Listen up, homeowners and aspiring buyers – the latest numbers are in, and they show a slight dip in how much our houses are worth. The total value of U.S. households' real estate has dropped by $361 billion from its peak, settling in at just over $48 trillion in the third quarter of 2025. While this might sound alarming, I want to assure you that this is a modest adjustment, and overall, our homes are still worth a whole lot more than they were just a few years ago.

As someone who's been watching the housing market for years, this kind of fluctuation isn't exactly a shocker. We've seen incredible growth in home values over the past decade, far more than doubling in many areas. So, a small dip isn't necessarily a sign of doom and gloom, but it's definitely worth understanding what's behind it.

U.S. Household Real Estate Value Drops $361B From Record High

What's Driving the Real Estate Value Drop?

The Federal Reserve's Z.1 Financial Accounts data gives us this snapshot, and it’s corroborated by insights from Realtor.com®. Senior Economist Jake Krimmel points to a small quarterly drop in the Case-Shiller Home Price Index as a key player in this decrease. Think of the Case-Shiller index as a way to track how home prices are changing over time across major cities. When it dips even a little, it can ripple out and affect the overall national value.

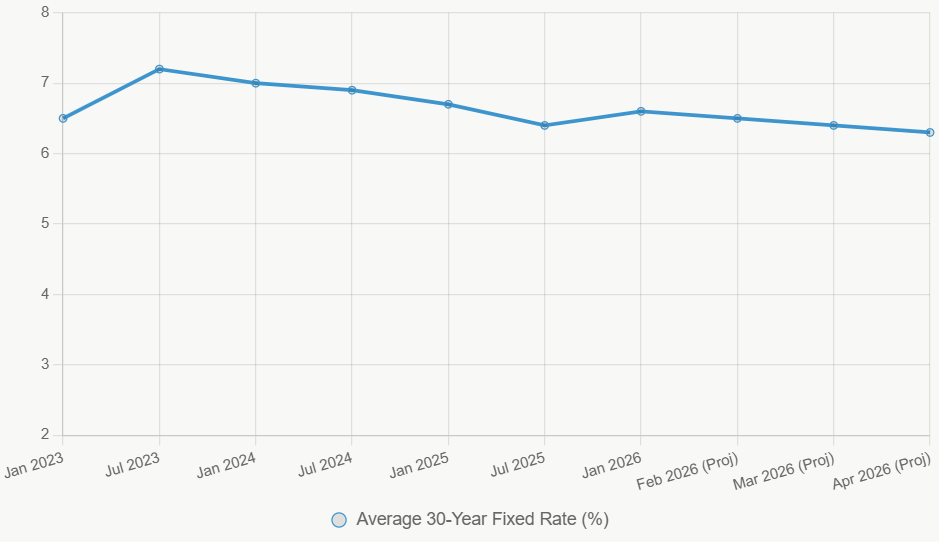

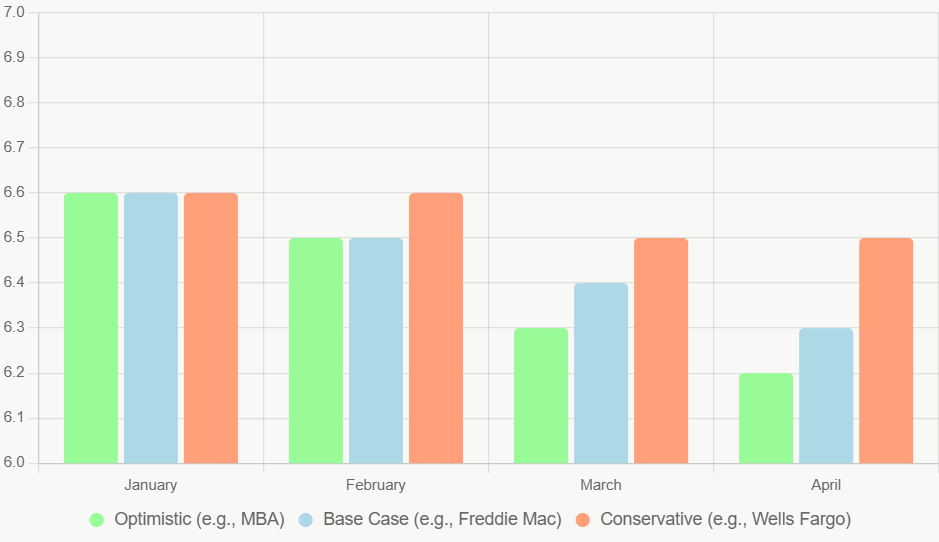

But it's not just one thing. Several factors are subtly nudging the market. Persistently high mortgage rates, which have been lingering in the 6%-8% range throughout 2024 and 2025, are a big one. When borrowing money to buy a house becomes more expensive, it naturally puts a damper on demand and, consequently, prices.

