The world of finance often feels like a labyrinthine puzzle, especially when it comes to stock market prediction. As investors grapple with myriad factors influencing their portfolios, understanding how certain elements intertwine with market dynamics is crucial. Stock market prediction is not merely a speculative exercise; it's an intricate analysis that can shape financial futures.

Stock Market Prediction: Insights for the Coming Year

Key Takeaways

- Historical Trends: Stock markets have shown different performances under various political administrations.

- Impact of External Factors: Economic indicators such as inflation, unemployment rates, and technology trends play a significant role in market movements.

- Political Climate: The upcoming 2024 election's influence on the economy and stock market is widely discussed but may be overstated.

- Positive Outlook: Current economic conditions suggest a bullish trend for the stock market in the next year.

The correlation between the political climate and stock market performance often overshadows more critical economic fundamentals. Investors frequently ask themselves: “Will my investments thrive depending on who sits in the White House?” While politics can affect policy, the undercurrents that drive the market are often more complex than simply aligning with party lines.

Historical Performance and Political Influence

Historical performance of the stock market under different presidential administrations provides a foundational understanding of these dynamics. Since the inception of the S&P 500 in 1957, the index has yielded an average compound annual growth rate (CAGR) of 7.4% without accounting for dividends. However, this average masks significant variations depending on the political leadership in place:

- Democratic presidents have overseen a CAGR of 9.8%.

- Conversely, Republican presidents have an average CAGR of 6.0%, with a median return of 10.2% as opposed to Democrats' 8.9%.

These statistics suggest that while Democrats may achieve a higher average return, Republicans can exhibit stronger median performances. A deeper dive reveals that during periods of unified control—when one party holds both Congress and the presidency—the stock market's performance becomes more closely tied to economic cycles rather than political affiliation.

Research indicates that from 1926 to today, when Republicans controlled both the White House and Congress, the S&P 500 returned an average of 14.5%, and Democratic control yielded about 14.0%. During times of split government, Democratic presidents have seen the S&P return 16.6% compared to 7.3% under Republican presidents. This indicates that governance style and economic conditions may influence market performance just as much, if not more, than party affiliation.

