The Mobile housing market currently leans towards a seller's market due to low inventory levels and high demand. With fewer properties available for sale compared to the number of buyers in the market, sellers have the advantage of receiving multiple offers and potentially selling their homes above the asking price. This competitive environment often leads to quick sales and limited negotiating power for buyers.

How is the Mobile Housing Market Doing Today?

Current Market Trends

According to Redfin, as of February 2024, the median price of mobile homes surged by 2.7% compared to the previous year, reaching a respectable median price of $188,000. However, this increment in price did come with a slight trade-off in terms of market speed, as homes in Mobile now take approximately 44 days to sell, up from 37 days in the preceding year. Despite this, 141 homes changed hands during February, slightly fewer than the 154 homes sold during the same period in the prior year.

Competitiveness and Dynamics

Mobile's housing market, while not as brisk as some metropolitan areas, still maintains a degree of competitiveness. Homes typically sell within 34.5 days, with certain properties even garnering multiple offers. Interestingly, the average home in Mobile tends to sell for about 4% below the list price, going pending in around 35 days. Conversely, highly sought-after properties may command premiums, selling for approximately 1% above the list price and securing a buyer in as little as 7 days.

Market Performance Metrics

Metrics such as the sale-to-list price ratio and the percentage of homes sold above the list price provide further insight into market dynamics. Year-over-year, the sale-to-list price ratio increased by 0.7 percentage points to 97.0%, indicating a growing alignment between listing prices and actual sale prices. However, the percentage of homes sold above the list price decreased by 1.5 percentage points to 26.4%, signaling a potential shift in buyer behavior or market conditions.

Mobility and Relocation Trends

Understanding migration and relocation patterns is crucial in comprehending the broader real estate landscape. From December '23 to February '24, 37% of Mobile homebuyers explored options outside of Mobile, while the remaining 63% opted to stay within the metropolitan area. Interestingly, only a minute fraction (0.19%) of homebuyers nationwide expressed an interest in relocating to Mobile from outside metropolitan areas. Among those considering a move to Mobile, Atlanta emerged as the leading source of prospective homebuyers, followed closely by Chicago and Los Angeles.

Market Outlook and Implications

Looking ahead, the Mobile housing market appears poised for continued growth, albeit with fluctuations in response to economic indicators and consumer behavior. Factors such as interest rates, employment trends, and supply-demand dynamics will undoubtedly shape the market's trajectory in the coming months. Presently, Mobile strikes a balance between affordability and competitiveness, offering opportunities for both buyers and sellers.

There are a number of factors driving the strong housing market in Mobile, including:

- A growing economy: Mobile's economy is growing, with new jobs and businesses coming to the area. This is leading to increased demand for housing.

- A low cost of living: Mobile has a relatively low cost of living, making it an attractive place to live and work.

- A variety of housing options: Mobile offers a variety of housing options, from affordable starter homes to luxury waterfront estates. This means that there is something for everyone in the Mobile housing market.

Overall, the Mobile, Alabama housing market is strong and expected to remain so in the near future. Buyers should be prepared to act quickly and make competitive offers in order to secure a home in this market.

Mobile, AL Housing Market Forecast 2024 and 2025

Housing Metrics Explained

For sale inventory: According to Zillow, as of February 29, 2024, the Mobile housing market has 827 properties available for sale.

New listings: In the same timeframe, there were 230 new properties listed for sale.

Median sale to list ratio: The median sale to list ratio, recorded as of January 31, 2024, stands at 0.981.

Median sale price: The median sale price for homes in Mobile, AL, as of January 31, 2024, is $184,333.

Median list price: The median list price for properties in the area, reported on February 29, 2024, is $229,348.

Percent of sales over/under list price: According to data from January 31, 2024, 19.9% of sales were above the list price, while 62.9% were below.

Mobile MSA Housing Market Forecast

The Mobile Metropolitan Statistical Area (MSA) housing market is projected to experience moderate growth in the coming months, according to forecasts. The MSA encompasses Mobile, AL, and its surrounding counties, constituting a significant portion of Alabama's real estate landscape. The forecast indicates a steady increase in housing demand, with the market index expected to rise from 0.5 as of February 29, 2024, to 1 by March 31, 2024, and further to 1 by May 31, 2024. This upward trajectory suggests a favorable outlook for both buyers and sellers within the Mobile MSA.

The Mobile Metropolitan Statistical Area (MSA) comprises Mobile County, the third-most populous county in Alabama, along with neighboring counties. With Mobile serving as its economic and cultural hub, the MSA encompasses a diverse range of communities, each contributing to the region's housing market dynamics. As one of Alabama's largest MSAs, Mobile's housing market exerts a substantial influence on the state's overall real estate landscape.

The Mobile MSA boasts a sizable housing market characterized by a mix of urban and suburban neighborhoods, catering to various lifestyle preferences. With a population exceeding 400,000 residents, Mobile County alone underscores the significance of the region's real estate sector. The housing market's resilience and adaptability contribute to its prominence within the state, attracting both local and out-of-state investors seeking lucrative opportunities.

Is Mobile, AL a Buyer's or Seller's Housing Market?

