Buying a home feels like playing a guessing game with the economy sometimes, doesn't it? One minute rates are inching down, giving you a glimmer of hope, and the next they’re bouncing back up, making affordability feel like a distant dream. If you’re trying to figure out when might be the right time to buy, sell, or refinance, you’re definitely not alone. So, what are the mortgage rate predictions for the next 3 years?

From where I stand, looking at the trends and talking to folks in the know, my best guess is that we’ll see rates settle into something more predictable, likely hovering in the mid-6% range through 2028. We probably won't see those shocking sub-3% rates again anytime soon, but this stabilization could actually bring some much-needed calm to the housing market.

Mortgage Rates Predictions for the Next Three Years: 2026 to 2028

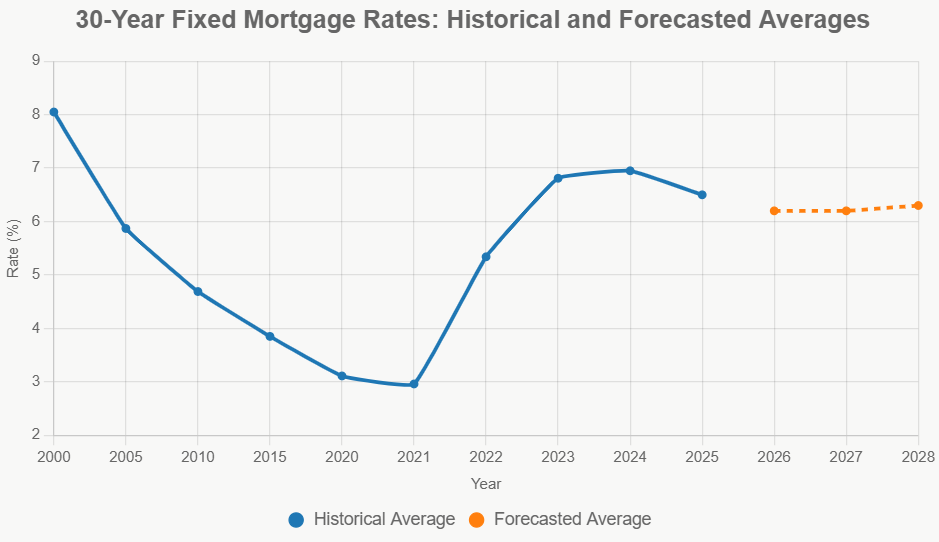

It’s been quite a ride, hasn't it? Remembering the days when getting a mortgage felt like finding gold – rates were unbelievably low, dipping below 3% during the pandemic chaos. It felt like the world had turned upside down, and borrowing money became incredibly cheap. Before that, things were more normal, maybe hovering in the 4-5% range for a long time. And way back, before I even got into this business full-time, rates were often in the 7% or 8% range. Now, after inflation went a bit wild, we're back up in the 6% territory, which feels high compared to the recent past, even though it’s not historically extreme.

Why Rates Have Been Such a Rollercoaster

If you’re trying to wrap your head around why mortgage rates have been swinging like a pendulum, it really boils down to a few key things happening in the bigger economic picture. Think of it like weather – lots of different forces coming together to create the conditions we experience.

- The Federal Reserve's Balancing Act: The Fed is like the economy's thermostat. They have two main jobs: keep prices stable (fight inflation) and keep people employed. When inflation got too high recently, they cranked up their main tool, the federal funds rate. Since mortgage rates tend to follow the direction of this rate (even if not perfectly 1:1), ours went up too. My feeling is the Fed is walking a tightrope. They want to bring inflation down to their target (around 2%) without causing a massive recession. So, they’ve been slowly cutting rates, and they’ll likely continue if inflation keeps cooling. As of late 2025, rates are around 4.5%-4.75%, and they might nudge down further, but they'll be cautious. A stubborn economy or unexpected inflation spikes could make them pause or cut slower than we’d like.

- The 10-Year Treasury Yield – Mortgage Rates' Big Brother: A lot ofwhat happens with mortgage rates is closely tied to the interest paid on U.S. Treasury notes, especially the 10-year one. Think of it as a benchmark. When investors feel nervous about the economy, they often pour money into Treasuries, pushing their prices up and yields (interest rates) down. When they're confident, they might sell Treasuries for riskier investments, pushing yields up. Right now, forecasts suggest the 10-year yield might ease a bit, maybe settling around 4.1% in the coming years. This usually means mortgage rates follow suit, but not always exactly.

