Everyone would be a millionaire if real estate investing were 100% risk-free. No one would have any reason not to invest. Real estate investing, like any other form of investing, comes with risks. Only those investors who are willing to take on these risks and have the knowledge and skills to manage them will be successful in the long term.

Real estate investing requires a significant amount of knowledge and understanding of the market, the property, and the financing options available. Investors who are not well-informed about these factors may not be able to effectively manage the risks associated with their investments.

For example, an investor who is not familiar with the local market may not be able to accurately predict changes in demand and property values, which can lead to a loss. Similarly, an investor who is not familiar with the property they are investing in may not be aware of property-specific risks such as structural problems or zoning changes, which can also lead to a loss.

In addition to knowledge, investors must also have the skills necessary to manage risks. For example, an investor who is not able to effectively manage tenants may have difficulty collecting rent or may have to deal with costly repairs and maintenance. Furthermore, an investor who is not able to effectively negotiate financing terms may end up with a mortgage or loan that is not favorable, which can lead to additional risks.

Here Are Some Real Estate Investing Risks and How to Manage Them

Market Risk:

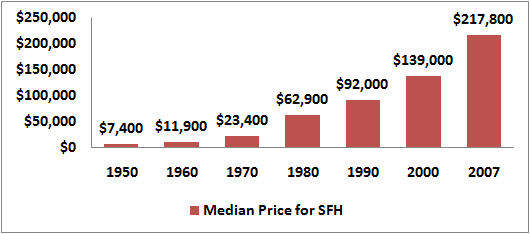

Market risk in real estate refers to the potential for the value of a property to decrease due to changes in economic conditions and supply and demand. Economic factors such as recession, inflation, and unemployment rates can all affect the demand for housing and, as a result, the value of properties.

During a recession, for example, unemployment rates may increase, and people may have less disposable income, which can lead to a decrease in demand for housing. As a result, property values may decrease, leading to a loss for the investor. Similarly, if there is an oversupply of housing in a particular area, it can lead to an excess of properties on the market, which can also lead to a decrease in property values.

It's important to note that market risk can be mitigated by investing in a diversified portfolio of properties, which can spread the risk across different types of properties, locations, and economic conditions. As well as, doing proper research and due diligence to identify properties that are likely to hold their value or appreciate in value, and investing in areas that are likely to be in demand in the future.

Rental Risk:

Rental risk in real estate refers to the potential for a loss of income from rental properties due to a variety of factors. One of the main risks is that the property may not be occupied, meaning that the landlord will not receive any rental income. This can happen for a variety of reasons, such as a lack of demand for rental properties in the area, a lack of suitable tenants, or difficulty in finding tenants.

Additionally, if the property is only occupied for a short period of time, the landlord may not be able to charge enough rent to cover the costs of the property, leading to a loss. Another risk is that tenants may not pay rent on time or at all. This can lead to a loss of income for the landlord and can also lead to additional expenses, such as legal fees and court costs if the landlord needs to evict the tenant.

Property damage caused by tenants can also lead to a loss of income. Tenants may cause damage to the property through neglect or misuse, which can lead to repairs and maintenance costs for the landlord. Moreover, if the landlord is not able to find suitable tenants, the property may be vacant for a long time, which can lead to additional expenses, such as property taxes and mortgage payments, which will further decrease your income.

To mitigate rental risks, a landlord should screen tenants carefully, using credit checks, employment and landlord references, and background checks. Also, it's important to have a solid lease agreement that clearly outlines the rights and responsibilities of both the landlord and the tenant, as well as the consequences for not following the lease agreement. Additionally, landlords should keep the property well-maintained to attract and retain tenants and should have a plan in place to handle vacancies and non-payment of rent.

Potential for Negative Cash Flow Risk:

Like many other investments, real estate has the potential to create losses. Whenever you complete a deal with less money than you started with, you've created negative cash flow. And too much negative cash flow can leave you broke. So you must know how to find and analyze a good real estate investment. If this is a skill you are working on, you can reduce your risk and save some time by using the services of a real estate investment firm.

Availability of Funds:

One of the primary barriers to investing in real estate is the lack of funding. Even though you can invest in real estate without using your own money, you still need to have money from somewhere. There are many creative ways of getting other people's money (OPM) to complete a transaction, and many good books have been written on the subject. One of the latest incarnations of OPM has been the use of corporate credit.

Interest rate Risk:

Changes in interest rates can affect the affordability of a property, which can affect the demand for that property. This can also affect the value of a property. For example, if interest rates increase, it may make it more difficult for buyers to afford a property, which can lead to a decrease in demand and a decrease in property values.

Property-specific Risk:

Issues with a particular property, such as structural problems, zoning changes, or environmental hazards, can all negatively impact the value of the property. For example, if a property is found to have a serious structural problem, it may be difficult to find buyers or renters willing to purchase or occupy the property, which can lead to a decrease in value.

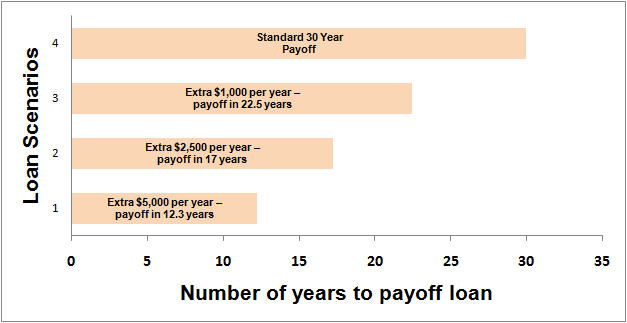

Leverage Risk:

Real estate investing often involves borrowing money, which can amplify potential losses. When you borrow money to invest in real estate, you are increasing your risk of losing money. If the value of the property decreases, you may owe more on the property than it is worth, which can result in a loss.

Time Constraints:

Some types of investments require more time than others, for example, distressed and rehab properties. Other types of investments require you to be available during business hours. If your regular job demands most of your time, you might find it difficult to make time to invest in real estate. Understand the time involved with the various types of real estate investments so you can plan your schedule around your investing.

Need for an Exit Strategy:

Before you go into a deal, you need to have a feasible plan for getting rid of your investment property. Note the word “feasible.” Your exit strategy has to be logical and doable; otherwise, it's not a very good exit strategy. Your plan may be to fix and flip the property right away, or it may be to lease and hold for 10 years.

Be sure to invest with a clear and specific exit strategy in mind. And always have a contingency plan in place in case situations come up that are out of your control. Real estate investing, like any other form of investing, has some potential risks. On the positive side, these risks are associated with the potential for high returns. But with proper planning and ongoing education, you will be successful as a real estate investor.

In summary, real estate investing is a risky business, and only those investors who are willing to take on these risks and have the knowledge and skills to manage them will be successful. It's important for an investor to thoroughly research and understand the market and the property before investing, and to have a solid plan in place for managing risks.

Explore Nationwide Real Estate Investing Opportunity

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060