can add up over the life of a 30-year mortgage!

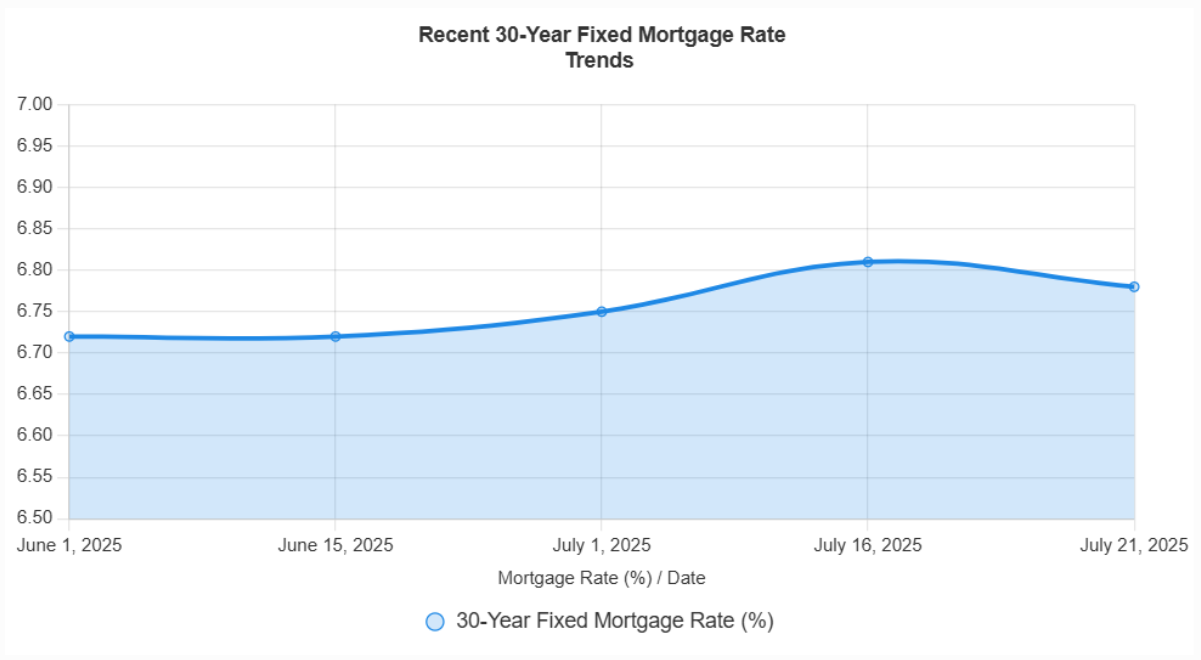

A Snapshot of National Mortgage Rate Trends

It's not just about what's happening at the state level. The national mortgage rates are also constantly in flux.

Here's a quick look at the national averages as of July 29, 2025:

| Loan Type | New Purchase Rate |

|---|---|

| 30-Year Fixed | 6.91% |

| FHA 30-Year Fixed | 7.55% |

| 15-Year Fixed | 5.93% |

| Jumbo 30-Year Fixed | 6.85% |

| 5/6 ARM | 7.35% |

Important Caveat About Advertised Rates

I want to emphasize something crucial here and that you keep in mind when searching for mortgages deals. The rates you see advertised online are often teaser rates, the absolute best-case scenario. They might require you to “buy down” the rate with points, have an excellent credit score, or take out a very specific loan amount. These things are almost impossible to achieve so please keep in mind.

The Need to Shop Around

This cannot be overstated: always shop around! Don't settle for the first rate you see. Get quotes from multiple lenders – local credit unions, large national banks, and online mortgage companies. Comparing rates is the single best way to make sure you are getting the best deal for your circumstances. The difference of even 0.1-0.2% can save you thousands of dollars over the life of the mortgage.

What Factors Play a Role in Mortgage Rate Fluctuations?

Many of us just worry about how the rates affect our wallets, but understanding the factors that cause movements can help us plan better. Here's a breakdown:

- Bond Market: The 10-year Treasury yield is an indication and a key index. When Treasury yields rise, mortgage rates tend to follow suit.

- Federal Reserve Policy: The Fed can indirectly influence mortgage rates through its bond-buying programs and the federal funds rate.

- Competition Among Lenders: A more competitive market can lead to lower rates as lenders vie for your business.

The Fed's Actions and What They Mean for You

The Federal Reserve's monetary policy plays a significant role in shaping mortgage rates. Here’s a summary of the latest:

- Recent Rate Cuts: The Fed made three rate cuts in late 2024, bringing the federal funds rate down by 1%, to between 4.25% and 4.5%.

- 2025 Outlook: The Fed plans for two more rate cuts in 2025. However, viewpoints vary when the cuts have to be implemented.

- Key Influencers on Fed Policy

- Tariffs and Inflation: Trump’s tariffs could lead to substantial inflation.

- Economic Slowdown: GDP growth is expected to slow down to 1.4%.

- Political Pressure: The Fed is resisting pressure to aggressively cut rates.

Read More:

States With the Lowest Mortgage Rates on July 25, 2025

Are Mortgage Rates Expected to Go Down Soon: A Realistic Outlook

What Will Happen With Mortgage Rates in The Future?

Analysts suggest that if the Fed continues with the rate cuts, the 30-year mortgage rate could go down to 5% by 2028.

Currently, bond markets believe there is only a 5% chance that there will be a rate cut by July 2025, with higher odds for rate cuts in September or October.

The Fed's upcoming meeting on July 30, 2025, is likely to result in a pause.

Longer-term, the Fed anticipates a gradual easing cycle, with rates settling around 2.25%–2.5% by 2027.

How to Find the Best Mortgage Rate For You: A Step-by-Step Guide

Here's my advice on how to find the best mortgage rate:

- Check Your Credit Score: A higher credit score translates to lower rates.

- Decide on a Loan Type: 30-year fixed, 15-year fixed, adjustable-rate – each has pros and cons!

- Shop Around: Get quotes from multiple lenders, from your local credit union to online giants.

- Get Pre-Approved: This gives you a firm idea of what you can borrow.

- Consider a Mortgage Broker: Brokers can shop around on your behalf.

- Negotiate: You're not obligated to accept the first offer.

Final Points to Remember

Navigating the world of mortgage rates can feel complex, but armed with the right information, you can make smart choices. Always compare rates, understand the factors, and don't be afraid to negotiate. You will receive the best mortgage rate possible if you keep these things in mind. Good luck with your homebuying or refinancing journey!

Invest in Real Estate in the Top U.S. Markets

Investing in turnkey real estate can help you secure consistent returns with fluctuating mortgage rates.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Expect High Mortgage Rates Until 2026: Fannie Mae's 2-Year Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?