The current state of the Nashville housing market leans towards being a seller's market, characterized by low inventory levels, high demand, and competitive bidding among buyers. With a median sale to list ratio of 0.983 and a significant percentage of sales exceeding list prices, sellers hold the advantage in negotiations.

How is the Nashville housing market doing currently?

Market Activity

According to the Greater Nashville REALTORS®, in February, Nashville witnessed a total of 2,247 closings. This comprised various property types, including residential homes, condominiums, multi-family units, and land lots. Among these, residential properties accounted for the bulk, with 1,751 closings. Condominiums followed suit with 362 closings, while multi-family units and land lots contributed 13 and 121 closings, respectively.

Median Price

One of the pivotal aspects influencing the market's health is the median price of properties. In Nashville, the median price for residential homes stood at $478,870 in February. Meanwhile, condominiums boasted a median price of $339,990. These figures shed light on the varying affordability levels across different property types within the city.

Inventory Levels

Understanding inventory dynamics is crucial for gauging market competitiveness and housing availability. During February, Nashville had a total of 8,967 properties listed on the market. Among these, residential properties constituted 5,887 units, indicating a substantial housing stock available for prospective buyers. Condominiums and land lots contributed 1,326 and 1,673 units, respectively, further diversifying the options for home seekers.

Pending Transactions and Days on Market

Another noteworthy metric is the number of pending transactions, which provides insights into future market activity. In February, Nashville recorded 2,566 pending transactions, indicating a robust pipeline of deals awaiting closure. Additionally, the average days on market stood at 59 days, suggesting a moderately quick turnover rate for properties in the current market.

Reflecting on these figures, it's evident that Nashville's housing market remains active and dynamic. The healthy inventory levels, coupled with a considerable number of pending transactions, signify sustained interest from both buyers and sellers. However, the median price discrepancies among property types underscore the importance of understanding market segments and their respective affordability ranges.

Also Read: Tennessee Real Estate Appreciation & Forecast

Is Now a Good Time to Buy a House in Nashville?

Deciding whether it's a good time to buy a house involves considering personal circumstances, financial readiness, and market conditions. In Nashville, several factors indicate that now could be a favorable time for prospective buyers.

- Abundant Inventory: With 8,967 properties listed on the market, buyers have a wide selection of homes to choose from, increasing the likelihood of finding a suitable property.

- Stable Prices: The median prices for residential homes and condominiums have remained relatively stable, offering buyers price consistency and transparency.

- Low Interest Rates: Favorable mortgage rates can enhance affordability and lower the overall cost of homeownership, making it an attractive time for buyers to secure financing.

However, individual circumstances, such as employment stability, financial readiness, and long-term housing goals, should also factor into the decision-making process.

Nashville Housing Market Forecast for 2024 and 2025

What are the Nashville real estate market predictions for 2024? Property values across Nashville and Davidson County are expected to rise over the next twelve months. We have seen people move from big towns to suburbs throughout the country. Nashville too has seen an influx of buyers coming from larger markets like Seattle, New York, and California.

Another factor in the increase in out-of-state homebuyers is that Tennessee is one of only seven states that does not impose an income tax and one of two that doesn’t collect tax on earned income. This has multiplied the demand for housing. High demand and low inventory are causing home prices in Nashville to rise rapidly.

