Given the intense competition and high demand, the current housing market in Irvine predominantly favors sellers. With homes selling quickly and often above the asking price, sellers have the upper hand in negotiations. However, this doesn't mean that buyers are at a disadvantage. With proper preparation and guidance from real estate professionals, buyers can still find opportunities in Irvine's vibrant market.

There are still some factors that are supporting the Irvine housing market. The city is home to a number of tech companies, including Google, Broadcom, and Amazon. This strong job market is attracting a lot of new residents to the area, which is driving up demand for housing.

Additionally, Irvine is a very desirable place to live, with excellent schools, safe neighborhoods, and a variety of amenities. This makes it a tough market for buyers, but it also means that home prices are likely to remain high in the long term.

Irvine, California is overshadowed by Los Angeles located forty miles to the northwest. It is, however, a suburb of that rapidly expanding housing market and a niche housing market in its own right. Irvine, California is a one-hour drive from Los Angeles if the highways aren’t snarled with cars. The Irvine housing market is certainly part of the L.A. metro area, though many residents tend to work in Orange County.

The city of Irvine is home to around three hundred thousand people. We won’t say that cities like Anaheim are suburbs of Irvine since they’re as large (or larger) as Irvine itself. These LA suburbs have seen significant growth as people move out of the overpriced and often dangerous LA area while trying to maintain quality of life and proximity to high-paying jobs.

Irvine Housing Market Trends in 2024

According to Redfin, in February 2024, Irvine witnessed a remarkable surge in home prices, up 14.5% compared to the previous year, boasting a median price of $1.5 million. What's more intriguing is the pace at which homes are snatched off the market; homes in Irvine are typically sold within a mere 25 days, significantly shorter than the national average.

Irvine Current Market Dynamics

Irvine stands out as a fiercely competitive market, with homes often receiving multiple offers, some even with waived contingencies. The average home sells for approximately 2% above the list price, a trend indicating the strong demand in the region. Moreover, hot homes can command prices up to 5% above the list price, illustrating the intense competition among buyers.

One of the metrics reflecting the market's competitiveness is the sale-to-list price ratio, which stands at 102.1%, marking a 3.5 percentage point increase year-over-year. Additionally, 51.9% of homes are sold above the list price, showcasing a significant 28.4 percentage point surge compared to the previous year. Conversely, the percentage of homes with price drops has decreased slightly, standing at 9.7%, down by 0.61 percentage points year-over-year.

Irvine Housing Market Competitiveness and Demand

Despite the surge in home prices, Irvine remains an attractive destination for homebuyers. In fact, 20% of homebuyers in the recent quarter expressed interest in moving out of Irvine, while the majority, 80%, aimed to stay within the metropolitan area. However, Irvine continues to attract interest from outside metros, with 5% of homebuyers considering relocating from other parts of the country.

Notably, homebuyers from San Francisco show the highest interest in moving into Irvine, followed closely by those from New York and Seattle. This influx of potential buyers underscores the desirability of Irvine's real estate market and its appeal to a diverse range of individuals.

Looking ahead, the future market outlook for Irvine appears promising. The sustained demand for housing, coupled with limited inventory, is likely to keep the market competitive in the foreseeable future. However, factors such as economic conditions and interest rates may influence the pace of growth and market dynamics.