The Mobile housing market currently leans towards a seller's market due to low inventory levels and high demand. With fewer properties available for sale compared to the number of buyers in the market, sellers have the advantage of receiving multiple offers and potentially selling their homes above the asking price. This competitive environment often leads to quick sales and limited negotiating power for buyers.

Are Home Prices Dropping in Mobile?

Despite fluctuations in market conditions, home prices in Mobile, AL, have shown resilience over time. While short-term variations may occur due to factors such as seasonal trends and economic conditions, there is no indication of a significant, sustained drop in home prices based on current data. The market's stability and consistent demand contribute to the maintenance of property values in the region.

Will the Mobile Housing Market Crash?

As of the present analysis, there are no imminent signs of a housing market crash in Mobile, AL. While market conditions can change rapidly and are influenced by various factors, including economic indicators, interest rates, and geopolitical events, the Mobile housing market remains relatively stable with moderate growth projected in the foreseeable future. However, ongoing monitoring of market trends and prudent financial planning are essential for both buyers and sellers to navigate potential risks.

Is Now a Good Time to Buy a House?

For prospective homebuyers in Mobile, AL, the decision to purchase a property depends on individual circumstances and long-term financial goals. Despite the competitive nature of the current seller's market, there are opportunities for buyers to secure favorable deals, especially with low mortgage rates as compared to last year.

However, it's essential for buyers to conduct thorough research, assess their financial readiness, and work with experienced real estate professionals to navigate the complexities of the purchasing process. Ultimately, the decision to buy a house should align with one's personal and financial objectives, considering both short-term benefits and long-term investment potential.

Is Mobile, AL a Good Place to Invest in Real Estate?

Mobile, Alabama is indeed a promising location for real estate investment. Several compelling factors make it an attractive choice for potential investors:

1. Affordability and Value Appreciation

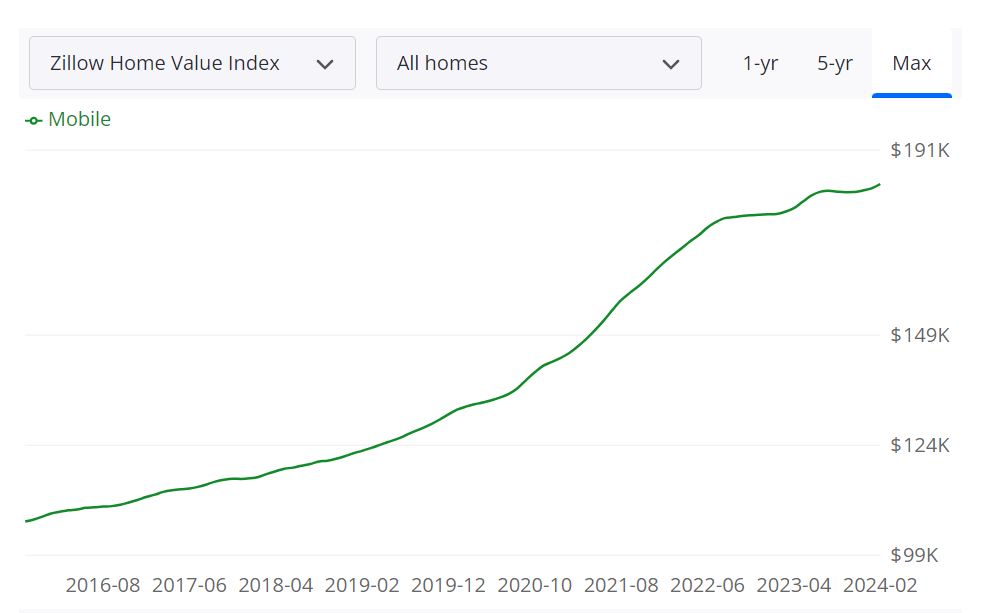

Mobile boasts an affordable housing market, with the average home value at $183,518 (source: Zillow). The value appreciation, showing a 3.8% increase over the past year, signifies potential for solid returns on investment.

2. Strong Market Demand

The market in Mobile is driven by demand for housing due to a growing economy and an influx of new jobs and businesses. The city's low cost of living further attracts individuals and families, fueling the demand for homes.

3. Diverse Housing Options

Mobile offers a wide range of housing options, catering to various demographics. From affordable starter homes to luxury waterfront estates, the market provides opportunities for diverse investments, appealing to a broader range of potential buyers or renters.

4. Strategic Location and Development Opportunities

Mobile's strategic location as a port city and its proximity to the Gulf of Mexico make it a hub for trade and commerce. Additionally, ongoing infrastructural development projects enhance the overall appeal of the city, potentially boosting property values in the future.

5. Attractive Rental Market

The city's growing population and economic activity create a robust rental market. Real estate investors can benefit from rental income, especially in areas popular with renters, such as the Midtown, Spring Hill, and West Mobile neighborhoods.

Considering these factors, Mobile, Alabama presents a promising landscape for real estate investment. However, it's crucial to conduct thorough market research, consider your investment goals, and work with a qualified real estate agent to make informed decisions and maximize your investment potential.

References:

- https://www.zillow.com/mobile-al/home-values

- https://www.redfin.com/city/12836/AL/Mobile/housing-market

- https://www.realtor.com/realestateandhomes-search/Mobile_AL/overview

- https://www.neighborhoodscout.com/al/mobile/real-estate