Let’s talk about the big question on everyone’s mind here in the Sunshine State: Will the Florida housing market crash in 2026? After looking at the latest data and talking to folks who make it their business to understand these things, my take is that a full-blown crash – meaning a sharp, widespread drop in prices like we saw in 2008 – is unlikely in Florida by 2026.

However, that doesn't mean we won't see some bumps and even some price drops in certain areas. Things are definitely shifting from the red-hot market of a few years ago into a more balanced, and dare I say, more normal, environment.

Is the Florida Housing Market on the Edge of a Crash or Downturn?

As someone who's kept a close eye on Florida real estate for a while, I've seen it go through its ups and downs. Right now, what I’m seeing is not a panic situation, but a market that’s maturing. The frenzy might be over, but that doesn’t automatically mean a collapse is coming. It’s more about a recalibration after a period of intense growth. The August 2025 data from Cotality (formerly CoreLogic) paints a picture of a slowing national price growth as of August 2025, and Florida is part of that bigger trend.

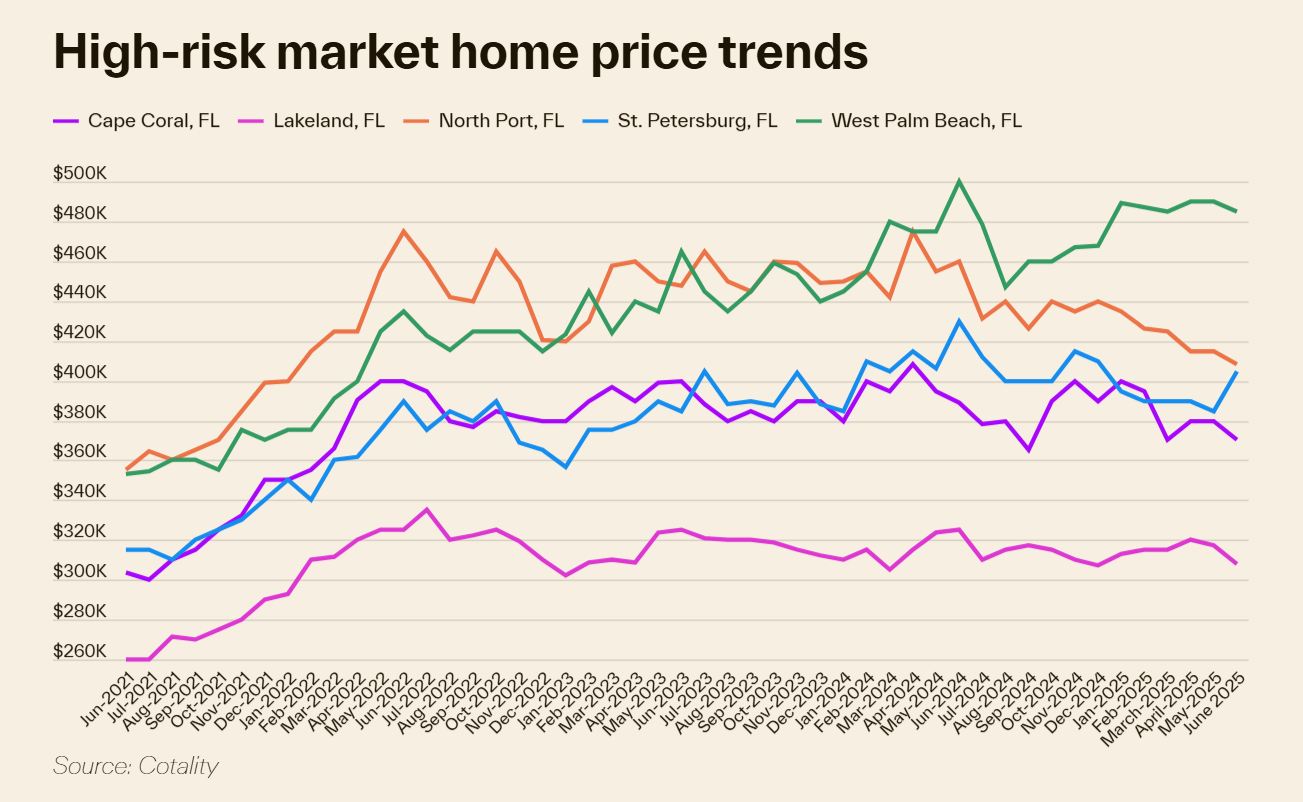

While the national year-over-year price growth dipped to 1.7% in June 2025, and Florida itself saw some negative price growth in certain areas like Cape Coral, North Port, and Fort Myers reported in the “Markets to Watch” section, it’s not a universal decline across the entire state.

