The Kansas City housing market is hot and in many ways the envy of housing pundits on both coasts. This dynamic market spans both Missouri and Kansas and is characterized by rising home prices, low inventory, and a fiercely competitive market. Whether you're a buyer or a seller, staying on top of the latest trends and forecasts for 2024 is crucial. In this article, we'll provide a comprehensive overview of the Kansas City housing market by delving into the latest data, insights, and predictions. So, let's dive right in!

Current Kansas State Housing Market Trends in 2024

Kansas City is also in the state of Kansas. It is the third-largest city in the U.S. state of Kansas, and the county seat of Wyandotte County. The following housing market trends are the state of Kansas and the Kansas City located there. Kansas is a state in the Midwestern United States that has seen some significant changes in its housing market in recent years.

According to recent data provided by the Kansas Association of REALTORS®, the market continues to favor sellers, despite witnessing a decline in sales activity. Jon Fort, President of KAR and affiliated with Arc Real Estate in Garden City, notes that although sales have dipped, prices are on the rise, and homes are spending less time on the market compared to pre-pandemic levels.

February 2024 Market Highlights

- Decrease in Home Sales: Home sales in Kansas saw a 7.4% decline in February 2024 compared to the same period last year. This trend is reflected nationally, with a 3.3% decrease in sales over the previous year.

- Rising Home Prices: Despite the drop in sales, home prices continue to climb across the state. The average sale price statewide in February 2024 was $294,960, marking an 8.0% increase from the previous year. Prices in the Midwest rose by 6.8%, while the entire US experienced a 5.7% increase.

- Shift in Mortgage Rates: Mortgage rates have seen a slight decrease, offering some relief to prospective buyers. The national average commitment rate on a 30-year conventional mortgage for the week ending March 15, 2024, stood at 6.87%.

These market dynamics present both challenges and opportunities for homebuyers and sellers alike. While the decrease in sales activity may raise concerns for sellers, the upward trajectory of home prices indicates a continued demand in the market. For buyers, although mortgage rates have slightly dropped, the competitive landscape and rising prices necessitate a strategic approach.

Insights into Missouri Housing Market Trends in 2024

Number of Listings and Residential Property Sales

According to the Missouri REALTORS®, in February 2024, the number of listings in Missouri stood at 8,842, reflecting a gradual decline from the previous months. However, this figure signifies a notable decrease compared to the same period last year, underlining a trend worth considering. Despite the decrease in listings, it's crucial to note that the number of residential properties sold year-to-date (YTD) has experienced a slight uptick, reaching 8,698, marking a 3.9% increase from the previous year.

Median Selling Prices

One of the most significant aspects of the Missouri housing market is the median residential property selling price. Over the past year, there has been a steady increase, with the median price reaching $235,000 in February 2024. This marks a substantial 21.1% surge compared to the same period three years ago, indicating a robust growth trajectory in property values. Furthermore, the month-to-month comparison reveals a 6.8% increase in the median selling price from February 2023 to February 2024, demonstrating a consistent upward trend.

Market Activity and Performance

Despite fluctuations in the number of homes sold, the Missouri housing market continues to exhibit resilience and stability. In February 2024, there were 4,509 homes sold, representing a 13.6% increase compared to the same month in the previous year. However, it's noteworthy that the average number of days on the market has also seen a slight uptick, reaching 52 days in February 2024. This trend suggests a nuanced balance between supply and demand dynamics within the market.

Economic Impact and Dollar Volume

When analyzing the economic impact of the housing market, the dollar volume provides valuable insights into the overall performance. Despite fluctuations in market activity, the monthly dollar volume in February 2024 reached $1,276,708,208, showcasing a resilient market with significant transactional value. While there was a slight decrease from the previous month, the year-over-year comparison indicates an 11.4% increase in dollar volume, highlighting the enduring strength of the Missouri housing market.

Kansas City, Missouri Housing Market Report

Located on the Missouri River at the confluence with the Kansas River, the city is contiguous with Kansas City, Kansas. But most of Kansas City lies within Jackson County, Missouri. A large, prosperous, self-sufficient, and culturally rich city, it is no wonder why it has seen a continuous rise in its employment, directly impacting the local real estate.

