Currently, the Baton Rouge housing market leans slightly towards sellers, with indicators such as a relatively low median days to pending and a significant percentage of sales occurring below the list price. However, the market also offers opportunities for buyers, evidenced by the median sale price and sale to list ratio.

Baton Rouge Housing Market Trends in 2024

According to Redfin, in February 2024, the Baton Rouge housing market exhibited a decline in home prices, registering a 15.0% drop compared to the previous year. The median price for homes in Baton Rouge stood at $216,000. Notably, homes now take 63 days on average to sell, reflecting a slight increase from 49 days the previous year. During February of this year, 173 homes were sold, a decrease from 211 homes sold during the same period last year.

Despite these fluctuations, Baton Rouge remains a somewhat competitive market, with homes typically selling in 50 days. It's worth mentioning that certain properties receive multiple offers, indicating pockets of high demand within the market.

Price Trends

Baton Rouge's median sale price is notably 47% lower than the national average, presenting an attractive option for prospective homebuyers seeking affordability. On average, homes in Baton Rouge sell for approximately 4% below the listing price. However, “hot homes” may sell at or near the list price, often going pending within an impressive 14 days.

Market Dynamics

The sale-to-list price ratio currently stands at 96.3%, indicating a slight decrease of 0.66 percentage points year-over-year. Additionally, 10.4% of homes are sold above the list price, marking a modest increase of 0.5 percentage points compared to the previous year. However, there has been a 2.6 percentage point increase in homes with price drops, reaching 25.8% year-over-year.

Migration and Relocation Trends

Analyzing migration and relocation patterns offers insights into the broader dynamics influencing the Baton Rouge housing market. From December '23 to February '24, 21% of homebuyers in Baton Rouge explored options outside the city, while 79% expressed a preference for remaining within the metropolitan area.

When considering inbound migration, 0.12% of homebuyers nationwide searched to relocate to Baton Rouge from outside metropolitan areas. Among the top contributing metros, Lafayette emerged as the primary source of inbound homebuyers, followed by Los Angeles and Dallas.

Baton Rouge Housing Market Forecast 2024 and 2025

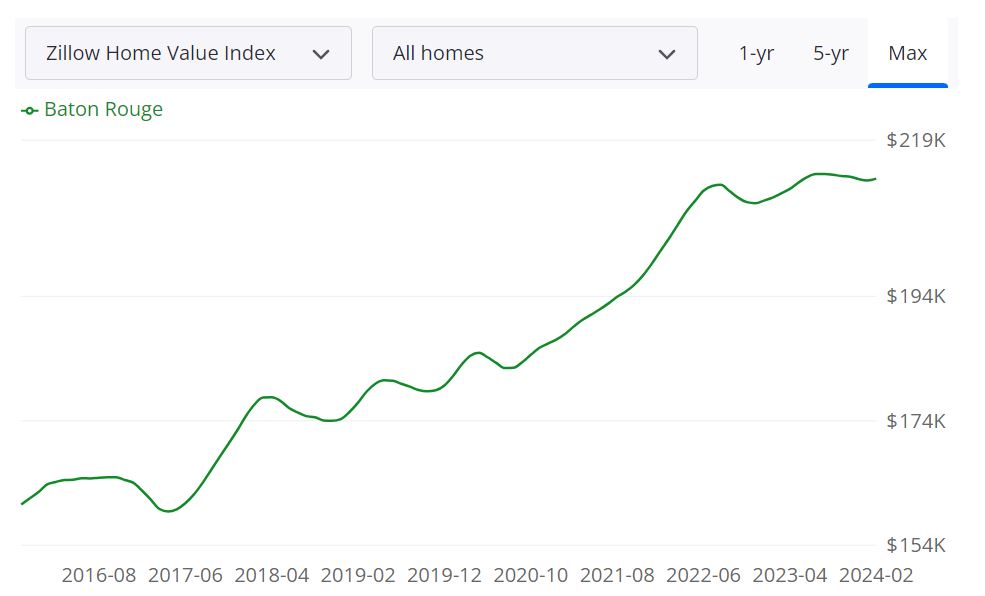

In recent years, the Baton Rouge housing market has demonstrated resilience and steady growth, as evidenced by data provided by Zillow. The average home value in Baton Rouge currently stands at $213,295, reflecting a 1.5% increase over the past year. Notably, homes in Baton Rouge typically go pending in approximately 38 days, indicating a relatively swift sales process. As of February 29, 2024, there were 1,290 properties available for sale, with 275 new listings added during the same period.

