The Des Moines housing market is one of the hottest in the country. Home prices have been rising steadily for the past few years, and there is no sign of that slowing down anytime soon.

There are a number of factors that are contributing to the strong housing market in Des Moines. The city is experiencing a growing economy, which is attracting new residents. Additionally, Des Moines is a relatively affordable city compared to other major metropolitan areas. This is making it an attractive option for homebuyers who are priced out of other markets.

The strong housing market is good news for homeowners in Des Moines, as it is helping to increase the value of their homes. However, it is also making it more difficult for first-time homebuyers to enter the market. The supply of homes for sale is simply not keeping up with the demand, which is driving up prices.

If you are thinking about buying a home in Des Moines, it is important to be prepared to move quickly and to offer above asking price. You may also want to consider working with a buyer's agent who can help you navigate the competitive market.

Table of Contents

Des Moines, IA Housing Market Trends in 2024

How is the Housing Market Doing Currently?

In January 2024, the housing market in Des Moines, IA, exhibited robust growth, with home prices soaring by 8.9% compared to the previous year. According to Redfin, the median price for homes stood impressively at $190,000, reflecting a thriving market. Notably, homes are selling much faster than before, with the average time on the market dropping to just 22 days, down from 39 days the previous year. Despite a slight dip in the number of homes sold, with 157 homes changing hands in January compared to 159 the year prior, the market remains active and promising.

How Competitive is the Des Moines Housing Market?

Des Moines's housing market is fiercely competitive, characterized by swift transactions and multiple offers on properties. Homes typically receive offers within a mere 21 days, showcasing the high demand and limited inventory.

It's not uncommon for homes to attract multiple offers, some even with waived contingencies, indicating the intense competition among buyers. On average, homes sell for about 2% below the listing price, further emphasizing the competitiveness of the market. Moreover, hot properties can sell for around the list price within just 5 days, underscoring the urgency in the market.

Are There Enough Homes for Sale in Des Moines to Meet Buyer Demand?

Despite the high demand, the supply of homes for sale in Des Moines appears to be constrained. With homes selling rapidly and often attracting multiple offers, it's evident that the current inventory may not be sufficient to meet the robust buyer demand. The market dynamics suggest a need for more listings to alleviate some of the pressure and provide buyers with more options to choose from.

What is the Future Market Outlook in Des Moines?

Looking ahead, the future outlook for the Des Moines housing market remains promising. With steady appreciation in home prices and continued buyer interest, the market is expected to remain buoyant. However, addressing the supply-demand imbalance will be crucial in ensuring the sustainability of this growth. As the economy continues to recover and interest rates remain favorable, Des Moines is poised for further expansion and development in its real estate sector.

In recent months, Des Moines has witnessed interesting migration and relocation trends. While 29% of homebuyers expressed interest in moving out of Des Moines, a majority of 71% aimed to stay within the metropolitan area, indicating a strong attachment to the region. Additionally, data reveals that a small percentage of homebuyers from across the nation are considering relocating to Des Moines. Among them, Chicago homebuyers show the highest interest in moving to Des Moines, followed by those from Seattle and Los Angeles, highlighting the city's appeal as a destination for newcomers in search of a vibrant community and promising opportunities.

Des Moines, IA Housing Market Forecast for 2024 and 2025

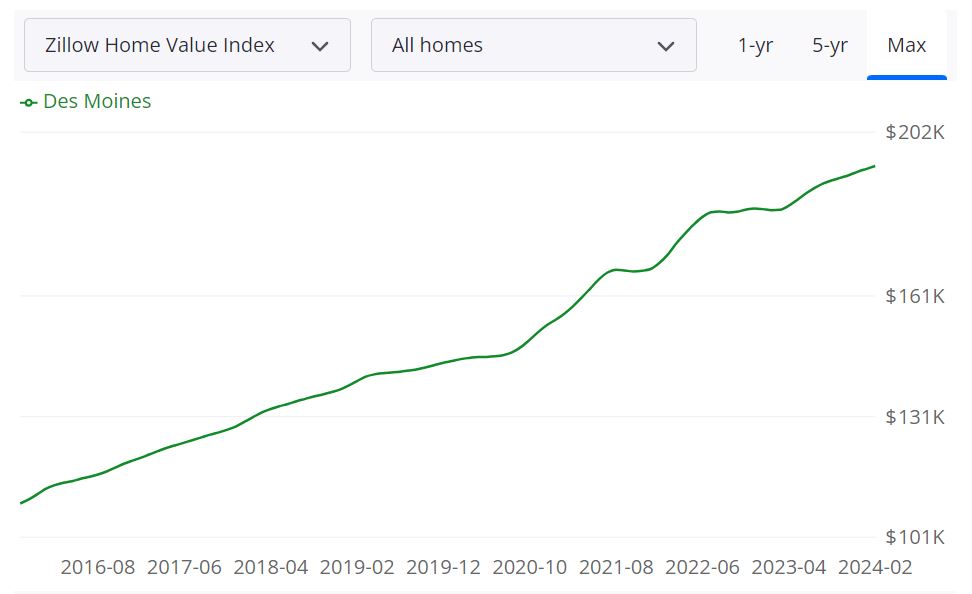

The Des Moines housing market presents an intriguing picture, with various metrics indicating its current state and future trajectory. According to Zillow, the average home value in Des Moines stands at $193,698, marking a 6.0% increase over the past year.

