The current state of the Baltimore housing market presents a mixed bag for buyers and sellers alike. While sellers may benefit from rising home prices and limited competition, buyers face challenges in navigating a competitive landscape with constrained inventory and higher mortgage rates in 2024.

Baltimore Housing Market Trends (Metro Area)

The Baltimore housing market is showing signs of robust growth, with home prices surging and inventory levels fluctuating.

How is the Housing Market Doing Currently?

According to the data by Bright MLS, as of February, home prices in the Baltimore metro area experienced a significant uptick, marking a 9.4% increase compared to the previous year. This surge represents the largest year-over-year price jump since May 2022. Notably, the steepest price hikes were observed in Baltimore and Howard counties, although all local markets in the metro area saw price appreciation.

Despite the overall increase in inventory by 9.9%, some local markets, including Anne Arundel, Carroll, and Howard counties, witnessed a decline in active listings. This shortage of available homes is exerting upward pressure on prices, with only 1.39 months of supply reported by the end of February.

However, amidst these fluctuations, there is a glimmer of hope for prospective buyers. New listings saw a remarkable 14.8% uptick in February, signaling the potential for increased sales activity in the upcoming months.

How Competitive is the Baltimore Housing Market?

The Baltimore housing market remains competitive, driven by high demand and limited inventory. With prices on the rise and a relatively low supply of homes, buyers are facing stiff competition, particularly in sought-after neighborhoods.

Additionally, despite the increase in new listings, the number of pending sales lagged behind last year's figures, dropping by 2.4%. This trend could be attributed to the recent surge in mortgage rates, which hovered near 7% in February, deterring some potential buyers from entering the market.

Are There Enough Homes for Sale to Meet Buyer Demand?

While the uptick in new listings offers some relief for buyers, the Baltimore metro area continues to grapple with a shortage of available homes. The disparity between supply and demand is evident in the dwindling inventory levels, particularly in certain counties where active listings declined year-over-year.

The persistent imbalance between supply and demand underscores the need for proactive measures to address housing affordability and accessibility in the region. Efforts to incentivize new construction and expand housing options could help alleviate the strain on the market and provide more choices for buyers.

What is the Future Market Outlook for Baltimore?

Despite the challenges posed by fluctuating inventory and rising prices, the outlook for the Baltimore housing market remains optimistic. The anticipated influx of new listings in the spring could inject vitality into the market, fostering increased sales activity and offering buyers more options to choose from.

Moreover, ongoing economic growth and favorable demographic trends bode well for the long-term stability of the market. However, vigilance is warranted, as external factors such as mortgage rate fluctuations and broader economic conditions could influence market dynamics in the months ahead.

