Get ready, because the next 90 days are shaping up to be a period of relative stability for mortgage rates, with the average 30-year fixed rate likely to hover around 6.2%. While no one can predict the future with perfect accuracy, the smart money is on a gentle cooling rather than a dramatic drop. This means potential buyers and refinancers can expect a housing market that's a bit more predictable than the wild ride of the past few years, though significant savings below the 6% mark are unlikely in this initial window.

Mortgage Rates Predictions for Next 90 Days: January 2026 to March 2026

The buzz around the housing market in early 2026 is one of careful optimism. After a 2025 where the Federal Reserve began to ease up on interest rate hikes, we're entering the quarter from January to March 2026 with a slightly different vibe. Mortgage rates, which had been a source of big ups and downs, are expected to settle into a more stable groove. I've spent a lot of time digging into what the experts are saying, and I have some thoughts on what this means for you.

A Quick Look Back: How We Got Here

To truly understand where we're going, it helps to remember where we've been. Remember those unbelievably low mortgage rates, the ones that dipped below 3% back in 2020 and 2021? They made buying a home feel like a dream for many. But then, the Federal Reserve started hiking rates aggressively to fight off rising inflation, and by late 2023, we were seeing rates climb over 9%! It was tough for anyone trying to buy a house or refinance.

By the middle of 2025, rates had thankfully leveled off a bit, settling in the 6.5% to 7% range. But the big news was the Federal Reserve's decision to start cutting rates. By December 2025, we saw a noticeable dip, bringing the 30-year fixed mortgage rate down to about 6.21%. This dip is a direct result of inflation cooling down from its peak. While job growth has remained strong, the overall economic picture is pointing towards a calmer period.

One thing that's still a factor, though, is the “lock-in effect.” Many homeowners who secured those super-low pandemic-era rates are hesitant to sell and buy again at higher rates. This means the number of homes for sale is still a bit limited, which has kept home prices from falling drastically. As we step into 2026, don't expect rates to suddenly snap back to those record lows. The cost structure of things has shifted, and demand from the large millennial generation for homes is still robust.

Peeking at January to March 2026: The Rate Forecast

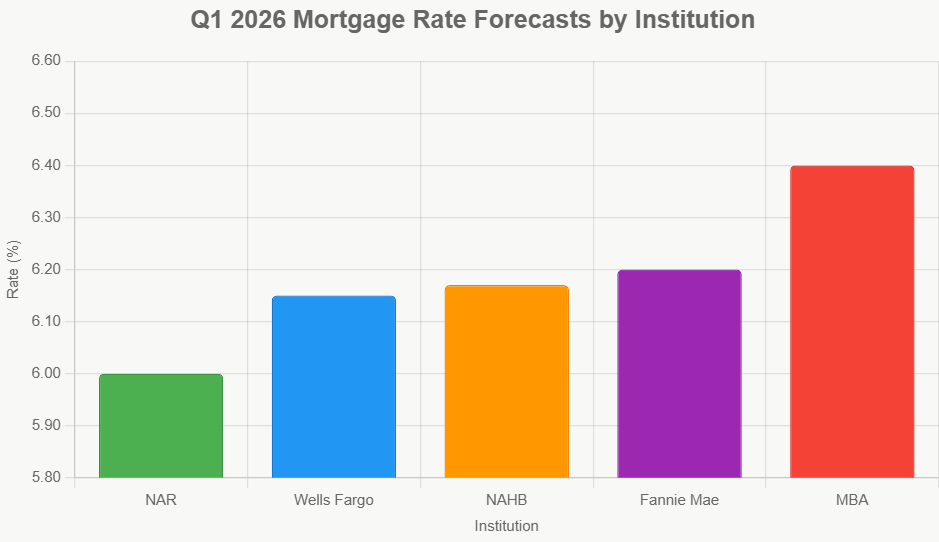

When I look at the predictions from various financial institutions, a clear theme emerges: the 30-year fixed mortgage rate should stay pretty steady, or even dip a tiny bit. Most sources are putting the average rate somewhere between 6.0% and 6.4%, with the sweet spot being around 6.2%.

Here’s a breakdown of what some leading organizations are forecasting for the 30-year fixed mortgage rate in Q1 2026:

| Institution | Q1 2026 Forecast | Key Rationale for Forecast | Potential Impact on Borrowers |

|---|---|---|---|

| National Association of Realtors (NAR) | 6.00% | Assumes steady economic growth and additional Fed rate cuts will materialize. | Most optimistic for buyers; potentially lower monthly payments. |

| Wells Fargo | 6.15% | Factors in persistent wage pressures that might keep inflation from falling too fast. | Slight affordability buffer, but not a dramatic shift. |

| National Association of Home Builders (NAHB) | 6.17% | Considers construction material costs and improvements in housing supply chains. | Balanced outlook, reflecting construction realities. |

| Fannie Mae | 6.20% | Projects gradual quarterly declines, ending 2026 at 5.9%. | Suggests a foundational rate for early 2026. |

| Mortgage Bankers Association (MBA) | 6.40% | A more conservative view, anticipating higher Treasury yields and loan activity. | Could mean slightly higher borrowing costs for some. |

| Consensus Average | ~6.18% | Weighted average of forecasts, indicating market expectations. | A stable, slightly easing rate environment. |

These estimates align with broader 2026 outlooks: Fannie Mae anticipates an annual average near 6.0%, while MBA holds at 6.4% for the full year. S&P Global Ratings offers an even more optimistic lens, forecasting a 2026 average of 5.77%, driven by robust non-agency mortgage-backed securities issuance. Redfin and other analysts peg the yearly average at 6.3%. For the specific window of January to March, the general consensus is that rates will hover in the mid-6% range.

