The Stockton housing market is a vibrant and competitive arena, showcasing unique trends and factors that contribute to its dynamic nature. Given the competitive nature and limited inventory, the Stockton housing market leans towards being a seller’s market. Sellers enjoy the upper hand, commanding higher prices and witnessing swift transactions. However, this doesn’t discount the opportunities available for savvy buyers who are willing to act decisively and craft compelling offers.

Let’s delve into various aspects of the Stockton real estate landscape to gain a comprehensive understanding.

Table of Contents

Stockton Housing Market Trends 2024

How is the Housing Market Doing Currently?

As of February 2024, the Stockton housing market witnessed a slight dip of 0.9% in home prices compared to the previous year, according to Redfin. Despite this, the median price stood at a commendable $442K, showcasing the resilience of the market in the face of economic fluctuations. Homes in Stockton are selling at a faster pace, with an average of 35 days on the market, a significant improvement from 62 days last year. Moreover, the number of homes sold in February decreased slightly from 160 to 152, reflecting a subtle adjustment in buyer-seller dynamics.

How Competitive is the Stockton Housing Market?

Stockton emerges as a competitive arena for real estate transactions, with homes flying off the shelves within 29 days on average. The market is characterized by its cutthroat nature, where multiple offers are commonplace, often leading to bidding wars. It’s not uncommon for homes to fetch prices above the listing price, especially the hot properties, which can command a premium of approximately 2% and go pending in a mere 11 days. This competitive fervor is evidenced by the fact that homes sell for just 1% below the list price, indicating strong buyer interest.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the robust demand from buyers, the Stockton market grapples with a shortage of inventory. This shortage fuels the competitive environment, driving up prices and creating a sense of urgency among buyers. While the market sees a steady influx of interested buyers, the supply side struggles to keep pace, leading to a scenario where homes receive multiple offers and often sell above the listing price. As such, navigating the complexities of the Stockton housing market requires a strategic approach from both buyers and sellers.

What is the Future Market Outlook for Stockton?

Looking ahead, the future of the Stockton housing market appears promising yet nuanced. While the current trends favor sellers due to the high demand and limited inventory, factors such as economic conditions and housing policies can influence the trajectory of the market. As the city continues to evolve, it’s essential for stakeholders to stay attuned to market dynamics and adapt their strategies accordingly.

Stockton Housing Market Forecast for 2024 & 2025

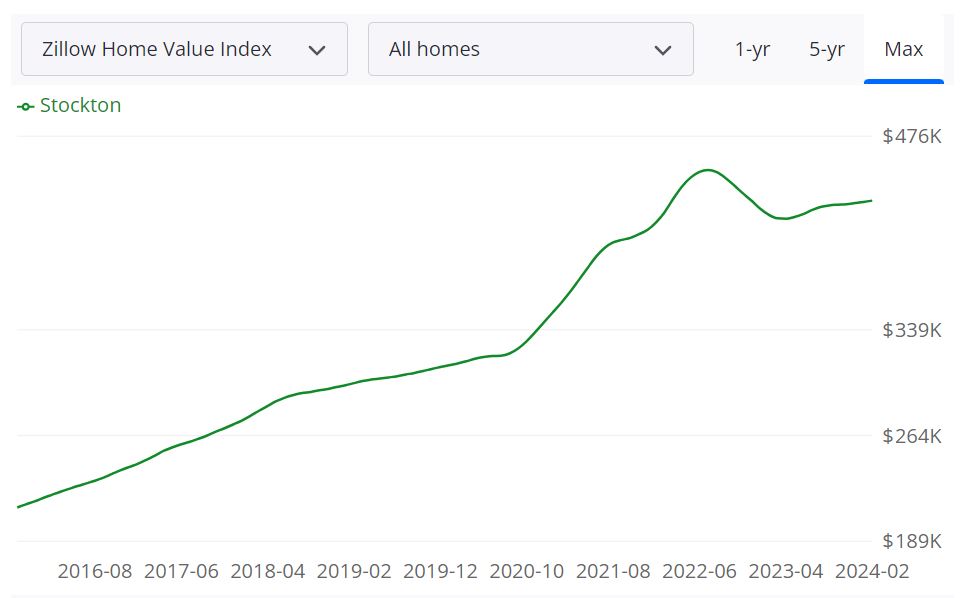

According to Zillow, the average home value in Stockton currently stands at $430,810, exhibiting a modest increase of 2.4% over the past year. Homes in Stockton typically go pending within approximately 19 days, indicating a swift turnover rate.