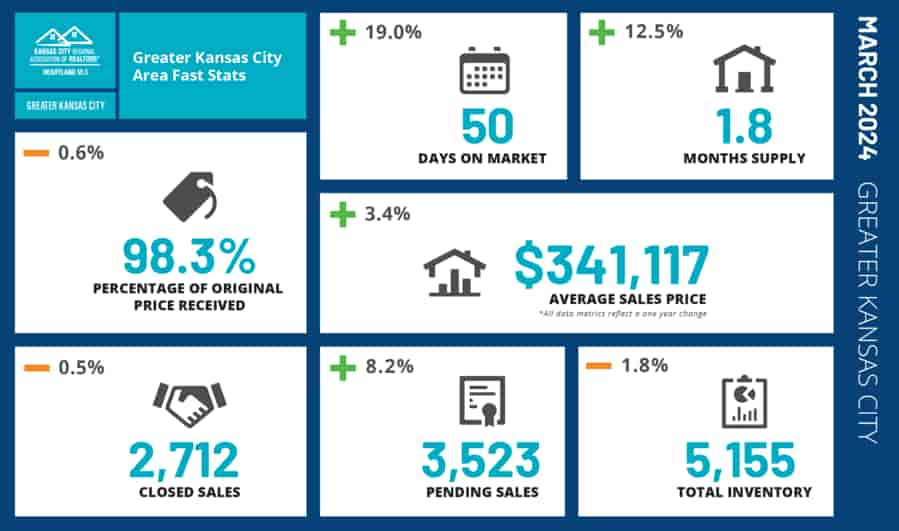

Here are the Greater Kansas City housing market statistics for March 2024 as reported by the Kansas City Regional Association of Realtors (KCRAR).

- In the Greater Kansas City housing market, the average sales price is up +3.4% to $341,117

- Home sales in the Kansas City area totaled 2712 units in March 2024, down 0.5 percent from the same month in 2023.

- Pending sales were up by 8.2% to 3523 properties being under contract.

- Homes that sold in December were on the market for an average of 50 days and sold for 98.3 percent of their original asking prices.

- The number of active listings decreased by 1.8% year-over-year, which makes the supply equal to 1.8 months (up 12.5% YoY).

- Months' supply refers to the number of months it would take for the current inventory of homes on the market to sell given the current sales pace.

- It is a good indicator of whether a real estate market favors buyers or sellers, and Kansas City is a seller's market.

Kansas City, MO Housing Market Forecast for 2024 and 2025

Kansas City's housing market is one of the most affordable in the nation. It is one of the hottest real estate markets for affordable rental real estate investment. What are the Kansas City real estate market predictions? Based on the current data and trends, there is no indication of an imminent housing market crash in Kansas City. The market appears stable, with healthy demand and rising home values.

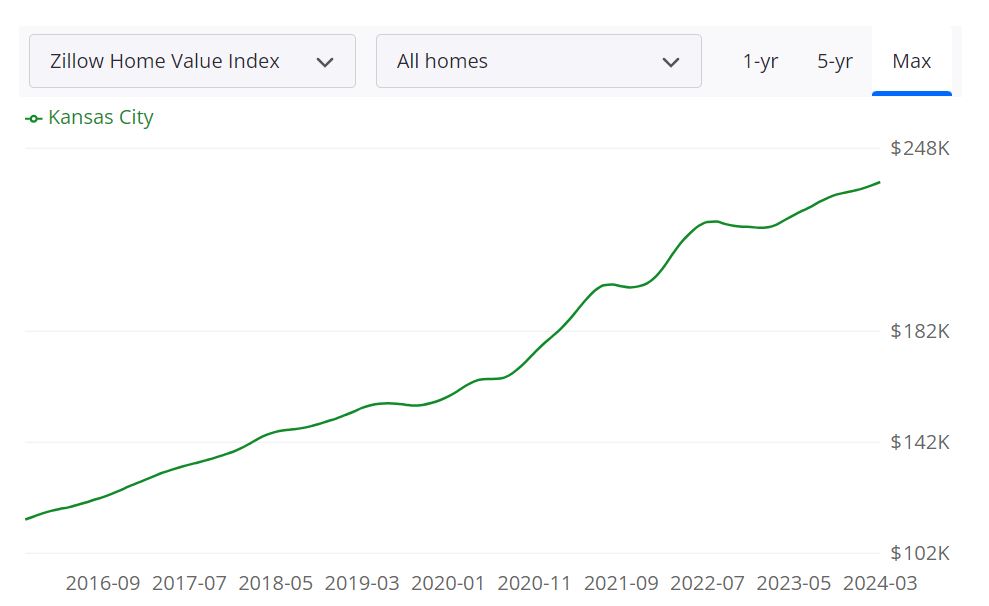

According to Zillow, the Kansas City housing market is currently experiencing a robust growth trajectory, with the average home value soaring to $236,292, marking an impressive 6.9% increase over the past year. Moreover, homes in Kansas City are swiftly going to pending status in approximately 7 days, indicating a high demand in the market.

