Assessing whether it's a buyer's or seller's market requires a nuanced understanding of prevailing conditions. In the context of Akron, the market exhibits elements of both, making it a balanced and inclusive environment for real estate transactions. While sellers may benefit from the upward trend in home prices and the potential for offers above the list price, buyers can capitalize on the availability of inventory and competitive pricing.

Akron Housing Market Trends in 2024

As of January 2024, the housing market in Akron reflects a significant surge in home prices, with a remarkable 22.5% increase compared to the previous year. According to Redfin, the median price for homes in Akron stands at $128,000, showcasing an upward trajectory in property values.

How is the Akron Housing Market Doing Currently?

The current state of the Akron housing market is marked by robust activity. Despite the challenges posed by external factors, such as economic fluctuations, the market has demonstrated remarkable resilience. With a median sale price significantly lower than the national average, Akron presents an attractive option for homebuyers seeking affordability without compromising on quality.

Notably, homes in Akron are spending slightly longer on the market compared to the previous year, with an average of 41 days before being sold. However, this modest increase in the time taken for sales is indicative of a market that remains active and engaged.

How Competitive is the Akron Housing Market?

Akron's housing market exhibits a moderate level of competitiveness, offering opportunities for both buyers and sellers alike. While the median sale price is notably lower than the national average, the market is dynamic and responsive to fluctuations in demand.

One of the key indicators of market competitiveness is the sale-to-list price ratio, which currently stands at 97.5%, reflecting a slight increase compared to the previous year. Additionally, a notable 32.8% of homes are sold above the list price, showcasing the willingness of buyers to invest in the Akron housing market.

Are There Enough Homes for Sale in Akron to Meet Buyer Demand?

One of the critical considerations for prospective homebuyers is the availability of inventory to meet their needs. In Akron, while the market is competitive, there is a steady supply of homes to cater to buyer demand. Despite the increase in home prices, the market remains accessible to a diverse range of buyers.

Furthermore, the migration and relocation trends indicate a strong inclination among homebuyers to stay within the metropolitan area, underscoring the appeal and desirability of Akron as a residential destination.

What is the Future Market Outlook for Akron?

Looking ahead, the future market outlook for Akron appears promising. With continued economic growth and development initiatives, the housing market is poised for sustained expansion and progress. While external factors may influence short-term fluctuations, the underlying strength of the market remains intact.

Moreover, the influx of homebuyers from various regions across the nation signifies Akron's emergence as a destination of choice for individuals seeking affordable and livable communities.

Akron Housing Market Predictions 2024 and 2025

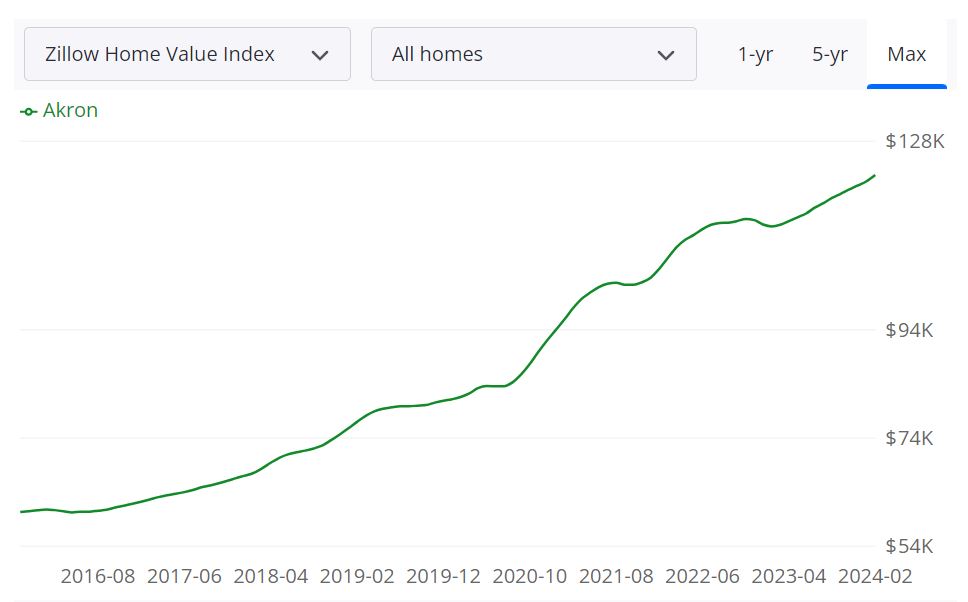

According to Zillow, the average Akron home value stands at $122,758, marking an increase of 8.4% over the past year. Properties in Akron typically go pending within approximately 14 days, indicating a brisk market activity.

For Sale Inventory and New Listings

As of February 29, 2024, Akron boasts a for sale inventory of 526 properties, indicating the availability of housing options for prospective buyers. Additionally, 200 new listings entered the market in the same period, contributing to the diversity of available properties.

Sale Metrics

The median sale price for homes in Akron as of January 31, 2024, stands at $112,833, whereas the median list price is $126,267 as of February 29, 2024. This data suggests that properties are typically listed at slightly higher prices than their eventual sale values.

The median sale to list ratio, calculated as of January 31, 2024, stands at 0.983, indicating that on average, properties sell for approximately 98.3% of their listed prices.

Moreover, the percent of sales over list price is 28.9%, while 56.7% of sales occur under list price as of January 31, 2024. These statistics suggest a mixed market where some properties sell above the listed price while others sell below.

