Fort Worth's housing market in 2024 is characterized by a delicate balance between supply and demand. While the increase in listings suggests a more favorable environment for buyers, the modest rise in median home prices and the competitive nature of the market hint at seller-friendly conditions. But, it also depends on various factors, including location, pricing, and individual preferences.

Table of Contents

Fort Worth Housing Market Trends in 2024

How is the Housing Market Doing Currently?

According to the February 2024 Housing Report, Fort Worth has seen a steady climb in inventory, accompanied by a modest increase in the median home price, which now stands at $329,000. This marks a 0.9 percent uptick from the figures reported in February of the previous year.

While active listings surged by 25.4 percent in Fort Worth and 28.7 percent in Tarrant County, closed sales witnessed a slight decline of 2.2 percent in Fort Worth and 4.1 percent in Tarrant County.

Interestingly, despite the increase in listings, the inventory has been steadily climbing over the past few months, reaching 2.5 months in Fort Worth and 2.4 in Tarrant County. According to the Texas Real Estate Research Center at Texas A&M University, a balanced market would ideally have 6.5 months of inventory.

How Competitive is the Fort Worth Housing Market?

Blake Barry, the 2024 President of the Greater Fort Worth Association of REALTORS®, noted a slight decrease in the days on the market in Fort Worth. As more options become available, home buyers are advised to be prepared to make swift offers if a property captures their interest.

Despite a slower-than-anticipated rebound on the national scale, there has been an increase in sales of newly built homes, driven primarily by the historically low supply of existing homes. However, housing affordability remains a concern for many prospective buyers, with even slight fluctuations in mortgage rates causing ripples throughout the market.

The latest data shows a decline in mortgage rates to 6.88 percent for a 30-year fixed-rate mortgage, but it's worth noting that about a third of homebuyers don't feel the impact, as all-cash sales accounted for 32 percent of transactions in January.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the increase in listings, there's still a lingering question of whether there are enough homes for sale to meet buyer demand. Lawrence Yun, Chief Economist at the National Association of REALTORS®, acknowledges the solidity of the job market and the country's record-high total wealth. These favorable economic conditions bode well for home buying, yet consumers are displaying extra sensitivity to changes in mortgage rates, impacting home sales.

Looking ahead, the future market outlook remains optimistic, albeit cautiously so. The surge in newly built home sales indicates resilience in the face of supply challenges, but affordability concerns persist. It's essential for both buyers and sellers to stay informed and adapt to the evolving market conditions.

Fort Worth Housing Market Forecast for 2024 and 2025

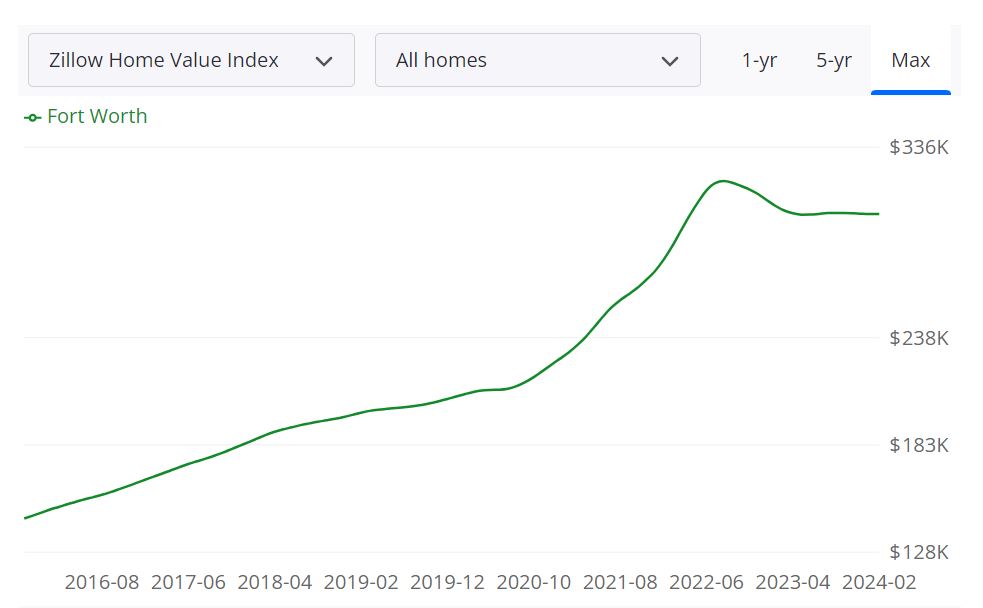

According to Zillow, the average home value in Fort Worth stands at $302,359, indicating a slight decrease of 1.3% over the past year. Homes in the area typically go pending within 30 days, reflecting a fast-paced market.

- For Sale Inventory: As of February 29, 2024, there were 2,369 properties listed for sale in Fort Worth.

- New Listings: During the same period, 703 new properties were listed on the market.

