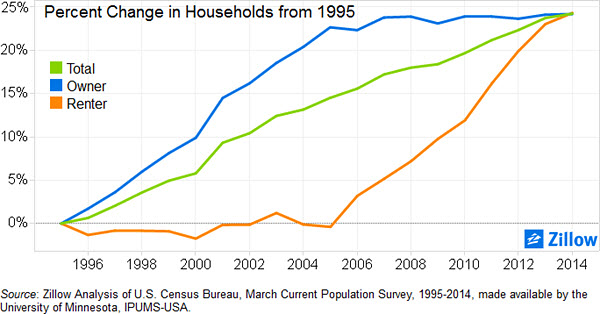

Over the past decade, almost all of the growth in America’s households has been driven by renters, especially renters of single-family residences (SFRs).

Over the past decade, almost all of the growth in America’s households has been driven by renters, especially renters of single-family residences (SFRs).

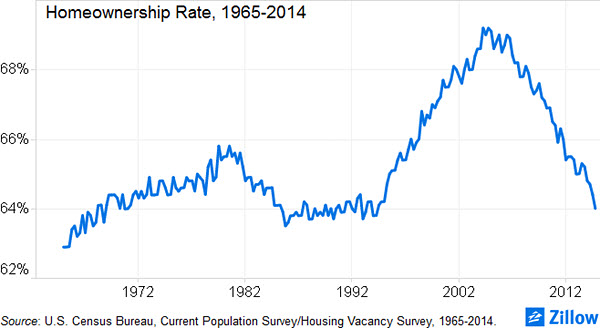

Owning the stereotypical modest home with a white picket fence was long a hallmark of the suburban society that characterized the second half of the twentieth century (at least in the popular imagination). But the foreclosure crisis triggered by the Great Recession made renters out of millions of former homeowners.

Additionally, tight credit and low for-sale inventory in many areas make buying a home today difficult for many, even as demand for the luxuries offered by a single-family residence – more space, (even a sense of) more security, a yard and access to good, suburban schools – remains robust.

As a result, SFR rentals have become an increasingly visible and viable option for millions of families nationwide.

The convergence of three trends explains much of the growing popularity of SFR rentals:

The Foreclosure Crisis. Early during the Housing Bust, foreclosures forced many former owners to become renters, often in the same homes or neighborhoods where they previously resided. This contributed to the growing number of renter households early in the recession.

Investor Activity. As prices fell in response to the rising number of foreclosure resales, investors bought many of these bargain homes with the intent of renting them. This expanded the options available to the growing population of renter households, but also constrained the supply of entry-level properties in the for-sale market.

Inventory Crisis. Potential new home buyers struggled in this competitive market characterized by low for-sale inventories, large numbers of all-cash offers, and rapidly increasing prices which made buying a home less affordable and drove potential buyers to the single-family rental market.

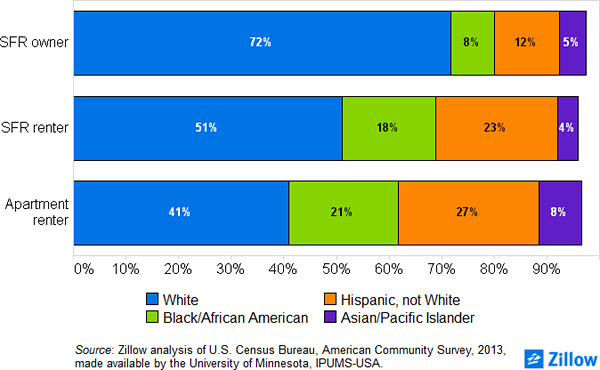

The charts below illustrate some of the trends in the SFR rental market, and compare the residents of SFR rentals with those of owner-occupied SFRs and tenants in more typical apartments. Compared to SFR owners, SFR renters tend to be younger, less-affluent families.

The homeownership rate increased sharply during the Housing Boom, but has declined steadily, reversing the prior decade's gains by late 2014.

From 1995-2005, household growth was driven by owner-occupied units. In the next decade, growth was driven by rentals.

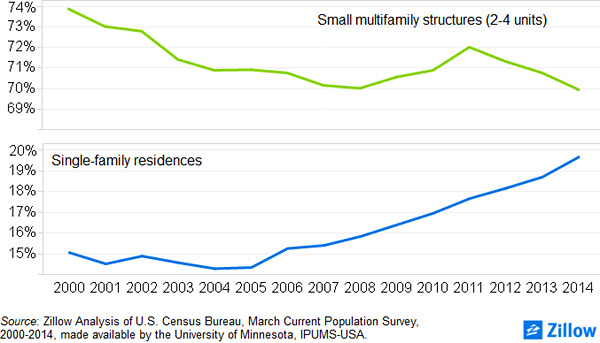

Share of occupied units that are rented.

Racial and ethnic minorities are overrepresented among SFR renters.