Fort Myers, located in southwestern Florida, is a popular destination for tourists, retirees, and families due to its warm climate, beautiful beaches, and relaxed lifestyle. The Fort Myers housing market has been experiencing steady growth over the past few years, with home prices rising and inventory levels decreasing. This report provides an overview of the current Fort Myers housing market trends and forecasts for 2024.

Fort Myers Housing Market Trends in 2024

Fort Myers, FL, nestled along the southwestern coast of Florida, has long been a sought-after destination for its beautiful weather, stunning beaches, and vibrant lifestyle. For those considering diving into the Fort Myers, FL 2024 housing market, understanding the current trends and forecasts is crucial.

According to Realtor.com, the sale-to-list price ratio is a vital metric that gauges the balance between supply and demand in the market. In February 2024, homes in Fort Myers, FL sold for approximately 3.81% below the asking price on average, indicating favorable conditions for buyers. This ratio underscores the negotiation power wielded by buyers in the current market scenario.

The Median Listing Home Price: Reflecting Market Dynamics

In February 2024, the median listing home price in Fort Myers, FL stood at $416.5K, showcasing a slight downward trend of -2% year-over-year. This figure offers a glimpse into the evolving dynamics of the housing market, influenced by various factors ranging from economic conditions to demographic shifts.

Understanding Pricing Dynamics: Median Listing vs. Sold Price

One of the critical indicators of market performance is the median listing home price versus the median home sold price. While the median listing price provides insight into sellers' expectations, the median sold price offers a glimpse into the realities of transactions. In Fort Myers, FL, the median home sold price was recorded at $382.5K, underlining the negotiation dynamics between buyers and sellers.

Market Dynamics: Buyer's Advantage

Fort Myers, FL presents itself as a buyer's market in February 2024, with the supply of homes surpassing the demand. This scenario provides buyers with a plethora of options and ample room for negotiation. For those looking to enter the market or upgrade their living arrangements, this environment offers favorable conditions.

Time on Market: Insights into Market Activity

The median days on market is a pivotal metric offering insights into market activity and property liquidity. In Fort Myers, FL, homes typically sell after 58 days on the market on average. This figure not only reflects the efficiency of the local real estate market but also serves as a barometer of buyer interest and seller expectations.

Fort Myers Housing Market Forecast 2024 and 2025

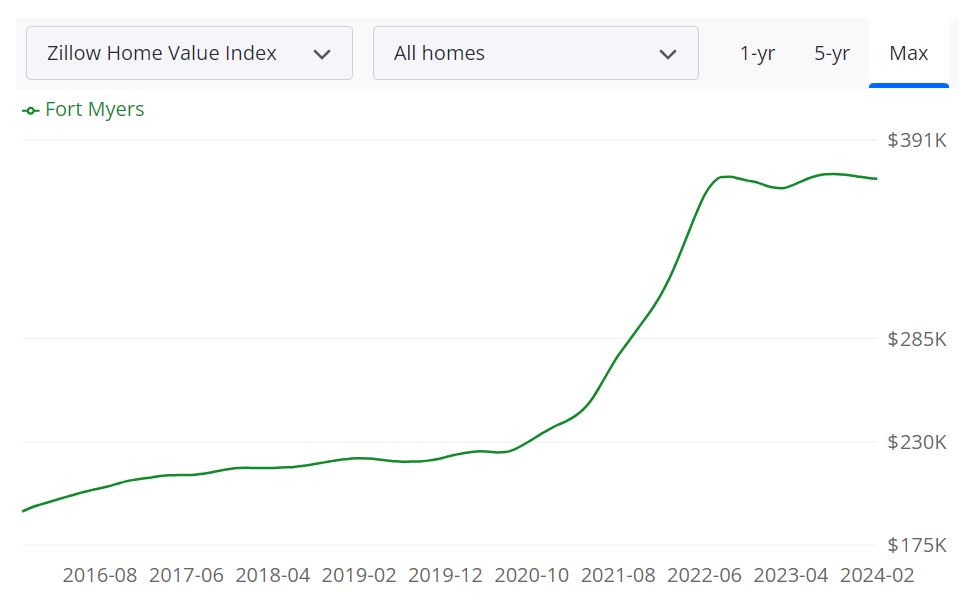

According to Zillow, a prominent real estate marketplace, the following metrics shed light on the Fort Myers housing market as of February 29, 2024:

Inventory:

- For Sale Inventory: As of February 29, 2024, Fort Myers has 3,792 properties listed for sale. This figure represents the number of homes available on the market, providing options for potential buyers.

- New Listings: In addition to the existing inventory, 884 new listings entered the market in February 2024. This influx of new listings indicates ongoing activity in the real estate market.

Pricing:

- Median Sale Price: The median sale price for homes in Fort Myers as of January 31, 2024, was $331,933. This figure represents the middle value of all sale prices, providing insight into the affordability and value of homes in the area.

