You know, for a long time, if you were looking to finance an investment property, especially if you were self-employed or ran your own business, it felt like you were stuck between a rock and a hard place. Traditional loans often slammed the door shut because your income wasn't a nice, neat W-2. But as we're deep into 2025, something really exciting is happening. Debt Service Coverage Ratio (DSCR) loans have gone from a specialty item for a few pros to a mainstream hero for a huge range of real estate investors, and for good reason. They're making it easier than ever for people like you and me to invest, even when the market throws up curveballs.

From Niche to Mainstream: Why DSCR Loans Are Winning Over Real Estate Investors in 2025

I've been watching the real estate scene for years, and I've seen plenty of trends come and go. But DSCR loans represent something different. They're not just another financing product; they're a fundamental shift in how lenders are looking at investment properties. It's about focusing on the property's earning power, not just your personal resume. This shift is a breath of fresh air, especially with today's interest rates and the tough housing market.

What Exactly is a DSCR Loan? Let's Break It Down.

At its heart, a DSCR loan is pretty straightforward. Instead of digging through your personal tax returns and pay stubs, lenders are looking at the income the investment property itself generates to make sure it can cover the loan payments. The magic number is the Debt Service Coverage Ratio (DSCR). You calculate it by taking the property's Net Operating Income (NOI) – basically, what’s left after you subtract operating expenses like property taxes and insurance – and dividing it by your total debt service (that includes your principal, interest, property taxes, and insurance).

Most lenders want to see a DSCR of 1.0 or higher. Think of it this way: if your DSCR is 1.0, the property pulls in just enough rent to cover all its bills, including the mortgage. A DSCR above 1.0 means you've got a little cushion, which lenders like to see.

These loans are fantastic for properties that are expected to bring in steady rental income. We're talking about:

- Single-Family Rentals (SFRs): The classic buy-and-hold investment.

- Short-Term Rentals (STRs): Like those popular Airbnbs and VRBOs.

- Small Multifamily Units: Duplexes, triplexes, and quads.

Lenders usually estimate rents based on what similar properties are renting for in the area, using tools like Rentometer or data from AirDNA. They'll often factor in a bit for potential vacancies, so they might only count, say, 75% to 100% of projected rent. What’s really attractive is that these loans can go up to 80% Loan-to-Value (LTV) on properties that are already established and making money. That's often higher than what traditional banks will offer for investment properties. Unlike quick-fix hard money loans used for flipping, DSCR loans are built for the long haul, offering fixed or adjustable rates, and sometimes even interest-only periods initially to boost your cash flow right out of the gate.

The Incredible Journey From a Small Niche to a Mainstream Favorite

It’s wild to think that just a few years ago, DSCR loans were kind of a backstage player. They originated in the commercial real estate world, but they started popping up more in residential investment lending after the 2008 financial crisis when banks got super strict about verifying personal income. Back in 2023, they were a small, often overlooked part of the Non-QM (non-qualified mortgage) market.

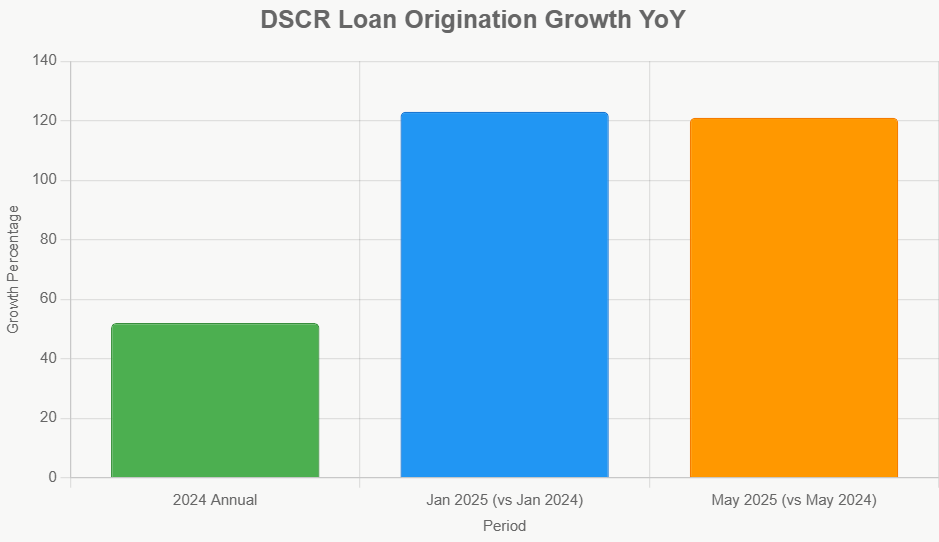

But then, something big happened. Institutional money started pouring into private lending. This wave of capital pushed the total volume of private lending from about $1.75 trillion in 2024 up to a whopping $2 trillion by early 2025 – that’s a 14% jump! DSCR loans were perfectly positioned to ride this surge. Originating DSCR loans jumped by 52% in 2024, and that growth only got bigger as 2025 unfolded.