ALSO READ: Maryland Housing Market Forecast

Baltimore Housing Market Forecast for 2024 & 2025

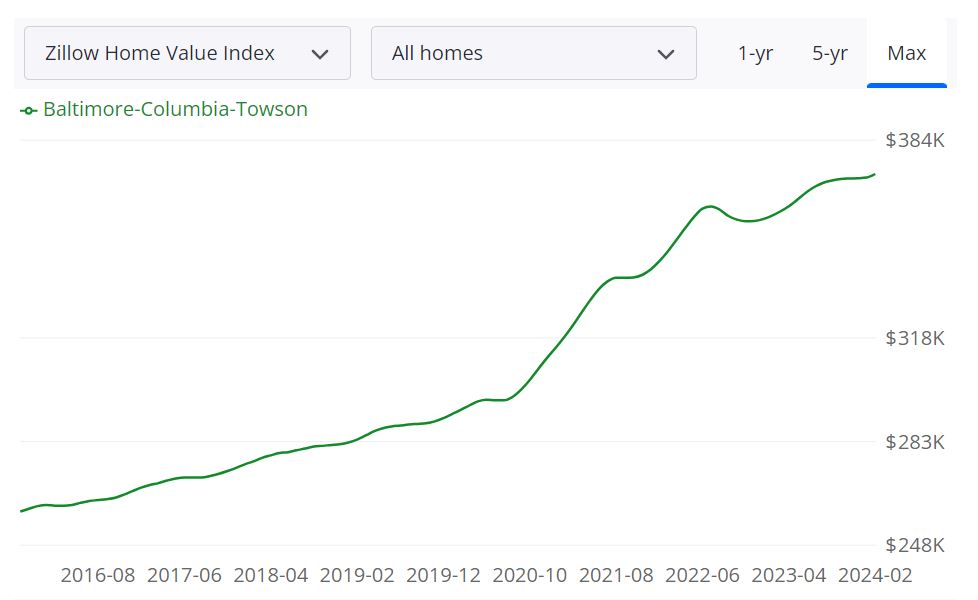

The Baltimore housing market is currently showing positive signs of growth, according to Zillow, a prominent real estate database company.

Home Values

The average home value in the Baltimore-Columbia-Towson area stands at $373,454, marking a 3.9% increase over the past year. This appreciation in value is indicative of a healthy market. Additionally, homes in this area typically go pending in approximately 13 days, reflecting a robust demand for properties.

Market Forecast

Zillow's 1-year market forecast, as of February 28, 2024, indicates a -1.1% change, suggesting a mild adjustment in the market. While this forecast may seem slightly negative, it's essential to consider various factors influencing the market dynamics.

Housing Inventory

As of February 29, 2024, there are 4,868 homes available for sale in the Baltimore area. This ample inventory provides options for potential buyers, contributing to a diverse market landscape. Moreover, there were 1,857 new listings during the same period, indicating ongoing activity within the market.

Median Sale and List Prices

The median sale price for homes in Baltimore as of January 31, 2024, is $326,000, while the median list price stands at $323,300 as of February 29, 2024. This slight variance between sale and list prices reflects stability in the market, with sellers pricing their properties reasonably.

Sale to List Ratio

The median sale to list ratio, calculated as 1.000 as of January 31, 2024, indicates that homes are typically selling at their listed prices. This parity between listing and sale prices suggests a balanced market where fair transactions occur.

Sales Performance

In January 2024, 38.9% of home sales in Baltimore were conducted over the list price, while 36.7% were sold under the list price. This diversity in sales performance highlights the flexibility of the market, accommodating both seller and buyer preferences.

Market Size and Scope

The Baltimore-Columbia-Towson metropolitan area encompasses several counties, contributing to a vibrant and expansive housing market. With its diverse range of neighborhoods and economic activities, Baltimore's housing market plays a significant role in the regional real estate landscape.

Is Baltimore a Buyer's or Seller's Housing Market?

Determining whether it's a buyer's or seller's market in Baltimore requires careful analysis of various factors, including inventory levels, pricing trends, and sales activity. With a significant inventory of homes available for sale and a balanced sale-to-list ratio, Baltimore currently leans towards a neutral market. However, the competition among buyers for properties priced competitively suggests a slight advantage for sellers. Prospective buyers can still find opportunities in this market with strategic negotiation and due diligence.

Are Home Prices Dropping in Baltimore?

Despite the mild adjustment forecasted by Zillow, home prices in Baltimore are not experiencing a significant decline. The slight decrease projected in the market forecast does not necessarily translate to a widespread drop in prices. Instead, it may indicate a period of stabilization or moderation in the market after previous appreciation. Overall, home prices in Baltimore remain relatively stable, with fluctuations reflecting normal market cycles.

Will the Baltimore Housing Market Crash?

Speculating on whether the Baltimore housing market will crash requires caution and consideration of multiple variables. While market forecasts provide insight, they do not guarantee future outcomes. Factors such as economic conditions, interest rates, and regulatory changes can influence market volatility. Currently, there are no indications of an imminent market crash in Baltimore. However, vigilance and monitoring of market trends are advisable for all stakeholders.

Is Now a Good Time to Buy a House in Baltimore?

Determining the optimal time to buy a house in Baltimore depends on individual circumstances and long-term goals. While market conditions may favor sellers slightly, buyers can still find value and opportunities in the current market. With interest rates at low levels as compared to last year and a diverse inventory of homes available, now can be an attractive time to enter the market for qualified buyers. However, careful consideration of personal finances and market dynamics is essential before making a purchase decision.