Understanding the Current Scene: What the Numbers Say

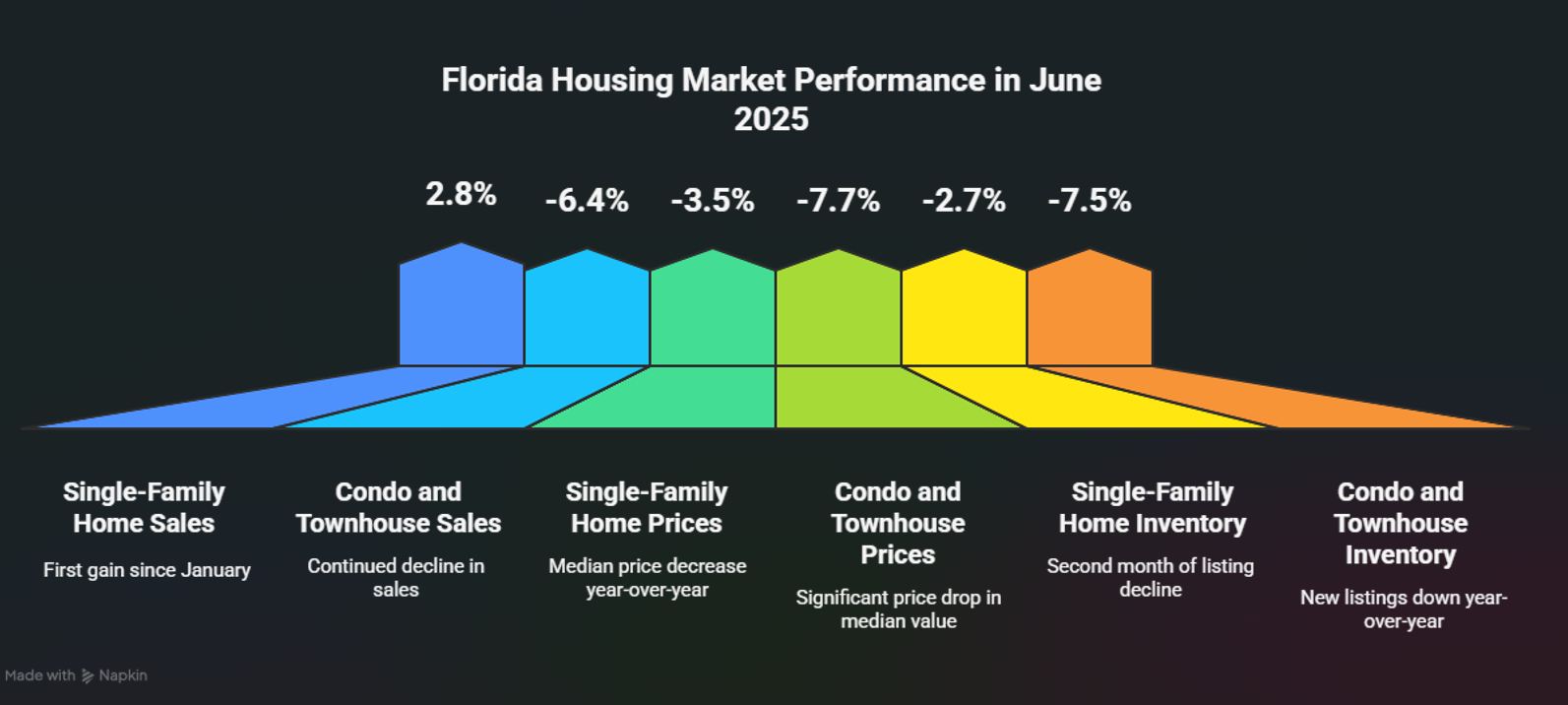

Let’s break down what the recent data tells us about Florida’s housing market. According to Florida Realtors® data for June 2025:

- Single-Family Home Sales: We saw a 2.8% year-over-year increase in closed sales of existing single-family homes. This is notable because it's the first gain in that metric since January, suggesting a bit of life returning to the sales activity.

