Let's cut to the chase: based on what I'm seeing from countless economic reports and talking to folks who know the real estate world inside and out, 2026 does indeed look like it has the potential to be a buyer's housing market, or at least a much more balanced one, than we've seen in years. This doesn't mean a crash is coming, or that sellers will be left holding the bag, but the scales could be tipping back towards those looking to purchase a home. A combination of slightly lower mortgage rates and a slow but steady increase in available homes for sale is creating a scenario where buyers might find themselves with a bit more breathing room and negotiation power.

Will 2026 Be the Year of the Buyer's Housing Market?

It's been a wild ride in the housing market. For a good while there, if you were selling a home, things seemed almost too easy. Homes were snatched up almost as soon as they were listed, often with multiple offers above the asking price. If you were a buyer, well, it felt like trying to grab a winning lottery ticket – stressful and often disappointing. But as I look ahead to 2026, the picture appears to be changing. We're not talking about a sudden free-for-all for buyers, but rather a gradual shift towards a market where you might actually have a comfortable seat at the table. Let me walk you through why I think this is the case.

The Big Picture: A Market Finding Its Footing

After years of scorching hot sales, where homes felt like they were disappearing from listings as fast as they appeared, we're starting to see some tell-tale signs of change. Reports from major players like Fannie Mae, the National Association of Realtors (NAR), and data analysts at Zillow are all pointing towards a significant pivot by 2026. They suggest that the total number of homes sold in the U.S. could see a healthy jump. Think around a nearly 10% increase from the year before.

What's driving this belief? Two main things: mortgage rates that are predicted to ease up a bit, and the inventory of homes for sale slowly but surely growing. Now, I want to be clear – this isn't expected to be a sudden free-fall in prices or a market where sellers are desperate. Instead, economists are forecasting a more balanced market. This balance is exactly what buyers have been hoping for. They'll likely have more options to choose from and a better chance to negotiate terms that work for them.

It's a stark contrast to just a couple of years ago. We saw mortgage rates that were incredibly low, which, combined with a severe lack of homes, supercharged the seller's advantage. Now, as rates are a bit higher but expected to dip slightly in the coming years, the dynamic starts to shift.

Will Mortgage Rates Finally Become Our Friend Again?

This is the million-dollar question, or maybe I should say, the hundreds-of-thousands-of-dollars-less-per-monthly-payment question! Mortgage rates have been the stubborn roadblock for many aspiring homeowners. When rates hover in the mid-6% range, as they have been, it significantly impacts how much house you can afford.

However, the projections for 2026 are looking more encouraging. Leading housing finance agencies are predicting that the average 30-year fixed mortgage rate could dip back down to around 5.9% by the end of 2026. Imagine what that means for your monthly payment on a $400,000 loan. A drop from, say, 6.8% to 5.9% could save you hundreds of dollars every single month.

To give you a clearer picture, look at this chart. It shows how mortgage rates have swung over the years and where they might be headed.

This gradual cooling of rates is key. It’s not going to happen overnight, and it's tied to broader economic trends, like inflation cooling down. If inflation stays stubbornly high, we might not see rates drop as much as predicted. But the current trajectory suggests a much more favorable borrowing environment for buyers in 2026. This improvement in affordability could unlock demand from people who have been waiting on the sidelines, but it’s not expected to be so dramatic that it sends sellers into a frenzy to list their homes.

Inventory and Sales: More Homes, More Choices

Another crucial piece of the puzzle is the number of homes available for sale – what we call inventory. For a long time, inventory has been critically low, which is why sellers had so much power. But things are starting to change here, too. The supply of homes for sale is beginning to rebound.

