The St. Louis real estate market has been through some ups and downs over the past few years, but it remains a stable and thriving market overall. The balance between buyer and seller dynamics in the St. Louis housing market is influenced by a myriad of factors, including inventory levels, pricing trends, and buyer preferences.

Currently, the market leans towards equilibrium, offering opportunities for both buyers and sellers to achieve their respective objectives. While sellers may benefit from favorable pricing conditions and robust demand, buyers can capitalize on a diverse inventory and competitive financing options.

St. Louis Housing Market Trends in 2024

How is the Housing Market Doing Currently?

The current state of the St. Louis housing market reflects a mix of positive and stabilizing indicators. According to the data by St. Louis REALTORS®, new listings, a fundamental aspect of market activity, experienced a significant increase, rising by 19.9% for residential homes and 18.2% for townhouse/condo properties. This surge in new listings signals confidence among sellers, potentially broadening options for buyers in the market.

Similarly, pending sales saw an uptick, with residential homes recording a robust 16.5% increase, while townhouse/condo properties witnessed a respectable 6.1% rise. These figures underscore growing demand in the St. Louis housing market, driven by factors such as favorable interest rates and economic stability.

However, it's essential to note that inventory levels have also seen noteworthy changes. While residential home inventory increased modestly by 3.0%, townhouse/condo inventory experienced a substantial surge of 24.1%. This disparity could potentially impact market dynamics, influencing factors such as pricing and competition.

How Competitive is the St. Louis Housing Market?

The St. Louis housing market, characterized by healthy activity and balanced competition, presents an intriguing landscape for both buyers and sellers. With an increase in new listings and pending sales, buyers have a wider array of options to consider, fostering competitive bidding scenarios in certain segments of the market.

On the seller's side, the uptick in inventory for townhouse/condo properties may introduce heightened competition among sellers vying for buyer attention. Effective pricing strategies and value proposition will be crucial in attracting discerning buyers in this dynamic environment.

Are There Enough Homes for Sale in St. Louis to Meet Buyer Demand?

The influx of new listings coupled with a surge in pending sales signals promising activity in the St. Louis housing market. While inventory levels have seen variances across different property types, the overall trend suggests a healthy balance between supply and demand.

For buyers, this translates to a diverse selection of homes to explore, ranging from traditional residential properties to contemporary townhouse/condo offerings. However, it's crucial for buyers to act decisively, as competitive market conditions may lead to swift property transactions.

What is the Future Market Outlook for St. Louis?

Looking ahead, the future market outlook for St. Louis remains optimistic, buoyed by favorable economic indicators and sustained demand in the housing sector. While uncertainties may arise, the overall trajectory suggests continued growth and resilience in the market.

Factors such as job growth, infrastructure development, and demographic shifts will play pivotal roles in shaping the future dynamics of the St. Louis housing market. Investors and stakeholders are advised to stay attuned to emerging trends and market insights to capitalize on lucrative opportunities.