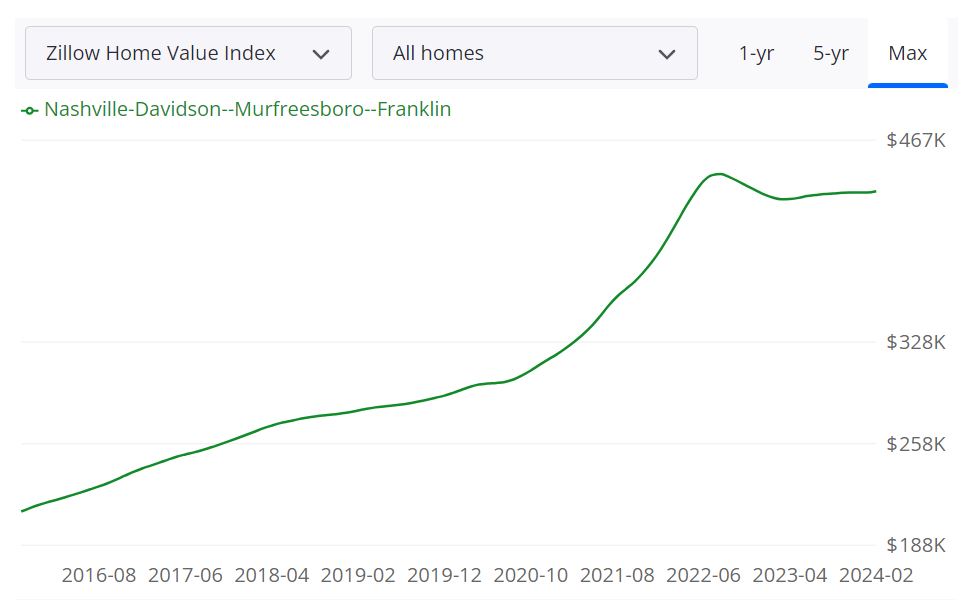

As individuals and families continue to seek homes in desirable locations, the Nashville-Davidson–Murfreesboro–Franklin metropolitan area stands out as a vibrant and sought-after housing market. According to Zillow, the average home value in this region currently stands at $432,557, marking a 1.0% increase over the past year. This growth is indicative of the market's resilience and attractiveness to potential buyers and sellers alike.

Market Forecast

Looking ahead, Zillow predicts a 1.6% increase in the Nashville housing market over the next year, offering promising prospects for both buyers and sellers. This forecast reflects the underlying strength and stability of the region's real estate landscape.

Key Metrics Explained

Understanding the various housing metrics can provide valuable insights into the dynamics of the Nashville housing market. Let's delve into each metric:

- For Sale Inventory: With 5,827 properties listed for sale as of February 29, 2024, the Nashville market offers a diverse range of options for potential buyers, catering to different preferences and budgets.

- New Listings: In February 2024, 1,562 new listings entered the market, indicating ongoing activity and expansion within the housing sector.

- Median Sale to List Ratio: The median sale to list ratio, standing at 0.983 as of January 31, 2024, highlights the competitiveness of the Nashville market, with properties often selling close to their listed prices.

- Median Sale Price: As of January 31, 2024, the median sale price for homes in Nashville was $408,333, reflecting the prevailing market conditions and buyer preferences.

- Median List Price: The median list price, recorded at $508,300 as of February 29, 2024, provides valuable insights for sellers in setting realistic and competitive listing prices.

- Percent of Sales Over List Price: In January 2024, 14.2% of sales in Nashville exceeded the listed prices, indicating strong demand and competitive bidding among buyers.

- Percent of Sales Under List Price: Conversely, 65.1% of sales in January 2024 were below the listed prices, reflecting the negotiation dynamics and varied market conditions.

Understanding the MSA and Counties

The Nashville-Davidson–Murfreesboro–Franklin metropolitan statistical area (MSA) encompasses several counties, including Davidson, Rutherford, Williamson, and others. This expansive region contributes to the robustness and diversity of the Nashville housing market, catering to a wide range of preferences and lifestyles.

With its diverse inventory, competitive pricing dynamics, and promising forecast, the Nashville housing market is significant in both scope and scale. Its appeal extends to buyers seeking urban amenities, suburban comforts, and rural retreats, making it a dynamic and desirable destination for homeownership.

Are Home Prices Dropping in Nashville?

As of the latest data available, home prices in Nashville have shown resilience, with the median sale price standing at $408,333 and the median list price at $508,300. While minor fluctuations may occur, there is no indication of a significant and sustained drop in home prices in the foreseeable future.

Will This Housing Market Crash?