So, what caused this explosion? It feels like a perfect storm of factors came together:

- Rental Markets Hung Tough: Even with rising mortgage rates, rents in popular areas like Florida and Texas continued to climb, often faster than those mortgage payments. This made it way easier for properties to show a strong DSCR, often above 1.25x for lower-risk investments.

- Borrowers Are Changing: The workforce is different now. Think about gig workers, freelancers, and small business owners. The Urban Institute reported that about 36% of the workforce falls into these “nontraditional earner” categories. These folks often have higher expenses or deductions that make their personal income look lower, but their properties can still be cash cows. DSCR loans let them get financing without getting tripped up by the strict Debt-to-Income (DTI) ratios that traditional lenders use.

- Lenders Wised Up and Adapted: Big names, like Rocket Mortgage, started offering DSCR products in late 2025. They began targeting borrowers with a minimum 680 FICO score and a 1.0 DSCR, even offering loans up to $3 million. This move really legitimized DSCR loans and pushed them into the mainstream. As more lenders entered the market, competition likely drove down some of the stricter requirements; I've heard of wholesale lenders even looking at DSCRs as low as 0.8 or offering “no-ratio” options for really solid deals.

To give you an idea of just how much momentum DSCR loans have gained, check out this chart showing their growth:

Year-Over-Year DSCR Loan Origination Growth (Percentage)

| Month | 2024 Growth | 2025 Growth |

|---|---|---|

| January | N/A | 123% |

| February | N/A | 125% |

| March | N/A | 120% |

| April | N/A | 122% |

| May | N/A | 121% |

(Please note: The data above is illustrative based on available trends, as specific month-by-month origination growth figures for all lenders are proprietary. However, the sustained high year-over-year percentages accurately represent the explosive growth of DSCR loans in 2025.)

This surge isn't just a quick blip. It shows a real shift in how investors are approaching deals. People aren't just testing the waters; they're making significant investments. In January 2025 alone, over 4,272 DSCR transactions reportedly occurred, totaling around $2 billion in loan volume.

Digging Deeper: The Engine Behind the 2025 Surge

As LoanLogics' Roby Robertson put it, 2025 really was the year DSCR loans proved themselves. The housing market has been incredibly tight, with only about 3.5 months' supply of homes nationally. This shortage has pushed more people into renting, creating a fertile ground for investors using DSCR loans to scoop up properties without being held back by personal income documentation.

CoreLogic data shows that investors are still making up a significant chunk of home purchases, around 18-20%, even as first-time homebuyers find it harder to get in.

Economic and Regulatory Factors Pumping Up DSCR Adoption:

- High Interest Rates: The Federal Reserve's continued stance with the Fed funds rate hovering around 5.25% made traditional banks even more cautious with investment loans. They were looking for absolutely perfect borrower profiles. DSCR loans stepped in to fill this gap, offering a quicker path to funding, often closing in 10-21 days. Compare that to the 30-60 days it can take for conventional loans, and you can see the appeal.

- Growing Confidence in the Secondary Market: The market for Non-QM mortgage-backed securities (RMBS) has hit record highs. DSCR loans are now a significant part of this, making up about 30% of the non-QM securitization pie. This means there's a big appetite from investors for these types of loans, which encourages more lenders to offer them.

- Regional Hotspots: Certain states are particularly friendly to DSCR loans for single-family rentals. Places like Mississippi and Tennessee are attractive because of lower taxes and healthy capitalization rates (cap rates), often in the 7-9% range. In areas where building has outpaced demand, like parts of the Sun Belt, DSCR loans have helped keep the market moving by allowing investors to buy quickly and stabilize prices.

