The phrase “housing market correction” may seem like something out of a novel or news article about Wall Street analysts. However, for real estate investors and homeowners alike, it means that prices have dropped significantly since their peak—and will continue to do so until demand for properties rises again. In other words, this is not just a normal dip; it's the beginning of the end for some high-end properties.

Whether you're a first-time homebuyer, an investor looking to cash in on the booming real estate market, or a homeowner who is simply looking to upgrade your home, the housing market has undoubtedly had a significant impact on everyone, no matter their financial situation. After years of steady price increases and increasing demand from both new and existing homes, many Americans are now feeling the strain of the imminent housing market correction.

Is the Housing Market Correction Coming in 2024?

In 2024, the question of whether a housing market correction will occur is a multifaceted issue with no straightforward answer. Various experts hold different perspectives on the matter. Here's a breakdown of the contrasting viewpoints:

Correction, not crash:

Most experts align on the notion that a correction, characterized by slower growth in home prices or even marginal declines, is more probable than a crash involving steep price drops. This consensus is underpinned by several key factors:

- Strong economy and labor market: Despite inflation concerns, the economy exhibits resilience, providing stability for numerous households.

- Stricter lending standards: In contrast to the 2008 crisis, contemporary lending standards are more rigorous, mitigating the risk of widespread defaults.

- Low inventory: The limited housing supply persists, lending support to moderate price levels.

Potential for price declines:

Nevertheless, certain indicators hint at the possibility of price declines, including:

- High mortgage rates: Rates exceeding 6% might dissuade buyers and diminish affordability.

- Affordability issues: Elevated prices and interest rates collectively make homeownership less achievable for many.

- Regional variations: Market trends are likely to differ by region, with some areas, such as the west coast, potentially experiencing more significant price adjustments than others.

Overall, uncertainty remains:

Predicting the precise nature and extent of a correction proves challenging. While a full-blown crash appears unlikely, the consensus leans towards anticipating slower growth or modest price declines in 2024. The exact scenario will hinge on factors such as economic conditions, mortgage rates, and regional dynamics.

It's crucial to bear in mind that these are broad predictions, and the specific market you're interested in may exhibit distinct behavior. If you're contemplating buying or selling a home in 2024, seeking guidance from a local real estate professional can offer valuable insights tailored to your area.

ALSO READ: Will the Real Estate Housing Market Crash?

Let's take a closer look at what exactly causes a housing market correction and what you can do to prepare if/when it happens to your neighborhood.

What is a Housing Market Correction?

A housing market correction is a name for a period where prices start falling in some parts of the housing market. This usually happens when there has been a rapid rise in home values over the past few years. Simply put, a housing market correction is a period of declining home prices that is likely to continue for at least a few years.

This is different from a normal dip, which often occurs after a period of rapid price increases. While a correction is not necessarily a bad thing, it is a sign that demand in a particular area is falling and that prices will continue to decrease until demand picks up again. Housing market corrections are caused by two major factors.

First, baby boomers are aging and are more likely to be on a fixed income than their younger counterparts. This means they can no longer afford as many expensive homes as they once did. Second, there has been an increasing demand for housing from young people and families, particularly those looking to buy their first homes. With fewer people in the market looking to purchase expensive homes, prices have gone down.

When a house loses value, it can be tempting to just cut your losses and move on. However, that might not be the best strategy when a housing market correction is happening. In most cases, it’s not advisable to sell your home during a market correction because it will likely lose even more value than it already has.

You should also expect that selling your home now will take some time. The longer you wait, the more your asking price will fall, which makes selling now less appealing as well. If you are thinking about selling your home during a market correction, keep these things in mind first:

- What type of house do you live in?

- Are you able to downsize into something smaller or build something new from scratch?

- If so, what kind of neighborhood do you want to be in and what amenities are available?

- Are those things important to you after all?

- How much equity do you have in your property?

- How much money have you spent on repairs and improvements since buying it?