Key Housing Metrics:

1. Inventory: As of March 31, 2024, there are 1,323 homes available for sale in Kansas City, offering a diverse range of options for potential buyers.

2. New Listings: In March 31, 2024, 579 new listings entered the market, signaling ongoing activity and opportunities for those seeking to purchase a property.

3. Median Sale Price: The median sale price as of February 29, 2024, stands at $226,790, reflecting the average price at which homes are being sold in the market.

4. Median List Price: The median list price as of March 31, 2024, is $221,333, providing a benchmark for sellers to gauge their property's value.

5. Sale to List Ratio: With a median sale to list ratio of 0.999 as of February 29, 2024, homes in Kansas City are typically selling very close to their listed price.

6. Percent of Sales Over/Under List Price: Approximately 31.0% of sales in February 29, 2024, were over the list price, while 48.3% were under, illustrating the dynamics of negotiations in the market.

Kansas City MSA Housing Market Forecast:

The Metropolitan Statistical Area (MSA) of Kansas City, MO, encompasses various counties in Missouri and Kansas. This housing market is projected to witness significant growth, with forecasts indicating a steady rise in property values. For instance, by April 30, 2024, the forecast predicts a 0.5% increase, followed by a 1.1% rise by June 30, 2024, and a further 1.8% uptick by March 31, 2025. This forecast underpins the promising outlook for the Kansas City MSA, highlighting opportunities for both buyers and sellers.

The Kansas City MSA encompasses several counties, including Jackson, Clay, Platte, and Cass in Missouri, along with Johnson, Wyandotte, and Leavenworth in Kansas. With its diverse range of communities and housing options, the MSA offers a tailored experience for residents, catering to various lifestyle preferences and budgetary considerations. The housing market in this region is sizable, with a multitude of properties available across urban, suburban, and rural settings, ensuring there's something for everyone.

Is Kansas City a Buyer's or Seller's Housing Market?

The current housing market conditions in Kansas City suggest a balance between buyers and sellers. While there is a healthy inventory of homes available for sale, indicating a favorable situation for buyers, the swift pace at which homes are going to pending status and the steady rise in home values signify seller-friendly conditions. Therefore, it can be considered a balanced market, offering opportunities for both buyers and sellers to achieve their respective goals.

Are Home Prices Dropping?

As of the latest data available, there are no indications of home prices dropping in the Kansas City housing market. On the contrary, the average home value has experienced a notable increase of 6.9% over the past year, reflecting a trend of appreciation rather than depreciation. With the demand for homes remaining robust and inventory levels steady, there are no imminent signs of a decline in home prices.

Will the Kansas City Housing Market Crash?

While predicting the future of any housing market with absolute certainty is challenging, the current indicators in the Kansas City housing market do not suggest an impending crash. The market is exhibiting stability, with a balanced supply-demand dynamic and steady appreciation in home values. Additionally, the forecast for the Kansas City MSA points towards continued growth in property values over the coming months, further mitigating the likelihood of a housing market crash.

Kansas City, MO Real Estate Investment Overview

Is Kansas City a Good Place For Real Estate Investment? Many real estate investors have asked themselves if buying a property in Kansas City is a good investment. You need to drill deeper into local trends if you want to know what the market holds for real estate investors and buyers. Kansas City is the largest city in the U.S. state of Missouri, famous for its distinct barbeque cuisine and jazz heritage. Also nicknamed the City of Fountains, Kansas City is now emerging as a growing market for real estate investments.

When we refer to the Kansas City housing market, it comprises the Kansas City metropolitan area, which is a bi-state metropolitan area anchored by Kansas City, Missouri. Its 14 counties straddle the border between the U.S. states of Missouri (9 counties) and Kansas (5 counties). It is the second-largest metropolitan area centered in Missouri (after Greater St. Louis) and is the largest metropolitan area in Kansas, though Wichita is the largest metropolitan area centered in Kansas.

Kansas City, MO is a minimally walkable city in Jackson County with a population of approximately 460,377 people. In the past ten years, the annual real estate appreciation rate has amounted to 2.88% in Kansas City, according to NeighborhoodScout.com. Kansas City has a mixture of owner-occupied and renter-occupied housing units. Three and four-bedroom single-family detached homes are the most common housing units in Kansas City. Other types of housing that are prevalent in Kansas City include large apartment complexes, duplexes, rowhouses, and homes converted to apartments.

