The Harrisburg housing market, like many across the nation, has experienced a whirlwind of change in recent years. At present, the Harrisburg housing market leans decidedly in favor of sellers, owing to the combination of robust demand, limited inventory, and competitive bidding dynamics. Sellers enjoy the upper hand, commanding strong offers and swift sales, often at or above the listed price.

Conversely, buyers face stiff competition and must act decisively to secure their desired property in a market characterized by multiple offers and fast-paced transactions. Let's dive into more details.

Harrisburg Housing Market Trends in 2024

How is the Housing Market Doing Currently?

In February 2024, the Harrisburg housing market showcased remarkable resilience and vigor, with home prices soaring by an impressive 40.8% compared to the previous year. According to Redfin, this surge catapulted the median price of homes to $190K. However, this robust growth was accompanied by a slight elongation in the time homes spend on the market, with properties selling after an average of 14 days, as opposed to just 9 days the year before. Despite this, the market remained highly competitive, with homes flying off the shelves in a mere 13 days, on average.

How Competitive is the Harrisburg Housing Market?

Harrisburg's housing market is undeniably competitive, as evidenced by several key indicators. Firstly, the median sale price in Harrisburg stands at a striking 53% lower than the national average, making it an attractive destination for prospective buyers seeking affordability without compromising on quality.

Moreover, the brisk pace of home sales, with properties typically spending just 13 days on the market, underscores the fierce competition among buyers vying for limited inventory.

Additionally, the prevalence of multiple offers, often accompanied by waived contingencies, further illustrates the intense competition in the market. This heightened demand has also translated into homes selling for approximately 2% below list price, a testament to the bargaining power wielded by eager buyers.

Furthermore, in the case of particularly sought-after properties, bidding wars can ensue, driving sale prices up by approximately 3% above the listed price, with these homes going pending in a mere 3 days.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the robust demand from buyers, the supply of homes in Harrisburg appears to be somewhat constrained. The number of homes sold in February 2024 dipped slightly to 56, down from 59 the previous year. This decline in sales volume could be indicative of a shortage of available inventory, which, in turn, contributes to the heightened competition observed in the market.

Moreover, the data suggests a year-over-year decrease in the percentage of homes sold above the list price, dropping by 7.1 percentage points to 26.8%. This decline could be attributed to the limited supply of homes unable to keep up with escalating buyer demand.

What is the Future Market Outlook for Harrisburg?

Looking ahead, the future outlook for the Harrisburg housing market appears promising yet nuanced. While the current market conditions favor sellers, with homes selling swiftly and often at or above the listed price, potential challenges loom on the horizon. The sustained growth in home prices, coupled with a slight lengthening of the sales cycle, could indicate a gradual normalization of the market. Moreover, the migration and relocation trends suggest a notable proportion of homebuyers exploring opportunities outside of Harrisburg, which could impact future demand dynamics.

- Consider the diverse neighborhoods within Harrisburg, each with its own unique character and price point.

- Research interest rates and factor them into your budget calculations.

- Partner with a qualified realtor who understands the intricacies of the local market.

If you're thinking of investing in real estate, Harrisburg is a great option. The housing market is strong, and there's a lot of potential for growth. With its low cost of living and proximity to major cities like Philadelphia and Baltimore, Harrisburg is a great place to live, work, and invest.

Popular Neighborhoods

Some of the most popular neighborhoods in Harrisburg include East Harrisburg, Allison Hill, and South Allison Hill. These neighborhoods are all close to the city center and offer a variety of amenities, such as parks, schools, and shopping. They're also home to a mix of housing types, from single-family homes to apartments, so there's something for everyone.

Harrisburg Housing Market Forecast 2024 and 2025

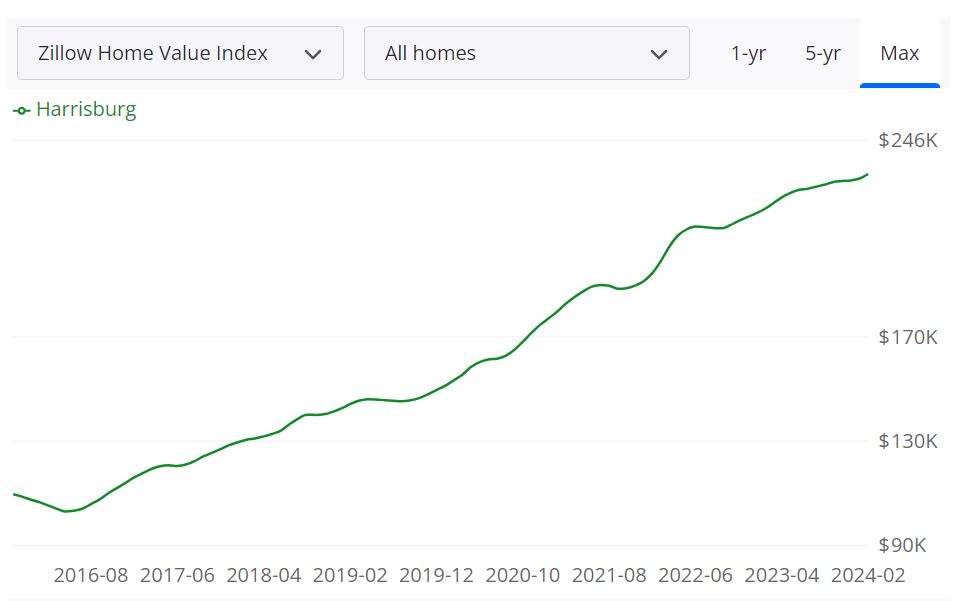

The Harrisburg housing market continues to display resilience and growth, reflecting a robust demand for residential properties. According to Zillow, the average home value in Harrisburg stands at $233,228, marking a solid 6.1% increase over the past year. Remarkably, properties in Harrisburg typically go pending within approximately 9 days, underscoring the market's brisk pace.