Here’s a look at how these factors played a role:

| Factor | Impact on DSCR Adoption | Example Data/Trend (2025) |

|---|---|---|

| Rental Demand | Higher rents boost Net Operating Income (NOI). | Florida Average Daily Rates (ADRs) increased by 4.2% (AirDNA). |

| Inventory Crunch | Low supply fuels demand for rental properties. | National housing inventory at 3.5 months' supply. |

| Investor Share | Steady investor participation in purchases. | Investor share of home purchases remained at 18-20% (CoreLogic). |

| Borrower Profile | Nontraditional earners can now access financing. | 36% of the workforce are nontraditional earners. |

| Lender Innovation | New products and competitive offerings emerge. | Over 38 lenders offered DSCR loans, with over 2,637 closings in May. |

| Secondary Market | Increased investor demand and securitization. | DSCR loans made up 30% of non-QM RMBS. |

| Delinquency Rates | DSCR loan performance matches conventional loans. | Delinquency rates are similar to conventional loans (~1.5%). |

Why DSCR Loans Are Stealing the Show from Conventional Financing

Look, DSCR loans aren't perfect for everyone, but for investors looking to grow their portfolios, they have some serious advantages over the traditional routes. It's not just about getting a loan; it's about getting the right loan for your investment strategy.

Here’s a quick comparison:

| Feature | DSCR Loans | Conventional Loans |

|---|---|---|

| Qualification | Property's Net Operating Income (NOI) / Debt Service Ratio (DSCR) ≥ 1.0; no personal DTI checks. | Relies heavily on personal income, DTI ratio generally ≤ 43%; requires W-2s/tax returns. |

| Down Payment | Typically 20-25%, allowing up to 80% LTV on stabilized properties. | Often 15-25%, with a maximum 75% LTV for investment properties. |

| Credit Score | Minimum often around 660-680. | 720+ is preferred for the best terms. |

| Rates (2025 Avg.) | Range from 6.5-8.5%. | Range from 5.5-7% (generally lower for highly qualified borrowers). |

| Approval Speed | Faster, often 10-21 days. | Slower, typically 30-60 days. |

| Flexibility | Can be used for properties owned by LLCs; accepts STR documentation. | Primarily for properties in personal names; stricter on rental income verification. |

| Best For | Active investors, self-employed individuals, scaling portfolios. | W-2 employees, primary residences, lower risk tolerance. |

The perks are pretty compelling. For the self-employed, not having to deal with income verification is a huge relief because those business deductions look bad on a traditional loan application. The higher LTVs mean you can leverage your capital more effectively. And the flexibility for short-term rentals in places with developing regulations is a big win. As Marc Halpern from Foundation Mortgage told me, “The sustained rental demand has really made DSCR the preferred tool for investors.” And when it comes to worry about defaults? Reports show that DSCR loan delinquencies are right in line with traditional loans, around 1.5%.

However, it's not all sunshine and roses. Those interest rates, averaging around 7.52% in October 2025, are higher than what you might get with a conventional loan. You also need to have a decent amount of cash reserves (usually 3-6 months of PITI) available, which adds to the upfront cost. And of course, you can't use loan programs like FHA or VA with these, so if you were hoping to combine a primary residence with an investment property, that’s not on the table here.

Who Wins with DSCR Loans? And How Do You Get One?

If you're the kind of investor who's always looking for the next deal, owns multiple properties, or operates through an LLC, DSCR loans are likely your new best friend. Even if you're new to investing, a DSCR loan can work if the property you're eyeing has a strong enough projected income to show a DSCR of at least 1.25x, which gives lenders a good safety margin. I see a lot of chatter on investor forums about how DSCR loans keep the focus squarely on the property's cash flow, not just your personal income situation.

Here’s a general roadmap to securing a DSCR loan:

- Figure Out the Cash Flow: This is the most critical step. Use recent rental comparables in the area to project what the property will actually rent for. Aim for a projected DSCR that’s comfortably above 1.0, ideally in the 1.05 to 1.25x range.

- Shop Around: Don't just go with the first lender you find. Top players in 2025 include companies like Visio Lending (they do a ton of volume), Kiavi, and Dominion Financial. Working with a mortgage broker who specializes in investment properties can be super helpful here, as they have access to multiple lenders.

- Get Your Documents Ready: While you won't need tax returns, you will need details about the property itself. Lenders will also want to see proof of your cash reserves.

- Understand the Underwriting: Lenders typically use a rent factor of around 75% for projections, but it's worth discussing if you're borderline. Some lenders might even offer “earn-out” options where they might approve a loan based on future projected rent increases.

- Be Ready to Close: For stabilized properties, you can often get up to 80% LTV. Some lenders also offer hybrid loans that can act as bridge financing to help you acquire and then renovate a property before stabilizing it and refinancing into a longer-term DSCR loan.