- Condo and Townhouse Sales: These, however, were still down, with a 6.4% year-over-year decline in closed sales. This indicates a difference in how the different types of housing are performing.

- Median Prices: The statewide median sales price for single-family existing homes in June was $412,000, which is a 3.5% decrease compared to June 2024. For condos and townhouses, the median price was $300,000, marking a 7.7% drop year-over-year. This is a key indicator of the cooling trend; prices are easing, not soaring.

- Inventory: One of the most important factors influencing market crashes is inventory – how many homes are for sale. In Florida, we saw 2.7% fewer single-family homes listed for sale in June 2025 compared to the previous year. This is the second straight month of decline in new listings after a period of growth. For condos and townhouses, new listings were down 7.5% year-over-year in June. While inventory growth has slowed, the months' supply for single-family homes was at 5.6 months in June and the second quarter, and 10 months for condos and townhouses. Generally, a six-month supply is considered balanced, so this is giving buyers more room to negotiate.

From my perspective, these numbers are telling a story of a market that’s moving away from seller dominance. When prices are coming down and inventory is increasing at a decent pace (even if new listings are slowing a bit), buyers have more power. This is a healthy adjustment after years of extremely tight inventory and rapidly rising prices.

Why a Full-Blown Florida Housing Market Crash in 2026 is Unlikely

So, back to the main question: crash or no crash? Here’s why I lean towards “no crash” for the overall Florida market by 2026:

- Strong Underlying Demand: Florida continues to be a desirable place to live. We’re seeing domestic in-migration – people moving into the state – which is a major driver of housing demand. People are drawn to our climate, lower taxes, and job opportunities, especially in certain sectors. This steady stream of new residents provides a baseline of demand that helps prevent a drastic price drop.

- Affordability is Improving (Slowly): While affordability has been a major challenge, the slight easing of prices and slower price growth is making housing more accessible. The Cotality data mentions that year-over-year price growth dipped to 1.7% in June 2025, which is below the rate of inflation. This means real home prices are becoming slightly more affordable. The income required to afford a median-priced home is a critical metric. If this number starts coming down, more people can enter the market.

- Insurance Costs are a Factor, Not a Deal-Breaker for Everyone: I can’t talk about Florida without mentioning insurance. Rising insurance premiums are a serious concern and are indeed eroding long-term affordability, as noted by Cotality’s Chief Economist. These variable costs have jumped significantly. However, for many buyers, the dream of homeownership, especially in areas with strong job markets or desirable amenities, will likely outweigh the insurance hurdle, provided they can secure a loan and afford the monthly payments. It's a headwind, for sure, but not the same as a complete market collapse.

- Less Speculative Activity Than Before: The easy money and speculative buying that some saw in past boom cycles seems to have died down. More buyers today are looking for primary residences, not just investments to flip quickly. This makes the market more resilient.

- Not All Markets are Created Equal: Florida is a massive state with diverse local economies. While some areas might see more significant price adjustments, others will remain relatively stable or even continue to experience modest growth. For instance, the “Markets to watch” list from Cotality identifies areas like Cape Coral, Lakeland, North Port, St. Petersburg, and West Palm Beach as having a very high risk of price decline. This highlights that localized dips are possible, but they don't necessarily signal a statewide crash.

Factors That Could Potentially Temper the Market Further

While I don't foresee a nationwide-style crash, there are factors that could lead to more cooling in Florida by 2026:

- Interest Rate Stability (or Increases): Mortgage interest rates have a huge impact. If rates remain elevated or even climb higher, it will continue to dampen demand and put downward pressure on prices. The “Homes required to afford median-priced home” metric from Cotality shows a figure of $89,600, which is quite high. If this number increases due to rising rates, it further curbs affordability.

- Economic Slowdown or Recession: A significant economic downturn, leading to job losses and decreased consumer confidence, would naturally impact housing demand. If the projected “slowing U.S. economy” discussed by Dr. Selma Hepp intensifies, we could see a more pronounced effect.