- Median Sale to List Ratio: The median sale to list ratio as of January 31, 2024, stood at 0.989, indicating that homes were typically sold close to their listing prices.

- Median Sale Price: The median sale price recorded on January 31, 2024, was $307,667.

- Median List Price: The median list price for homes as of February 29, 2024, was $333,000.

- Percent of Sales Over List Price: In January 31, 2024, 21.0% of sales were made above the list price.

- Percent of Sales Under List Price: Conversely, 57.8% of sales were recorded under the list price during the same period.

Each of these metrics provides a unique perspective on the Fort Worth housing market, offering valuable insights for both buyers and sellers. Understanding these metrics can empower individuals to make informed decisions regarding property investment or sale, ensuring they are well-prepared to navigate the complexities of the local real estate market.

While past performance can provide valuable insights, it's essential to consider future projections when making real estate decisions. Factors such as economic indicators, population growth, and market trends can all influence the Fort Worth housing market in the coming months.

Are Home Prices Dropping in Fort Worth?

While the average home value in Fort Worth has experienced a modest decrease over the past year, it's important to consider the broader trends and factors influencing pricing. Market fluctuations, economic conditions, and supply-demand dynamics all play a role in determining home prices.

Determining whether the current Fort Worth housing market favors buyers or sellers is crucial for making informed decisions. With a slight decrease in the average home value and a median sale to list ratio close to 1, it appears to be more balanced. However, factors such as inventory levels, days on market, and competition can further influence this dynamic.

Will the Fort Worth Housing Market Crash?

Predicting a housing market crash requires careful analysis of various economic indicators, market trends, and external factors. While the Fort Worth housing market may experience fluctuations, a crash is not inevitable. Factors such as job growth, population influx, and housing affordability can mitigate the risk of a severe downturn. However, it's essential for buyers, sellers, and investors to remain vigilant and adapt their strategies accordingly.

Is Now a Good Time to Buy a House in Fort Worth?

Deciding whether it's a good time to buy a house in Fort Worth depends on individual circumstances and financial goals. With a relatively balanced market, favorable mortgage rates, and a diverse range of properties available, now could be an opportune time for buyers. However, factors such as personal finances, long-term plans, and market forecasts should also be considered. Consulting with a real estate professional can provide valuable insights tailored to your specific situation.

Should You Invest in the Fort Worth Real Estate Market?

Population Growth and Trends

- Fort Worth has been experiencing significant population growth in recent years, making it an attractive destination for real estate investors. The city's population growth can be attributed to factors such as job opportunities, affordability, and a thriving economy.

- With its strategic location in the Dallas-Fort Worth metroplex, Fort Worth benefits from spillover growth from the larger metropolitan area, contributing to its sustained population increase.

Economy and Jobs

- Fort Worth boasts a diverse and robust economy with key sectors including aerospace and aviation, healthcare, manufacturing, and logistics. The presence of major corporations, including Lockheed Martin and American Airlines, provides a stable job market.

- The city's job market has been expanding, creating a strong demand for housing. This employment growth is a positive indicator for real estate investors, as a strong job market is often correlated with a healthy housing market.

Livability and Other Factors

- Fort Worth offers a high quality of life, with a lower cost of living compared to many other major U.S. cities. The city is known for its cultural amenities, excellent schools, and family-friendly communities, making it an appealing place for residents.

- Fort Worth's affordability and diverse housing options cater to a broad range of potential tenants, which is advantageous for real estate investors seeking a diverse rental market.

Rental Property Market Size and Growth

- The rental property market in Fort Worth is substantial and continues to grow. The city's expanding population and job market have created a consistent demand for rental properties.

- Rental properties in Fort Worth offer investors the opportunity to generate passive income and the potential for long-term appreciation of property values.

Other Factors Related to Real Estate Investing

- Fort Worth's real estate market is known for its stability and resilience. Even during economic downturns, the city's housing market has shown relative strength.

- The city's regulatory environment is favorable for real estate investors, with landlord-friendly laws that provide protection for property owners.

- Fort Worth's real estate market offers a variety of property types, from single-family homes to multifamily units and commercial properties. This diversity allows investors to tailor their portfolios to their preferences and investment goals.

- Fort Worth is strategically located near major transportation hubs, including DFW International Airport. This connectivity enhances the city's desirability as a place to live and work, further benefiting real estate investors.

Thus, investing in the Fort Worth real estate market presents a compelling opportunity for investors. The city's population growth, strong economy, livability, and rental market size all contribute to its attractiveness. With a diverse range of property types and a favorable regulatory environment, Fort Worth is a destination worth considering for real estate investors seeking long-term growth and stability in their portfolios.

Sources:

- https://www.zillow.com/fortworth-tx/home-values

- https://www.gfwar.org/housing-report

- https://www.redfin.com/city/30827/TX/Fort-Worth/housing-market

- https://www.realtor.com/realestateandhomes-search/Fort-Worth_TX/overview