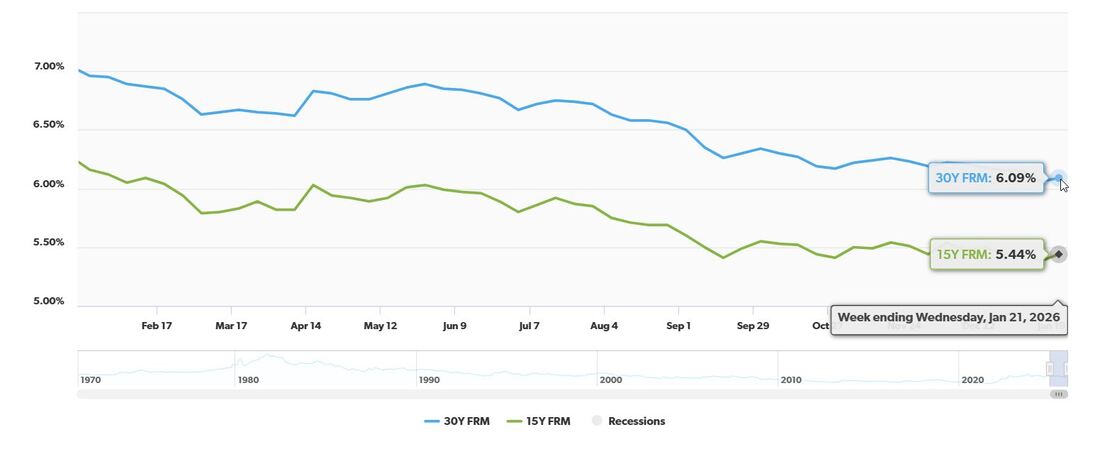

As of today, January 29, 2026, the general trend for mortgage rates shows a slight uptick following the Federal Reserve's recent decision to pause its rate-cutting spree. Specifically, according to Zillow's data, the 30-year fixed mortgage rate has climbed to 6.00%, marking a seven-basis-point increase. While this might sound like a lot, it's a signal that the market is adjusting to new economic signals.

It's been a bit of a rollercoaster for mortgage rates lately. For a good chunk of the past year, we were hovering around some of the lowest points we'd seen in a while. But this week, we've seen a small shift upwards.

Today's Mortgage Rates, Jan 29: 30-Year Fixed Rate Rises Amid Fed's Recent Decision

What the Numbers Are Telling Us Today

Let's break down the current rates, as reported by Zillow. It’s good to have a clear picture of where things are at.

| Loan Type | Rate |

|---|---|

| 30-year fixed | 6.00% |

| 20-year fixed | 5.84% |

| 15-year fixed | 5.45% |

| 5/1 ARM | 6.20% |

| 7/1 ARM | 6.05% |

| 30-year VA | 5.41% |

| 15-year VA | 5.07% |

| 5/1 VA | 5.13% |

These figures are important. They give us a benchmark, but it’s what’s behind these numbers that really matters for understanding the future.

Why the Slight Increase? The Federal Reserve's Influence

The most significant factor pushing mortgage rates higher this week is the Federal Reserve's decision at their January 28th meeting to pause rate cuts. For a while there, the Fed had been cutting its benchmark interest rate, which usually trickles down and makes borrowing, including mortgages, a bit cheaper.

However, after three consecutive cuts late last year, they've decided to hit the brakes. This pause is a signal that they believe the economy is starting to stabilize, or at least that they want to see how these previous cuts play out before making further moves. For us on the ground, this translates to mortgage rates moving a bit higher.

My Take: Stability on the Horizon?

From my perspective, this pause from the Fed is actually a good thing for stability. We’ve seen a lot of back-and-forth with rates. Now, the experts are predicting that rates will likely stay within a pretty defined range for a good while. Many are saying we'll see the 30-year conforming loan rate stay between 6% and 6.5% for most of 2026.

Why is this important? Because home buyers and sellers thrive on predictability. Wild swings in interest rates make planning difficult. If rates were to suddenly drop significantly below 6%, you can bet we'd see a huge surge in buyer demand, almost like everyone rushing to get their loan before the prices go up again.

What Really Moves Mortgage Rates? It's Not Just the Fed

It’s a common misconception that the Federal Reserve’s federal funds rate is the direct driver of mortgage rates. While it has an influence, mortgage rates are actually more closely tied to something called the 10-year Treasury yield. Think of it as a barometer for where investors think the economy and inflation are heading.

