Don't hold your breath for those dreamlike 3% or 4% mortgage rates to reappear anytime in the next few years. Most economists and housing experts are pointing to a future where rates settle into a much higher “new normal” of somewhere between 5.5% and 6.5% for the foreseeable future, meaning a return to those ultra-low pandemic-era numbers is highly improbable before 2030. If they do come back, it would likely require a significant global economic shake-up, not just a gentle economic breeze. The days of snagging a 30-year fixed rate below 4% feel like a distant, almost surreal memory.

Mortgage Rate Predictions Through 2030: 3% and 4% Rates Are Unlikely to Return Soon

What are the Experts Saying? The “New Normal” of Higher Rates

The consensus is pretty strong. Those incredibly low rates we enjoyed a few years back? They were a product of extraordinary circumstances, a kind of economic adrenaline shot to keep things from collapsing during the pandemic. It wasn't sustainable in the long run, and now we're seeing the aftermath.

Here’s a breakdown of what the crystal balls are showing for the next few years:

- 2026–2027: Expect mortgage rates to largely hang out between 5.9% and 6.5%. Fannie Mae, a big name in the mortgage world, thinks we might see rates dip just below 6% (around 5.9%) by late 2026, but then they’re predicted to stay pretty much stuck there through 2027. It’s like they’ll hit a plateau.

- 2028–2029: A few optimists are whispering that rates could potentially touch 5.5% during this period. But this is a big “if.” It would only happen if inflation stays super low and the economy takes a serious nosedive. Not exactly a rosy outlook for that to occur.

- 2030: By the time we ring in the new decade, some analysts, like those at Redfin, suggest that a sense of “normal” affordability might return. However, this is based on rates stabilizing around that 5.5% mark, not a magical comeback to the 3% or 4% club.

It's important to remember that these are projections, educated guesses based on the best data available. Life, and especially the economy, has a knack for throwing curveballs. But as it stands, the outlook isn't painting a picture of super-cheap borrowing.

Why Your Dream of 3% or 4% Rates is Likely a No-Go

So, what’s holding those rates back from diving back into the abyss of what we once considered normal? It boils down to a few key economic realities.

- Historical Context Isn't Working in Our Favor: Think about it. The current rates, often hovering in the 6% range, are actually lower than the long-term historical average for a 30-year fixed mortgage. Since 1971, that average has been around 7.74%. So, in a strange way, we're almost back to “normal” when compared to decades of history, rather than the pandemic anomaly.

- Treasury Yields – The Unseen Force: The 10-year Treasury yield is like the big brother of mortgage rates. It doesn't dictate them exactly, but it sets a strong influence. And right now, the predictions are for this yield to stay above 4% all the way through 2030. This creates a kind of hard floor, a barrier that prevents mortgage rates from plummeting into the 3% or 4% territory. There’s just too much cost baked in for lenders.

- “Emergency Mode” is Over: For rates to drop that dramatically again, we’d probably need another massive global economic crisis. Think of the 2008 financial meltdown or the early days of COVID-19. These were situations where the Federal Reserve had to step in with extreme measures, printing money and slashing interest rates to emergency lows, to prevent total collapse. Experts simply don't see the conditions right now for such drastic interventions.

Digging Deeper: What Needs to Happen for Rates to Drop

It’s not just about wishful thinking. For the 10-year Treasury yield to consistently dip below 4% again, and consequently pull mortgage rates down with it, some pretty significant economic shifts would need to occur.

Here are the conditions that would likely pave the way for lower yields and, therefore, potentially lower mortgage rates:

- A Serious Economic Slowdown or Recession: If the U.S. economy starts to stumble significantly, with unemployment climbing noticeably (think consistently above 4.5%) and the Gross Domestic Product (GDP) shrinking, investors tend to flee riskier assets and pile into the safety of U.S. Treasuries. This surge in demand pushes bond prices up and yields down. We’ve seen this pattern before, especially in the lead-up to economic downturns.

- Inflation Under Control (Like, Really Under Control): The Federal Reserve aims to keep inflation at 2%. For Treasury yields to drop below 4%, the market’s expectation for long-term inflation would need to become very low, staying close to or even below that 2% target. If people and businesses believe prices will stay stable, investors don’t need as high a yield to protect their purchasing power.

- The Fed Reverses Course Aggressively: If the economy tanks, the Federal Reserve might start cutting its main interest rate (the federal funds rate) dramatically. This action signals to the market that money will become cheaper, and it puts downward pressure on longer-term yields. The 10-year Treasury yield is very sensitive to expectations about where the Fed’s short-term rates are headed.

