The Charlotte housing market in 2024 leans towards being a seller's market. With rising prices, low inventory, and high demand, sellers have the upper hand in negotiations, while buyers must act decisively to secure desirable properties.

Looking ahead, the future market outlook for Charlotte appears promising, albeit with some uncertainty lingering amidst economic fluctuations and global events. However, the steady appreciation in home values and continued demand suggest a resilient market poised for growth.

Charlotte Housing Market Trends in 2024

The Charlotte Metropolitan Statistical Area (MSA) encompasses Cabarrus, Gaston, Iredell, Lincoln, Mecklenburg, Rowan, and Union Counties in North Carolina, along with Chester, Lancaster, and York Counties in South Carolina. Here's the data provided by the Canopy Realtor® Association to unveil the secrets behind the numbers and understand what they mean for those seeking to buy or sell property in the Charlotte housing market.

How is the Housing Market Doing Currently?

Looking at the key metrics from February year to date, we observe notable shifts in various aspects of the market. One of the most significant indicators, the median sales price, has seen a considerable increase of 8.0% compared to the previous year. This surge in prices reflects the high demand for homes in the region.

Furthermore, the average sales price has also seen a double-digit growth of 10.1%, indicating a healthy appreciation in property values. Despite these positive trends, there are nuances to consider, such as the percent change in closed sales, which has experienced a slight decline of 2.9%.

How Competitive is the Charlotte Housing Market?

With the increase in new listings by 18.7%, it's clear that sellers are taking advantage of the favorable market conditions. However, this surge in listings hasn't necessarily translated into a proportional rise in pending sales, which have remained relatively stagnant with a marginal increase of 0.6%.

Buyers, on the other hand, are facing a competitive landscape characterized by a low inventory of homes for sale. The months supply of inventory has increased by 15.4%, indicating a slight improvement in supply, yet still falling short of meeting the robust demand.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the increase in new listings and inventory, the list to close ratio has seen a significant decrease of 12.5%. This suggests that homes are spending less time on the market before being sold, emphasizing the urgency for buyers to act swiftly in a competitive environment.

Moreover, the percent of original list price received has risen by 2.0%, indicating that sellers are achieving higher prices for their properties, further underscoring the seller-friendly nature of the current market.

Buyers may find opportunities in the market, especially with the low mortgage rates as compared to last year and favorable financing options available. Conversely, sellers can capitalize on the high demand and competitive pricing environment to maximize returns on their investments.

Charlotte Rent Price Trends in 2024

The Zumper Charlotte Metro Area Report analyzed active listings last month across the metro cities to show the most and least expensive cities and cities with the fastest growing rents. The North Carolina one bedroom median rent was $1,169 last month. Charlotte was the most expensive city with one bedrooms priced at $1,490 while Shelby was the most affordable city with rent at $860.

The Fastest Declining Cities For Rents in Charlotte Metro Area (Y/Y%)

- Concord rent had the largest decline, down 15% since this time last year.

- Rock Hill saw rent drop 6.3%, making it second.

- Charlotte was third with rent falling 4.5%.

The Fastest Declining Cities For Rents in Charlotte Metro Area (M/M%)

- Shelby rent had the largest decline last month, down 6.5%.

- Huntersville & Charlotte saw rents both dip 2.6%, making them tied for second.

- Mooresville was third with rent decreasing 2.1%.

Charlotte Housing Market Forecast for 2024 and 2025

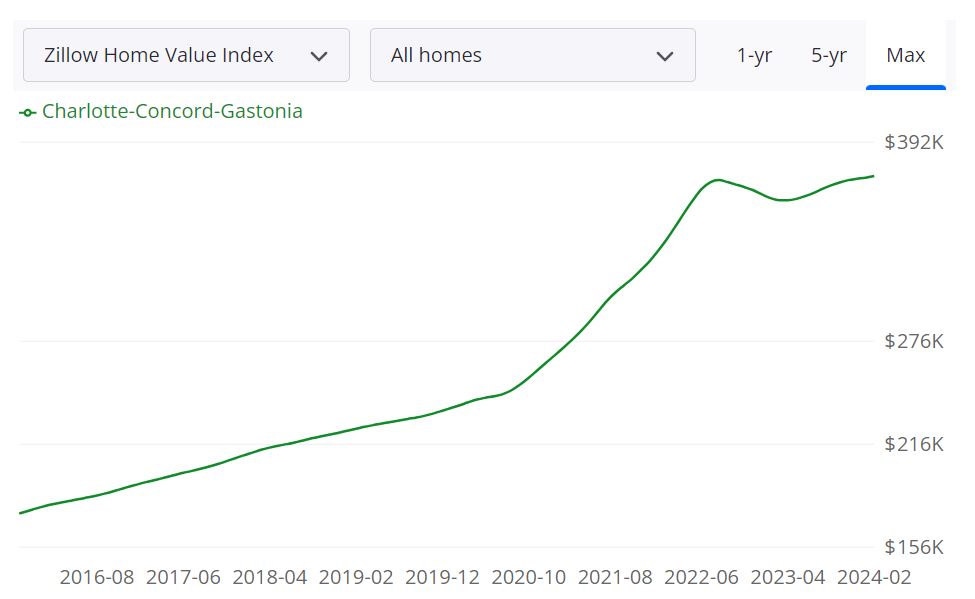

The Charlotte-Concord-Gastonia metropolitan area, often referred to as the Charlotte MSA, encompasses several counties in North and South Carolina. This region boasts a thriving housing market, offering diverse options for buyers and sellers alike.

