For many homeowners who purchased a house in the last couple of years, February 2026 is indeed signaling it's a prime time to explore refinancing your mortgage, especially if you’re relying on the common “1% Rule” as your guide. This simple guideline suggests that if you can shave a full percentage point off your interest rate, it's usually a smart financial move, and right now, that looks very promising for a significant number of people.

I've been following the mortgage market for years, and one thing I've learned is that timing can make a huge difference in your finances. When rates were climbing in 2024 and early 2025, many of us might have felt a bit stuck with our loan terms. But seeing those rates start to tick down now, it’s time to get serious about whether a refinance makes sense for you.

Does the 1% Rule Say It’s Time to Refinance Your Mortgage in 2026?

Understanding the 1% Rule and Why It Matters Now

Let's break down this “1% Rule” because it's a straightforward way to figure out if refinancing could save you money. The idea is simple: if you can lower your current mortgage interest rate by at least 1 percentage point, it’s typically worth looking into refinancing. This rule is a great starting point because it helps you quickly assess potential savings.

Think about it this way: every little bit you save on your monthly mortgage payment adds up. Over the life of a 30-year loan, even a small reduction in your interest rate can mean saving tens of thousands of dollars. My personal experience has shown me that people often get so used to their current payments that they don't even consider refinancing unless there’s a dramatic shift in rates. But the 1% Rule is designed to catch those significant, yet sometimes overlooked, savings opportunities.

Key Refinancing Insights for 2026

The mortgage market has seen some interesting shifts. Let’s look at where we are and how it plays into the 1% Rule.

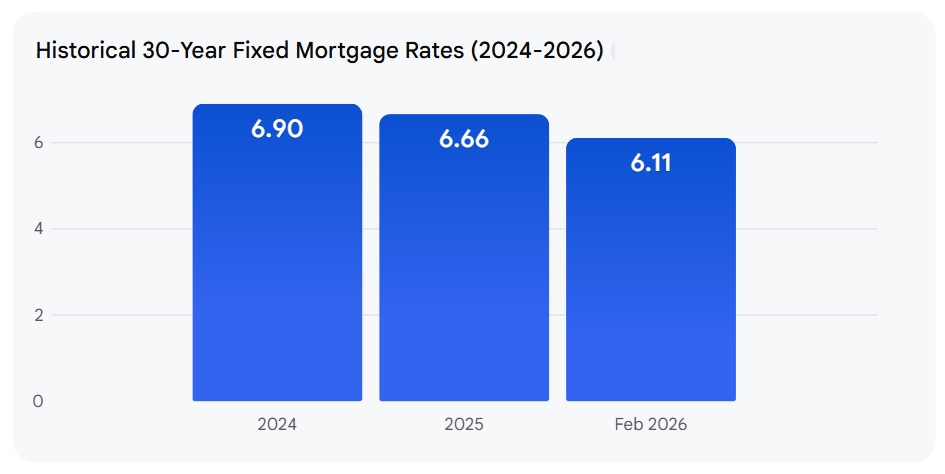

- Historical Rate Trends:

- In 2024, average 30-year fixed mortgage rates were around 6.90%.

- By 2025, rates had dipped slightly to an average of 6.66%.

- As of February 2026, these rates have fallen further to an average of 6.11%.

This downward trend is exactly what the 1% Rule is designed to capitalize on.

Does the 1% Rule Trigger for You?

Whether this rule applies to you really depends on when you secured your original loan. It's not a one-size-fits-all situation.

- Purchased in 2024 or Early 2025: If you bought a home during this period, you likely locked in a rate that was near the peak, maybe around 6.90% to 7.00%. With current average rates at approximately 6.11% in early February 2026, many of you are either already at, or very close to, a full percentage point drop. This means now is a very strong contender for a refinancing opportunity.

- Purchased in Late 2025: For those who bought in late 2025, rates averaged around 6.66%. If you refinance now at 6.11%, you're looking at a reduction of about 0.50%. While this is a good saving, especially on a large loan, it doesn't strictly meet the 1% rule. However, as we'll discuss, it might still be worth considering.

- Pandemic-era Owners (Rates Below 5%): If you were fortunate enough to secure a mortgage during the super-low rate environment of the pandemic (think rates below 4% or 5%), the current market at 6.11% is still significantly higher. For you, refinancing right now would likely mean paying more in interest, so it's probably not the best move.