- If other major expenses need to be taken care of soon as well such as getting the older car fixed or replacing an old furnace, will paying them off help with the value loss instead?

Why Do Housing Markets Experience Correction?

This is something investors and homeowners alike should know. While a housing market correction is something we should be prepared for, it’s important to remember that it doesn’t necessarily mean the end of the real estate market. Instead, a correction is simply a period during which demand falls and prices go down. Ultimately, once demand picks up again, prices will increase and the market will be stronger than ever.

Reasons for this include both external and internal factors. External factors, like aging boomers and the increasing percentage of people on a fixed income, will naturally cause a decrease in demand for expensive homes. Internal factors, on the other hand, are caused by things such as a lack of inventory and a decrease in affordability, which is why we often see a correction when housing prices drop.

How to Know If You’re in a Housing Market Correction

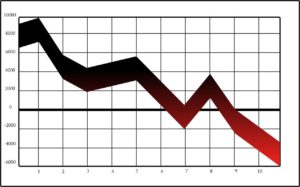

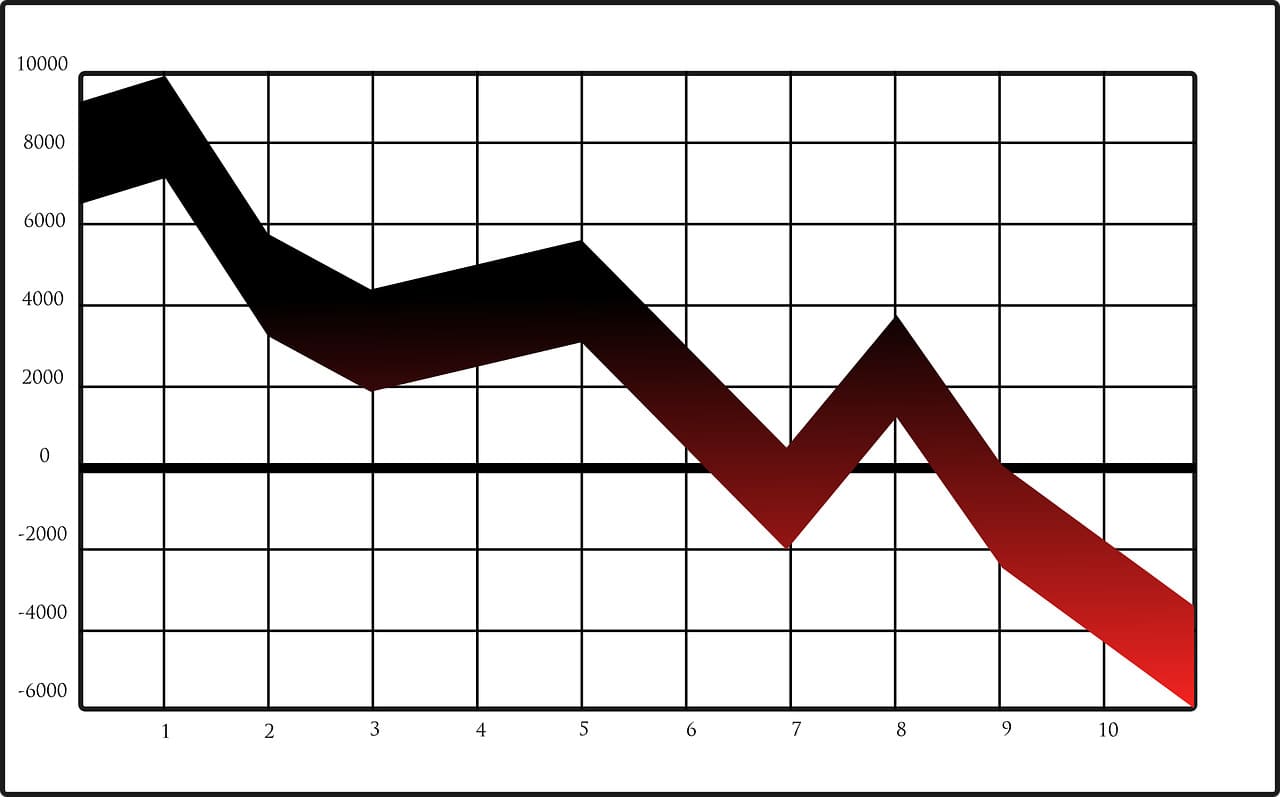

There are a few telltale signs that you may be in a housing market correction. These include a significant decrease in home prices since the peak of the market and a significant decrease in sales. In addition, home prices may be falling faster than they once were. But, don’t forget: a housing market correction doesn’t necessarily mean that prices are going to fall to zero. Instead, they will likely continue to decrease as long as there is a lack of demand.

If you’re one of the people who believe a housing market correction is already underway, keep an eye out for these signs:

- Homes are selling significantly slower than they once were.

- There is a significant decrease in prices.

- There is a significant decrease in sales.

- Homes are selling for significantly less than they were a few months ago.

- Homes are selling for significantly less than similar houses are selling for in the same area.

How to Deal With a Housing Market Correction

It is difficult to predict the exact state of the housing market in 2023, but there are a few strategies that may be effective for handling a housing correction. These include:

- Diversifying your portfolio: Investing in a variety of properties and markets can help spread risk and reduce the impact of any downturn in one specific area.

- Staying informed: Keeping an eye on market trends and economic indicators can help you anticipate a correction and make adjustments to your investments accordingly.

- Being patient: Real estate is a long-term investment, and corrections are often temporary. If you have a long-term perspective, you may be able to ride out a downturn and come out ahead in the end.

- Be prepared for a long-term investment, since some corrections can take several years to recover.

- Seek advice from experts in the field such as real estate agents, financial advisors, and economists, to get an idea of the current and future market trends.