Irvine Real Estate Market Forecast 2024 and 2025

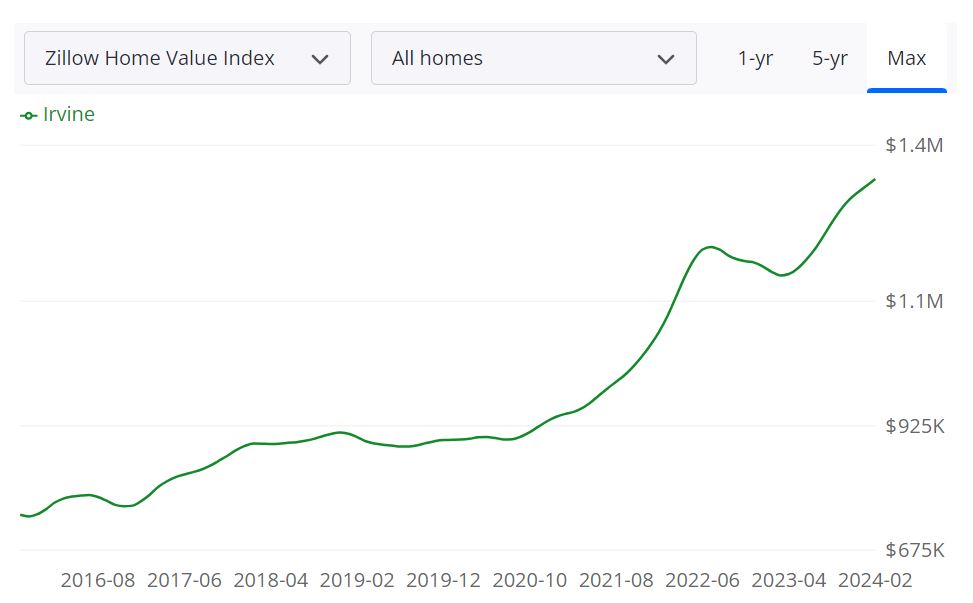

Irvine is a master-planned city in Orange County, California, the United States in the Los Angeles metropolitan area. According to Zillow, the average home value in Irvine stands at $1,421,458, reflecting a 15.1% increase over the past year. Homes in Irvine tend to go pending swiftly, typically within 13 days, indicating a competitive market.

Housing Metrics Explained

1. For Sale Inventory: As of February 29, 2024, Irvine had 257 properties listed for sale, providing potential buyers with a range of options to consider.

2. New Listings: On February 29, 2024, there were 140 new listings added to the Irvine housing market, showcasing ongoing activity and interest in the area.

3. Median Sale to List Ratio: The median sale to list ratio, recorded as 1.000 as of January 31, 2024, indicates that, on average, homes in Irvine are selling for their listed price.

4. Median Sale Price: The median sale price of homes in Irvine was $1,397,500 as of January 31, 2024, offering insight into the affordability and value of properties in the area.

5. Median List Price: As of February 29, 2024, the median list price for homes in Irvine stood at $1,478,000, providing a benchmark for sellers and buyers alike.

6. Percent of Sales Over List Price: 42.8% of sales in Irvine were recorded as being over the list price as of January 31, 2024, indicating a competitive market where buyers may need to offer more than the listed price to secure a property.

7. Percent of Sales Under List Price: Conversely, 41.7% of sales in Irvine were under the list price as of January 31, 2024, suggesting that negotiation opportunities may exist for prospective buyers.

The meticulous analysis of these housing metrics not only provides valuable insights into the current state of the Irvine housing market but also aids in forecasting future trends. Understanding these metrics can ensure informed decision-making for both buyers and sellers, tailored to their specific needs and preferences.

Are Home Prices Dropping in Irvine?

Despite fluctuations in the real estate market, data from Zillow indicates that home prices in Irvine have been on an upward trajectory, experiencing a 15.1% increase over the past year. This suggests that, at present, home prices are not dropping but rather continuing to rise, reflecting the ongoing demand and competition within the market.

The current state of the Irvine housing market suggests that it leans more towards being a seller's market. With low inventory levels, high demand, and a significant percentage of sales going over the list price, sellers hold a considerable advantage. Buyers may find themselves competing with others for desirable properties, potentially leading to bidding wars and higher sale prices.

Will the Irvine Housing Market Crash?

While predicting market crashes with certainty is challenging, the current indicators in the Irvine housing market do not point towards an imminent crash. The robust demand, limited inventory, and steady price appreciation suggest a market that is stable and resilient. However, as with any market, external factors such as economic conditions and policy changes can influence its trajectory in the future.

Is Now a Good Time to Buy a House in Irvine?

Whether now is a good time to buy a house depends on various factors, including individual circumstances and long-term goals. While the Irvine housing market favors sellers, opportunities still exist for buyers, especially those who are prepared to act swiftly and competitively. Additionally, low mortgage rates may make homeownership more affordable for some. Ultimately, prospective buyers should carefully evaluate their financial situation, market conditions, and personal preferences before making a decision.

