The current housing market in Minnesota can be described as competitive, albeit balanced. With a growing number of new listings and pending sales, buyers have a range of options to choose from. However, sellers are also benefiting from favorable conditions, including a steady rise in median sales price and a high percentage of original list price received.

Looking ahead, the future market outlook for Minnesota remains positive, albeit with some uncertainties. Factors such as economic conditions, interest rates, and housing policies may influence market trends in the coming months. However, the overall trajectory suggests continued growth and stability in the real estate sector.

Minnesota Housing Market Trends in 2024

New Listings and Pending Sales

One of the key indicators of a vibrant housing market is the number of new listings. According to the data by Minnesota REALTORS®, in February 2024, Minnesota witnessed a 34.8% increase in new listings compared to the same period last year. This surge indicates a growing confidence among sellers in the market's stability and potential for profit.

Moreover, pending sales, which represent properties under contract but not yet closed, also experienced a 12.6% uptick year-over-year. This suggests a healthy demand from buyers, eager to capitalize on favorable market conditions.

Closed Sales and Median Sales Price

As new listings and pending sales show promise, closed sales in Minnesota have followed suit, rising by 11.5% compared to February 2023. This uptrend is a testament to the robust activity within the housing market.

Accompanying the increase in closed sales is a modest but consistent rise in the median sales price. From February 2023 to February 2024, the median sales price climbed by 4.4%, indicating steady appreciation in property values. This growth can be attributed to a combination of factors, including limited inventory and high demand.

Market Dynamics

Despite the positive momentum seen in new listings and closed sales, it's essential to consider other factors shaping the market. The percent of original list price received remained relatively stable, showing a marginal increase of 0.2% year-over-year. This suggests that sellers are still able to negotiate favorable prices for their properties.

Additionally, the days on market until sale remained unchanged at 53 days, indicating that properties are selling at a consistent pace. However, it's worth noting the 26.7% increase in months supply of inventory, which could potentially lead to a more balanced market in the future.

Buyer's or Seller's Market?

Assessing whether it's a buyer's or seller's market depends on various factors, including inventory levels, median sales price, and days on market. Currently, the market in Minnesota can be considered balanced, offering opportunities for both buyers and sellers. Buyers have a range of options to choose from, while sellers can still command favorable prices for their properties. However, as inventory levels continue to rise, both buyers and sellers need to stay informed and adapt to changing market conditions.

Minnesota Housing Market Forecast 2024 and 2025

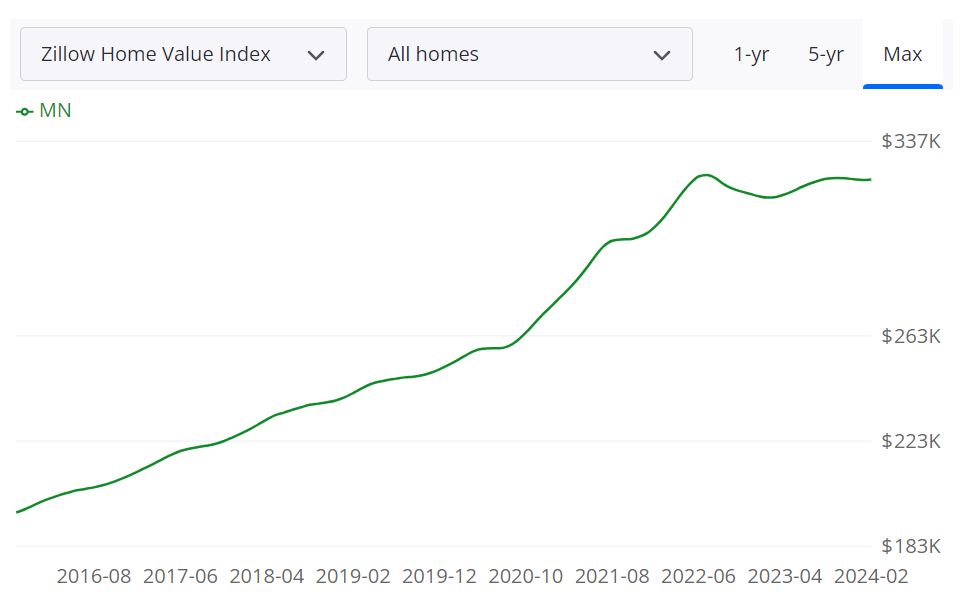

According to Zillow, the leading real estate marketplace, here's a breakdown of the current state of the Minnesota housing market as of February 29, 2024.

For Sale Inventory

As of February 29, 2024, there are 10,758 properties listed for sale in Minnesota. This figure represents the number of homes available on the market and provides insight into the overall supply of housing.