- Inflation and Economic Speed: As I mentioned, high inflation was the main reason rates shot up. While it's cooling, sitting around 2.5% in late 2025, it’s not quite at the Fed's 2% goal yet. If inflation stays sticky or creeps back up, the Fed might keep rates higher for longer. On the flip side, if the economy grows steadily (like the projected 2.1%–2.4% for 2026), that's generally good news. A strong economy usually supports slightly higher rates, but if growth falters badly and signals a recession, that could push rates down faster as the Fed tries to stimulate things. It’s a tricky balance.

- The Rest of the World and Unexpected Shocks: It might seem strange, but things happening overseas – conflicts, energy price shocks, trade disputes, even elections in other major countries – can ripple through our economy and affect mortgage rates. Remember 2021 when supply chain issues popped up everywhere? That added to inflation and indirectly pushed rates up. We have to keep an eye on global stability because unexpected events can cause major market jitters, leading to rate volatility.

- The Housing Market Itself: Believe it or not, the housing market’s own health plays a role. Even with higher rates, demand for homes is still pretty strong in many areas, and the number of homes for sale (inventory) remains stubbornly low. This imbalance helps keep home prices climbing, albeit at a slower pace now (maybe 1-2% per year). While rising prices might seem good for sellers, it keeps affordability a challenge for buyers, which can indirectly influence lender confidence and rate setting over the long term.

What the Experts Are Saying (And What I Think)

Everyone from big banks to government-sponsored enterprises has an opinion on where rates are headed. While forecasts always have a range, most seem to agree that the dramatic drops of the pandemic era are behind us for now. Here’s a snapshot based on the latest outlooks for the 30-year fixed mortgage rate:

| Forecast Source | 2026 Average | 2027 Average | 2028 Average | My Quick Take |

|---|---|---|---|---|

| Fannie Mae | ~6.0% | ~6.0% | N/A | Most optimistic, betting on quick Fed action. |

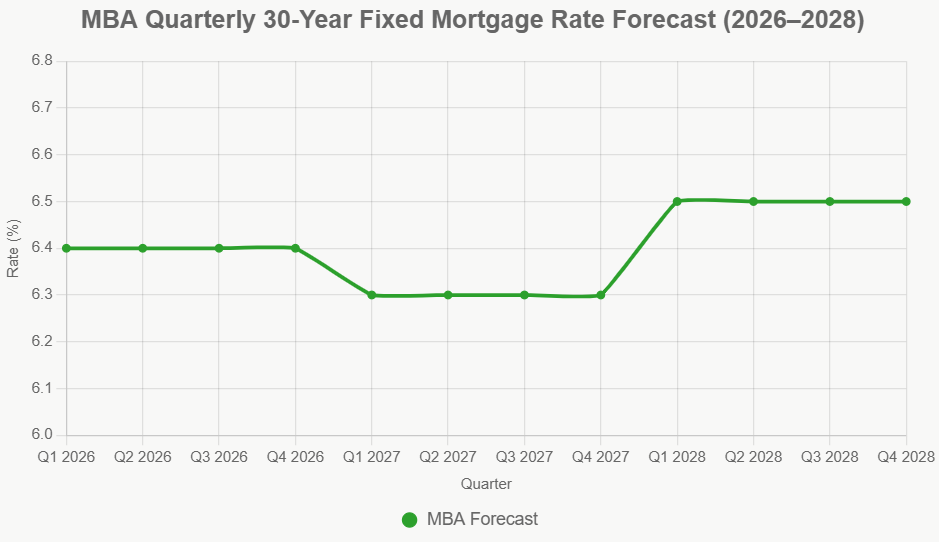

| Mortgage Bankers Assoc. (MBA) | 6.4% | 6.3% | 6.5% | More cautious, sees rates sticking higher for longer. |

| NAHB | 6.19% | Improving (~6.0%) | N/A | Similar to Fannie Mae, slightly more conservative. |

| Redfin | 6.3% | N/A | N/A | Mid-range prediction for next year. |

| My Consensus Estimate | ~6.2% | ~6.2% | ~6.3% | A realistic average, acknowledging uncertainty. |

You can see there’s a general agreement that rates will likely stay above 6% for the next three years. Fannie Mae seems to think rates could dip below 6% sooner rather than later, likely banking on inflation cooperating fully with the Fed. The MBA, though, brings up a good point – things like ongoing government spending could potentially keep demand high and inflation from falling too fast, arguing for rates to stick closer to the mid-6% range.