Looking ahead, several considerations might influence the Irvine real estate market:

- Economic Indicators: Keep an eye on broader economic indicators such as employment rates, GDP growth, and interest rates. These factors play a crucial role in shaping housing demand and affordability.

- Supply Levels: The balance between supply and demand will be a significant determinant of future market trends. If housing inventory increases, it could ease the competitive environment and potentially impact the frequency of sales over list price.

- Local Developments: Irvine's real estate market could be influenced by ongoing local developments, infrastructure projects, and changes in the business landscape. These can impact the desirability of the area and subsequently affect property values.

- Interest Rates: Changes in mortgage interest rates can influence affordability and thus impact both buying and selling activity.

Irvine Real Estate Investment Overview

Now that you know where Irvine is, you probably want to know why we’re recommending it to real estate investors. Investing in real estate is touted as a great way to become wealthy. Should you invest in Irvine real estate? Many real estate investors have asked themselves if buying rental property in Irvine is a good investment? You need to drill deeper into local trends if you want to know what the market holds for the year ahead.

We have already discussed the Irvine housing market forecast for answers on why to put resources into this market. Regulatory restrictions on top of environmental regulations make it incredibly difficult to develop open land. It also drives up the cost of redevelopment, such as when you tear down a small home on a large lot to build anything from a modern 2600-square-foot home to a duplex. This slows down construction and redevelopment in the Irvine housing market and limits supply overall.

That’s aside from local and state regulations that drive up the cost of labor and materials. Conversely, it ensures significant appreciation of any Irvine real estate investment property. Although, this article alone is not a comprehensive source to make a final investment decision for Irvine we have collected ten evidence-based positive things for those who are keen to invest in the Irvine properties. Investing in Irvine properties will fetch you good returns in the long term as the home prices in Irvine have been trending up year-over-year.

Irvine Real Estate Appreciation

If you're a home buyer or a real estate investor, Irvine has unquestionably been one of the best long-term real estate investments in the country over the last decade. According to Neigborhoodscout, Irvine has had some of the highest home appreciation rates of any community in the country over the last decade.

Irvine real estate has appreciated by 96.64 percent over the last decade, which equates to an annual appreciation rate of 7.00 percent on average, placing Irvine in the top 30% of all cities for real estate appreciation. Irvine's appreciation rate over the last twelve months has been 7.84 percent.

While real estate’s mantra can be summarized as “location”, the Irvine real estate market is defined by it. Home prices in the Irvine housing market are certain to go up because the city is entirely built out. And they can’t build up into the regional and state parks directly east of the city. Nor can they spread west, since cities like Corona Del Mar and the Crystal Cove State Park hem it in on the western edge.

Everything to the north and south is built out. That means that the only way one could increase housing stock is to tear down existing stock and build taller, denser, or both. Conversely, people are willing to pay a premium to live in the Irvine area given the wealth of dedicated greenspace.

Some of the best neighborhoods in or around Irvine, California are Northwood, Woodbridge, Westpark, Tustin, Tustin Legacy, Woodbury, Laguna Altura, Cypress Village, Turtle Rock, Pavilion Park, and Stonegate. Shady Canyon has a median listing home price of $7.6M, making it the most expensive neighborhood. Oak Creek is the most affordable neighborhood, with a median listing home price of $718.9K.

Here are some of the best neighborhoods to invest in Irvine real estate because they have the highest appreciation rates since 2000 (List by Neigborhoodscout.com).

- Hidden Canyon

- Parasol Park

- Solano At Altair / Celestial At Altair

- Oak Creek West

- Terrace

- Turtle Rock West

- University Park

- Foothill Ranch

- Irvine Spectrum / Irvine Medical and Science Complex

- Westpark South

The Job Market

Orange County is Southern California’s tightest job market. Unemployment is less than 3 percent, and many of them are good-paying professional jobs. That’s one reason why many choose to live in Irvine. Given the horrors of regional traffic, anyone working at UC Irvine, Verizon, Irvine Company, or Broadcom typically chooses to live here so they aren’t commuting three hours a day to these good-paying jobs.