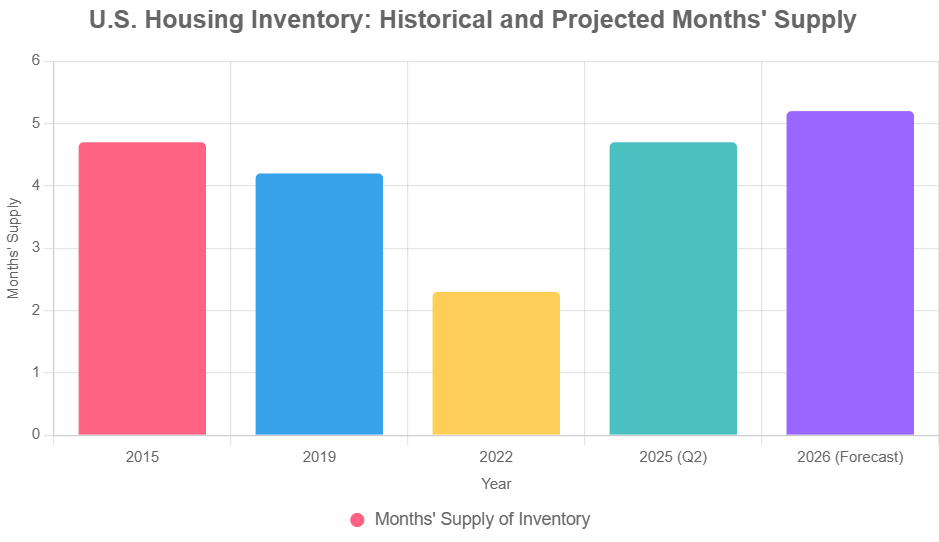

- Months' Supply: We often talk about “months' supply of inventory.” This means if no new homes were built or listed, how long would it take to sell all the homes currently on the market? For a balanced market, experts typically look for around 6 months of supply. We've been well below that for a while. By mid-2025, we're seeing predictions that the national average will be closer to 4.7 months' supply. By 2026, many areas are expected to reach or even exceed the 5-month mark. While still not a buyer's absolute dream scenario in every location, this is a very significant improvement and gives buyers more breathing room.

- Sales Volume: As inventory grows and mortgage rates become more manageable, we can expect more homes to sell. Forecasters are predicting a noticeable rebound in existing home sales. We could see an addition of hundreds of thousands of transactions annually compared to the last few years. This increase in activity means more homes are changing hands, which is generally a sign of a healthier, more accessible market.

This table gives a snapshot of how inventory has looked and where it might go, helping you visualize the shift:

| Year | Months' Supply of Inventory (Approximate) | Market Tendency |

|---|---|---|

| 2015 | 4.7 | Balanced |

| 2019 | 4.2 | Balanced |

| 2022 | 2.3 | Seller's Market |

| 2025 (Mid-Year) | 4.7 | Shifting |

| 2026 (Forecast) | 5.2+ | Buyer's Tilt |

(Data from FRED and aggregated forecasts; balanced market generally considered around 6 months.)

The key takeaway here is that while inventory is growing, it's not expected to flood the market. This gradual increase is what helps foster that buyer leverage without causing a dramatic price collapse.

Home Prices: Steady Growth, Not Soaring Heights

Now, let's talk about prices. Will 2026 be the year we see home prices plummet? My professional opinion, based on the data and economic forecasts I've reviewed, is no. We are not looking at a housing market crash. Instead, we're anticipating much more modest price growth.

Think along the lines of 1% to 4% appreciation nationally over the course of the year. This is a far cry from the double-digit, sometimes even 15%-20% surges we witnessed in the peak of the pandemic market. This slower, more sustainable price appreciation is actually a sign of a healthier market. It means that the market is stabilizing rather than overheating.

For example, national median home prices might sit somewhere in the $420,000 to $430,000 range by 2026. This is still an increase, but at a pace that is more in line with historical norms and wage growth for many people. Builders are also offering more incentives, and while demand is still present, it's tempered by affordability concerns, which helps keep price growth in check.

I've seen historical data that really drives this point home. This table shows the trend:

| Year | Median Sales Price ($) | Year-over-Year Change (%) |

|---|---|---|

| 2015 | 289,200 | +6.9% |

| 2019 | 309,800 | +4.0% |

| 2020 | 336,900 | +8.8% |

| 2022 | 389,800 | +9.2% |

| 2024 (End of Q4) | 419,300 | +7.1% |

| 2025 (Mid-Year) | 410,800 | -2.0% (Seasonal) |

| 2026 (Forecast) | 428,000 | +3.0% |

(Source: FRED St. Louis Fed; forecasts averaged from NAR/Zillow.)

As you can see, after a period of rapid growth, the pace is expected to moderate significantly. This means if you're buying, you won't feel like you're constantly trying to catch a runaway train.

Regional Differences: It's Not the Same Everywhere

It’s crucial to understand that the U.S. housing market is not a single, uniform entity. What happens in one state, or even one city, can be quite different from what's happening across the country. This is especially true when we talk about 2026 potentially being a buyer's market.

- Sun Belt Softening: Areas that saw immense price growth during the pandemic, particularly in states like Florida, Texas, and parts of the Southwest (often referred to as the “Sun Belt”), might see more softening. Some forecasts suggest these regions could experience modest price declines or flat growth. This is often due to a combination of increased new construction and a slight cooling of demand as the allure of remote work shifts for some. For buyers in these locales, 2026 could offer genuine opportunities.