New Listings

In February 2024, there were 3,168 new listings added to the Minnesota housing market. New listings indicate the rate at which properties are entering the market, reflecting the level of activity and potential opportunities for buyers.

Median Sale to List Ratio

The median sale to list ratio, which stood at 0.995 as of January 31, 2024, is an important metric for understanding pricing dynamics. This ratio compares the actual sale price of homes to their listing prices, offering insights into negotiation trends and market competitiveness.

Median Sale Price

The median sale price of homes in Minnesota was $294,167 as of January 31, 2024. This figure represents the midpoint of all home sale prices, providing a benchmark for assessing affordability and market trends.

Median List Price

As of February 29, 2024, the median list price for homes in Minnesota is $322,965. This metric reflects the average asking price for properties currently on the market and is a key consideration for both buyers and sellers when determining pricing strategies.

Percent of Sales Over and Under List Price

In January 2024, 28.5% of home sales in Minnesota were completed at prices exceeding the list price, while 51.5% were sold below the list price. These percentages highlight the prevalence of negotiation in real estate transactions and the balance of power between buyers and sellers.

Are Home Prices Dropping in Minnesota?

As of the latest data available, there isn't a widespread trend of home prices dropping across Minnesota. While certain areas may experience fluctuations or adjustments in prices due to local market conditions, overall, home prices have shown resilience and stability.

Factors such as strong demand, limited inventory, and low mortgage rates as compared to last year have supported home prices, preventing significant declines. However, it's essential to monitor market trends closely, as real estate markets can be influenced by various economic and social factors, which may impact pricing dynamics in the future.

Will the Minnesota Housing Market Crash?

Predicting a housing market crash with certainty is challenging, as it depends on numerous complex factors, including economic conditions, mortgage rates, housing supply, and consumer behavior. While the current housing market in Minnesota shows signs of strength and stability, potential risks and vulnerabilities exist, such as economic downturns, interest rate hikes, or unforeseen events.

It's crucial for stakeholders to remain vigilant, monitor market trends, and assess risks carefully. Additionally, implementing prudent financial practices and maintaining realistic expectations can help mitigate potential impacts of market downturns.

Is Now a Good Time to Buy a House in Minnesota?

Whether now is a good time to buy a house depends on individual circumstances, financial readiness, and personal preferences. Several factors contribute to this decision, including mortgage rates, housing inventory, affordability, and long-term housing goals. Currently, favorable mortgage rates and government incentives may make homeownership more accessible for some buyers.

Additionally, buying in a competitive market with high demand and limited inventory may require patience and strategic planning. Prospective buyers should assess their financial situation, conduct thorough research, and consider consulting with real estate professionals to determine if now is the right time to make a purchase.

Regional Housing Market Forecast for Minnesota

The regional housing market forecast provides valuable insights into the anticipated trends and fluctuations in various cities across Minnesota. Analyzing data from February 29, 2024, and projecting forward to March 31, 2024, May 31, 2024, and February 28, 2025, reveals the expected changes in housing market performance.

Minneapolis, MN: The Minneapolis metropolitan statistical area (MSA) is projected to experience a slight increase in housing market performance, with a forecasted growth rate of 0.2% by March 31, 2024, and a further increase to 0.4% by May 31, 2024. However, by February 28, 2025, a modest decline of -1.6% is anticipated, indicating potential market stabilization or slight downturn.

Duluth, MN: Duluth, another significant city in Minnesota, is forecasted to see positive growth in its housing market, with projected increases of 0.3% by March 31, 2024, and 0.9% by May 31, 2024. This trend suggests growing demand and investment opportunities in the region. By February 28, 2025, the growth rate is expected to stabilize at 0.7%, indicating sustained market performance.

Rochester, MN: Rochester's housing market is also expected to experience growth, with forecasted increases of 0.3% by March 31, 2024, and 0.8% by May 31, 2024. However, by February 28, 2025, a slight decrease of -0.4% is projected, suggesting a potential adjustment in market dynamics.

St. Cloud, MN: St. Cloud is anticipated to see steady growth in its housing market, with forecasted increases of 0.4% by March 31, 2024, and 0.8% by May 31, 2024. By February 28, 2025, the growth rate is expected to stabilize at 0.4%, indicating consistent market performance.

Grand Forks, ND: While not located in Minnesota, the Grand Forks metropolitan statistical area has ties to the state and is included in the analysis. Grand Forks is forecasted to experience fluctuations in its housing market, with projected growth rates of 0.4% by March 31, 2024, and 0.4% by May 31, 2024. However, by February 28, 2025, a notable decline of -3% is expected, suggesting potential challenges or shifts in market dynamics.

Mankato, MN: Mankato's housing market is anticipated to see mixed performance, with forecasted increases of 0.3% by March 31, 2024, and 0.5% by May 31, 2024. However, by February 28, 2025, a slight decline of -0.7% is projected, indicating potential adjustments in market conditions.

