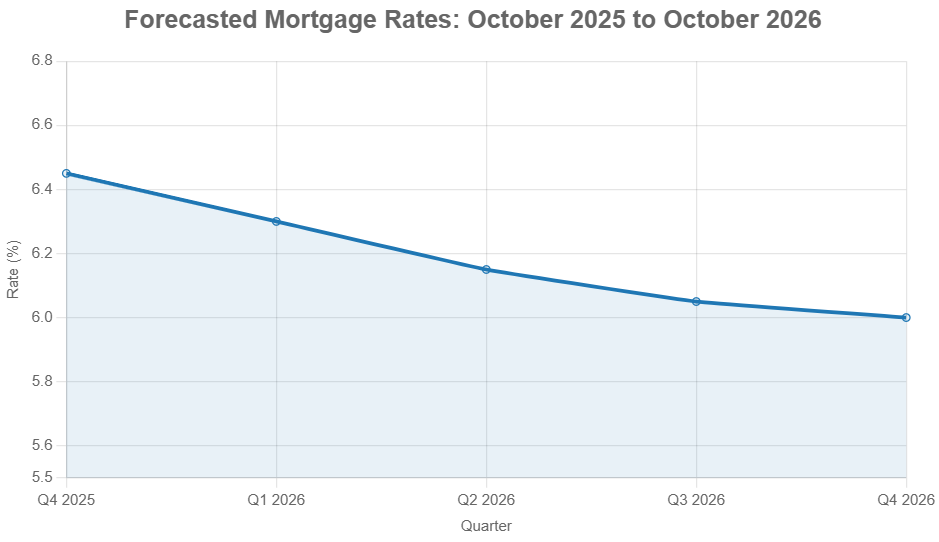

Hoping to buy a home or refinance your current mortgage soon? You're probably wondering what the future holds for interest rates. The good news is that mortgage rates are expected to see a modest decline over the next 12 months, gradually easing from the mid-6% range towards the low 6% range by late 2026. This isn't a crystal ball prediction, of course, but a consensus emerging from the sharp minds at major forecasting institutions. My take on this is that while we won't see a dramatic crash, the slight downward trend offers a much-needed breath of fresh air for affordability.

Mortgage Rate Predictions for Next 12 Months: October 2025 to October 2026

After several years of wild swings – thanks to a global pandemic, a surge in inflation, and the Federal Reserve's efforts to get things under control – many of us are looking for some stability. As we stand here in mid-October 2025, it’s the perfect time to look ahead. This article will unpack the predictions for mortgage rates between October 2025 and October 2026, digging into why these changes are expected and what it means for you. We'll look at what’s driving these numbers, expert opinions, and how you can best position yourself.

A Quick Look Back: The Rollercoaster Ride We've Been On

To truly appreciate where we might be going, we need to briefly glance at where we've been. Remember those unbelievably low rates below 3% in 2020 and 2021? That was a wild time, making it cheaper than ever to buy a home or refinance an existing loan. But then, inflation started marching upwards, hitting a peak of 9.1% in mid-2022. The Federal Reserve responded by hiking its key interest rate multiple times, pushing the average 30-year fixed mortgage rate above 7% by the end of 2023.

Things have been a bit more balanced this year. In 2024, rates have hovered around 6.8%, even dipping into the high 5% range on occasion when there was hope for early rate cuts. Now, as we enter late 2025, rates are sitting around 6.27%. This is a significant drop from the double-digit rates our parents or grandparents might have experienced, but still higher than the recent past. This journey highlights just how sensitive mortgage rates are to economic winds.

Here’s a quick summary of how things have shaken out:

| Year | Average 30-Year Fixed Rate | Key Event |

|---|---|---|

| 2020 | 3.11% | Pandemic stimulus |

| 2021 | 2.96% | Low inflation |

| 2022 | 5.34% | Fed starts raising rates |

| 2023 | 6.81% | Inflation peaks, rates surge |

| 2024 | 6.80% | High rates, economic uncertainty |

| 2025 (YTD) | 6.60% | Fed cuts begin easing |

This history lesson reminds us that while rates feel high right now, they’ve been much, much higher.