While the possibility of a housing market crash cannot be entirely ruled out, the current indicators suggest stability and resilience in the Nashville market. Factors such as sustained demand, diverse inventory, and economic fundamentals contribute to mitigating the risk of a crash. However, ongoing monitoring and prudent decision-making remain essential.

Here are the ten neighborhoods in Nashville having the highest real estate appreciation rates since 2000—List by Neigborhoodscout.com.

- Maxwell Heights

- Rolling Acres / Lockeland Springs

- East Nashville

- Greenwood / Lincoln College of Technology Nashville

- Shelby Hills

- East Hill

- North Nashville

- Germantown

- Edgehill / Historic Waverly

- Fisk Meharry / Fisk University

Nashville Real Estate Investment Outlook

Is Nashville a Good Place For Real Estate Investment? Many real estate investors have asked themselves if buying a property in Nashville is a good investment. You need to drill deeper into local trends if you want to know what the market holds for real estate investors and buyers. Nashville is a minimally walkable city in Davidson County with a population of approximately 601,201 people.

Nashville, Tennessee is famous for the Grand Ole Opry, the recreation of the Parthenon, and country music. It is best known as a tourist attraction in middle America. Nashville itself is home to just over six hundred thousand people. That alone makes it the 24th most populous city in the country. If you count semi-independent parts of Davidson County, then the Nashville real estate market is home to about 700,000 people. The Nashville metropolitan area contains more than two million people.

Many of those live in Davidson and Murfreesboro. Nashville has a mixture of owner-occupied and renter-occupied housing units. According to Neighborhoodscout.com, a real estate data provider, one and two-bedroom single-family detached homes are the most common housing units in Nashville. Other types of housing that are prevalent in Nashville include large apartment complexes, duplexes, rowhouses, and homes converted to apartments.

The Nashville housing market has been good for sellers in the past years due to the rising prices, and it is considered one of the hottest housing markets in the U.S. The Nashville real estate boom began about 10 years ago and investors expect these trends to continue in 2021 and the foreseeable future, making Nashville one of the most desirable housing markets in the country.

Several long-term trends make the Nashville market a good place to invest in real estate without any fear of boom and bust like what hit Arizona during the Great Recession. In 2020, Nashville came in at No. 4 in the country for expected activity and price appreciation, in comparison to 25 large markets around the country, according to a survey published by Zillow.

Nashville was the only market analyzed in which no panelists said they expected home values to fall in 2020. The home values (nationally) were expected to grow by 2.8% in 2020. 59% of panelists expected Nashville home values to appreciate faster than their expected national rate of 2.8%. 31% of panelists expected Nashville home prices to appreciate slower than they do nationally while 10% of panelists expected them to grow about the same as they do nationally.

One of the best features of the Nashville real estate market is the median property price in the city, which is considered more affordable than most of the other top markets for investing in real estate in the U.S. As the inventory remains limited, it means that Nashville will remain among the fastest-moving housing markets in the U.S. Also, as the mortgage rates remain at record lows, it makes buying a property more affordable now than it was in previous years.

Let’s take a look at the number of positive things going on in the Nashville real estate market which can help investors who are keen to buy an investment property in this city.

1. A Strong Economy And Job Opportunities

In early 2018, a Quartz article joked that Nashville could give up the nickname Music City and be called Job City. Nashville’s claim to the title was having the lowest unemployment rate of any metropolitan area with more than a million people. Nashville real estate market demand will remain strong as long as people want to move here for work, and unlike some areas, they can find it here. The Nashville area economy includes thriving technology, service, education, health, and manufacturing sectors.

Notable job growth has occurred in the professional and business services, leisure and hospitality, manufacturing, and mining, logging, and construction sectors. Financial enterprises have also discovered the benefits of doing business in Nashville, giving abundant employment prospects to bankers, accountants, and budget analysts. While the tourism industry is thriving, white-collar jobs are expanding rapidly, too.