St. Louis Real Estate Market Forecast for 2024 and 2025

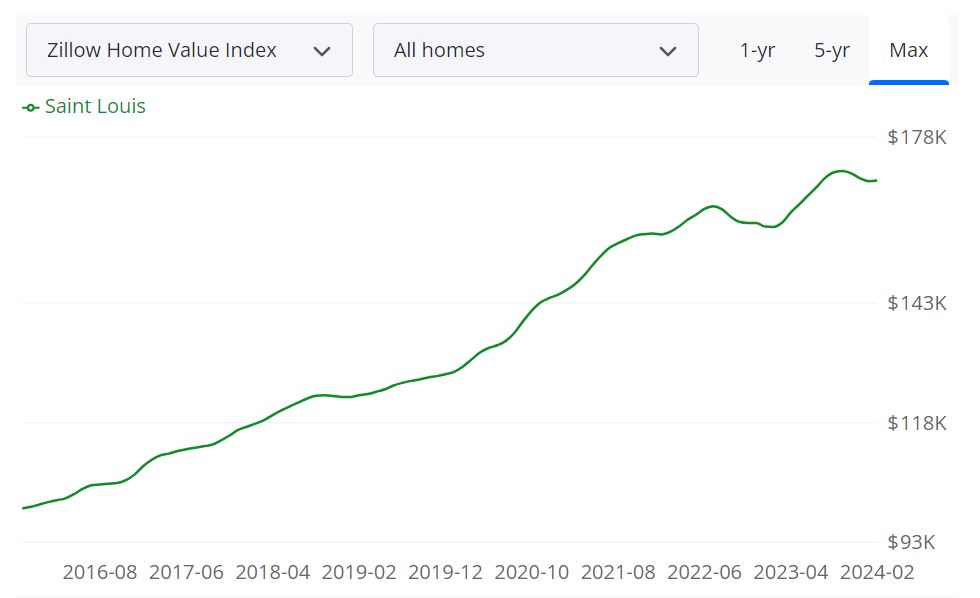

According to Zillow, the average home value in Saint Louis stands at $169,352, reflecting a 6.1% increase over the past year. Homes in this area typically go pending within approximately 18 days. This data, updated through February 29, 2024, provides valuable insights into the current state of the St. Louis housing market.

For Sale Inventory

As of February 29, 2024, there are 824 properties listed for sale in St. Louis. This inventory serves as a key indicator of the available options for potential buyers in the market.

New Listings

On February 29, 2024, 251 new listings entered the St. Louis housing market. These fresh listings contribute to the overall supply of homes available for purchase.

Median Sale to List Ratio

The median sale to list ratio for St. Louis, as of January 31, 2024, stands at 0.989. This ratio indicates the relationship between the final sale price of a property and its initial listing price, offering insights into market competitiveness and negotiation dynamics.

Median Sale Price and Median List Price

The median sale price for homes in St. Louis was $178,118 as of January 31, 2024, while the median list price, updated to February 29, 2024, is $180,967. These figures represent the midpoint of home prices in the market, providing a benchmark for both buyers and sellers.

Percent of Sales Over and Under List Price

As of January 31, 2024, 26.6% of home sales in St. Louis were transacted above the list price, while 55.6% were below the list price. These percentages offer insights into market dynamics and buyer/seller behavior.

Examining the St. Louis MSA Housing Market Forecast

The St. Louis MSA (Metropolitan Statistical Area) housing market forecast predicts a 0.5% increase in home values by March 31, 2024, followed by a 1.2% rise by May 31, 2024, before stabilizing back to a 0.5% growth rate by February 28, 2025. This forecast, based on extensive data analysis and market trends, provides valuable insights for investors, homebuyers, and sellers alike.

The St. Louis MSA encompasses multiple counties in the state of Missouri, including St. Louis County, St. Charles County, and Jefferson County, among others. With its diverse mix of urban, suburban, and rural areas, the St. Louis MSA constitutes a significant portion of the regional housing market, attracting residents from various demographics.

St. Louis itself serves as the economic and cultural hub of the MSA, boasting a rich history, vibrant neighborhoods, and a diverse range of industries. As one of the largest metropolitan areas in the Midwest, the St. Louis MSA offers a wide array of housing options, from historic homes in established neighborhoods to modern developments in burgeoning suburbs.

Is it a Buyer's or Seller's Housing Market?

The current state of the St. Louis housing market suggests a seller's market, characterized by low inventory levels, high demand, and competitive bidding among buyers. With homes typically selling quickly and often at or above their list prices, sellers hold the advantage in negotiations, enjoying the opportunity to secure favorable terms and maximize their returns.

Are Home Prices Dropping in St. Louis?

Despite fluctuations in market conditions, there is currently no evidence to suggest a widespread decline in home prices across St. Louis. The steady increase in average home values, coupled with sustained demand, indicates a resilient market where prices remain relatively stable. However, localized factors or broader economic trends could influence pricing dynamics in specific neighborhoods or segments of the market.

