For anyone looking to buy a home, refinance their mortgage, or simply understand where their housing costs might be headed, knowing what mortgage rates will do in the coming years is a huge deal. So, let's talk about mortgage rate predictions for the next 5 years, from 2026 to 2030.

My take? While we won't be seeing those unprecedented sub-3% rates of the pandemic era again anytime soon, I do believe we'll see a gradual easing of rates over the next five years, likely settling somewhere between 5.5% and 6.5% for a 30-year fixed mortgage. This means things will get a bit more manageable for buyers and refinancers, but the dream of super-low rates is probably over for now.

Mortgage Rate Predictions for the Next 5 Years: 2026 to 2030

The Current Vibe: Where We Stand in Late 2025

As I'm writing this, in December 2025, the average rate for a 30-year fixed mortgage is hovering around 6.23%. That's a welcome drop from the higher rates we saw earlier in the year, but it's still a far cry from the rock-bottom rates of 2021. Why are rates still this elevated? It's mostly because the Federal Reserve is playing it cautiously.

They're trying to bring inflation under control, and that means keeping a close eye on short-term borrowing costs, which, in turn, influence the longer-term mortgage rates we see. Right now, the 10-year Treasury yield, a key benchmark for mortgage rates, is sitting around the 4.2% mark.

A Look Back: The Rollercoaster of Mortgage Rates

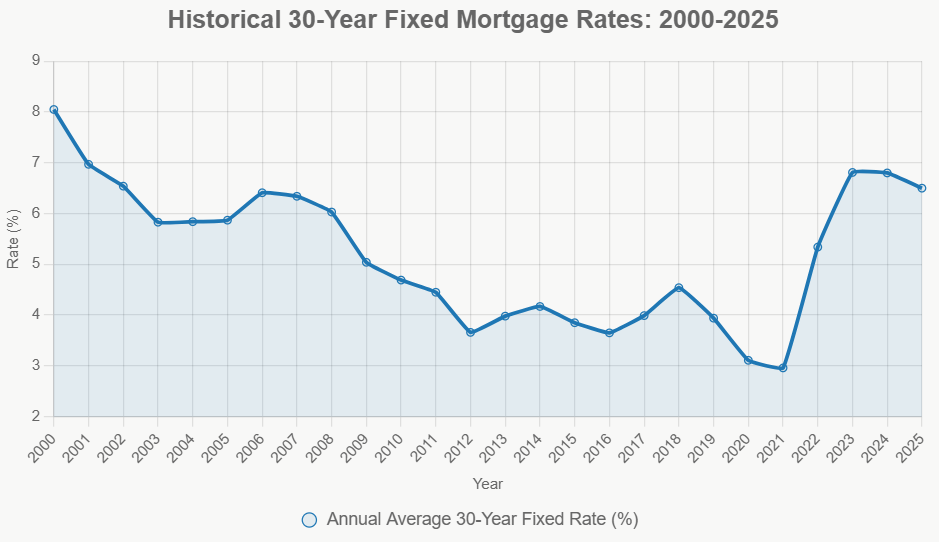

To understand where we’re going, it’s helpful to see where we’ve been. Over the last quarter-century, mortgage rates have done a real tightrope walk. We've seen them soar above 8% in the early 2000s when the economy was booming, and then plunge to historic lows below 3% during the height of the COVID-19 pandemic.

These swings are driven by a mix of factors: the natural ups and downs of the economy, decisions made by the Federal Reserve, and major global events. The jump we saw after 2022, when rates climbed back above 7%, was a direct result of the Fed’s aggressive efforts to combat rising inflation. It really shows us how sensitive mortgage rates are to the overall health of our economy.

Here's a snapshot of how average annual rates have looked over the years:

| Year | 30-Year Fixed Rate (Approx.) | Key Event(s) |

|---|---|---|

| 2000 | 8.64% | Dot-com boom, Fed hikes |

| 2008 | 6.03% | Financial crisis, rate cuts |

| 2012 | 3.66% | Quantitative easing |

| 2021 | 2.96% | COVID-19 pandemic, ultra-low rates |

| 2023 | 6.81% | Inflation surge, Fed rate hikes |

| 2025 | ~6.50% | Tentative stabilization |

This history teaches us a crucial lesson: rates don't tend to stay at extreme highs or lows forever. They usually drift back towards their long-term averages as the economy finds its balance. The current average of around 6.50% in 2025, down a bit from 2024, seems to be the start of that return to more normal levels. But, we can't forget that periods of high inflation, like in the 1980s when rates topped 16%, show us that we should never get too comfortable.