Housing Metrics Breakdown

Examining the housing metrics offers valuable insights into the Stockton market’s performance:

- For Sale Inventory: As of February 29, 2024, there were 417 properties listed for sale, indicating the available options for potential buyers.

- New Listings: On February 29, 2024, 148 new properties entered the market, contributing to inventory dynamics.

- Median Sale to List Ratio: As of January 31, 2024, the median sale to list ratio stood at 1.000, showcasing the relationship between listing prices and actual sale prices.

- Median Sale Price: Data from January 31, 2024, indicates a median sale price of $400,417, reflecting the average transaction value in the market.

- Median List Price: As of February 29, 2024, the median list price for homes in Stockton was $431,000, representing sellers’ pricing expectations.

- Percent of Sales Over/Under List Price: In January 31, 2024, 43.6% of sales closed above list price, while 39.2% were below list price, indicating negotiation dynamics in transactions.

Stockton MSA Housing Market Forecast

The Stockton Metropolitan Statistical Area (MSA) encompasses San Joaquin County and parts of neighboring counties. Its housing market plays a significant role in the California real estate landscape. Looking ahead, the forecast for the Stockton MSA projects a 0.4% increase by March 31, 2024, followed by a 1.1% rise by May 31, 2024, before stabilizing with a 0.3% increase by February 28, 2025.

Are Home Prices Dropping in Stockton?

Despite the fluctuations in housing markets, Stockton has shown resilience with home prices maintaining stability. While there may be minor fluctuations in certain neighborhoods or property types, overall, there hasn’t been a significant downward trend in home prices. The Zillow data suggests a modest 2.4% increase in home values over the past year, indicating a relatively stable market.

Is Now a Good Time to Buy a House in Stockton?

Deciding whether it’s the right time to buy a house in Stockton depends on individual circumstances, financial readiness, and long-term goals. Despite being a seller’s market, historically low mortgage rates and favorable financing options make it an attractive time for buyers looking to invest in property. However, prospective buyers should conduct thorough research, consider their financial situation, and consult with real estate professionals to determine if now is the opportune moment to make a purchase.

Will the Stockton Housing Market Crash?

Predicting a housing market crash requires a thorough analysis of economic indicators, lending practices, and market fundamentals. While Stockton, like any market, is susceptible to economic downturns, there are currently no indications of an imminent crash. The market’s stability, coupled with steady demand and manageable inventory levels, suggests a resilient housing market unlikely to experience a sudden crash.

Overall Market Trends:

- The Stockton housing market is still considered to be a seller’s market, which means that there are more buyers than sellers. This is good news for sellers, who can expect to sell their homes quickly and for a good price.

- However, rising interest rates are starting to cool the market, and buyers may have more negotiating power in the future.

- It is important to note that the housing market is cyclical, and the trends we are seeing now may not continue in the future.

- Stockton’s allure is evident in migration patterns, with 3% of homebuyers looking to move into the city from outside metros.

- Manhattan leads the list of metros from which people are relocating to Stockton, followed by South Bend and Ithaca.

- Additionally, 76% of Stockton homebuyers prefer to stay within the metropolitan area, with Sacramento being the most popular destination.

- On the flip side, outbound migration reveals that Sacramento, CA, Los Angeles, and San Diego are the top destinations for individuals leaving Stockton.

As individuals weigh the decision to buy or sell, staying informed about market dynamics, economic trends, and local factors remains crucial. The Stockton housing market, while exhibiting stability, is subject to various influences that can shape its trajectory in the coming months.