Almost anyone with a marketable skill can find a good-paying job in Nashville. This trend is expected to continue for at least the next 10 years, with opportunities especially robust for healthcare, IT, and design/media specialists. Average incomes on the city's west side are higher than in areas east of downtown.

2. Strong Demographic Trends In Nashville

The average age of Nashville residents is around 33, much younger than the national average of 40. This means the Nashville real estate market contains a larger than average number of young families, and given the strong job market, these adults and their children will contribute to housing demand for years to come.

3. Quality of Life in Nashville Attracts People of All Ages

Nashville was ranked the fastest-growing large metropolitan area in the United States in 2017. This is in no small part due to its high rankings in various quality-of-life surveys such as U.S. News and World Report. That publication ranked Nashville the 17th best place to live in America in 2020-2021 — giving it high marks on desirability and value.

It was also ranked 12th in its list of best places to retire and 23rd in the fastest-growing places. This means many are choosing to move here because of the quality of life whether or not they’re coming for work. Nashville is also known as the Country Music Capital of the World and it has unique museums and architecture.

Today, Nashville is a hot relocation destination with a thriving economy, continuous population growth, and a diverse, ever-growing services base. Consumers who act aggressively to break into the local real estate market should enjoy both a high quality of life and rising home values for the foreseeable future.

Demographics of the Nashville:

- College-educated: 40%

- Homeowners: 65.6%

- Married: 43%

4. Known Redevelopment Opportunities

Redevelopment can be hit and miss since you can’t be sure a waterfront area or community slated for revitalization goes up in value. One benefit of the Nashville housing market is that there are known areas of redevelopment where returns are nearly certain. The area around the future professional sports stadium comes to mind. East Nashville is gentrifying, as well.

5. A Large Student Population

The Nashville housing market presents a prime opportunity for real estate investors who would like to cater to students. This is partially due to the fact it is the capital of the state, and it is partially because it is simply the largest city in the state. Local universities include but are not limited to Tennessee State University, Lipscomb University, Belmont University, Aquinas College, Fisk University, and Vanderbilt University.

American Baptist College, Trevecca Nazarene University, Meharry College, Welch College, and Nashville State Community College are also located here. If you want to invest in the suburban Nashville housing market, Middle Tennessee State University is located in Murfreesboro. The presence of several colleges and universities, along with both private and public secondary schools, presents rich possibilities to academic professionals.

6. The Tourism-Related Rental Market

The Nashville housing market provides two different tourism-related rental markets. One is, of course, renting homes to tourists who are more likely to be families and retired couples than swinging singles. Another possibility is renting to young adults who work in the tourism industry themselves.

Just over a third of the market rents, a figure similar to the national average. This means that a sudden decline in tourism isn’t going to hurt the Nashville housing market much. The city is currently arguing over limits for AirBnB rentals for non-residents, but no restrictions on this are in place yet or in the foreseeable future.

7. Affordable Nashville Real Estate

The typical home price in Nashville is around $457,360 (Zillow). Nashville is relatively affordable compared to other major U.S. metro areas, though the housing market has become increasingly competitive. You can buy two moderately large single-family homes here for the price of a cheap condo in California, and you can buy half a dozen rental properties in the Nashville real estate market for the price of one good house in New York City. Nor will the area see a building boom that causes real estate to go down dramatically in value, since rentals had a vacancy rate of around 4% in 2016.

Some new housing stock may come onto the market, but not enough to hurt the value of existing homes. The area has seen an increase in its population, as well as a rise in home values. The Southern Suburbs submarket, which includes the cities of Murfreesboro and Franklin, is the fastest-growing submarket in Nashville Metro Area. Since Tennessee is one of the few states that doesn't tax wages, residents can keep more of their income, though there is a 6% hall tax on investment interest and dividends.

The state Legislature agreed in 2016 to start phasing out the Hall income tax, with its total elimination beginning on Jan 1, 2021. This is considered among the most important tax reforms in the history of Tennessee. From a 6 percent tax rate on investment income, the levy was to be reduced by 1 percent each year through 2020. For the year that started Jan. 1, the rate is 2 percent. Hence, Tennessee is on its way to becoming a truly no-income-tax state, to join seven other states — Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming.

