Currently, the Huntsville housing market leans towards being a seller's market. With limited inventory and homes often selling quickly, sellers have the advantage of attracting multiple offers and achieving favorable sale prices. This trend is further reinforced by the relatively low median days to pending, indicating high demand and competitive conditions for buyers.

About Huntsville:

Huntsville is the county seat of Madison County and the largest city in Alabama. The 2020 census estimated Huntsville's population at 215,070, which represents a 20% increase over the 2010 census. More than 1.2 million reside in the Huntsville metro area.

The Huntsville Metropolitan Statistical Area is a metropolitan statistical area on the northern border of Alabama. The metro area's principal city is Huntsville and consists of two counties: Limestone and Madison. Huntsville has the nickname “Rocket City” for its close ties to NASA. Huntsville, AL, known as ‘The Rocket City’, has seen some great progress in various areas of the city in recent years. Let us take a look at the market data from various sources so that you can stay up-to-date with trends in the Huntsville AL real estate market.

Current Huntsville AL Housing Market REPORT

Huntsville, a city known for its technological advancements and vibrant community, witnessed a shift in its housing market during the fourth quarter of 2023. Let's delve into the comprehensive data – “The Huntsville Residential 4th Quarter Report 2023 published by ACRE.”

Residential Sales Trends

In the fourth quarter of 2023, Huntsville recorded a total of 1,518 residential sales, marking a 10.8% decrease compared to the third quarter of 2022. This dip is noteworthy when considering historical data, as fourth-quarter sales stand 30.6% below the 3-year quarterly average and 26.2% below the 5-year quarterly average.

Median Selling Price

The median selling price in Huntsville for the fourth quarter of 2023 was $327,592, reflecting a 0.8% decrease from the previous year. However, in the broader context, the fourth quarter median sales price is 11.2% above the 3-year quarterly average and 22.3% above the 5-year quarterly average.

Average Sales Price

The average sales price in Huntsville for the fourth quarter of 2023 witnessed a 3.8% increase from the previous year, reaching $382,598. In comparison to historical data, this average is 17.2% above the 3-year quarterly average and 29.4% above the 5-year quarterly average.

Days on the Market (DOM)

The average number of days on the market in the fourth quarter of 2023 increased to 34 days, representing a 17-day increase from the previous year. In the larger context, this quarter's DOM average is 31.0% above the 5-year quarterly average and 116.1% above the 3-year quarterly average.

Inventory Insights

The residential units available for sale in the fourth quarter of 2023 saw a 15.7% increase compared to the same period last year. This surge in inventory is substantial when considering historical data, as it stands 62.9% above the 5-year quarterly average and 79.2% above the 3-year quarterly average.

Months of Supply

Assessing the market balance, the # of months of supply in the fourth quarter of 2023 was 3.7 months. This figure is 105.0% above the 5-year quarterly average and 134.2% above the 3-year quarterly average, indicating a surplus in housing inventory.

Huntsville Alabama Housing Market Forecast for 2024 and 2025

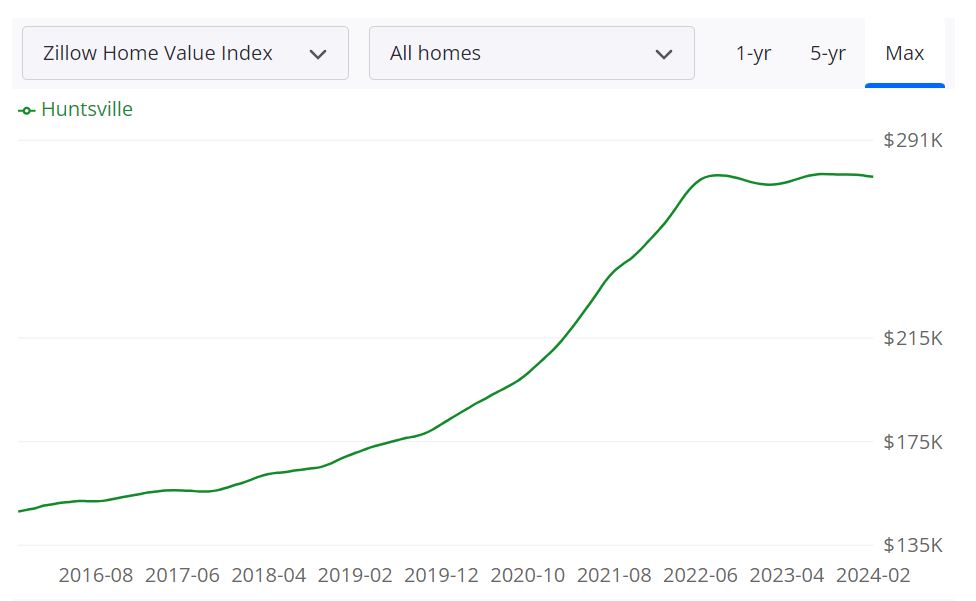

According to Zillow, the Huntsville housing market presents several key metrics that offer insight into its current state and future trends.

- Average Home Value: The average home value in Huntsville stands at $277,353, reflecting a modest 1.1% increase over the past year.

- Days to Pending: Homes in Huntsville typically go pending in approximately 32 days, indicating a relatively brisk pace of sales.

- Inventory: As of February 29, 2024, there were 607 homes available for sale in Huntsville.