Looking at the detailed quarterly forecasts (like the MBA's projected stability), it paints a picture not of wild swings, but of gradual adjustments. Personally, I lean towards the MBA’s cautious view. Predicting the exact path of inflation and the Fed’s reaction is incredibly difficult. There are just too many variables. So, assuming stability around the 6.2% to 6.4% mark feels like the most grounded expectation for the average borrower over the next few years. This doesn't mean rates won't dip below 6% occasionally, or spike temporarily, but the average trend seems to be pointing towards this range.

What This Means for You (The Real Impact)

Okay, numbers are one thing, but what does a mortgage rate around, say, 6.25% actually mean for you and your wallet?

- For Homebuyers: Let's crunch some numbers. If you borrow $400,000, a rate of 6.25% means your monthly principal and interest payment is roughly $2,460. Compare that to 2021 when rates were around 3%, and that same $400,000 loan had a payment of about $1,690. That's a difference of nearly $800 per month! This directly impacts how much house you can afford. You might need a bigger down payment, have to look at smaller homes, or accept a higher monthly burden. First-time buyers, especially, might find it tough. Programs like FHA loans can help by allowing higher debt-to-income ratios, but it’s still a stretch for many.

- For Refinancers: A huge number of homeowners refinanced a few years back and locked in rates below 4%, many even below 3%. This created a powerful “rate lock-in” effect, where people are hesitant to sell or move because they’d lose their super-low rate. As rates hover in the mid-6% range, refinancing isn't attractive for most of these homeowners. However, if rates were to dip significantly, say below 5.9%, it could become appealing again for some, potentially saving them hundreds on their monthly payments. But right now, the incentive isn't strong enough for mass refinancing.

- For the Market: The MBA predicts about $2.2 trillion in single-family mortgage originations for 2026 – that's up 8% from 2025. This suggests that even with rates higher than the lows, enough people are buying or needing mortgages to keep the industry busy. They also expect home sales to rise slowly, maybe reaching 4.5 million annually by 2027. My take is that this gradual increase is healthier than the frenzy we saw before. It suggests a market finding its footing, though record-low inventory might still be a bottleneck, preventing huge leaps in sales volume.

Smart Moves in Today's Market

Given this outlook, what can you actually do? I always tell people it’s about being prepared and strategic.

- If You're Buying: Don't wait endlessly for rates to plummet back to 3%. If you find a home you love and can afford it now at current rates (maybe mid-6%), seriously consider locking it in. You can always refinance later if rates drop significantly. Explore options like temporary rate buydowns offered by sellers or builders – these can lower your rate for the first year or two, easing the initial affordability crunch.

- Consider ARMs (Carefully): Adjustable-Rate Mortgages (ARMs) often start with a lower rate than fixed mortgages. If you plan to sell or refinance before the rate starts adjusting (usually after 5, 7, or 10 years), an ARM might save you money. But be very aware of the risks if your plans change.

- Boost Your Credit Score: This is non-negotiable. A higher credit score qualifies you for better rates. Even a half-percent difference can save you tens of thousands over the life of a loan. Focus on paying bills on time and reducing debt.

- Save for a Bigger Down Payment: A larger down payment reduces the loan amount, meaning a lower monthly payment regardless of the rate. It also helps you avoid Private Mortgage Insurance (PMI) on conventional loans once you reach 20% equity.

- Shop Around: Don't just go to one lender. Get quotes from multiple banks, credit unions, and especially mortgage brokers. Rates and fees can vary significantly.

My Bottom Line: Stability Amidst Uncertainty

Looking ahead, the mortgage rates predictions for the next 3 years point towards a period of relative stability, likely centered in the 6.2% to 6.4% range. While this isn't the rock-bottom borrowing cost we saw a few years back, it's far from the worst rates in history. This greater predictability could be a good thing, allowing potential buyers who were waiting on the sidelines to re-enter the market more confidently and helping the housing market find a more sustainable rhythm.

My advice? Stay informed. Keep an eye on inflation reports and the Federal Reserve's announcements. Talk to trusted mortgage professionals to understand how different rate scenarios impact your personal finances. Focus on what you can control – your credit score, your savings, your budget. While rates are a huge piece of the puzzle, they're just one piece. Being financially prepared is your best strategy for navigating whatever the next few years bring.

Invest Smartly in Turnkey Rental Properties

With rates dipping to their lowest levels this year, investors are locking in financing to maximize cash flow and long-term returns.

Norada Real Estate helps you seize this rare opportunity with turnkey rental properties in strong markets—so you can build passive income while borrowing costs remain historically low.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rates Predictions for the Next 2 Years: 2026-2027

- Mortgage Rate Predictions for the Next 5 Years: 2026 to 2030

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?