8. Stability

We’ve touched on the subject of rental market stability. Nashville has high employment rates and low vacancy rates, but none of those numbers are enough to throw the market into overdrive, whether it leads to a glut of supply to meet high demand or a boom-bust cycle. The Nashville Business Journal ranked Nashville as the most stable housing market in the state in 2018. The city’s relatively slow permitting process slows down the construction of new units, keeping home prices stable and high.

9. It Is Landlord Friendly

Tennessee like much of the south is landlord-friendly. Landlords in the Nashville real estate market don’t have to have a written lease unless the rental agreement is longer than three years, though that’s always recommended. There is a limited payment grace period. Receipts aren’t required for rent and deposit payments, though again, that would be wise. Interest isn’t due on deposits. You can charge late fees but have to specify them in the lease. The only minor issue is that you have to have a rental license before you can be a landlord.

10. The Good Return on the Investment

Interestingly, the average annual salary is about $62,000 (source: Payscale.com), leading many here to rent instead of buy. According to RENTCafe, 46% of the households in Nashville, TN are renter-occupied while 53% are owner-occupied. However, the rental market isn’t so hot that it is guaranteed to collapse anytime soon. Renter household growth has outpaced the construction of rental units and the conversion of single-family homes to rental units since 2010.

That is why average rent hovers around $1,400 a month, providing decent returns to landlords who don’t over-leverage but without worrying about a condo boom to cash in on rental demand diminishing profits over the long term. Also, the fact that rents in the Nashville real estate market are almost $200 per month greater than the Tennessee average is a strong reason to buy real estate here than elsewhere in the state. And know that rental rates for large apartments and condos are even higher – commanding rents in the $1500-2000 range. About 25% of the apartments fall in this price range whereas 47% fall in the range of $1,001-$1,500.

As of March 2024, the median rent for all bedroom counts and property types in Nashville, TN is $1,950. This is -1% lower than the national average. Rent prices for all bedroom counts and property types in Nashville, TN have remained the same in the last month and have decreased by 7% in the last year.

The monthly rent for an apartment in Nashville, TN is $1,733. A 1-bedroom apartment in Nashville, TN costs about $1,655 on average, while a 2-bedroom apartment is $2,131. Houses for rent in Nashville, TN are more expensive, with an average monthly cost of $2,405.

References

Housing Market Data, Trends & Statistics

https://www.greaternashvillerealtors.org/pages/market-data-news/

https://www.zillow.com/Nashville-tn/home-values

https://www.deptofnumbers.com/rent/tennessee/nashville

https://www.redfin.com/city/13415/TN/Nashville/housing-market

https://www.realtor.com/realestateandhomes-search/Nashville_TN/overview

https://www.neighborhoodscout.com/tn/nashville/real-estate#description

https://www.msn.com/en-us/money/realestate/nashville-housing-market-trends-and-prices

https://www.tennessean.com/story/money/real-estate/2021/06/04/what-know-nashville-housing-market/5253078001/

Demographics

https://suburbanstats.org/population/tennessee/how-many-people-live-in-nashville

https://en.wikipedia.org/wiki/Nashville,_Tennessee

Landlord friendly

https://www.avail.co/education/laws/tennessee-landlord-tenant-laws

Quality of life

https://www.nashvillechamber.com

https://realestate.usnews.com/places/tennessee/nashville

Stability

https://thinkrealty.com/nashville-housing-market-room-grow

https://www.bizjournals.com/nashville/news/2018/05/23/report-card-tennessee-best-places-to-buy-a-house.html

Stadium / redevelopment

https://www.tennessean.com/story/sports/2018/09/05/nashville-mls-stadium-pro-soccer-team/1200230002/

https://www.theringer.com/features/2017/11/21/16678002/airbnb-nashville

Employment

https://qz.com/1251382/nashville-tennessee-has-the-uss-lowest-unemployment