If you are looking to make a profit, you don’t want to buy the most expensive property in the Kansas City real estate market and expect to make a good profit on rents. Perhaps you are looking for a slightly different hold-over, an investment property in Kansas City that you might move into or sell at retirement in the future. Either way, knowing your profit potential and purpose is the first thing to consider.

Top Reasons To Invest In Kansas City Real Estate

- Kansas City is the largest city in Missouri and is the sixth-largest in the Midwest.

- Kansas City has long been a favorite of real estate investors.

- Affordable Turnkey Properties.

- The largest city in the state of Missouri.

- The population is expected to grow to 2,200,000 by 2020.

- 1-year positive appreciation forecast (ZHVI).

- #62 in the U.S. out of the top 100 MSAs – FHFA.

Overview of Kansas City & its Real Estate Market

Kansas City is a large, prosperous, self-sufficient, and culturally rich city located astride the Missouri River. In the metropolitan area, the population is estimated at 2.1 million. The median household income in Kansas City is 45,376 and the median home price is $146,300. Kansas City is the largest city in Missouri and is the sixth-largest in the Midwest. It hosts the Kansas City Chiefs as well as the Kansas City Royals. It's home to some of the Best Ribs in America.

The city has over 200 water fountains, making it only second to Rome, Italy, hence the nickname “City of Fountains.” It is also important to remember that only Paris, France has more Boulevards. In 2017, a WalletHub survey for real estate market growth in the United States listed the “Kansas City Real Estate Market” at number 18 out of 300 of the fastest-growing cities in the US.

Kansas City has started to do some major revitalization downtown. More than $6 million has been spent giving the downtown area a facelift and new makeover, including, apartments, offices, and condominiums. These facelifts have also been done in both indoor and outdoor malls, restaurants, and places for concerts, plays, and other forms of entertainment. Kansas City real estate is very affordable; the home prices are near the national average. All of these make Kansas City properties attractively appealing to investors and homebuyers who are looking for gains in cash flow.

Employment in Kansas City

Employment in Kansas City is diverse, with major industries including healthcare, finance, and manufacturing. The city has a low unemployment rate and a growing job market, making it an attractive place to live and work. The unemployment rate in Kansas City, MO, is currently at 2.80% for March 2023, which is lower than the long-term average of 6.06%.

This rate is slightly higher than the 2.7% reported in February 2023. Comparatively, the US average unemployment rate is 6.0%. This indicates that the unemployment rate in Kansas City is significantly lower than the national average.

Kansas City is experiencing a period of growth, with a thriving job market, a vibrant arts and culture scene, and numerous new development projects. The city's population is also steadily increasing, with more people choosing to call it home. This growth is expected to continue in the coming years, making Kansas City an attractive destination for businesses and individuals alike.

Great Place to Live Due To Rich Culture & Favorable Weather

The city is known for its distinct barbeque cuisine and uniquely crafted breweries, which makes it a preferred destination for foodies. It has more than 100 barbecue restaurants and is known in Missouri as the “world's barbecue capital. The ancient heritage of Jazz music makes it suitable for immigrants who are passionate about music.

The city lies on the shores of the Missouri & Kansas Rivers with a landscape full of fountains. The overall ambiance and accommodating culture are sure to attract more and more residents into the city, which will prove to be a boon for investments in Kansas City Real Estate Market. The weather in Kansas City is beautiful and usually clear and sunny.

September, May, and June are the most pleasant months in Kansas City, while January and December are the least comfortable month. You can almost always count on the 4th of July to be a great day to BBQ and shoot off fireworks and watch your neighbors shoot theirs, creating a competition. The neighborhood fireworks shows have always been as big as the city's, only the last half of the night.

During the shows, everyone in the neighborhood waters the top of their houses for a week straight to avoid catching fire. Where else in America can you find that? Even better, the people are friendly and the weather is inviting. There are nearby lakes for boating, fishing, swimming, and camping. The weather is almost always enjoyable. They get most of their rain in the spring of April and the summer month of June.

Cost of Living in Kansas City

Another great factor that is seen as a boon to the Kansas City real estate market is the cost of living. The cost of living in Kansas City is reasonable and affordable. With the cost of rent and the price you might pay for a house already discussed, there's the cost of day-to-day expenses to consider. A basic lunch around the business district is around $12 unless you go to a fast-food restaurant and order a combo meal, then you're looking at $7.