- New Listings: In February 2024, 152 new listings entered the Huntsville housing market.

- Median Sale to List Ratio: The median sale to list ratio, a measure of how close homes are selling to their list prices, was 0.980 as of January 31, 2024.

- Median Sale Price: The median sale price of homes in Huntsville was $248,667 as of January 31, 2024.

- Median List Price: The median list price for homes in Huntsville was $330,967 as of February 29, 2024.

- Percent of Sales Over/Under List Price: In January 2024, 16.9% of home sales in Huntsville were over list price, while 63.4% were under list price.

Huntsville MSA Housing Market Forecast

The Huntsville Metropolitan Statistical Area (MSA), encompassing Madison, Limestone, and Giles counties, is anticipated to experience a moderate but steady growth trajectory in the coming months. According to the data provided, the MSA is projected to see a 0.6% increase in housing market performance by April 30, 2024, with further gains expected to reach 5.3% by January 31, 2025. This forecast suggests a promising outlook for the Huntsville MSA, indicating resilience and potential for sustained expansion.

The Huntsville MSA comprises Madison, Limestone, and Giles counties, collectively forming a robust housing market poised for growth and development. With its strategic location, burgeoning industries, and strong community infrastructure, the Huntsville MSA attracts both residents and investors alike. The housing market within this MSA is sizable, catering to a diverse range of preferences and budgets, offering opportunities for homeownership and investment across various neighborhoods and property types.

Are Home Prices Dropping in Huntsville?

Despite fluctuations in market conditions, home prices in Huntsville have remained relatively stable, with no significant indications of a widespread decline. While individual properties may experience price adjustments based on various factors such as location, condition, and market demand, overall, the trend suggests no substantial drop in home prices in the foreseeable future.

Will the Huntsville Housing Market Crash?

Given the current economic indicators and housing market data, there is no imminent risk of a housing market crash in Huntsville. While market conditions may fluctuate due to external factors such as interest rates, employment rates, and economic stability, the Huntsville housing market has shown resilience and continues to exhibit steady growth. However, it's essential to monitor market trends and make informed decisions based on individual circumstances and risk tolerance.

Is Now a Good Time to Buy a House in Huntsville?

For prospective buyers considering entering the Huntsville housing market, now could be a favorable time to buy a house. While competition among buyers may be stiff, historically low mortgage rates and a stable housing market provide an opportune environment for purchasing property. Additionally, investing in homeownership offers long-term benefits and potential appreciation, making it a compelling option for those seeking stability and financial growth.

Should You Invest in the Huntsville Real Estate Market?

Booming Economy, Fueling Growth:

Huntsville is a powerhouse of economic activity, driven by the ever-expanding aerospace and defense industries. Major players like NASA, Lockheed Martin, and Boeing call it home, fostering a steady influx of high-paying jobs. This translates to a thriving population, with growth exceeding the national average, fueling demand for housing and creating a stable investment environment.

Soaring Affordability, Stellar Appreciation:

Compared to national averages, Huntsville boasts remarkably affordable housing. The median home price sits comfortably below the national benchmark, offering investors greater value for their dollar. While prices have seen significant appreciation in recent years, experts predict continued, healthy growth due to robust demand and limited inventory. This sweet spot of affordability and appreciation creates a fertile ground for building equity and maximizing returns.

Rental Market on Fire, Steady Cash Flow:

Huntsville's rental market is sizzling hot. With a low vacancy rate and high occupancy, investors can expect reliable rental income and consistent cash flow. The diverse tenant pool, ranging from young professionals to established families, ensures a broad market appeal for your investment property.

Location, Location, Location: A Strategic Advantage:

Huntsville's strategic location in the southeastern US provides excellent access to major transportation hubs and a growing regional economy. This prime location attracts businesses and residents alike, further solidifying its future growth potential.

Quality of Life that Attracts and Retains:

Beyond the economic factors, Huntsville offers a high quality of life that attracts and retains residents, further bolstering the real estate market. Affordable living, excellent schools, a vibrant arts and culture scene, and stunning natural beauty make Huntsville a desirable place to live, work, and raise a family. This translates to stable tenant pools and lower vacancy risks for investors.

Beyond the Horizon: A Sustainable Future:

Huntsville isn't just a one-hit wonder. The city is diversifying its economy, attracting new industries like tech and healthcare, ensuring long-term sustainability and growth. This forward-thinking approach mitigates investment risks and positions Huntsville for continued success in the years to come.

Ready to Launch Your Investment Journey?

Huntsville's real estate market presents a lucrative opportunity for investors seeking a stable, appreciating, and cash-flowing investment. With its dynamic economy, strategic location, and high quality of life, Huntsville offers a launchpad for building a prosperous real estate portfolio. However, remember, thorough research, careful planning, and partnering with a local expert are crucial for navigating the market successfully. So, buckle up, do your due diligence, and prepare to be wowed by the potential of Huntsville's real estate!

Remember, this is just an overview, and it's essential to conduct your own research and due diligence before making any investment decisions.

References

- https://acre.culverhouse.ua.edu/

- https://www.zillow.com/huntsville-al/home-values/

- https://acre.culverhouse.ua.edu/category/statewide/huntsville-madison-county/

- https://www.realtor.com/realestateandhomes-search/Huntsville_AL/overview