The Forces Shaping Tomorrow's Mortgage Rates

You might wonder, “What exactly makes mortgage rates move?” It's not random. Mortgage rates are closely watched indicators tied to bigger economic shifts. Think of mortgage rates as having a close cousin: the 10-year U.S. Treasury yield. Usually, the spread between them is about 1.5% to 2%. So, when the 10-year Treasury yield moves, mortgage rates tend to follow, influenced by government policy, global events, and economic data released right here at home. For the next year, here are the main players:

1. The Federal Reserve's Next Moves

The Fed's federal funds rate is the conductor of the economic orchestra. After a 50-basis point cut in September 2025, the rate is now in the 4.75-5% range. The Fed has signaled plans for two more 25-basis point cuts before the year ends (November and December) and possibly another in early 2026. Their goal is to bring the rate down to around 3.9%. Each cut generally makes borrowing cheaper across the board, which can push mortgage rates lower. However, if inflation starts creeping back up – and it’s currently at 2.4% according to the core PCE index – the Fed might pause these cuts, keeping mortgage rates higher for longer.

2. Inflation and How the Economy's Doing

With the latest inflation reading at 2.4%, the Fed's 2% target is looking achievable. This is good news for those hoping for lower rates. On the flip side, the economy is showing resilience. GDP is projected to grow by 2.1% in 2025, and unemployment remains low at 4.1%. This strength, often called a “soft landing,” means the economy isn't collapsing, which can sometimes lead investors to demand higher returns, pushing yields up. Plus, you can't ignore global events. Any ripple effects from conflicts in regions like the Middle East could push energy prices higher, potentially reigniting inflation concerns.

3. Treasury Yields and the Bond Market Shuffle

As of October 2025, the 10-year Treasury yield is sitting around 4.1%. The general expectation is that it will stay fairly stable around that mark through much of 2026, which would point to mortgage rates in the 6% ballpark. But the bond market can be jumpy. Things like new U.S. debt being issued or shifts in how foreign investors see U.S. markets can cause short-term spikes. We’ve already seen brief jumps before, and more are possible.

How the Housing Market Talks Back

There’s still a shortage of homes for sale – we're looking at about 3.5 months' worth of supply. This scarcity is helping to keep home prices from falling, with Fannie Mae predicting a 2.8% price increase in 2025. As mortgage rates begin to ease, we expect more buyers to enter the market. Fannie Mae also forecasts that home sales will go from 4.72 million units in 2025 to 5.16 million in 2026. This surge in demand, coupled with a potential refinancing boom (projected to jump from 26% of market volume to 35% in 2026), can create its own momentum in the mortgage market.

These factors don't act alone; they influence each other. For example, if job growth reports are stronger than expected, it might signal the Fed to hold off on rate cuts, even if inflation is cooling.

What the Experts Are Saying: Cautious Optimism Prevails

When I look at the forecasts from major players like Fannie Mae, the Mortgage Bankers Association (MBA), and others, a consistent theme emerges: expect stability for the rest of 2025, followed by a gradual dip in rates throughout 2026.

Here’s a snapshot of what some of the leading organizations are predicting for the average 30-year fixed mortgage rate:

| Organization/Expert | End of Q4 2025 | End of Q4 2026 | Notes |

|---|---|---|---|

| Fannie Mae | ~6.4% | ~5.9% | Predicts strong refinance activity |

| MBA | ~6.5% | ~6.4% | More conservative outlook |

| NAR | Mid-6% | ~6.0% | Focuses on affordability challenges |

| Zillow Home Loans | Mid-6% | N/A | Focus on specific market trends |

If we average these out, we're generally looking at rates around 6.45% by the end of 2025, gradually moving down to around 6.0% or perhaps a touch lower by the end of 2026. The differences in these forecasts often come down to underlying assumptions about how quickly inflation will fall or how strong the overall economy will remain.

To help visualize this, imagine a gentle downward slope. We start on a relatively flat plateau in late 2025, and then, throughout 2026, that slope gets a bit steeper as rates ease. There will, of course, be smaller bumps and dips along the way, but the overall direction appears to be downward.

How These Rate Predictions Might Affect You

So, what does this mean for real people like you and me?

- For Homebuyers: If you're looking to buy, the market might feel a bit more accessible as we move into 2026. While rates won't be at historic lows, the easing trend could make monthly payments more manageable. If current rates fit your budget and you’ve found the right home, securing a loan sooner rather than later might still be a good idea, especially if you’re worried about bidding wars erupting as more buyers enter the market. Some lenders offer options like temporary rate buydowns, which can lower your initial payments.

