Currently, the Virginia Beach housing market is tilted in favor of sellers. With homes selling quickly, often above the asking price, and a high level of competition among buyers, sellers have the advantage in negotiations. However, with inventory showing signs of growth and an increase in price drops, buyers may find opportunities to negotiate favorable terms in certain cases.

Virginia Beach Housing Market Trends in 2024

How is the Housing Market Doing Currently?

As of February 2024, the Virginia Beach housing market is showing positive growth trends compared to the previous year. According to Redfin, home prices have increased by 7.5%, with the median price now standing at $355,000. This uptick in prices reflects the steady demand for homes in the area. On average, homes are staying on the market for 28 days, slightly longer than the 23-day average from the previous year. Despite this slight increase, the market remains competitive, with homes selling relatively quickly.

How Competitive is the Virginia Beach Housing Market?

In Virginia Beach, the housing market is highly competitive, with homes typically selling in 31 days. Many properties receive multiple offers, with some buyers even waiving contingencies to secure a purchase. The average selling price aligns closely with the list price, indicating a strong seller's market. Additionally, hot properties can sell for approximately 2% above the list price and go pending in as little as 13 days. These dynamics highlight the intense competition among buyers in the Virginia Beach housing market.

Are There Enough Homes for Sale to Meet Buyer Demand?

Despite the competitive nature of the market, there are signs of inventory growth. In February, 423 homes were sold, marking an increase from the 408 sold during the same period last year. However, there has also been an increase in the percentage of homes experiencing price drops, which rose by 6.0 percentage points compared to the previous year. This suggests that while inventory is increasing, some sellers may be adjusting their pricing strategies to attract buyers.

What is the Future Market Outlook for Virginia Beach?

Looking ahead, the future market outlook for Virginia Beach appears positive but with some considerations. While home prices have seen steady growth, it will be important to monitor factors such as interest rates and economic conditions that may influence buyer behavior. Additionally, the influx of out-of-state buyers searching to move into Virginia Beach indicates continued interest in the area, which could further drive demand in the coming months.

Virginia Beach Housing Market Forecast for 2024 & 2025

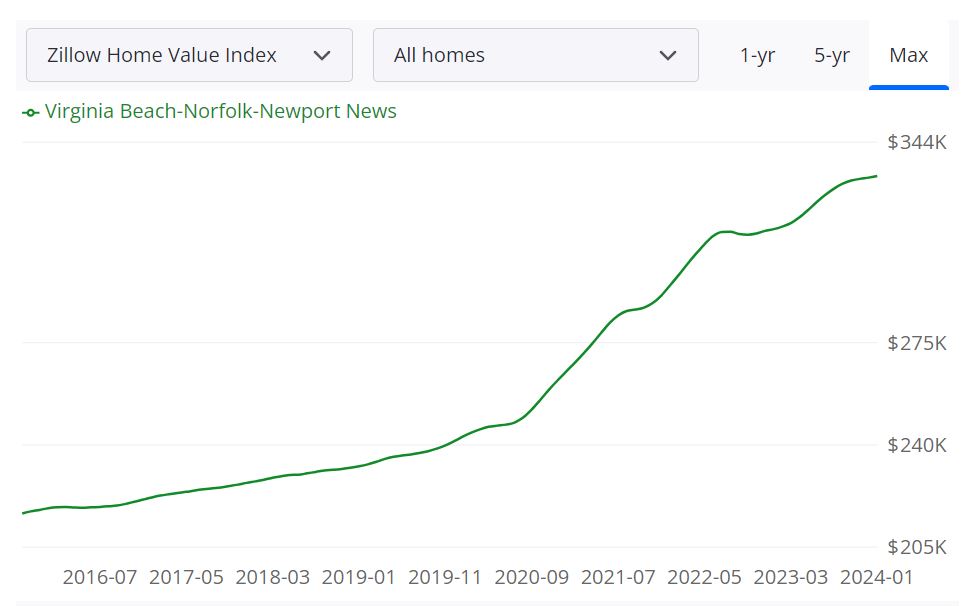

According to Zillow, the average home value in the Virginia Beach-Norfolk-Newport News area stands at $332,820, reflecting a robust 5.8% increase over the past year. Homes in this region typically go pending in approximately 32 days (Data through January 31, 2024). Let's delve into the key housing metrics to gain a deeper understanding of the market dynamics.

1-Year Market Forecast

The +3.3% 1-year market forecast, as of January 31, 2024, indicates a positive trajectory for the Virginia Beach housing market, highlighting its resilience and potential for growth.

For Sale Inventory

As of January 31, 2024, the Virginia Beach housing market boasts a 4,583 for sale inventory, showcasing a diverse range of options for potential homebuyers.

New Listings

In January 2024, 1,457 new listings were added to the Virginia Beach-Norfolk-Newport News housing market, providing fresh opportunities for those looking to enter the real estate market.

Median Sale to List Ratio

The 1.000 median sale to list ratio, as of December 31, 2023, suggests a balanced and competitive market environment, where properties are generally selling close to their list prices.

Median Sale Price

As of December 31, 2023, the median sale price in Virginia Beach stands at $306,333, reflecting the average price at which homes are sold in the area.

Median List Price

The current median list price, reported on January 31, 2024, is $336,125, providing valuable insights into the pricing trends and expectations in the market.

Percent of Sales Over/Under List Price

Examining the data from December 31, 2023, 36.9% of sales were recorded over the list price, showcasing a competitive market, while 32.7% of sales were under the list price, indicating opportunities for strategic negotiations.

