Sixty-five percent of U.S. housing markets are worse off today than they were four years ago according to the California-based real estate research firm RealtyTrac.

Sixty-five percent of U.S. housing markets are worse off today than they were four years ago according to the California-based real estate research firm RealtyTrac.

The results of the survey arrive the same day as the final presidential debate and just weeks before the general election.

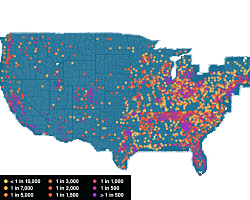

We've all heard that the housing bubble's pop led to thousands of foreclosures, but its interactive maps like this that really show how prevalent the problem was — and still is. Part of a project on 30 election issues, the map below uses data from RealtyTrac to display foreclosure rates by county.

We've all heard that the housing bubble's pop led to thousands of foreclosures, but its interactive maps like this that really show how prevalent the problem was — and still is. Part of a project on 30 election issues, the map below uses data from RealtyTrac to display foreclosure rates by county. After nine consecutive months of appreciation, August was the first month where home values decreased by 0.1% to $152,100, according to Zillow.

After nine consecutive months of appreciation, August was the first month where home values decreased by 0.1% to $152,100, according to Zillow. Following up to our previous article titled, “

Following up to our previous article titled, “ Consider Minneapolis, Minn. You could’ve bought, out of foreclosure, a three-bedroom, two-bath house of 1,356 square feet on a quarter acre lot for about $29,000. It needed a lot of work, but houses in the neighborhood recently sold for $75,000.

Consider Minneapolis, Minn. You could’ve bought, out of foreclosure, a three-bedroom, two-bath house of 1,356 square feet on a quarter acre lot for about $29,000. It needed a lot of work, but houses in the neighborhood recently sold for $75,000. Investors are buying homes at a more rapid pace than ever before, and this time their investments actually make sense. Most are buying homes below replacement cost, or at prices that allow for a reasonable rental return.

Investors are buying homes at a more rapid pace than ever before, and this time their investments actually make sense. Most are buying homes below replacement cost, or at prices that allow for a reasonable rental return. The Wall Street Journal and The New York Times both published articles in the past six weeks stating that the housing market has reached a bottom. But hold on for just a minute… It seems that not everyone believes it.

The Wall Street Journal and The New York Times both published articles in the past six weeks stating that the housing market has reached a bottom. But hold on for just a minute… It seems that not everyone believes it. There are many complicated ways to analyze the market conditions in your local area, enough to confuse and boggle the novice investor’s mind. However, you can keep things simple by using our “MAD” method. This means paying attention to three important factors and noting whether they’re going up or down:

There are many complicated ways to analyze the market conditions in your local area, enough to confuse and boggle the novice investor’s mind. However, you can keep things simple by using our “MAD” method. This means paying attention to three important factors and noting whether they’re going up or down: One crisp fall Sunday afternoon under bright blue skies, my wife and I visited five homes up for sale. We remembered them by their street names: Big Acre, Blue Silo, Pontiac, Prairie Rose and Lamont. The lineup has a poetic ring to it, but the real music is the potential rates of return from owning them and renting them out.

One crisp fall Sunday afternoon under bright blue skies, my wife and I visited five homes up for sale. We remembered them by their street names: Big Acre, Blue Silo, Pontiac, Prairie Rose and Lamont. The lineup has a poetic ring to it, but the real music is the potential rates of return from owning them and renting them out.