- For Refinancers: This is where the real opportunity might lie, especially in the latter half of 2026. If you have a mortgage with a rate significantly higher than what’s predicted for 2026, refinancing could lead to substantial savings. Even a drop of half a percentage point can save you over $100 per month on a $300,000 loan. Keep a close eye on rates and be ready to act if you hit a sweet spot.

- For Homeowners/Sellers: A more accessible market with slightly lower rates could mean more buyers are willing to make a move. This might lead to increased home sales and can be advantageous if you're planning to sell your current home and buy a new one.

Potential Risks and Opportunities

It's crucial to remember that forecasting is not an exact science.

- Upside Risk: If inflation proves stubborn, or if there are major geopolitical events that disrupt energy supplies, the Fed might keep rates higher for longer. This could push mortgage rates back above 6.5% by late 2026.

- Downside Opportunity: Conversely, if inflation falls faster than anticipated and the economy cools more than expected, we could see the Fed cut rates more aggressively. This might push 30-year fixed mortgage rates below 5.9% by the end of 2026, leading to a significant surge in refinancing activity.

Here’s a quick summary:

| Scenario | Predicted Rate by Oct 2026 | Housing Market Effect |

|---|---|---|

| Base Case (Cooling Inflation) | ~6.0% | Moderate increase in sales activity |

| Upside Risk (Fed Pauses Cuts) | 6.5%+ | Slowdown in sales, continued affordability challenges |

| Downside Opportunity (Fast Fall) | <5.9% | Refinancing boom, increased sales, potential bidding up |

What This Means for Your Financial Strategy

No matter where you stand in the housing journey, here’s my advice based on what I see unfolding:

- If You're Buying: Get pre-approved soon to know what you can afford. If the current rates work for your budget and you're ready, don't wait endlessly. But if you can afford to wait until spring or summer 2026, you might see slightly better rates. Consider looking into rate buydown options offered by builders or sellers – these can be very effective ways to lower your initial payment.

- If You're Refinancing: Do your homework. Use online calculators to see how much you could save with different rate drops. Even a seemingly small decrease can add up over the life of a loan. A 0.5% drop on a $300,000 loan could save you roughly $100-$120 per month. Make sure you understand all the closing costs associated with refinancing.

- General Tips for the Best Rates:

- Boost Your Credit Score: Aim for a score of 740 or higher. The better your credit, the lower your rate.

- Shop Around: Don't just go with the first lender you talk to. Getting quotes from 3-5 different lenders can save you an average of 0.25% on your rate.

- Consider Different Loan Types: If you plan to move in a few years, an Adjustable-Rate Mortgage (ARM) might offer a lower initial rate, though it comes with the risk of future increases.

- Stay Informed: Keep an eye on weekly surveys like Freddie Mac's Primary Mortgage Market Survey. For deeper analysis, check out the insights from the MBA.

Remember, these are general guidelines. Your personal financial situation is unique, so talking to a trusted mortgage broker or financial advisor is always a smart move. They can help you weigh the pros and cons based on your specific goals and circumstances.

The Bottom Line

Looking at the mortgage rate predictions over the next 12 months, I see a trend of gradual improvement. We're moving from the mid-6% range towards the low 6% range, and potentially even dipping below 6% by the end of 2026. It’s not a sudden drop, but a steady, more predictable path.

While economic uncertainties will always exist – from inflation to global events – the consensus among experts points towards a more favorable environment for borrowers in the coming year. For those dreaming of homeownership or looking to improve their current mortgage, this evolving economic picture offers genuine opportunities. Staying informed and prepared will be key to making the best decisions for your financial future. The journey to homeownership might require patience, but the path is becoming clearer.

Grap The Opportunity — Invest in Cash-Flowing Real Estate

As mortgage rates remain high, savvy investors are locking in properties that deliver consistent rental income and long-term appreciation.

Work with Norada Real Estate to find turnkey, cash-flowing homes in stable markets—helping you grow wealth no matter which way rates move.

HOT NEW INVESTMENT PROPERTIES JUST LISTED!

Speak with a seasoned Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Will Mortgage Rates Go Down in 2025: Morgan Stanley's Forecast

- Mortgage Rate Predictions 2025 from 4 Leading Housing Experts

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?