Homes in the area typically go pending in approximately 22 days, underscoring the rapid pace of transactions in the market. Diving deeper into the numbers, the inventory for sale as of February 29, 2024, tallies 543 properties, with 168 new listings hitting the market during the same period.

Explaining Key Housing Metrics

- Median Sale Price: As of January 31, 2024, the median sale price in Des Moines reached $195,667, reflecting the typical price point for homes in the area.

- Median List Price: Concurrently, the median list price as of February 29, 2024, stands at $221,633, showcasing the asking prices set by sellers in the market.

- Sale to List Ratio: With a median sale to list ratio of 0.989 as of January 31, 2024, homes in Des Moines typically sell close to their listed prices.

- Percent of Sales Over/Under List Price: Notably, 21.9% of sales in Des Moines as of January 31, 2024, were above list price, while 57.7% were below list price, indicating variance in transaction values.

Zooming out to the broader Des Moines Metropolitan Statistical Area (MSA), the housing market forecast hints at a positive trajectory. Based on data projections, the MSA, comprising Des Moines and its surrounding counties, including Polk, Dallas, and Warren, among others, is anticipated to experience steady growth.

This forecast, stretching from February 29, 2024, to January 31, 2025, suggests a 0.3% increase by April 30, 2024, followed by a more robust uptick of 2.5% by January 31, 2025.

The Des Moines Metropolitan Statistical Area (MSA) encompasses a cluster of counties in Iowa, serving as a vital economic and cultural hub for the region. In addition to Des Moines, the MSA includes counties such as Polk, Dallas, Warren, and others, collectively contributing to its sizeable housing market.

This designation offers insights into the interconnected nature of real estate dynamics within the broader geographical context, highlighting the economic and demographic factors influencing housing trends.

Is Des Moines a Buyer's or Seller's Housing Market?

Currently, the Des Moines housing market leans more towards being a seller's market. This is evident from the low inventory levels and the relatively quick pace at which homes are selling, with properties typically spending just 22 days on the market. In such market conditions, sellers hold a stronger position due to the limited supply of homes compared to the high demand from potential buyers.

Are Home Prices Dropping in Des Moines?

Contrary to a drop in home prices, the data indicates a steady increase in median sale prices over the past year. As of January 31, 2024, the median sale price in Des Moines stood at $195,667, marking a 6.0% increase over the previous year. This trend suggests a resilient market with price appreciation rather than depreciation.

Will the Des Moines Housing Market Crash?

While no market is immune to fluctuations, there are currently no indications of an imminent housing market crash in Des Moines. The stable price growth and moderate increases in key metrics like median sale prices and inventory levels point towards a healthy and sustainable market. However, it's essential to monitor economic factors and market dynamics to anticipate any potential shifts.

Is Now a Good Time to Buy a House in Des Moines?

For prospective buyers, the current conditions in the Des Moines housing market present both opportunities and challenges. While the market may favor sellers due to limited inventory, historically low mortgage rates and steady price appreciation could make it an advantageous time to enter the market. However, individual circumstances and financial considerations should always be taken into account when making the decision to buy a house.

Should You Invest in the Des Moines Real Estate Market?

Population Growth and Trends

Investors contemplating the Des Moines real estate market should carefully examine various factors, starting with population growth and trends.

- Steady Population Growth: Des Moines has been experiencing consistent population growth, with approximately 663,381 residents in 2022. This upward trend is a positive sign for real estate investors as it indicates a growing demand for housing.

- Diverse Demographics: The city attracts a diverse range of residents, contributing to a dynamic real estate market. A mix of demographics can create opportunities in various property types, from family homes to apartments.

Economy and Jobs

The local economy and job market play a vital role in determining the attractiveness of a real estate market for investors.

- Strong Economy: Des Moines boasts a robust and diversified economy, with sectors such as insurance, finance, healthcare, and technology contributing to its economic stability. This diversity can provide stability to the real estate market, even during economic fluctuations.

- Job Opportunities: A healthy job market is crucial for attracting residents and tenants. Des Moines has low unemployment rates and continues to create jobs, making it an appealing destination for those seeking employment.

Livability and Other Factors

The overall livability of a city and additional factors can significantly impact the real estate market's appeal to investors.

- Livability: Des Moines is known for its high quality of life, with affordable housing, excellent schools, and a vibrant cultural scene. A city's livability can drive demand for real estate, making it an attractive investment location.

- Tax Benefits: Iowa offers various tax incentives for homeowners and investors, which can positively impact your financial returns from real estate investments.

Rental Property Market Size and Growth

Investors interested in rental properties should assess the size and growth of the rental market.

- Rental Demand: Des Moines has a consistent demand for rental properties, with a mix of students, young professionals, and families seeking rental units. Understanding the specific rental demographics can help you target your investment strategy.

- Rental Income Potential: The city's rental market can provide attractive income opportunities, especially in neighborhoods with strong rental demand.

Other Factors Related to Real Estate Investing

Investing in real estate involves various considerations beyond the local market. These include:

- Market Research: Conduct thorough research on property prices, historical trends, and market conditions in Des Moines. This data will help you make informed investment decisions.

- Property Management: Decide whether you will manage properties yourself or hire a property management company. Property management can impact your investment's success and your peace of mind.

- Risk Mitigation: Diversify your real estate investments to spread risk. Consider various property types, such as residential, commercial, or multifamily, to balance your portfolio.

References:

- https://www.zillow.com/DesMoines-ia/home-values

- https://www.redfin.com/city/4570/WA/Des-Moines/housing-market

- https://www.realtor.com/realestateandhomes-search/Des-Moines_IA/overview