Will the St. Louis Housing Market Crash?

While no market is immune to volatility, there are currently no indications of an imminent housing market crash in St. Louis. The region's diverse economy, strong job market, and steady population growth contribute to its overall housing market stability. However, it's essential to monitor factors such as interest rates, economic indicators, and housing supply to assess any potential risks and make informed decisions.

Is Now a Good Time to Buy a House in St. Louis?

For prospective homebuyers considering St. Louis as their next investment, now could be an opportune time to enter the market. While competition among buyers remains fierce, low mortgage rates as compared to last year and favorable financing options enhance affordability and increase purchasing power. Additionally, investing in a home in a stable market like St. Louis offers the potential for long-term appreciation and a solid foundation for building wealth.

St. Louis Real Estate Investment Overview

Is St. Louis a Good Place For Real Estate Investment? St. Louis, Missouri is a city with a rich history, culture, and a growing economy. The city boasts a diversified economy with multiple sectors, including healthcare, education, and manufacturing, providing a stable foundation for real estate investments. St. Louis offers a range of investment opportunities, from affordable fixer-uppers to high-end luxury properties, making it an attractive option for both beginner and seasoned real estate investors.

One of the most significant factors driving the St. Louis real estate market is its affordability. The average home value in St. Louis is $166,804, making it one of the most affordable cities in the US. Despite being affordable, the city's real estate market is poised for growth over the next twelve months.

Another factor driving St. Louis's real estate market is the city's growing population. The city's population has been steadily increasing over the years, which has led to an increased demand for housing. This demand has caused rental prices to rise, making it an ideal city for real estate investors looking to capitalize on rental properties.

St. Louis is also home to some of the best neighborhoods in the country. Neighborhoods like Forest Park Southeast, Central West End, and Botanical Heights offer an excellent opportunity for real estate investment due to their high median home values and growth potential. Overall, St. Louis is a promising location for real estate investment, with a growing economy, affordable housing, and an increasing population. Investing in St. Louis real estate can provide investors with long-term financial benefits.

Top reasons to invest in St. Louis real estate:

Let's take a deeper dive into each of the top reasons to invest in the St. Louis real estate market.

- Affordable Home Prices: The average home value in St. Louis is $169,352, which is significantly lower than the national average. This means that investors can purchase properties at a lower price point and potentially see higher returns on their investment.

- Strong Rental Market: St. Louis has a robust rental market with a high demand for rental properties. Rental rates have been steadily increasing over the past few years. Investors can take advantage of this trend by purchasing rental properties and generating passive income.

- Growing Job Market: St. Louis has a diverse economy and is home to several major companies and industries, including healthcare, biotechnology, and finance. This has led to a growing job market with low unemployment rates, making it an attractive location for young professionals and families.

- Urban Revitalization: St. Louis has undergone a significant urban revitalization in recent years, with several neighborhoods experiencing redevelopment and an influx of new businesses and residents. This has led to increased property values in these areas and presents opportunities for investors to purchase properties before they appreciate in value.

- Strong Real Estate Market Forecast: According to Zillow's MSA-level forecast, the St. Louis real estate market is expected to experience modest growth in the coming years, with a projected increase in home values of 0.5% by March 2024, 1.2% by May 2024, and an increase of 0.5% by February 2025. While not a dramatic increase, this forecast suggests a stable and steady market that is unlikely to experience significant declines.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS strives to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

References:

- https://www.zillow.com/saint-louis-mo/home-values/

- https://www.stlrealtors.com/pages/housingreport/

- https://www.redfin.com/city/16661/MO/St-Louis/housing-market

- https://www.zumper.com/rent-research/st-louis-mo

- https://www.neighborhoodscout.com/mo/st-louis/real-estate#description

- https://www.realtor.com/realestateandhomes-search/Saint-Louis_MO/overview