Current Economic Conditions Impacting Stock Market Prediction

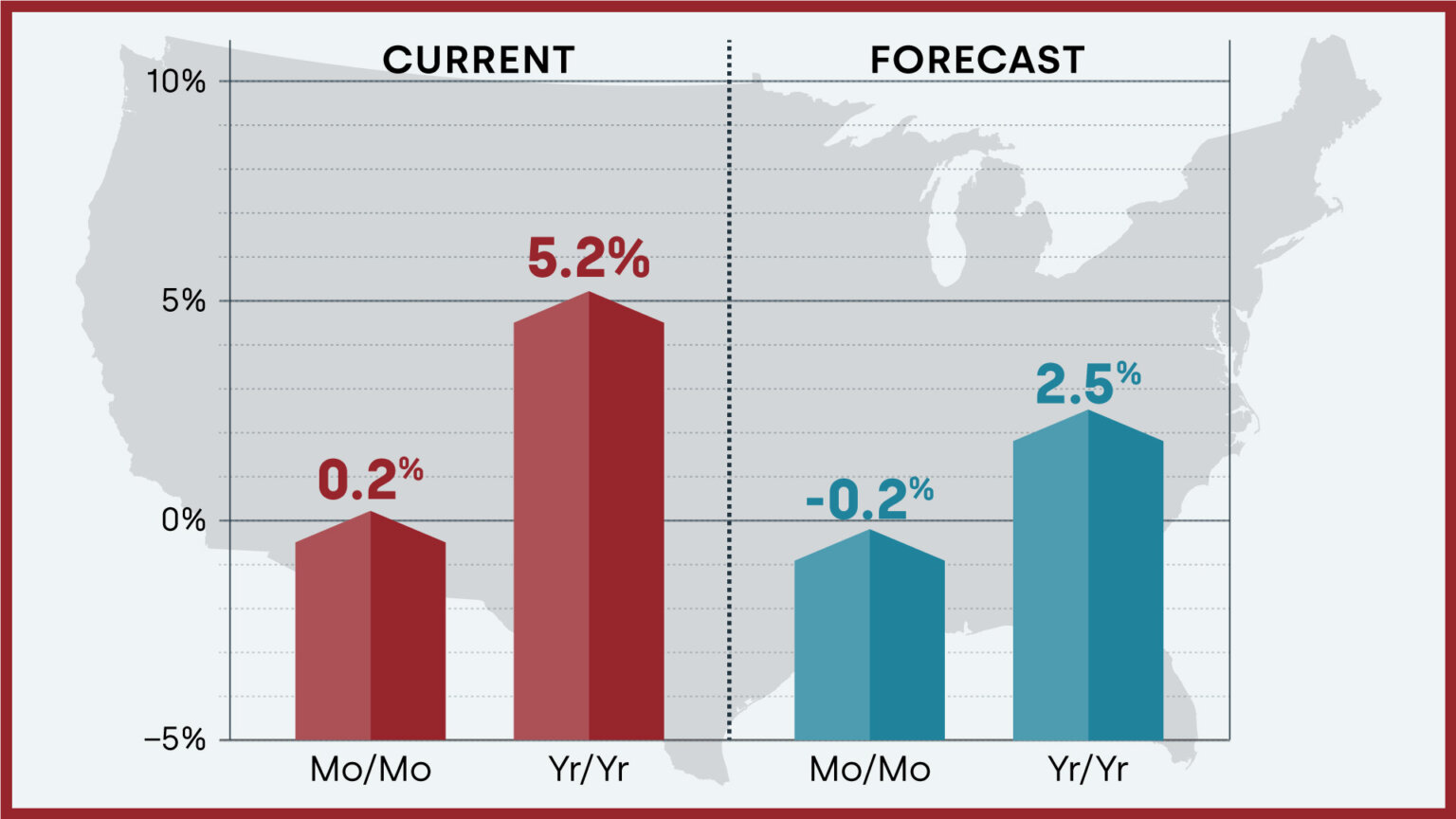

Presently, macroeconomic indicators are vital for stock market prediction. Recent data shows that inflation is nearing the Federal Reserve's target of 2%, a welcome deviation from the 40-year high faced earlier. However, challenges remain. For instance, the housing sector is grappling with a 4.5 million home shortage, complicating affordability despite inflation stabilizing (Motley Fool).

Low unemployment, currently at 4.3%, also fuels optimism about consumer spending and corporate profits—key drivers of stock market growth. The significant role of artificial intelligence (AI) in augmenting corporate earnings cannot be overlooked. Companies like Nvidia and Microsoft have already reaped substantial benefits from AI advancements, creating a ripple effect through investments and innovations across various sectors. Such positive developments in technology lend credence to a bullish market forecast in the coming year.

The Role of the Federal Reserve

A significant influencer that often goes unnoticed in stock market predictions is the Federal Reserve. Its control over monetary policy—particularly interest rates—substantially impacts market sentiment. Analysts predict that the Federal Reserve may begin lowering interest rates soon, creating more favorable borrowing conditions and possibly boosting the economy (Motley Fool).

Lower interest rates typically encourage spending and investment, driving up stock prices as businesses expand. Moreover, with inflation gathering steam in recent months but projected to remain manageable, favorable economic conditions likely support sustained growth in the stock market.

Predictions for the Next Twelve Months

Looking ahead, stock market prediction for the next twelve months presents an encouraging outlook. Despite the uncertainty surrounding the 2024 elections, many experts argue that the fundamental drivers of the economy—the growth in technology and resilient consumer confidence—will play a more significant role in shaping market trajectories. Market analysts maintain that irrespective of the electoral outcome, the conditions appear ripe for a bullish run. Here are some potential scenarios:

- Economic Growth: Continued investments in AI and technology sectors may lead to substantial corporate earnings.

- Interest Rates: If predicted cuts in interest rates materialize, we may witness a heightened appetite for investments, driving stock prices up further.

- Consumer Spending: Sustained low unemployment might stimulate consumer spending, bolstering economic performance.

In summary, while political narratives often dominate discussions about stock market prediction, the more substantial influences lie within economic fundamentals, corporate performance, and technological advancements. As we enter the new financial year, stakeholders and investors would do well to focus on these metrics, acknowledging that while politics and policies matter, they are just parts of a larger picture.

ALSO READ:

- Echoes of 1987: Is Today’s Stock Market Crash Leading to a Recession?

- Is the Bull Market Over? What History Says About the Stock Market Crash

- Wall Street Bear Predicts a Historic Stock Market Crash Like 1929

- Economist Predicts Stock Market Crash Worse Than 2008 Crisis

- Stock Market Forecast Next 6 Months

- Next Stock Market Crash Prediction: Is a Crash Coming Soon?

- 65% Stock Market Crash: Top Economists Share Scary Predictions for 2024

- Stock Market Crash: 30% Correction Predicted by Top Forecaster