Brainerd, MN: Brainerd's housing market is expected to demonstrate positive growth, with forecasted increases of 0.2% by March 31, 2024, and a notable uptick to 0.9% by May 31, 2024. By February 28, 2025, the growth rate is projected to accelerate further to 1.8%, indicating a robust and thriving market in the region.

Faribault, MN: Faribault is anticipated to experience moderate growth in its housing market, with forecasted increases of 0.3% by March 31, 2024, and 0.6% by May 31, 2024. However, by February 28, 2025, a slight decline of -0.5% is expected, suggesting potential market adjustments or fluctuations.

Fergus Falls, MN: Fergus Falls' housing market is forecasted to exhibit relatively stable performance, with minimal changes projected. Expectations include marginal increases of 0.1% by March 31, 2024, and a slight decrease of -0.2% by May 31, 2024, indicating a balanced market environment.

Winona, MN: Winona's housing market is expected to demonstrate positive growth, with forecasted increases of 0.4% by March 31, 2024, and a further uptick to 1% by May 31, 2024. By February 28, 2025, the growth rate is projected to stabilize at 0.3%, indicating sustained market performance.

Red Wing, MN: Red Wing is forecasted to experience moderate growth in its housing market, with projected increases of 0.2% by March 31, 2024, and 0.4% by May 31, 2024. However, by February 28, 2025, a slight decline of -0.7% is anticipated, suggesting potential market adjustments or shifts.

Bemidji, MN: Bemidji's housing market is expected to demonstrate positive growth, with forecasted increases of 0.5% by March 31, 2024, and a further uptick to 0.9% by May 31, 2024. By February 28, 2025, the growth rate is projected to stabilize at 0.9%, indicating sustained and robust market performance.

Willmar, MN: Willmar's housing market is expected to demonstrate positive growth, with forecasted increases of 0.4% by March 31, 2024, and a further uptick to 1% by May 31, 2024. By February 28, 2025, the growth rate is projected to stabilize at 0.5%, indicating sustained and stable market performance in the region.

Austin, MN: Austin is anticipated to experience significant growth in its housing market, with forecasted increases of 0.6% by March 31, 2024, and a notable uptick to 1.4% by May 31, 2024. By February 28, 2025, the growth rate is expected to accelerate further to 1.7%, indicating a robust and thriving market in the area.

Alexandria, MN: Alexandria's housing market is forecasted to exhibit moderate growth, with projected increases of 0.4% by March 31, 2024, and 0.9% by May 31, 2024. However, by February 28, 2025, a slight decrease of 0.1% is anticipated, suggesting potential market adjustments or fluctuations.

Owatonna, MN: Owatonna is expected to demonstrate significant growth in its housing market, with forecasted increases of 0.6% by March 31, 2024, and a notable uptick to 1.3% by May 31, 2024. By February 28, 2025, the growth rate is projected to stabilize at 1.2%, indicating sustained and robust market performance in the region.

Hutchinson, MN: Hutchinson's housing market is anticipated to experience moderate growth, with forecasted increases of 0.4% by March 31, 2024, and 0.9% by May 31, 2024. By February 28, 2025, the growth rate is expected to stabilize at 0.6%, indicating sustained and stable market performance in the area.

Albert Lea, MN: Albert Lea's housing market is expected to demonstrate moderate growth, with forecasted increases of 0.3% by March 31, 2024, and a notable uptick to 1.4% by May 31, 2024. By February 28, 2025, the growth rate is projected to stabilize at 1.7%, indicating sustained and robust market performance in the region.

New Ulm, MN: New Ulm's housing market is forecasted to exhibit moderate growth initially, with projected increases of 0.5% by March 31, 2024. However, by May 31, 2024, a slight decline of -0.4% is anticipated, suggesting potential market adjustments or fluctuations.

Marshall, MN: Marshall's housing market is anticipated to experience moderate growth initially, with forecasted increases of 0.6% by March 31, 2024. However, by May 31, 2024, a notable decline of -1.9% is projected, indicating potential challenges or shifts in market dynamics.

Worthington, MN: Worthington is expected to demonstrate significant growth in its housing market, with forecasted increases of 1.1% by March 31, 2024, and a notable uptick to 1.8% by May 31, 2024. By February 28, 2025, the growth rate is projected to stabilize at 1.2%, indicating sustained and robust market performance in the region.

Sources:

- https://www.mnrealtor.com/buyers-sellers/marketreports

- https://fred.stlouisfed.org/series/MNSTHPI#

- https://www.zillow.com/mn/home-values/

- https://www.neighborhoodscout.com/mn/real-estate

- https://fred.stlouisfed.org/series/ACTLISCOUMN#