Charlotte's housing market is characterized by its sizeable inventory, competitive pricing, and rapid turnover. With a diverse range of properties and robust demand, the region offers opportunities for both seasoned investors and first-time homebuyers. As we look ahead, Zillow's forecast of a 3.0% market growth over the next year signals continued stability and potential for further appreciation in property values.

1. Home Value:

The average home value in the Charlotte area stands at $373,206, reflecting a 3.6% increase over the past year. This figure underscores the region's attractiveness to homeowners and investors alike.

2. Days on Market:

Homes in Charlotte typically go pending in approximately 20 days, indicating a brisk pace of transactions within the market. This swift turnaround time underscores the high demand for properties in the area.

3. Inventory:

As of February 29, 2024, there were 7,139 homes available for sale in the Charlotte area. This ample inventory provides buyers with a wide array of choices as they explore the market.

4. New Listings:

In February 2024, 2,112 new listings entered the market, further enriching the inventory and offering fresh opportunities for prospective buyers.

5. Sale to List Ratio:

The median sale to list ratio as of January 31, 2024, stood at 0.991. This ratio indicates that, on average, homes in Charlotte sell for just under their list price, highlighting the competitiveness of the market.

6. Median Sale and List Prices:

The median sale price in the Charlotte area was $343,833, while the median list price as of February 29, 2024, was $381,167. These figures provide insight into the prevailing price trends within the market.

7. Sales Performance:

In January 2024, 26.9% of sales in Charlotte were conducted over list price, while 55.6% were completed under list price. These statistics reflect the varied dynamics of negotiations and pricing strategies employed by buyers and sellers.

Are Home Prices Dropping in Charlotte?

As of the latest data available, there are no indications of home prices dropping in the Charlotte area. On the contrary, the market has experienced steady appreciation in property values over the past year. While fluctuations may occur in specific neighborhoods or segments of the market, overall trends point to continued stability and potential for further growth.

Will the Charlotte Housing Market Crash?

While predictions about market crashes are inherently speculative, current indicators suggest that Charlotte's housing market is unlikely to experience a sudden crash. The region benefits from a diverse economy, strong job growth, and steady population influx, which underpin the stability of the real estate market. However, it's essential to monitor factors such as economic conditions, interest rates, and regulatory changes, as they can influence market dynamics over time.

Is Now a Good Time to Buy a House in Charlotte?

For prospective buyers considering a purchase in Charlotte, now presents both opportunities and challenges. While the market favors sellers, historically low mortgage rates as compared to last year and the potential for property appreciation make it an attractive time to buy. However, buyers should be prepared to act swiftly, conduct thorough research, and work closely with a knowledgeable real estate agent to navigate the competitive landscape effectively. Ultimately, the decision to buy a house should align with individual financial goals, lifestyle preferences, and long-term plans.

Charlotte Real Estate Investment Overview

Charlotte is a bustling city in North Carolina, known for its thriving economy, rich culture, and abundance of outdoor recreational activities. With a growing population and a strong job market, the real estate market in Charlotte is poised for steady growth in the coming years. The average home value in the Charlotte-Concord-Gastonia area is $373,206. Additionally, the 1-year market forecast predicts a 3% increase, making it a promising market for investors.

One of the top reasons to invest in Charlotte's real estate market is the city's strong job market. With a diverse range of industries and companies, including the headquarters of Bank of America and Duke Energy, Charlotte has a low unemployment rate and a growing population. This combination of factors is likely to continue to drive demand for housing in the city.

Another reason to consider investing in Charlotte's real estate is the city's attractive rental market. With a growing number of young professionals and families moving to the area, there is a strong demand for rental properties. The rental market in Charlotte is also experiencing significant growth and demand. With the influx of new residents and a strong job market, the demand for rental properties has been steadily increasing.

This has led to an increase in rental rates. One of the main factors contributing to the growth of Charlotte's rental market is the high demand for housing in the city's urban core. Many young professionals and families are seeking to live close to the city's vibrant downtown area, and are willing to pay a premium for the convenience and amenities this area offers. This has led to a surge in new apartment developments and mixed-use properties being built in and around downtown Charlotte.

Another contributing factor to the growth of Charlotte's rental market is the city's strong job market. With the presence of major employers like Bank of America, Wells Fargo, and Lowe's, many people are relocating to Charlotte for work and are looking for rental properties to live in while they establish themselves in the area.

Investing in rental properties in Charlotte can be a lucrative opportunity for real estate investors. With the city's strong job market and population growth, there is a consistent demand for rental properties. Additionally, with the high demand for urban housing, investing in properties in or near downtown Charlotte can provide a steady stream of rental income and the potential for long-term appreciation.

Charlotte also offers a relatively affordable real estate market compared to other major cities in the United States. This makes it an attractive option for investors looking to enter the market or expand their portfolio.

Finally, Charlotte has a strong and growing economy, which bodes well for the future of the real estate market. As the city continues to attract new businesses and residents, the demand for housing is likely to increase, creating opportunities for investors to capitalize on this growth.

In summary, Charlotte's real estate market offers investors a promising opportunity for long-term growth and income. With a strong job market, attractive rental market, affordable prices, and a growing economy, there are many reasons to consider investing in Charlotte's real estate market.

References:

- https://www.zillow.com/Charlotte-nc/home-values

- https://www.zillow.com/Charlotte-Concord-Gastonia-nc/home-values/

- https://www.carolinahome.com/market-data/monthly-reports

- https://www.zumper.com/blog/charlotte-metro-report/

- https://www.neighborhoodscout.com/nc/charlotte/real-estate

- https://www.realtor.com/realestateandhomes-search/Charlotte_NC/overview