Beyond the 1% Rule: The Break-Even Analysis

While the 1% Rule is a fantastic starting point, I always encourage people to look a bit deeper. The real bottom line is the break-even point. This refers to how long it will take for the money you save each month to cover the costs associated with refinancing.

Refinancing isn't free. There are closing costs, which can typically range from 2% to 6% of your loan amount.

Here's a simplified way to think about it:

- Calculate your monthly savings: (Your current interest rate – New interest rate) * Your remaining loan balance / 12 = Monthly Interest Savings.

- Calculate your closing costs: Let's say your closing costs are $6,000.

- Find your break-even point: Closing Costs / Monthly Savings = Number of months to recoup costs.

If you plan to stay in your home for longer than your break-even period, refinancing is almost always a good idea. Even if the rate drop is less than 1%, if your monthly savings are substantial enough to cover closing costs in, say, 18-24 months, and you plan to live there for 5-10 years, it's a smart financial decision.

The Impact of Large Loan Balances

It’s also crucial to consider the size of your loan. For homeowners who have a large loan balance, even a drop of less than a full percentage point can result in significant monthly savings.

Let's say you have a remaining loan balance of $400,000 and your rate drops by 0.50% (from 6.66% to 6.11%):

- Estimated Monthly Savings on Principal & Interest: Roughly $200 (this is a simplified estimate, actual savings may vary).

If your closing costs were around $5,000, your break-even point would be about 25 months ($5,000 / $200). For many, this is well within a reasonable timeframe to recoup costs and start enjoying long-term savings. This is where the 1% Rule can sometimes be too rigid for certain homeowners.

Future Rate Outlook

What about the future? Mortgage rates are influenced by many factors, including inflation and the Federal Reserve's policies.

- Optimistic Outlook: Some experts are predicting that rates could potentially dip into the 5.5% range by mid-2026 if inflation continues to cool down. This would be a major drop and make refinancing incredibly attractive for a much wider group of homeowners.

- Stable Outlook: Others believe rates might stabilize around 6% for the rest of 2026. Even at 6%, if your current rate is 7% or higher, you’re still looking at substantial savings.

My personal take is that while predictions are helpful, it's best to focus on where rates are now and what that means for your specific situation. Planning for a future drop is smart, but don't miss out on savings that are available today.

Making the Decision

So, does the 1% Rule say it's time to refinance in 2026?

- For those who bought in 2024 and early 2025: Yes, it very likely does. You're in the prime position to hit that 1% savings mark.

- For those who bought in late 2025: It depends. While you might not hit the strict 1% rule, a 0.50% drop could still be very beneficial, especially with a larger loan balance. Carefully review your closing costs and calculate your break-even point.

- For pandemic-era homeowners with ultra-low rates: Probably not right now. Your current rate is likely still much better than what's available.

My advice is always to get personalized quotes from a few different lenders. Compare their rates, fees, and closing costs. Then, do your own break-even analysis. The 1% rule is a helpful benchmark, but your personal financial goals and how long you plan to stay in your home are the ultimate deciding factors. It's about making a smart, informed choice that benefits your financial future.

The 1% refinance rule is back in focus for 2026, but real estate investors know that cash flow and appreciation often outweigh short‑term rate changes. Turnkey rentals remain a proven path to passive income regardless of mortgage shifts.

Norada Real Estate helps investors secure turnkey properties designed for immediate ROI and long‑term growth—so your portfolio thrives whether you refinance or stay the course.

and

Florida’s modern build with strong cash flow vs Missouri’s affordable rental with higher cap rate. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Speak to Our Investment Counselor (No Obligation):

(800) 611-3060

Recommended Read:

- Best Time to Refinance Your Mortgage: Expert Insights

- Should You Refinance Your Mortgage Now or Wait Until 2026?

- When You Refinance a Mortgage Do the 30 Years Start Over?

- Should You Refinance as Mortgage Rates Reach Lowest Level in Over a Year?

- Half of Recent Home Buyers Got Mortgage Rates Below 5%

- Mortgage Rates Need to Drop by 2% Before Buying Spree Begins

- Will Mortgage Rates Ever Be 3% Again: Future Outlook

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years