The first thing to keep in mind when you’re in a housing market correction is not to panic. This is something that many homeowners and investors have likely done, making the situation worse than it needed to be. The best thing to do is to stay calm and proceed with caution. Stay focused on your goals, no matter how difficult they may be.

If your goal is to buy a house and you’re currently in a housing market correction, don’t change your mind. Instead, stay strong and keep looking for the right house. Once you find a house that you like and is within your price range, make an offer. Talk to your family and friends about how the housing market correction is affecting them.

Doing so will allow you to stay focused on the goal of buying a house and will help you to form alliances and find ways to help others. If you’re in a position to sell your home, do so quickly. Homes that are sitting on the market for too long will likely experience a price reduction. This means it may be in your best interest to sell as soon as possible. When you’re looking at homes for sale, stay focused on the house itself and not on the neighborhood or the price. Once you find a house that you like and is within your price range, make an offer.

What Happens After a Housing Market Correction?

Once a housing market correction has begun, it will continue until one of two things happens: the demand for homes increases, or the supply of homes increases. We often hear people talk about the importance of owning a home. It’s a significant investment that provides you with a place to live and protects your assets.

Unfortunately, most people don’t realize that it can be quite risky. A housing market correction can be a huge blow to your finances. If you’re looking to buy a home, make sure you do your research. This will help you to make a wise investment decision. Before you know it, the housing market correction will be a distant memory. Better yet, it will be a lesson that taught you a lot about investing. You may even come out ahead!

Bottomline

The housing market correction is an ongoing process that starts when a significant decrease in demand causes prices to fall. It will continue until demand increases or the supply of homes increases. As long as the demand for homes is weaker than it once was, we will continue to see a decline in home prices. The only way to stop the decline is if the demand for homes increases.

When you think about it, a housing market correction is actually a good thing. It means that homeowners are finally beginning to realize just how much their homes cost. This means you have one of the best opportunities to buy a house for a great price. With a housing market correction, now is the time to make sure you are ready to buy a home and become a homeowner.

It's important to note that this is general advice and not tailored to your specific situation. If you're uncertain about your investments or how to handle a potential correction, it's always best to consult a financial advisor.