Akron MSA Housing Market Forecast

Looking at the Akron Metropolitan Statistical Area (MSA) housing market forecast, projections indicate a positive trend in the coming months. The MSA encompasses Akron and its surrounding counties, serving as an indicator of the broader housing market in the region. According to data, as of January 31, 2024, the forecast shows a modest growth rate of 0.2%, which is expected to increase to 1.2% by April 30, 2024, and 4.1% by January 31, 2025.

The Akron MSA encompasses several counties, including Summit County, Portage County, and Medina County. With its diverse economy and range of housing options, the Akron MSA represents a significant segment of Ohio's housing market. Its sizeable population and economic activity contribute to the overall vibrancy of the housing sector.

Is Akron a Buyer's or Seller's Housing Market?

As of the latest data, the Akron housing market leans more towards being a seller's market. With a relatively low inventory of 526 properties for sale compared to 200 new listings, buyers may face stiff competition and limited options. Additionally, the median sale to list ratio of 0.983 suggests that properties are selling close to their listed prices, further indicating seller-friendly conditions.

Are Home Prices Dropping in Akron?

Despite occasional fluctuations, there is no indication of a significant downward trend in home prices in Akron. As of January 31, 2024, the median sale price remains at $112,833, indicating stability in the market. However, prospective buyers should monitor market conditions and consult with real estate professionals for the most up-to-date information.

Will the Akron Housing Market Crash?

While predicting market crashes with certainty is challenging, the current indicators in the Akron housing market do not suggest an imminent crash. The market exhibits signs of stability, with steady appreciation in home values and moderate fluctuations in inventory levels. However, factors such as economic downturns or unforeseen events can impact market dynamics. It's essential for buyers and sellers to stay informed and make decisions based on their individual circumstances and risk tolerance.

Is Now a Good Time to Buy a House?

For individuals considering purchasing a home in Akron, the current market conditions present both opportunities and challenges. While low inventory and competitive pricing may pose obstacles, low-interest rates as compared to last year and the potential for future appreciation make it an attractive time to buy. However, prospective buyers should conduct thorough research, assess their financial readiness, and consult with real estate professionals to determine if purchasing a home aligns with their long-term goals and financial situation.

Investing in the Akron Real Estate Market: Factors to Consider

Investing in the real estate market is a significant decision that requires a thorough analysis of various factors. When it comes to the Akron real estate market, several data and statistics play a crucial role in understanding its investment potential. Let's examine these factors and their potential impact on the Akron real estate market:

1. Population Growth Trends

The population growth trends in Akron are a key consideration for real estate investors. As of the latest available data, understanding whether the population is growing, stable, or declining is crucial. Population growth can drive demand for housing, impacting property values and rental income.

In Akron, it's important to note that population trends have been relatively stable in recent years. While not experiencing explosive growth, a stable population can provide a reliable and steady demand for housing, making it a suitable choice for long-term real estate investors.

2. Local Economy

The local economy plays a vital role in the health of the real estate market. A strong and diverse economy often attracts businesses and residents, positively affecting the housing market. In Akron, there are several noteworthy factors to consider:

- Employment Opportunities: Akron's economy benefits from the presence of major companies, including FirstEnergy, Goodyear Tire & Rubber, and PPG Industries. The stability of these companies can provide a reliable source of jobs for residents.

- Diversification: A diverse economy with a mix of industries can enhance the resilience of the real estate market. Akron's economic diversification includes manufacturing, healthcare, and education sectors.

These economic factors suggest that Akron's economy can have a positive impact on the real estate market, as it attracts both homeowners and renters due to job opportunities and stability.

3. Jobs and Employment

The availability of jobs and employment rates in Akron directly affect the housing market. Investors should consider the following job-related factors:

- Unemployment Rate: A low unemployment rate typically indicates a healthy job market and can stimulate housing demand.

- Job Diversity: A mix of job sectors can create a diverse tenant pool, reducing the risk associated with economic downturns in specific industries.

Overall, Akron's job market has remained relatively stable, with a mix of employment opportunities across multiple sectors, further supporting the real estate market's health.

4. Rental Market

For investors interested in rental properties, the rental market's condition is a critical factor. Data and statistics related to the rental market include:

- Rental Demand: Analyzing rental demand in Akron is essential. Factors such as a growing job market and a stable population can increase the demand for rental properties.

- Rental Rates: Understanding rental rates and their trends can help investors determine potential rental income. Akron's rental rates should be compared to property acquisition costs for profitability assessments.

Additionally, it's worth considering local regulations and landlord-tenant laws that may impact the rental market in Akron. Staying informed about these regulations is crucial for property management.

5. Property Taxes and Investment Incentives

Property taxes can significantly impact the return on investment for real estate properties. Investigate Akron's property tax rates and any potential incentives or tax breaks for real estate investors. Lower property taxes or investment incentives can improve your investment's overall profitability.

6. Infrastructure and Development

Investment in infrastructure and development projects, such as transportation, schools, and public amenities, can influence property values. Areas with planned improvements may experience increased demand and appreciation in property values.

7. Market Sentiment

Local market sentiment and investor confidence can impact real estate prices. Monitoring the perception of Akron's real estate market among professionals and the community can provide insight into future trends.

Investing in the Akron real estate market can be a favorable option, especially for those looking for stable and potentially profitable opportunities. The city's stable population, diverse economy, and job opportunities make it an attractive choice. However, as with any real estate investment, thorough research, due diligence, and consideration of all the factors mentioned above are essential to make informed and successful investment decisions.

References:

- https://www.zillow.com/akron-oh/home-values

- https://www.redfin.com/city/244/OH/Akron/housing-market

- https://www.realtor.com/realestateandhomes-search/Akron_OH/overview