What’s Driving the Rates? The Big Economic Forces

Mortgage rates aren't just plucked out of thin air. They’re closely tied to what’s happening in the broader financial world, especially the 10-year U.S. Treasury yield. Think of it this way: the Treasury yield is the base rate, and then lenders add a bit extra (usually around 1.8% to 2.2%) to cover their risks and account for things like homeowners paying off their mortgages early.

So, what are the key ingredients in this recipe?

- The Federal Reserve's Game Plan: The Fed controls the federal funds rate, which is the interest rate banks charge each other for overnight loans. The Fed has been cutting this rate, and projections suggest it could fall to around 3.4% by the end of 2025 and 2.9% in 2026. When the Fed lowers this rate, it usually brings down Treasury yields, which in turn should help ease mortgage rates. However, if government spending continues to balloon, leading to bigger budget deficits (some forecasts suggest hitting $2 trillion annually by 2028), it could push Treasury yields higher, putting a ceiling on how much mortgage rates can fall.

- The Inflation Story: Inflation is the Fed's main target. We've seen the main inflation numbers (CPI) cooling down to about 2.5% by late 2025. The Congressional Budget Office (CBO) predicts it will get even closer to the Fed's 2% target by 2027. If inflation stays under control, we should see mortgage rates continue to drop. But if new supply chain problems pop up or energy prices spike, inflation could flare up again, just like it did in 2022, pushing rates back up.

- Debt and Global Jitters: The U.S. national debt is a growing concern, projected to reach 120% of GDP by 2030. High debt levels can make investors nervous, and they might demand higher yields on Treasury bonds to compensate for the risk. Global political tensions can also play a role, potentially increasing uncertainty and pushing yields up. On the flip side, if the U.S. economy experiences a mild recession (which economists currently put at a 10-20% chance), the Fed would likely cut rates aggressively, which could accelerate the drop in mortgage rates, potentially seeing them fall even lower than anticipated.

- What's Happening in Housing: Even with interest rates, what's going on in the housing market itself matters a lot. We're still seeing a shortage of homes for sale – only about 3.5 months' supply in 2025. Plus, with millennials continuing to enter their prime home-buying years, demand remains strong. This imbalance between supply and demand can indirectly keep mortgage rates from falling too sharply, as lenders and the market anticipate continued buyer activity.

What Experts Are Saying: A Look at the Forecasts

When I look at what other smart people and institutions are predicting, there’s a general sense of cautious optimism. The consensus is that rates will ease somewhat initially and then settle into a more stable range. Here's a summary of what some key players are forecasting for the average 30-year fixed mortgage rate:

| Year | Fannie Mae Projection (Approx.) | MBA Projection (Approx.) | Consensus Range (Other Sources) | Key Considerations |

|---|---|---|---|---|

| 2026 | 5.9% (end-of-year) | 6.0-6.5% | 5.9-6.4% | Could dip below 6% if yields stabilize at 4% |

| 2027 | N/A | N/A | 6.0-6.4% | Fiscal policy risks might limit rate drops |

| 2028 | N/A | N/A | 5.5-6.2% | Potential for recession-driven drops to 5% |

| 2029 | N/A | N/A | 5.8-6.5% | Stabilization as the economy normalizes |

| 2030 | N/A | N/A | 5.7-6.3% | Long-term average likely to settle around 6% |

Source Insights:

- Fannie Mae talks about a “gradual rebound” in housing and suggests rates might only dip below 6% if quarterly GDP growth stays at a solid 2%.

- The Mortgage Bankers Association (MBA), looking at steady rates between 6% and 6.5% for 2026, sees this as a good balance for continued mortgage activity.

- Other forecasts from places like Yahoo Finance and U.S. News & World Report often echo the idea of rates staying in the 6-7% range unless there's an economic downturn. Morningstar has a more optimistic view, suggesting rates could hit 5% by 2028 if we have a “soft landing” in the economy.