Baltimore Real Estate Investment: Should You Invest in Baltimore?

Baltimore is a city with a rich history and culture, and it's also becoming an attractive location for real estate investors. With the rise of Baltimore's economy, population growth, and real estate market, it's no wonder that more and more investors are considering Baltimore for their next investment opportunity. If you're wondering whether Baltimore is a good place to invest in real estate, you've come to the right place. In this section, we'll take a look at the top eight reasons why investing in Baltimore could be a smart move for your real estate portfolio.

- Affordable Real Estate Prices: Baltimore is known for its affordable real estate prices, especially when compared to other major cities in the U.S. Investors can purchase properties for a fraction of the price they would pay in cities like New York, Los Angeles, or San Francisco. Additionally, Baltimore's real estate market has been on an upward trend over the past few years, making it a great time to invest.

- Strong Rental Market: Baltimore's rental market is thriving due to a combination of factors, including a growing population and a relatively low cost of living. Investors can take advantage of this by purchasing properties and renting them out to tenants. Additionally, many large companies are headquartered in Baltimore, which can provide a steady stream of potential renters.

- Growing Population: Baltimore's population has been steadily increasing over the past few years, with projections indicating that this trend will continue. A growing population means more demand for housing, which can drive up property values and rental prices. This makes it an attractive option for real estate investors.

- Diverse Economy: Baltimore's economy is diverse, with a variety of industries driving its growth. This includes healthcare, technology, finance, and education. A diverse economy can provide stability for real estate investors, as it is less likely to be affected by downturns in any one industry.

- Proximity to Major Cities: Baltimore is located within a few hours' drive of several major cities, including Philadelphia, Washington D.C., and New York City. This makes it an attractive location for people who work in these cities but want to live in a more affordable area. As a result, the demand for housing in Baltimore is likely to remain strong.

- Historic Charm: Baltimore is known for its historic architecture and charm. Many of its neighborhoods have a unique character and appeal to renters and buyers alike. This can make it easier to attract tenants and can also help drive up property values.

- Access to Higher Education: Baltimore is home to several prestigious universities, including Johns Hopkins University and the University of Maryland. This can attract students and faculty members who need housing, as well as researchers and other professionals who work at these institutions.

- Investment Incentives: The city of Baltimore offers a variety of incentives to real estate investors, including tax credits and exemptions. Additionally, there are several programs designed to encourage investment in certain areas of the city. These incentives can help investors maximize their returns and make Baltimore an even more attractive option for investment.

For most investors, buying or selling real estate is one of the most important decisions they will make. Choosing a real estate professional/counselor continues to be a vital part of this process. They are well-informed about critical factors that affect your specific market areas, such as changes in market conditions, market forecasts, consumer attitudes, best locations, timing, and interest rates.

NORADA REAL ESTATE INVESTMENTS has extensive experience investing in turnkey real estate and cash-flow properties. We strive to set the standard for our industry and inspire others by raising the bar on providing exceptional real estate investment opportunities in many other growth markets in the United States. We can help you succeed by minimizing risk and maximizing the profitability of your investment property in Baltimore.

Consult with one of the investment counselors who can help build you a custom portfolio of Baltimore turnkey properties. These are “Cash-Flow Rental Properties” located in some of the best neighborhoods of Baltimore.

Not just limited to Baltimore or Maryland but you can also invest in some of the best real estate markets in the United States. All you have to do is fill up this form and schedule a consultation at your convenience. We’re standing by to help you take the guesswork out of real estate investing. By researching and structuring complete Baltimore turnkey real estate investments, we help you succeed by minimizing risk and maximizing profitability.

References/Sources

- https://www.brightmls.com/

- https://www.zillow.com/baltimore-md/home-values

- http://www.mdrealtor.org/Resources/Publications/Monthly-Housing-Statistics

- https://www.redfin.com/city/1073/MD/Baltimore/housing-market

https://www.realtor.com/realestateandhomes-search/Baltimore_MD/overview