Right now, ongoing worries about inflation and how strong the economy is globally are key players. If inflation stays a bit higher than we’d like, that puts upward pressure on yields, and in turn, mortgage rates.

The “Psychological Switch”: When Rates Start with a “Five”

Here’s a quirky but important insight: Lenders, like those at Rocket Mortgage, have observed that when mortgage rates dip below 5.99%, buyer demand sees a significant jump, sometimes by as much as 30%. It’s like a collective “aha!” moment for borrowers. When a rate starts with a “five,” instead of a “six,” it just feels much more attainable and appealing, even if the actual difference is small. This psychological switch is a powerful force in the real estate market.

A Recent Boost from Government Action

You might remember that rates saw a nice dip recently. I recall seeing that President Trump had directed the federal government to step in and purchase a substantial amount of mortgage bonds – around $200 billion. This move was aimed at narrowing the gap between mortgage rates and Treasury yields, effectively trying to “unfreeze” rates and make them more accessible. While some of those gains have been softened by the rising 10-year Treasury yields I mentioned, it shows how government policy can directly impact the mortgage market.

Expert Predictions: A Narrow Band Ahead

Looking at the bigger picture, most of the big players in the housing industry, like the Mortgage Bankers Association and Fannie Mae, are forecasting a period of stability. They generally expect rates to stick within that 6% to 6.5% range for the 30-year fixed mortgage for the foreseeable future. This means that for those looking to buy or refinance, the market might be more predictable than it has been in recent years.

Key Economic Drivers Shaping Today's Rates

Beyond the immediate Fed decision and Treasury yields, several other economic forces are at play in 2026:

- Inflation Trends: This remains the number one factor for me. If inflation continues to cool down and gets closer to the Federal Reserve's target of 2%, we'll likely see mortgage rates follow suit. However, if inflation proves stubborn or even rises, lenders will need to charge more to protect their future earnings, keeping rates higher.

- Labor Market Health: A strong job market is good for the economy overall, but it can also put upward pressure on wages and, consequently, inflation. This can make the Fed hesitant to cut rates. On the flip side, if the job market starts to falter, or if we see signs of a recession, the Fed might be forced to cut rates more aggressively, potentially pushing mortgage rates down into the low 5% range.

- National Debt and Fiscal Pressure: Let's be honest, the U.S. has a significant national debt. High levels of government borrowing mean more bonds being issued, which can put upward pressure on all long-term interest rates, including mortgages. It's a persistent background factor.

Emerging Factors in 2026

This year has already brought some interesting developments that are shaping the mortgage market:

- Government Policy Shifts: As we’ve seen, the administration is actively trying to influence rates. The push for Fannie Mae and Freddie Mac to buy mortgage bonds is a direct attempt to make borrowing more affordable. It's a strategic move to manage economic growth.

- The “Lock-In” Effect and Inventory: A lot of homeowners locked in super-low mortgage rates during the pandemic, typically below 4%. This has created a “lock-in” effect, discouraging them from selling because they'd have to take on a much higher rate for a new home. However, as rates stabilize in the low 6% range, some economists are starting to believe that more people will finally decide to move. This could slowly, gradually, increase the number of homes for sale, which would be a welcome change for many buyers facing limited inventory.

What This Means for You

If you're thinking about buying a home or refinancing, remember that today's rates suggest a period of relative calm, but with a slight upward adjustment. It's a good time to:

- Talk to your lender: Get pre-approved to understand exactly what you can afford at current rates.

- Shop around: Even small differences in rates can save you thousands over the life of a loan.

- Consider your financial goals: If you plan to stay in your home for many years, a 6% rate might still be attractive compared to historical averages. If you're looking for a shorter-term solution, an ARM might be worth exploring, but understand the risks.

The mortgage market is always dynamic, influenced by a complex web of economic indicators and policy decisions. While today brings a slight rise, the outlook leans towards stability, which, in my book, is a positive sign for anyone navigating the housing market.

and

Florida’s A+ affordable rental vs Punta Gorda’s larger high‑yield property. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Speak to a Norada investment counselor (No Obligation):

(800) 611-3060

Mortgage rates remain high in 2026, but rental properties continue to deliver strong cash flow and appreciation. Savvy investors know that turnkey real estate is the path to passive income and long‑term wealth.

Norada Real Estate helps you secure turnkey rental properties designed for immediate cash flow and appreciation—so you can invest smartly regardless of interest rate trends.

Also Read:

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?