Irvine Rental Prices Are Rising

In Irvine, 50% of households are occupied by renters. It is easy to find a cheap apartment in a place no one wants to live, though the reasons why demand is low could range from abundant gunfire at night to a lack of jobs and people in the area. The Irvine housing market sits at a sweet spot. The City of Irvine consists of 8 zip codes and is often designated as one of the safest cities to live in. It has reasonable rental rates compared to expensive California coastal real estate prices, and it has a high quality of life rating.

This isn’t a matter of opinion. It was determined by WalletHub. That’s why the Irvine real estate market came in eleventh on the Wallethub ratings, the best city in California according to their metrics. Sometimes a housing market can only be gauged by the competition. For example, the 2,500 monthly rental rate in the Irvine housing market sounds insane to those used to 1000 a month rents in the heartland. Yet this is only a few hundred dollars more a month than a renter would pay in neighboring Anaheim.

The more accurate comparison is the Irvine real estate market relative to Newport Beach directly to the west. Renting in Irvine is several hundred dollars cheaper a month than Newport Beach and other towns sitting on the Pacific shore, yet you’re just as close to major employers. Rent control hurts renters entering a market because those in the rent-controlled market have a major incentive not to move. This results in older singles and couples staying in the apartment in which they raised their children.

The same thing is found in California due to Proposition 13. Many retirees and childless middle-aged couples can’t afford to move until they can no longer stay in their home, since they’d pay higher property taxes on a smaller condo or two-bedroom home than they pay in their grandfathered four-bedroom suburban house. That drives up both rental rates and property prices in the Irvine real estate market.

Proposition 10 prevented rent control from being imposed on single-family homes and apartments built after 1995. The vote to repeal Prop 10 was one of the most expensive legislative battles in California history, but the statewide rent cap went into effect in September 2019. Now rental rate increases are capped. You may find deals on Irvine real estate investment properties by those who just want to get out before their hands are tied or their profit margins eroded. This parallels the potential opportunities created by Oregon’s statewide rent control law. People afraid they’ll lose money become eager to sell.

The Relatively Friendly Environment for Landlords

California is tenant-friendly. However, local jurisdictions range from outright hostile to property owners to lukewarm. We’ll say that the Irving real estate market is one of the least hostile to property owners. For example, Orange County had fewer restrictions on why you could evict a tenant. They had the 30/60 day notice to quit rules or the minimum the state required at the time. There was less risk of squatters ruining an Irvine real estate investment property and being protected by the courts than you would with a Los Angeles real estate property.

The Large Student Market For Investors

Student markets always present an excellent opportunity for real estate investors. The student market is almost immune to inflation. The value of the property is almost directly proportional to its proximity to campus. And in the case of the Irvine real estate market, potential student renters are competing with locals for limited rental spots.

The robust rental market gives an Irvine real estate investment property extra value since the demand for the rental isn’t tied directly to the rise and fall of one particular school. Conversely, UC Irvine is home to around 30,000 students. That means the demand for an Irvine real estate investment property near campus won’t fall 10 percent because they built a new dorm or two.

Buying or selling real estate, for a majority of investors, is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

Irvine’s housing market seems expensive, but that is in line with local real estate trends. The area remains stable and strong, though recent legislative trends along with ongoing regulations make this a great time to buy.

References

- https://www.car.org/marketdata/data/countysalesactivity

- https://www.zillow.com/Irvine-ca/home-values

- https://www.redfin.com/city/9361/CA/Irvine/housing-market

- https://www.realtor.com/realestateandhomes-search/Irvine_CA/overview

- https://www.neighborhoodscout.com/ca/irvine/real-estate

- https://www.latimes.com/politics/la-pol-ca-proposition-10-rent-control-20181106-story.html

- https://www.rentcafe.com/blog/renting/states-best-worst-laws-renters

- http://www.irvinestop10.com/Employers.aspx