Madison, WI is a vibrant city located in Dane County, Wisconsin. Known for its beautiful lakes, thriving cultural scene, and renowned educational institutions like the University of Wisconsin-Madison, it has become an attractive place to live for many individuals and families.

As we look ahead to the remainder of 2024, the Madison, WI housing market is expected to maintain its momentum, driven by strong demand, favorable mortgage rates, and a robust local economy. However, challenges such as inventory shortages and affordability concerns may temper growth to some extent.

Is Madison a Seller's Housing Market?

According to Realtor.com, Madison, WI is currently characterized as a seller's market, signaling high demand and limited housing supply. With more prospective buyers than available homes, sellers hold the advantage in negotiations.

Sustained Price Growth

The median listing home price in Madison, WI stood at $434.9K in February 2024, marking a notable 10.1% increase compared to the previous year. This surge in prices underscores the city's desirability among homebuyers.

Steady Sale-to-List Price Ratio

One significant indicator of market competitiveness is the sale-to-list price ratio, which remained at 100% in Madison, WI for February 2024. This suggests that homes were generally selling for the asking price, illustrating a balanced negotiation environment.

Median Days on Market

Despite the competitive landscape, homes in Madison, WI are spending an average of 27 days on the market before being sold. This figure reflects a stable trend compared to the previous month and a slight decrease from the same period last year.

Implications for Buyers and Sellers

Buyers in Madison, WI should be prepared to act swiftly and decisively in their home search, as properties are selling rapidly amid heightened competition. It's essential to have financing in place and to work closely with a knowledgeable real estate agent who can provide guidance throughout the purchasing process.

On the other hand, sellers can capitalize on the current market conditions by pricing their homes competitively and ensuring they are in optimal condition to attract offers quickly. Collaborating with a reputable real estate professional can help sellers navigate negotiations and achieve favorable outcomes.

As we look ahead to the remainder of 2024, the Madison, WI housing market is expected to maintain its momentum, driven by strong demand, favorable mortgage rates, and a robust local economy. However, challenges such as inventory shortages and affordability concerns may temper growth to some extent.

Madison Housing Market Forecast 2024 and 2025

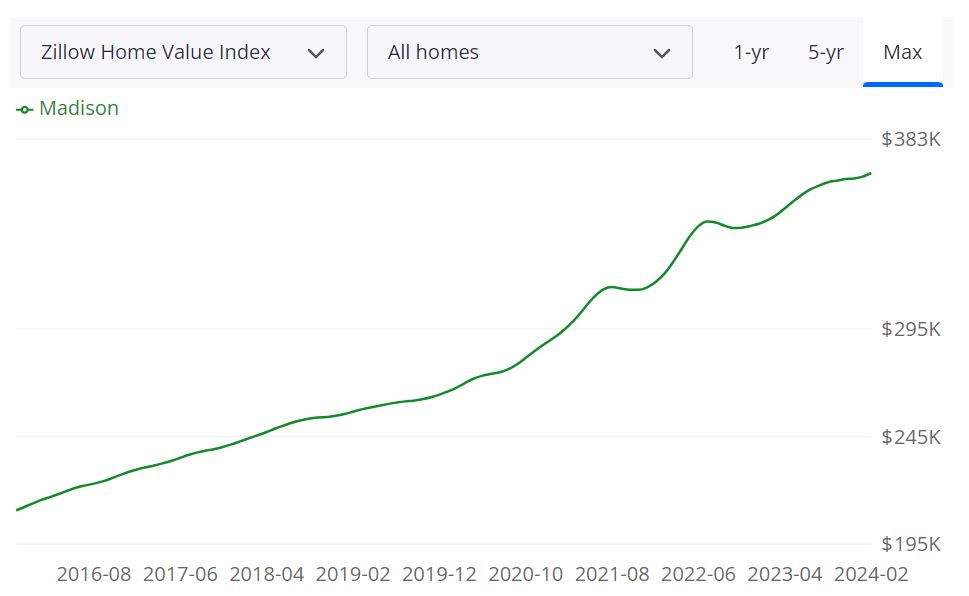

According to Zillow, the average home value in Madison, Wisconsin stands at $368,243, reflecting a 6.3% increase over the past year. Homes in Madison typically go to pending status in approximately 12 days. As of February 29, 2024, the city had 276 homes listed for sale, with 111 new listings during the same period.

The median sale price as of January 31, 2024, was $345,833, while the median list price as of February 29, 2024, was $383,300. Additionally, the median sale to list ratio, indicating the percentage of the sale price to the list price, stood at 1.000. In terms of pricing dynamics, 47.5% of sales were over the list price, while 35.8% were under the list price, as of January 31, 2024.

Understanding the Madison MSA Housing Market Forecast

The Madison Metropolitan Statistical Area (MSA) encompasses a broader geographical area beyond the city limits of Madison itself, comprising surrounding counties and communities. It serves as a comprehensive indicator of the region's housing market health and trends. The forecast for the Madison MSA, as of February 29, 2024, predicts a 0.7% increase in housing values by March 31, 2024, followed by a 1.6% increase by May 31, 2024, and another 1% increase by February 28, 2025.