Key Metrics Explained:

- Median Sale Price: As of January 31, 2024, the median sale price in Baton Rouge was $204,333, while the median list price, as of February 29, 2024, was $257,467. These figures provide insight into the pricing dynamics within the market.

- Sale to List Ratio: The median sale to list ratio, calculated as of January 31, 2024, stands at 0.978, offering a glimpse into the negotiation dynamics between sellers and buyers.

- Percentage of Sales: In January 2024, 11.0% of sales in Baton Rouge were above the list price, while 66.9% were below the list price, reflecting varying levels of competitiveness within the market.

Baton Rouge MSA Housing Market Forecast

The Baton Rouge Metropolitan Statistical Area (MSA) encompasses East Baton Rouge Parish and several surrounding parishes. With a population exceeding 800,000, it represents a significant portion of Louisiana's real estate market. According to the forecast provided by Zillow, the Baton Rouge MSA is projected to experience modest growth in the coming months.

As of February 29, 2024, the forecast indicates an anticipated 0.3% increase by March 31, 2024, followed by a 0.4% uptick by May 31, 2024. However, a slight downturn of -2.4% is predicted by February 28, 2025, highlighting potential fluctuations in market conditions.

Are Home Prices Dropping in Baton Rouge?

While the Baton Rouge housing market has experienced fluctuations, there is no definitive trend indicating a widespread drop in home prices. The market remains relatively stable, with incremental increases in average home values and median sale prices over recent years. However, localized factors and external economic influences can impact pricing dynamics, making it essential for buyers and sellers to stay informed and adaptable.

Will the Baton Rouge Housing Market Crash?

As with any market, the possibility of a housing market crash cannot be entirely discounted. However, current indicators suggest that the Baton Rouge housing market is resilient and capable of weathering economic uncertainties. While forecasts may project fluctuations in growth rates, there is no imminent sign of a catastrophic crash. Nonetheless, prudent financial planning and risk management strategies are advisable for homeowners and investors alike.

Is Now a Good Time to Buy a House in Baton Rouge?

Whether now is a good time to buy a house depends on individual circumstances and objectives. For prospective buyers in Baton Rouge, factors such as current market conditions, personal financial stability, long-term investment goals, and lifestyle preferences should be carefully considered. While the market offers opportunities, it's essential to conduct thorough research, consult with real estate professionals, and assess affordability and risk factors before making a decision.

Is Baton Rouge a Good Place to Invest in Real Estate?

Investing in real estate in Baton Rouge, Louisiana is a strategic decision with several compelling reasons:

1. Economic Growth and Stability

Baton Rouge has shown consistent economic growth over the years, supported by a diverse economy including industries like petrochemicals, manufacturing, healthcare, and education. The stability of its economic base is attractive for real estate investors, ensuring a steady demand for housing and properties.

2. Affordability and Favorable Price Trends

The average home value in Baton Rouge is relatively affordable compared to many other U.S. cities, making it accessible for investors with varying budgets. Additionally, the housing market has seen a positive trend in prices, indicating potential appreciation and good returns on investment.

3. Growing Population and Demand

Baton Rouge is experiencing a growth in population, driven by a mix of factors such as job opportunities, education institutions, and a desirable quality of life. A growing population translates to increased demand for housing, both in the rental and buying market, providing excellent prospects for real estate investment.

4. Educational Institutions and Student Housing

With multiple universities and colleges, including Louisiana State University (LSU), Baton Rouge is a hub for students. Investing in student housing can be a lucrative venture, especially in areas close to educational institutions, offering a steady stream of tenants and potential for high rental yields.

5. Infrastructure Development

Ongoing and planned infrastructure projects, like improvements in transportation and public facilities, enhance the overall desirability of Baton Rouge. Investing in areas benefiting from such developments can yield substantial returns as property values tend to rise in response to enhanced infrastructure.

Baton Rouge presents a favorable landscape for real estate investment due to its economic stability, affordability, population growth, educational prominence, and ongoing infrastructure enhancements. These factors combined create a promising environment for potential investors seeking a profitable and sustainable real estate market.

Sources:

- https://www.zillow.com/batonrouge-la/home-values

- https://www.redfin.com/city/1336/LA/Baton-Rouge/housing-market

- https://www.realtor.com/realestateandhomes-search/Baton-Rouge_LA/overview