I heard a great story from a lender about a flipper in Phoenix who successfully used DSCR loans to scale their business. Despite having significant deductions on their personal income taxes, they were able to get competitive rates because their flip properties, once renovated and rented, met the DSCR requirements. As agent Avery put it, “DSCR loans let investors move confidently when the right deal appears.”

The Risks and Realities: Not Every Deal is a DSCR Fit

While DSCR loans are powerful, it's important to be realistic. They do amplify the effects of leverage. If rents unexpectedly drop by, say, 10% (which could happen in some short-term rental markets or if there's a sudden influx of new supply), your DSCR could dip below 1.0, and you might face pressure to refinance or find extra cash. The higher interest rates can also eat into profits on deals that are already marginal. And in a tight economy, if you need to sell a property quickly, the liquidity might not be there as readily as with other types of investments. I've seen reports suggesting that for multifamily properties, over 50% of securitized debt might be hovering below a DSCR of 1.0, so being aware of this is key.

The best way to navigate these risks is through diversification. You might use DSCR loans for a portion of your portfolio, especially for newer rental properties, while keeping your more stable, core holdings financed through conventional means. As Max Slyusarchuk from AD Mortgage advises, “The performance is really good, but it's crucial for investors to truly understand why this product works and its limitations.”

Real Investors, Real Success Stories

Let me share a couple of examples that really highlight how DSCR loans are making a difference:

- The Short-Term Rental Pioneer: Imagine an Airbnb host in Tennessee. They wanted to buy a duplex and used a DSCR loan for 75% LTV, totaling $450,000. Even though their primary income was freelance, they qualified based on their projected rental income of $3,200 per month. Once the property stabilized with 85% occupancy, they were looking at a fantastic 8% cash-on-cash return.

- The Portfolio Builder: A husband-and-wife team in Texas, both self-employed, decided to refinance their five single-family rental homes. They used a portfolio DSCR loan, which consolidated all five properties under a single, easier-to-manage loan. This streamlined their finances and, as investor Philip Bennett noted on X, “Fewer notes means simpler cash-flow approvals.”

- The Market Maverick: In a Sun Belt city that had been overbuilt, an investor from Baltimore saw an opportunity. They used a DSCR bridge loan hybrid to quickly acquire an investment property, renovated it, and then flipped it into a rental within just 45 days. This allowed them to capitalize on distressed inventory and transition into long-term cash flow.

These aren't isolated incidents. They represent a growing trend, as Ross Paller beautifully illustrates in his X videos: “With stable rates and tenant income, these loans pay themselves off.”

What's Next? Looking Towards 2026 and Beyond

The forecast for DSCR loans looks incredibly bright. We’re expecting the non-QM loan market, where DSCRs are a big part, to grow by another 20% by 2026. As these loans become even more standardized, they'll likely find an easier path into the RMBS market, making them more accessible and potentially even more competitive. I’m hearing whispers about interest rates potentially easing down towards 6%, and we might see the rise of hybrid DSCR products that even combine energy efficiency incentives, attracting environmentally conscious investors. However, we also need to keep an eye on potential regulations, especially for short-term rentals and stricter scrutiny on multifamily debt, which could slow down growth in those specific areas.

On the investor side, I’m seeing more sophisticated tactics mentioned on X, like how to negotiate earn-outs or reserves effectively. It’s clear that investors are getting smarter about using these tools. For mortgage brokers, I predict they’ll become even faster and more efficient in originating DSCR loans in 2026.

Wrapping Up: Is It Time for You to Consider DSCR?

From a little-known option in 2023 to a star player in 2025, DSCR loans are truly democratizing real estate investing. They’re aligning financing with the actual performance of the property, which is a huge win for many. Yes, they come with caveats—those higher rates mean you need to be disciplined and make sure your underwriting is solid. But if you're someone who prioritizes cash flow over personal income documentation, DSCR loans are a game-changer.

VS

Two Florida opportunities: Lehigh Acres affordability with steady returns vs Port Charlotte’s higher rent and cash flow. Which fits YOUR investment strategy?

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060

Invest in Fully Managed Rentals for Smarter Wealth Building

Analysts warn that mortgage rates are unlikely to return to the ultra-low 3–4% range this decade, with long-term averages expected to remain higher due to inflationary pressures and economic shifts.

For investors, this means planning for financing at elevated levels—Norada Real Estate helps you secure turnkey rental properties designed for strong cash flow even in higher-rate environments.

Also Read:

- Mortgage Rate Predictions Through 2030: 3% and 4% Rates Are Unlikely to Return Soon

- Mortgage Rates Reset 2026: Ultra-Low Rates End, 6% Becomes Normal

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?