Is Virginia Beach a Buyer's or Seller's Housing Market?

With a median sale to list ratio of 1.000, the market currently appears balanced, offering opportunities for both buyers and sellers. The diverse inventory of 4,583 properties for sale provides options for buyers, while the competitive pricing dynamics create opportunities for sellers. It can be considered a neutral market, providing a fair ground for transactions.

Are Home Prices Dropping in Virginia Beach?

The data suggests a steady increase in the average home value, standing at $332,820, reflecting a 5.8% year-over-year growth. As of now, there is no indication of home prices dropping. The market's resilience and the positive forecast further support the notion that home prices are maintaining an upward trajectory, offering stability to homeowners and potential appreciation for investors.

Will the Virginia Beach Housing Market Crash?

The current indicators, including the positive 1-year market forecast of +3.3%, do not suggest an imminent housing market crash in Virginia Beach. A balanced median sale to list ratio and sustained price growth indicate a stable real estate environment. However, it's crucial to monitor economic factors and external influences that could impact the market in the future.

Is Now a Good Time to Buy a House in Virginia Beach?

Considering the market's balanced nature, diverse inventory, and positive forecast, now appears to be a favorable time for prospective buyers to enter the Virginia Beach housing market. The 32 days average time for homes to go pending suggests a competitive but efficient market, providing buyers with opportunities to make well-informed decisions. It's advisable for buyers to leverage the current market conditions and explore the available options.

As with any real estate decision, individuals should conduct thorough research, consider their financial situation, and consult with real estate professionals to make informed choices in alignment with their goals and preferences.

Is Virginia Beach a Good Place to Invest in Real Estate?

Virginia Beach is a popular destination for real estate investment due to its robust and competitive housing market. The city offers a diverse range of properties, including beachfront homes, condos, townhouses, and single-family homes. The average home value in the Virginia Beach-Norfolk-Newport News area is $332,820, with an annual increase of 5%. Additionally, homes in Virginia Beach typically go to pending status in around 32 days.

Here are the top reasons to invest in the Virginia Beach MSA for the long term:

Sure, here's more information on each point:

- Strong economy: Virginia Beach has a strong and diversified economy, with major industries including military, tourism, healthcare, and education. The military presence is particularly significant, with several military bases and facilities located in the area, including Naval Air Station Oceana and Joint Expeditionary Base Little Creek-Fort Story. This helps to provide stability to the local economy and job market.

- Population growth: Virginia Beach has seen steady population growth over the years, with a current population of over 450,000 people. This growth is expected to continue in the coming years, which bodes well for real estate investors. With more people moving to the area, there will be increased demand for housing, which can drive up prices and rental rates.

- Rental market: Virginia Beach has a strong rental market, with a high percentage of renters in the area. This is due in part to the large military population, many of whom prefer to rent rather than buy. Additionally, the area's strong tourism industry means that there is a steady demand for short-term rentals, such as vacation homes and Airbnb.

- Affordable housing: Despite its many amenities and strong economy, Virginia Beach is still relatively affordable compared to other coastal cities. The median home value in the area is around $313,000, which is significantly lower than the median home value in cities like San Francisco or New York. This makes it a more accessible market for real estate investors who may not have the capital to invest in more expensive cities.

- Quality of life: Virginia Beach is consistently ranked as one of the best places to live in the United States, thanks to its high quality of life. The area boasts miles of beautiful beaches, excellent schools, and a wide range of cultural and recreational amenities. This makes it an attractive place for people to live and work, which in turn makes it an attractive place to invest in real estate.

- The Landlord-Friendly State of Virginia: Virginia is generally considered a landlord-friendly state due to its laws and regulations that tend to favor landlords over tenants. This means that if you decide to invest in rental property in Virginia, you can expect a relatively smooth and hassle-free process of managing and renting out your property. Some examples of landlord-friendly laws in Virginia include allowing landlords to charge non-refundable fees, enforcing strict lease terms, and relatively quick eviction processes. These factors can make Virginia a desirable state for real estate investors looking to maximize their rental income while minimizing their risks and legal liabilities.

Overall, these factors combine to make Virginia Beach a strong real estate investment market. With a strong economy, growing population, strong rental market, affordable housing, and high quality of life, it's easy to see why investors are drawn to the area. The Virginia Beach real estate market presents an ideal mix of high demand, constrained supply, and a large number of renters who won’t go buy a house if interest rates drop.

The diverse local economy allows you to cater to tourists knowing you can rent the property out to locals, as well. Buying an investment property is different from buying an owner-occupied home. Investment properties are designed to make money as rentals, which means you must look at them solely as an income-producing entity just like any other business.

Whether you are a beginner or a seasoned investor, you probably realize the most important factor that will determine your success as a real estate investor is your ability to find great real estate investments. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities.

Let us know which real estate markets you consider best for real estate investing! If you need expert investment advice, you may fill up the form given here. One of our investment specialists will get in touch with you to discuss all facets of searching for, buying, and owning a turnkey investment property.

References:

- https://virginiarealtors.org/

- https://www.zillow.com/VirginiaBeach-va/home-values

- https://www.neighborhoodscout.com/va/virginia-beach/real-estate

- https://www.realtor.com/realestateandhomes-search/Virginia-Beach_VA/overview

- https://www.nvar.com/realtors/news/market-statistics

- https://www.redfin.com/city/20418/VA/Virginia-Beach/housing-market