Milk is around $3.50 a gallon, a 2 lt. A bottle of Coca-Cola is $1.82. These prices are about the same as the national average at –1%. Housing is at 8% below. Kansas City is 15% below Oklahoma and 8% below Indiana. In fact, New York City is 129% above compared to Kansas City, while 14% below Miami, Fl, and 23% below Chicago.

Summary of the cost of living in Kansas City:

- Four-person family monthly costs: $3,331.71 without rent.

- A single-person monthly costs: $935.08 without rent.

- Rent Prices in Kansas City, MO are 32.81% higher than in Wichita, KS

- Rent Prices in Kansas City, MO are 63.21% lower than in New York, NY.

- Rent Prices in Kansas City, MO are 26.01% lower than in Atlanta, GA

Rich and Stable Neighborhoods

The city is surrounded by neighborhoods like River Market District as well as the 18th & Vine District and the Country Club Plaza on its north, east & south sides respectively. These vicinities, in combination with the city’s vibrant real estate market, comprise all amenities residents and non-residents alike can take advantage of and put their investments in.

Some of the best neighborhoods in or around Kansas City, Missouri are Waldo, Raytown, The Downtown Loop, Northland, Westwood Hills, Patrician Woods, Chapel, Pendleton Heights, Crossroads, Turner, Westwood, Downtown Kansas City, Ward Parkway, Lake Quivira, Nashua, Shawnee Mission, and Briarcliff-Claymont.

Good Neighborhoods in Kansas City To Invest in Real Estate

- The Johnson County of Kansas City: It is high on the list of home buyers as an ideal place to raise a family. It has highly accredited school districts within the county, which include Shawnee Mission, Gardner Edgerton, Spring Hill, Blue Valley, Olathe, and De Soto. Most subdivisions see steady property valuation increases year after year.

- The Prairie Village, Kansas City: It is another good neighborhood with low crime rates, mature trees, plenty of quiet neighborhood parks, and accessible community pools.

- Leawood, Kansas City: It is a low crime rate area and it’s safer than 79 percent of U.S. cities. The residents have a median household income of $133,702, so they are quite well off. The region is home to the biggest Methodist church in the nation – the United Methodist Church of the Resurrection.

- Lenexa, Kansas City: This neighborhood has a median listing price of $394,000. Fifty-four percent report some school education, contrasted with the national average of 22 percent for all cities and towns.

Low median sales prices, which in return, drive a solid rent are another reason to look into the Kansas City real estate market. Add to that the weather, the many activities at your disposal, and the famous “Kansas City BBQ.” There isn't much left to desire when investing in the real estate market. Take a look around, make some calls, and talk to some of the people around Kansas City before you decide.

Good cash flow from Kansas City investment properties means the investment is, needless to say, profitable. A bad cash flow, on the other hand, means you won’t have money on hand to repay your debt. Therefore, finding a good Kansas City real estate investment opportunity would be key to your success. The three most important factors when buying real estate anywhere are location, location, and location. The location creates desirability. Desirability brings demand. There should be a natural and upcoming high demand for rental properties.

The neighborhoods in Kansas City must be safe to live in and should have a low crime rate. The neighborhoods should be close to basic amenities, public services, schools, and shopping malls. As with any real estate purchase, act wisely. Evaluate the specifics of the Kansas City housing market at the time you intend to purchase. Hiring a local property management company can help in finding tenants for your investment property in Kansas City.

Here are the top ten neighborhoods in Kansas City having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- South Hyde Park

- Westside North / Westside South

- 18th and Vine and Downtown East / Downtown East

- Crossroads

- Columbus Park

- River Market

- Longfellow

- Pendleton Heights

- Western 49-63

- Eastern 49-63 / Rockhurst University

Sources:

- https://kcrar.com/media-statistics/market-statistics/

- https://kansasrealtor.com/news-media/market-stats/

- https://www.zillow.com/kansas-city-mo/home-values

- https://www.redfin.com/state/Missouri/housing-market/

- https://www.kansascity.com/news/local/article244912977.html

- https://realestate.wichita.edu/data-research/data-by-market/kansas-market/

- https://www.realtor.com/realestateandhomes-search/Kansas-City_MO/overview

- https://www.neighborhoodscout.com/mo/kansas-city/real-estate/

- https://www.fhfa.gov/DataTools/Downloads/Documents/HPI/Fact-Sheets/MSAs/2019Q4/FS-KansasCity-2019Q4.pdf

- http://www.435mag.com/March-2017/Kansas-City-Real-Estate

- https://www.corevestmentfinance.com/hot-markets-for-residential-real-estate-investors-2018