- Midwest Stability: Conversely, many areas in the Midwest might continue to see steady, albeit slower, price appreciation. These markets often have more stable economies and a better balance between supply and demand, making them less prone to dramatic swings.

- Hot Spots Exist: Don't assume all “hot” markets will suddenly become buyer paradises. Major hubs with strong economies and limited land for new development, like parts of the Northeast or certain California cities, may continue to experience price growth, though likely at a more controlled pace than in recent years.

So, if you're looking to buy, doing your homework on specific local markets will be more important than ever. Don't rely solely on national headlines.

What This Means for You: Advice for Buyers and Sellers

So, with all this information, what should you do?

For Buyers:

- Get Pre-Approved and Stay Informed: Knowing your budget is crucial. As rates move, your pre-approval amount might adjust, but having that foundation is key. Keep an eye on local inventory. Apps and local real estate agent insights are invaluable here.

- Negotiate Smartly: In areas where inventory is higher or prices are softening, don't be afraid to negotiate. You might be able to ask for seller concessions, like help with closing costs or even a rate buy-down, which can save you money upfront and over the life of the loan.

- Credit Score is King: Continue to focus on maintaining a good credit score. Even small improvements can lead to better loan terms, especially as rates fluctuate.

For Sellers:

- Price Realistically: The days of wildly overpricing and expecting multiple offers might be behind us in many areas. Work with your agent to price your home competitively based on current market conditions. A home that sits on the market too long can become “stale.”

- Consider Incentives: If your home isn't moving as quickly, think about offering incentives. This could be anything from covering appraisal fees to contributing to a buyer's mortgage rate buydown. It shows you're serious about making a deal.

- Stage for Success: Presentation still matters. A well-staged, move-in ready home will always attract more serious buyers, especially in a market with more options.

For Investors:

- Focus on Rental Demand: In areas where homeownership remains a challenge due to affordability, rental markets can be strong. Look for locations with jobs and a growing population.

- Value Plays: Some regions, particularly in the Midwest, might offer properties at a more attractive price point, potentially leading to better returns on investment properties.

The Bottom Line: A Tentative Yes for Buyers

All signs point to 2026 being a more favorable year for housing market buyers. We're likely stepping into a period where the market feels more balanced, with more homes available and slightly more manageable mortgage rates. This shift should provide more opportunities and better negotiation power for those looking to purchase a home.

However, it's not a guaranteed free-for-all. Affordability is still a significant hurdle for many, and regional differences will remain pronounced. The key will be for buyers to be informed, patient, and strategic. Don't expect a market crash, but do expect a market that offers more choices and a fairer playing field than we've seen in recent years. As always in real estate, understanding your local market and working with knowledgeable professionals will be your greatest assets.

Position Yourself Ahead With Smart Real Estate Investments

If 2026 truly becomes the year of the buyer's market, now’s the time to get ahead—before prices stabilize and competition heats up again. Strategic investors will use this window to build long-term cash flow and equity.

Work with Norada Real Estate to identify emerging markets and turnkey rental properties that offer stability, income, and growth potential—no matter how the market shifts.

THE BEST TIME TO INVEST IS BEFORE THE CROWD!

Speak with a seasoned Norada investment counselor today (No Obligation):

(800) 611-3060

Want to Know More About the Housing Market Trends?

Explore these related articles for even more insights:

- Housing Market 2025: Booming vs. Shrinking Inventory Across America

- Housing Market Gains Supply But Buyers Hit Pause in 2025

- Mid-Atlantic Housing Market Heats Up as Mortgage Rates Go Down

- NAR Chief's Bold Predictions for the 2025 Housing Market

- Housing Market Update 2025: NAR Report Indicates Sluggish Trends

- 7 Buyer-Friendly Housing Markets in 2025 With Abundant Homes for Sale

- The $1 Trillion Club: America's Richest Housing Markets Revealed

- 4 States Dominate as the Riskiest Housing Markets in 2025

- Housing Market Predictions 2025 by Norada Real Estate

- Housing Market Predictions 2026: Will it Crash or Boom?

- Housing Market Predictions for the Next 4 Years: 2025 to 2029

- Real Estate Forecast: Will Home Prices Bottom Out in 2025?

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- Will Real Estate Rebound in 2025: Top Predictions by Experts