Barclays has cut rates on some of their mortgages below 4% in April 2025! This move comes amidst the ongoing financial uncertainty surrounding US trade tariffs and could signal a potential shift in the mortgage market. I think that it is a very welcome move for the mortgage market.

It’s been a whirlwind watching the economic news lately, especially with the back-and-forth on US trade tariffs. But amidst all the uncertainty, there's a glimmer of good news for prospective homeowners: Barclays, one of the UK's “big six” lenders, has lowered its mortgage rates to below 4% on select deals. As someone who's been following the mortgage market closely, I'm eager to break down what this means for you, and whether it's a sign of things to come.

Barclays Cuts Rates on Some Mortgages to Below 4% Amid US Tariffs Turmoil

Why This Matters

For a long time, the idea of securing a mortgage with an interest rate below 4% seemed like a distant dream. The fact that Barclays, a major player, is now offering these rates is pretty significant for a few key reasons:

- Increased Affordability: Lower interest rates directly translate to lower monthly mortgage payments. This can make homeownership more accessible to a wider range of people, especially first-time buyers struggling to save for a deposit.

- Potential Price War: Barclays' move puts pressure on other large lenders like Lloyds, HSBC, and NatWest to follow suit. A competitive price war could drive rates down even further, benefiting borrowers.

- Boost to the Housing Market: Lower rates can stimulate demand in the housing market, potentially leading to increased sales and a boost to the overall economy.

The Details: What Barclays is Offering

So, what exactly did Barclays change? According to reports, the bank has reduced some of its new mortgage rates by up to 0.38 percentage points. This affects both two-year and five-year fixed-rate deals. Specifically, those deals previously priced at 4.11% and 4.12% (aimed at buyers with larger deposits) have been slashed to 3.99%.

I am always keeping an eye on mortgage offerings. Here is a quick summary table.

| Mortgage Type | Previous Rate | New Rate | Difference | Notes |

|---|---|---|---|---|

| Two-Year Fixed Rate | 4.11% | 3.99% | -0.12% | Available to buyers with large deposits |

| Five-Year Fixed Rate | 4.12% | 3.99% | -0.13% | Available to buyers with large deposits |

US Tariffs and the Bigger Picture

The timing of Barclays' rate cut is definitely interesting. It comes amidst ongoing turmoil surrounding US trade tariffs. It's hard to say with certainty if the rate cut is a direct result of these tariffs, but the market volatility they create undoubtedly plays a role.

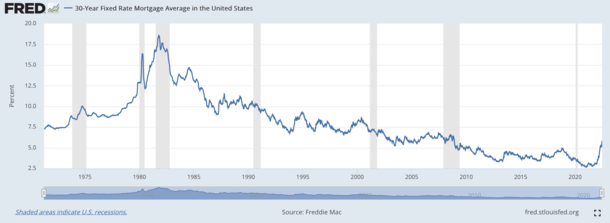

The US president’s on-again, off-again approach to tariffs creates a ripple effect across global markets. This uncertainty can influence central banks' decisions about interest rates. If the Bank of England anticipates a slowdown in the UK economy due to trade tensions, they might be more inclined to lower interest rates to stimulate growth.

Expert Opinions: A Mixed Bag

The initial reaction from mortgage experts is cautiously optimistic. Some believe Barclays' move could be the catalyst for a broader mortgage price war. Others suggest that it's too early to tell and that other lenders might wait to see how the market reacts before making similar cuts.

- Stephen Perkins (Yellow Brick Mortgages): He wonders if the decision was made before or after the US tariff developments.

- David Stirling (Mint Mortgages & Protection): He is waiting to see if Barclays is just testing the waters.

- Pete Mugleston (Online Mortgage Advisor): He states there could be a delayed reaction due to market unpredictability.

Recommended Read:

Mortgage Rates Drop: Demand Surges 20% Amid Tariff-Driven Turmoil

Tariffs Push Mortgage Rates Down But Housing Costs Remain Record High

Mortgage Rates Likely to Go Down in the Short Term Due to Tariffs

What This Means for You:

So, should you rush out and apply for a mortgage with Barclays? Here’s my take:

- Shop Around: Don't just settle for the first offer you see. Compare rates from different lenders to ensure you're getting the best deal.

- Consider Your Circumstances: A lower interest rate is great, but it's not the only factor to consider. Think about your long-term financial goals, your risk tolerance, and the terms and conditions of the mortgage.

- Get Professional Advice: Talk to a qualified mortgage advisor. They can help you navigate the complexities of the mortgage market and find the right product for your needs. They can really help you to understand what's happening and make sure that you don't make a bad decision,

- Be Prepared: gather all the necessary documentation, such as proof of income, bank statements, and credit reports, to expedite the application process.

- Understand Fixed vs. Variable: with fixed-rate mortgages, your interest rate stays the same for the agreed term (e.g., two or five years), providing stability and predictability in your monthly payments. This is beneficial when interest rates are expected to rise, as your payments remain constant. Conversely, with variable-rate mortgages, the interest rate can fluctuate based on the Bank of England's base rate or other market conditions. This can lead to lower payments when interest rates are falling but higher payments if rates increase. It's essential to assess your risk tolerance and financial situation to determine which type suits you best.

Looking Ahead: What to Expect

It's tough to predict the future, but here are a few potential scenarios:

- Other Lenders Follow Suit: If Barclays' move proves successful, other major lenders could be forced to lower their rates to stay competitive.

- Rates Remain Stable: Lenders might wait to see how the US trade situation unfolds before making any further adjustments. If tariffs remain in place or escalate, they might be hesitant to lower rates further.

- Rates Could Rise: If the UK economy proves resilient and the Bank of England doesn't cut interest rates, mortgage rates could actually start to creep back up.

As I have said, no one can say for certain what will happen, but keep an eye on the economic news and I believe you will have a decent idea of what direction the mortgage rates are going.

The Bottom Line

Barclays' decision to cut mortgage rates below 4% is a positive sign for potential homebuyers. It offers the prospect of greater affordability and could trigger a broader price war in the mortgage market. However, it's important to remember that the market is still influenced by global economic factors, so do your homework and seek professional advice before making any big decisions.

I hope this helps you understand the latest developments in the mortgage market and what they mean for you.

Work With Norada, Your Trusted Source for

Turnkey Real Estate Investments in the U.S.

Investing in turnkey real estate can help you secure consistent returns with fluctuating mortgage rates.

Expand your portfolio confidently, even in a shifting interest rate environment.

Speak with our expert investment counselors (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Expect High Mortgage Rates Until 2026: Fannie Mae's 2-Year Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rates Forecast for the Next 3 Years: 2025 to 2027

- 30-Year Mortgage Rate Forecast for the Next 5 Years

- 15-Year Mortgage Rate Forecast for the Next 5 Years

- Why Are Mortgage Rates Going Up in 2025: Will Rates Drop?

- Why Are Mortgage Rates So High and Predictions for 2025

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?