Key Metrics

- For Sale Inventory (February 29, 2024): With 288 properties listed for sale, Harrisburg offers a diverse array of housing options to prospective buyers.

- New Listings (February 29, 2024): The market saw 122 fresh listings, indicating ongoing activity and a steady influx of properties.

- Median Sale to List Ratio (January 31, 2024): Reflecting strong seller confidence, the median sale price compared to the list price is 1.000.

- Median Sale Price (January 31, 2024): The median sale price in Harrisburg is $202,333, offering a snapshot of the prevailing property values in the area.

- Median List Price (February 29, 2024): At $196,267, the median list price represents the average asking price for homes in the market.

- Percent of Sales Over/Under List Price (January 31, 2024): 39.4% of sales surpass the list price, while 39.9% fall below it, indicating a balanced negotiation landscape.

Harrisburg MSA Housing Market Forecast

The Harrisburg Metropolitan Statistical Area (MSA) encompasses various counties, including Dauphin, Cumberland, and Perry. This geographical region forms a vital component of Pennsylvania's real estate landscape, attracting homebuyers and investors alike. The MSA's housing market forecast reveals a positive trajectory, with projected growth rates of 0.5% by March 31, 2024, 1.2% by May 31, 2024, and 1.1% by February 28, 2025. This forecast underscores the region's stability and attractiveness for prospective homeowners and real estate developers.

Are Home Prices Dropping in Harrisburg?

As of the latest data available, there is no indication of home prices dropping in the Harrisburg housing market. On the contrary, home values have experienced a steady increase over the past year, with the average home value rising by 6.1%. This upward trajectory suggests sustained demand and market stability, mitigating the likelihood of a significant decline in prices in the near future.

Remember: national trends may not reflect local realities. Stay informed about Harrisburg market developments.

Will the Harrisburg Housing Market Crash?

While predictions about market crashes are inherently uncertain, the Harrisburg housing market currently shows no signs of imminent collapse. The market's resilience, evidenced by consistent demand, healthy price appreciation, and manageable inventory levels, indicates a stable and sustainable environment. However, it's essential to monitor economic indicators, interest rate fluctuations, and external factors that could influence market dynamics.

Bottom line: focus on your individual financial situation and long-term goals, not fearing a crash.

Is Now a Good Time to Buy a House in Harrisburg?

For individuals considering purchasing a home in Harrisburg, the current conditions present both opportunities and challenges. While it is undeniably a competitive market, characterized by limited inventory and potential bidding wars, low mortgage rates as compared to last year enhance affordability and increase purchasing power. Additionally, the region's projected growth and stable market outlook suggest that investing in homeownership could yield favorable returns over time. Ultimately, the decision to buy a house should be based on individual circumstances, financial readiness, and long-term objectives.

Should You Invest in the Harrisburg Real Estate Market?

1. Population Growth and Trends

The population growth in Harrisburg is a key factor contributing to the attractiveness of its real estate market. As of recent data, the city has experienced a steady increase in population, signaling a growing demand for housing. This upward trend is often indicative of a thriving community and a favorable environment for real estate investment.

2. Economy and Jobs

The strong local economy and employment opportunities in Harrisburg further enhance its real estate investment appeal. With major employers such as Hersheypark, The Pennsylvania State University, and Harrisburg University of Science and Technology, the city provides a stable job market, attracting residents and potential tenants. A robust economy typically translates to increased housing demand, making it an advantageous location for real estate investors.

3. Livability and Other Factors

- Harrisburg offers a four-season climate, making it appealing to a diverse range of residents.

- The city is located in a beautiful area with easy access to the mountains and the Susquehanna River.

- Harrisburg is home to parks, trails, and rivers, providing recreational opportunities for residents.

- Historical attractions such as the Pennsylvania State Capitol and the National Civil War Museum add to the city's cultural appeal.

These factors collectively contribute to the overall livability of Harrisburg, making it an enticing location for real estate investment.

4. Rental Property Market Size and Growth

The rental property market in Harrisburg is significant, and its growth potential adds to the investment allure. With 47.5% of sales over list price and 32.1% of sales under list price as of October 31, 2023, the market dynamics indicate opportunities for investors. The median sale to list ratio of 1.000 emphasizes the competitiveness of the rental market, ensuring a potentially lucrative venture for real estate investors.

5. Other Factors Related to Real Estate Investing

- The Harrisburg job market is growing, providing a stable tenant base for rental properties.

- The city is home to colleges and universities, attracting students and faculty in need of housing.

- Harrisburg's affordability compared to the national average makes it an appealing destination for first-time homebuyers and renters alike.

- The proximity to major cities like Philadelphia and Baltimore enhances the city's connectivity and attractiveness for potential residents.

Considering these factors, investing in the Harrisburg real estate market appears to be a promising opportunity with growth potential and a range of appealing dynamics for investors.

References:

- https://www.redfin.com/city/8380/PA/Harrisburg/housing-market

- https://www.realtor.com/realestateandhomes-search/Harrisburg_PA/overview

- https://www.zillow.com/home-values/11817/harrisburg-pa/