- Persistent Insurance Challenges: If insurance costs continue to skyrocket or insurers pull out of certain markets, it could make homeownership in those areas prohibitively expensive, leading to a more significant correction.

- Overbuilding in Specific Areas: While generally inventory has been tight, if certain regions or construction types experience overbuilding, it could lead to localized price drops.

What Does This Mean for Buyers and Sellers in Florida?

For Buyers:

- More Negotiating Power: This is a more balanced market where buyers can potentially find better deals and have more room to negotiate on price and terms.

- Patience is Key: Don't rush. Continue to monitor interest rates and housing prices. The market is likely to continue its gradual adjustment into 2026.

- Focus on Long-Term Value: Look for properties in areas with strong fundamental demand, good schools, and job growth, regardless of short-term price fluctuations.

- Factor in Insurance: Get a clear understanding of insurance costs for any property you consider, as this is a crucial part of your budget.

For Sellers:

- Realistic Pricing is Crucial: Overpricing your home will likely result in it sitting on the market. Work with your real estate agent to set a competitive price based on current market conditions.

- Home Presentation Matters: With more inventory, making your home stand out is essential. Ensure it’s in good condition and appealing to buyers.

- Be Prepared to Negotiate: You might not get the bidding wars and multiple offers we saw a couple of years ago. Be open to reasonable negotiations on price and terms.

Florida's Unique Position

Florida's housing market has always had its own rhythm, influenced by natural disasters, tourism, and its status as a retirement and vacation destination. The trends we’re seeing now are more about returning to a normal cycle after an overheated period. The Cotality data points to a national slowdown, and Florida is participating in that trend, but the state’s inherent attractiveness creates a strong undercurrent of demand.

The “Top 10 coolest markets” where prices are declining (like Cape Coral, FL, North Port, FL, etc.) are areas to watch closely. These are often markets that saw extremely rapid appreciation and might be more susceptible to price corrections as the broader market normalizes. The fact that Florida Realtors® is highlighting these areas isn't a sign of impending doom for the entire state, but rather a signal of natural market adjustments in specific pockets.

My Personal Take

Having weathered previous real estate cycles, I see the current situation in Florida as a necessary correction, not a catastrophe. The days of every home garnering multiple offers sight unseen are likely behind us for now. This is a good thing for long-term market health. Homeownership should be built on sustainable prices and incomes, not just speculation.

The data from Cotality and Florida Realtors® is consistent: price growth is slowing, inventory is becoming more available (though not flooding the market), and buyers have more leverage than they did a year or two ago. These are all signs of a market transitioning towards balance, which is the opposite of a market crash. A crash typically involves a rapid, widespread collapse in prices driven by a severe economic shock or a bursting speculative bubble. While economic uncertainty is present, the fundamental demand for housing in Florida remains strong due to its population growth and appeal.

So, will the Florida housing market crash in 2026? I believe the answer is no, not in the way most people fear. Expect continued cooling, perhaps some localized price drops, and a market that requires more careful consideration from both buyers and sellers. It's a shift from a “seller's market” to a more “buyer's market,” and that's a healthy evolution for the long run.

Position Yourself for Stability Amid Market Uncertainty

With growing speculation about a potential Florida housing market crash, the smartest investors are diversifying into markets with proven resilience.

Norada provides turnkey rental properties in high-demand, economically stable areas—helping you secure passive income and safeguard against market downturns.

NEW CASH-FLOWING PROPERTIES JUST LISTED!

Speak with an experienced Norada investment counselor today (No Obligation):

(800) 611-3060

Read More:

- 24 Florida Housing Markets Could See Home Prices Drop by Early 2026

- Is the Florida Housing Market Headed for Another Crash Like 2008?

- Key Trends Shaping the Florida Housing Market in 2025

- This Florida Housing Market Bucks National Trend With Declining Prices

- Florida Housing Market Crash 2.0? Analyst Warns of 2008 Echoes

- Tax Relief Proposed as Florida Housing Market Faces Deepening Crisis

- Florida Housing Market: Record Supply Expected to Favor Buyers in 2025

- Florida Housing Market Forecast for Next 2 Years: 2025-2026

- Florida Housing Market: Predictions for Next 5 Years (2025-2030)

- When Will the Housing Market Crash in Florida?

- South Florida Housing Market: Will it Crash?