Beyond that, we're seeing climbing property taxes and insurance costs. These aren't always included in the purchase price, but they add to the overall cost of homeownership. For many, these rising expenses are making it a tougher pill to swallow, even if the initial purchase price seems manageable.

And then there's the inventory. For a while, there just weren’t enough homes for sale. Now, some homeowners are realizing that those historically low interest rates they locked in a few years ago are probably not coming back anytime soon. So, they’re starting to put their homes on the market, which can lead to a slight tick up in housing inventory. More homes for sale means more choice for buyers, and potentially less upward pressure on prices.

Homeowner Equity: Still Strong?

Now, let's talk about what this means for homeowners. A big concern for many is how much equity they have – the difference between what their home is worth and what they owe on their mortgage. The good news is that even with this recent dip, owners' equity in real estate remains robust. In the first quarter of 2025, homeowners' equity share was around 72%. That's a really healthy number and acts as a significant cushion. It means most people still have a substantial amount of money tied up in their homes that they truly “own.” This strong equity position is a major reason why most experts don't see a repeat of the 2008 housing crash on the horizon.

What Does the Future Hold?

Looking ahead, Realtor.com® forecasts a 2.2% annual home price gain for 2026. That's a bit higher than the estimated 2% increase in 2025. However, and this is where things get a touch more nuanced, the forecast also suggests that inflation might outpace these price gains. This means that in “real” terms – adjusted for inflation – homeowners might see a slight decline in their home's purchasing power.

Krimmel puts it this way: “We forecast 2.2% home price gains but the homeownership rate to tick slightly down. In total, real estate values will be steady in 2026, but at the local level home values often diverge from national trends.”

This last part is crucial. National averages can be misleading. Some areas, especially those that saw massive price surges during the pandemic – think parts of coastal Florida or Austin, Texas – are experiencing a more notable softening in their home values. Conversely, other markets might continue to see modest growth. It really emphasizes the importance of looking at your specific local market rather than just the big picture.

A Mixed Bag for Buyers and Sellers

For potential buyers, this cooling market could offer a slightly better environment. We’re expecting existing home sales to grow about 1.7% to 4.13 million units. Combined with that potential increase in inventory, buyers might find more options and a bit more room to negotiate. However, those persistent high mortgage rates will still be a factor.

For sellers, it means the days of receiving multiple offers above asking price within hours of listing might be less common, at least for now. It’s a return to a more balanced market, where thoughtful pricing and good presentation are key.

Debt vs. Equity: A Balancing Act

It's also worth noting the other side of the financial coin: debt. In the third quarter of 2025, household debt increased by 4.1%, a slight uptick from the previous quarter. Mortgage debt specifically saw a notable $108 billion spike. This increase in debt, while potentially concerning, is happening alongside strong homeowner equity. It’s a complex financial equation, but the overall picture suggests homeowners are generally in a solid position, even with these subtle shifts.

Overall, the U.S. household real estate market is demonstrating resilience. While we've seen a small retreat from peak values, it's more of a gentle recalibration than a harsh correction. Understanding the underlying causes and looking at local market dynamics will be key for anyone navigating this ever-evolving space.

VS

Florida’s A+ affordable rental vs Punta Gorda’s larger high‑yield property. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060

Also Read:

- Top 10 Housing Markets Set to Deliver High ROI in 2026

- 10 Hottest Housing Markets of 2026: From Hartford to Milwaukee

- Top 10 Most Popular Housing Markets of 2025 for Homebuyers

- Will Real Estate Rebound in 2026: Top Predictions by Experts

- Housing Market Predictions for the Next 4 Years: 2026, 2027, 2028, 2029

- Housing Market Predictions for 2026 Show a Modest Price Rise of 1.2%

- Housing Market Predictions 2026 for Buyers, Sellers, and Renters

- 12 Housing Markets Set for Double-Digit Price Decline by Early 2026

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Housing Markets With the Biggest Decline in Home Prices Since 2024

- Why Real Estate Can Thrive During Tariffs Led Economic Uncertainty

- Rise of AI-Powered Hyperlocal Real Estate Marketing in 2025

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 5 Hottest Real Estate Markets for Buyers & Investors in 2025