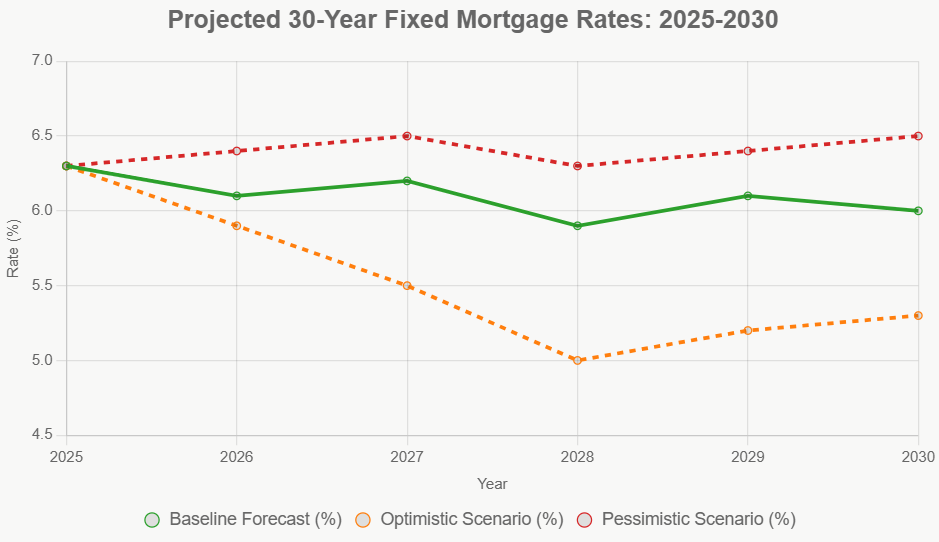

Possible Paths Forward: Best, Average, and Worst Cases

It’s important to remember that forecasting is never an exact science. There are always different paths the economy could take.

- The Optimistic Scenario (about a 20% chance): A recession hits in 2027. This would likely cause the Fed to slash interest rates significantly, potentially bringing 30-year fixed mortgage rates down to around 5% by 2028. We might see a surge in home sales, but the downside would be increased job losses.

- The Most Likely Scenario (about a 60% chance): Inflation stays reasonably controlled, hovering around 2%, and Treasury yields settle in the 4% range. This would keep mortgage rates in the 6% to 6.5% zone. This scenario supports moderate economic growth and allows for home prices to continue rising at a healthy, but not overheated, pace of about 5-7% annually.

- The Pessimistic Scenario (about a 20% chance): Government deficits continue to grow, leading to persistent inflation. This could push Treasury yields up to 5% or higher, keeping mortgage rates stubbornly high, around 6.5% to 7%. In this situation, home affordability would become a serious issue, potentially freezing up the housing market for many buyers.

We also need to consider risks like policy changes around elections that could worsen deficits or unexpected inflation spikes from global commodity markets. On the brighter side, efforts to increase the supply of housing, like reforming zoning laws, could help alleviate some of the demand-side pressure on prices and rates.

What Does This Mean for You?

So, how do these predictions translate into real-world advice for potential buyers, homeowners looking to refinance, and investors?

- For Homebuyers: If you're looking to buy, you should prepare for rates in the mid-6% range. This means your monthly payments will be higher than they were a few years ago. For example, on a $400,000 loan, your monthly principal and interest payment could be over $2,400 – that’s about 20% more than what the same loan cost in 2021. It might make sense to aim for a larger down payment (20% or more to avoid Private Mortgage Insurance, or PMI) and to be flexible with your buying timeline. Some people might consider an Adjustable-Rate Mortgage (ARM) if they plan to sell or refinance within 5-7 years. These often start with a lower “teaser rate” (perhaps in the 5.5-6% range), but remember, that rate will eventually adjust. Tools like rate-lock floats can help protect you from small rate increases for a short period.

- For Refinancers: If you managed to lock in a mortgage rate below 4% during the pandemic, you're in a fantastic position and probably shouldn't refinance unless you need cash. However, for the many homeowners who took out loans at rates above 7% (estimates suggest this could be around 40% of borrowers), waiting for rates to dip below 6% could lead to significant savings. I'm talking potentially $250 or more per month, which adds up to tens of thousands of dollars over the life of the loan.

- For Investors: With rates in the 6% range, the returns on rental properties (known as cap rates) might be tighter, likely around 4-5%. This could make value-added projects and multifamily properties more attractive than quick single-family home flips. Commercial real estate investors might see some challenges if rates stay high, but investments in agency-backed mortgage securities could still offer stability.

Beyond individual finances, these rate predictions have broader societal implications. Persistently higher rates can make it harder for younger generations and first-time buyers to enter the housing market, potentially widening the wealth gap. Policies like expanded down-payment assistance programs could be crucial in bridging this gap.

My Final Thoughts: Prudence and Patience

The next five years won't bring back the days of sub-4% mortgages, and I don't think we should expect that. However, the predicted gradual easing of mortgage rates, bringing them into the 5.5% to 6.5% range, does offer some breathing room for the housing market and for individuals trying to achieve homeownership.

My advice? Keep a close eye on the Federal Reserve's actions and statements, as they are the primary driver of interest rate policy. Focus on building a strong credit score and saving for a substantial down payment.

Don't rush into a decision, and always consider consulting with a trusted financial advisor or mortgage professional who can help you navigate the options based on your specific situation. The key to success in the coming years will be agility – being ready to adapt as economic conditions and interest rates evolve.

Invest Smartly in Turnkey Rental Properties

With rates dipping to their lowest levels this year, investors are locking in financing to maximize cash flow and long-term returns.

Norada Real Estate helps you seize this rare opportunity with turnkey rental properties in strong markets—so you can build passive income while borrowing costs remain historically low.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?