- Median List Price: As of February 29, 2024, the median list price for homes in Fort Myers stood at $396,333. This figure represents the midpoint of all listed prices, indicating sellers' expectations in the current market.

Sales Performance:

- Median Sale to List Ratio: The median sale to list ratio, calculated as of January 31, 2024, is 0.967. This ratio reflects the relationship between the final sale price of a home and its initial list price, offering insight into negotiation dynamics.

- Percent of Sales Over/Under List Price: In January 2024, 8.4% of sales in Fort Myers were completed above the list price, while 79.0% were below the list price. These percentages indicate the prevalence of competitive pricing strategies and negotiation dynamics in the market.

Are Home Prices Dropping in Fort Myers?

As of January 31, 2024, the median sale price for homes in Fort Myers was $331,933. While this figure represents a snapshot in time and may fluctuate, there is no indication from current data that home prices are dropping in Fort Myers. In fact, the modest 1.3% year-over-year increase in the average home value, as reported by Zillow, suggests a stable or appreciating market.

Will the Fort Myers Housing Market Crash?

Speculating about a housing market crash involves considering various economic, financial, and demographic factors, making it challenging to predict with certainty. However, based on current data and trends, there are no immediate signs of a housing market crash in Fort Myers. The city's relatively stable inventory levels, consistent pricing metrics, and sustained buyer demand indicate resilience within the market.

Nevertheless, it's essential to monitor economic indicators, interest rates, and housing supply and demand dynamics for any shifts that could impact the market's stability in the future.

Is Now a Good Time to Buy a House in Fort Myers?

Deciding whether now is a good time to buy a house in Fort Myers depends on individual circumstances, financial readiness, and long-term goals. Despite the competitive nature of the market and median list prices, several factors may make it an opportune time for prospective buyers:

- Low-Interest Rates: Low mortgage interest rates as compared to last year can make homeownership more affordable by reducing monthly mortgage payments.

- Stable Market Conditions: Fort Myers exhibits stability in inventory levels, pricing, and demand, providing a conducive environment for purchasing a home.

- Desirable Location: Fort Myers' desirable location, amenities, and quality of life factors contribute to its attractiveness as a place to live and invest.

How is Real Estate Investing in Fort Myers, FL?

Real estate investing in Fort Myers, FL can be a lucrative opportunity for investors, but like any investment, it also comes with potential risks and drawbacks. Potentially lower home prices and cost of living compared to Miami may attract investors and homebuyers looking for a more affordable option with similar climate and lifestyle features as Miami. Here are some of the top reasons to consider investing in Fort Myers real estate, as well as some potential cons to keep in mind:

Pros:

- Strong Housing Market: As discussed earlier, Fort Myers has experienced a significant increase in home values over the past year, with a healthy upward trend predicted to continue. This makes Fort Myers a great place for real estate investors to buy and hold properties for long-term appreciation.

- Growing Population: Fort Myers is experiencing steady population growth, with many people attracted to the area's warm climate, beaches, and outdoor activities. This population growth creates a strong demand for housing, making it easier for real estate investors to find tenants and keep their properties occupied.

- Low Taxes: Florida has no state income tax, and Fort Myers has some of the lowest property taxes in the state. This can make it easier for investors to generate positive cash flow on their properties.

- The Fort Myers multifamily real estate sector: It has experienced growth in recent years, with an increasing demand for rental properties in the area. The growth in the rental market can be attributed to several factors, including a growing population, a strong job market, and an increase in the number of retirees moving to the area. Investing in large multifamily properties in Fort Myers can offer several advantages, such as stable cash flow from rental income, long-term appreciation potential, and diversification of investment portfolio. Additionally, owning a multifamily property in Fort Myers can provide economies of scale in terms of property management, maintenance, and tenant acquisition.

Cons:

- Interest Rates: High-interest rates can make it more expensive for investors to finance their properties, which can reduce their overall return on investment.

- Natural Disasters: Fort Myers is located in a region of Florida that is prone to hurricanes and other natural disasters. This can create additional risks for real estate investors, who may need to pay higher insurance premiums and take extra steps to protect their properties from damage.

- Seasonal Rental Demand: Fort Myers is a popular destination for snowbirds and other seasonal residents, which can create fluctuations in rental demand throughout the year. Investors may need to adjust their rental rates or marketing strategies to account for these seasonal variations.

In conclusion, real estate investing in Fort Myers, FL has the potential to be a profitable opportunity for investors, but it also comes with some potential drawbacks and risks that need to be carefully considered. Investors should conduct thorough research and analysis before making any investment decisions and should work with experienced professionals to help mitigate risks and maximize returns.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market area, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

Sources:

- https://www.realtor.com/realestateandhomes-search/Fort-Myers_FL/overview

- https://www.zillow.com/home-values/31614/fort-myers-fl/