- Government Borrowing Scales Back: The U.S. government borrows a lot of money by issuing Treasury bonds. When there’s a huge supply of new bonds, it can push yields up if demand doesn’t keep pace. If the government significantly reduces its borrowing or creates a credible plan to lower its deficit, this could reduce the supply of bonds and help lower yields.

- Global Chaos Fuels “Safe Haven” Demand: The U.S. Treasury is often seen as a safe place to park money during times of global uncertainty. If a major international crisis or widespread geopolitical instability erupts, investors worldwide might rush to buy U.S. debt, driving up demand and pushing yields down. We saw a version of this during the early days of the pandemic.

The Federal Reserve's Own Projections

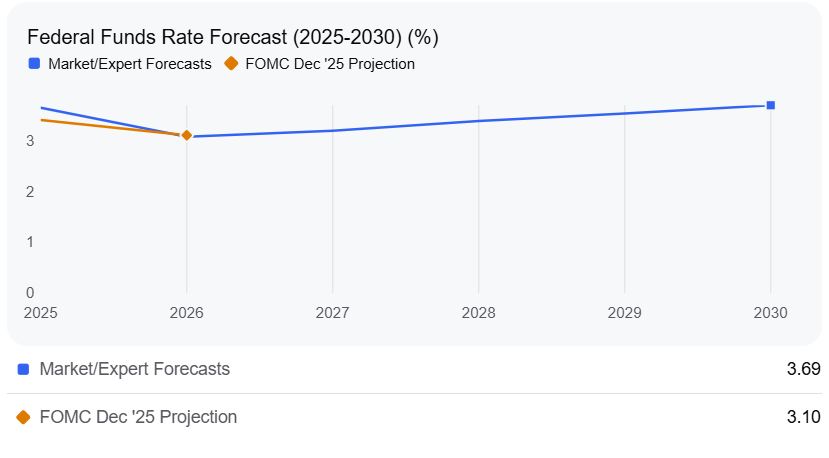

Even the Federal Reserve's own long-term projections for its key interest rate, the federal funds rate, offer some perspective. They see this “neutral” rate settling around 3%. This is the rate they believe allows the economy to grow without overheating or slowing down too much.

Current market and Fed projections show a gradual path of rate cuts from where we are now, likely stabilizing near that 3% mark in the longer run. However, market forecasts suggest the actual federal funds rate might even tick up slightly beyond that 3% neutral rate by 2030, perhaps hitting around 3.69%.

This data essentially reinforces the idea that while rates might come down from their current peaks, they're not expected to plummet to the historically low levels we've recently experienced. The Federal Funds Rate Forecast (2025-2030) chart provides a visual of this:

The key takeaway here is that all these forecasts are data-dependent. The path of inflation and the strength of the job market will be the primary drivers dictating exactly where interest rates end up.

So, What Does This Mean for You?

If you're in the market for a home, or looking to refinance, it means adjusting your expectations. Those significantly lower mortgage payments that seemed within reach a couple of years ago might require a different approach.

- Budget Realistically: When you're planning your home purchase, make sure your budget accounts for interest rates in the 5.5% to 6.5% range, not the 3% or 4% you might have hoped for.

- Focus on Affordability: Instead of banking on falling rates, focus on finding a home within your current budget and consider paying down your principal more aggressively if you can afford it.

- Don't Wait for a Miracle: While rates could fluctuate, the widespread expert opinion is that a return to the extreme lows of the pandemic era is unlikely for many years. It might be more practical to make your move now if your circumstances allow, rather than hoping for a massive rate drop that may not materialize.

For those of us who’ve been following the housing market for a while, this shift can feel like a real change. I remember when rates were in the 7s and 8s, and then suddenly we were seeing 3s. It felt like a different world. Now, we’re seeing a return to a more historically common range, but with the added impact of higher starting prices in many areas.

Ultimately, while 3% or 4% rates might not be on the horizon for a while, understanding these predictions can help you make smarter financial decisions. Staying informed about economic trends and consulting with a trusted mortgage professional will be your best allies in navigating the current mortgage market.

Invest in Fully Managed Rentals for Smarter Wealth Building

Analysts warn that mortgage rates are unlikely to return to the ultra-low 3–4% range this decade, with long-term averages expected to remain higher due to inflationary pressures and economic shifts.

For investors, this means planning for financing at elevated levels—Norada Real Estate helps you secure turnkey rental properties designed for strong cash flow even in higher-rate environments.

Also Read:

- Mortgage Rates Reset 2026: Ultra-Low Rates End, 6% Becomes Normal

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?