The Madison MSA, classified as a Metropolitan Statistical Area (MSA), is designated by the U.S. Office of Management and Budget and consists of Dane County primarily, along with surrounding areas that contribute to the economic and social dynamics of the region. Dane County serves as the nucleus of the MSA, hosting the city of Madison, which is the state capital of Wisconsin and a prominent economic hub in the region. The housing market within the Madison MSA encompasses a diverse array of communities, ranging from urban neighborhoods to suburban and rural areas, catering to various preferences and lifestyles.

Are Home Prices Dropping in Madison?

Despite fluctuations in the housing market, Madison has not experienced a significant drop in home prices in recent years. The consistent appreciation in home values, as evidenced by the 6.3% increase over the past year, suggests a resilient market with sustained demand. While localized variations may occur, overall, the trend in Madison points towards a stable or appreciating market, rather than a notable decline in home prices.

Will the Madison Housing Market Crash?

As with any market, the possibility of a housing market crash cannot be entirely ruled out, but current indicators in Madison do not suggest an imminent crash. Factors such as strong demand, low inventory levels, and steady economic fundamentals contribute to the market's stability. However, external events or economic shocks could potentially impact market dynamics. It's essential for buyers and sellers alike to stay informed about market trends and seek professional guidance to navigate any potential fluctuations.

Is Now a Good Time to Buy a House in Madison?

For prospective homebuyers in Madison, the decision to buy a house should be based on individual circumstances, financial readiness, and long-term goals. While the current market conditions may present challenges, such as limited inventory and competitive bidding, they also offer opportunities for investment and homeownership. Low mortgage rates as compared to last year and potential appreciation in home values could make it an attractive time to enter the market for those who are financially prepared and committed to homeownership.

Should You Invest in Madison Real Estate Market?

Madison, WI is currently experiencing a seller's market, which means there is a high demand for properties in the area. However, with the expected rise in interest rates and inflation, it's important to consider whether investing in the Madison, WI real estate market is a wise decision. Here are the top five reasons to invest and potential drawbacks to consider:

Reasons to Invest:

- Strong demand: The Madison, WI housing market is experiencing high demand due to its attractive location, growing economy, and excellent quality of life.

- Rental market potential: Madison, WI is home to the University of Wisconsin-Madison, which means there is a constant demand for rental properties. Investing in rental properties can provide a steady stream of passive income.

- Job growth: Madison, WI has a strong job market with several large employers, including the University of Wisconsin-Madison, American Family Insurance, and Epic Systems. This job growth can lead to an increase in demand for housing.

- Limited supply: There is a limited supply of homes in Madison, which can lead to higher prices and increased demand for properties.

- Favorable market conditions: The current seller's market in Madison means that it's a good time to invest in real estate as properties are selling quickly and for high prices.

Potential Drawbacks:

- Higher interest rates: The expected rise in interest rates can lead to an increase in mortgage rates, making it more expensive to invest in real estate.

- Inflation: Inflation can lead to a decrease in the value of the dollar, which can impact the overall economy and real estate market. I

- Competition: With a limited supply of homes, competition for properties can be fierce, leading to bidding wars and higher prices.

- Market fluctuations: The real estate market can be unpredictable, with fluctuations in demand, supply, and prices. Investing in real estate always comes with a degree of risk.

- Tax factors can be a significant factor for those considering investing in Madison real estate. While Wisconsin's overall tax burden is relatively high compared to other states, it is still considered a relative bargain compared to neighboring states. Additionally, Madison authorities have shown a tendency to keep tax rates low or even lower property taxes in some cases. However, property taxes in Madison can still be considered high compared to other areas, which may be a con for some investors. Ultimately, it depends on an individual's financial goals and priorities when deciding whether to invest in the Madison real estate market.

In conclusion, investing in the Madison, WI real estate market can be a good decision due to its strong demand, rental market potential, job growth, limited supply, and favorable market conditions. However, it's important to consider potential drawbacks such as higher interest rates, inflation, property taxes, competition, and market fluctuations. It's important to do thorough research and consult with a real estate professional before making any investment decisions.

Buying an investment property is different from buying an owner-occupied home. Whether you are a beginner or a seasoned pro you probably realize the most important factor that will determine your success as a Real Estate Investor in Madison, WI is your ability to find great real estate investments in that area.

According to real estate experts, buying in a market with increasing prices, low interest, and low availability requires a different approach than buying in a cooler market.

We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in the U.S. growth markets. We can help you succeed by minimizing risk and maximizing profitability.

Sources:

- https://www.realtor.com/realestateandhomes-search/Madison_WI/overview

- https://www.zillow.com/home-values/398849/madison-wi/

- https://www.redfin.com/city/12257/WI/Madison/housing-market