For those considering adjustable-rate mortgages (ARMs), which typically start lower than fixed rates, we might see initial rates in the 5.5% to 5.7% range. These could be appealing for people who plan to move or refinance within a few years, but remember, they come with the risk of going up later. FHA and VA loans, often used by first-time buyers, tend to be a little lower than conventional mortgages, so they might fall into the 5.8% to 6.0% range during this period.

What's Driving These Rates? The Key Influencers

Mortgage rates aren't just plucked out of thin air. They're deeply connected to what's happening in the broader economy. Here's a look at the core forces we'll be watching in Q1 2026:

| Influencer | Expected Q1 2026 Scenario | Potential Impact on Mortgage Rates | Sensitivity Level |

|---|---|---|---|

| Federal Reserve Policy | 2-3 more 25-bps cuts in the Fed Funds Rate, targeting 3.00%-3.25% by mid-year. | Each cut can shave 0.10%-0.25% off mortgage rates. A steady pace of cuts will contribute to the predicted decline. | High |

| Inflation (Core PCE) | Projected to ease to 2.3%, down from 2.6% in Q4 2025. | Lower inflation generally leads to lower bond yields and mortgage rates. Sticky services inflation is the key risk. | High |

| Economic Growth (GDP) | Expected to remain strong at 2.0%-2.5%. | Robust growth can signal a healthy economy, potentially leading to higher yields if demand outpaces supply. However, if growth is driven by stable-as-expected expansion, it supports current rate trends. | Medium |

| Unemployment Rate | Forecasted to remain low, potentially ticking up slightly to 4.2%-4.3%. | A slight tick up could encourage faster Fed rate cuts. A sharp rise would signal economic weakness, likely lowering rates as investors seek safer assets. | Medium |

| 10-Year Treasury Yield | Anticipated to average 3.8%-4.0%. | This is a direct benchmark. Higher yields mean higher mortgage rates, and vice-versa. Market sentiment and Treasury auctions are key. | Very High |

| Housing Supply & Demand | Housing starts projected at 1.4 million annually; inventory expected to rise 15% YoY. | Increased supply can moderate price growth and potentially ease some demand-side pressure on rates. However, strong demographics will keep demand robust. | Medium |

| Global Economic & Geopolitical Events | Ongoing geopolitical tensions and energy price volatility within Europe. | Unexpected global flare-ups can cause flight-to-safety in bond markets, pushing Treasury yields (and mortgage rates) down temporarily. Conversely, supply disruptions could increase costs. | Medium |

Key Influencer Breakdown:

- Federal Reserve Actions: The Fed's intentions are usually telegraphed. Their December 2025 “dot plot” (a graphic showing individual members' predictions for future interest rates) suggested a path of gradual cuts throughout 2026. If they stick to this and inflation cooperates, we'll see mortgage rates follow suit. The FOMC meeting at the end of January 2026 will be a critical confirmation point.

- Inflation Dynamics: While overall inflation is cooling, the rate at which it declines is crucial. If services inflation (like healthcare and rent increases) remains elevated, it could prevent rates from falling too quickly. We'll be watching the January Personal Consumption Expenditures (PCE) price index report very closely.

- Employment and Growth Metrics: We're not on the verge of a recession, which is good news for stability. If job growth continues at a healthy pace (around 150k-180k per month), it supports consumer spending and signals a resilient economy. However, if unemployment were to jump unexpectedly, that would be a stronger signal for the Fed to accelerate rate cuts, potentially pulling mortgage rates down more significantly.

- Global and Supply-Side Factors: The world can be unpredictable. Any major geopolitical event, particularly involving energy supplies, can cause a ripple effect. On the positive side, improvements in how we build and deliver homes can help ease price pressures.

- Investor Sentiment and Bond Markets: The bond market is essentially a collective guess of future interest rates and economic conditions. If investors feel confident about the economy easing into a soft landing, they'll demand higher yields, pushing mortgage rates up. If they anticipate a slowdown or recession, they'll pour money into safer bonds, driving yields down.

What This Means for You and the Housing Market

These predicted mortgage rates in the first quarter of 2026 aren't just numbers; they have real-world effects:

- For Buyers: If you've been on the fence, the 6.2% rate range might offer a slight improvement in affordability. For example, on a $400,000 loan, a drop of even 0.25% could save you $50-$100 a month. This can make a difference, especially for first-time homebuyers trying to get their foot in the door.

- For Refinancers: If your current mortgage rate is above 6.5%, then the potential for lower rates in Q1 2026 could be a great opportunity for you. However, if you managed to lock in a rate below 5% in years past, you'll likely be happy to hold on to that.

- Home Prices and Availability: With rates stabilizing and starting to decline slightly, we should see more people feeling comfortable enough to buy. This could help the number of homes for sale increase by around 15% year-over-year. We're also looking at home prices continuing to grow, but probably at a more modest pace of 3-4% nationally, a far cry from the double-digit jumps we saw in recent years.

Here’s a look at how some key housing market metrics are expected to perform, based on projections from industry leaders:

| Housing Market Metric | Q4 2025 Estimate | Q1 2026 Projection | Significance for Borrowers |

|---|---|---|---|

| Existing Home Sales | 4.1 million | 4.2 million | Suggests continued buyer activity, with slightly more options likely appearing on the market. |

| New Home Starts (Annualized) | 1.35 million | 1.38 million | Indicates builders are responding to demand, which can help increase overall housing inventory. |

| Median Home Price Growth | ~3.5% YoY | ~3.0% YoY | Moderating price growth means homes become more accessible, especially when combined with rate stability. |

| Home Affordability Index | ~92 | ~95-97 | An increase means a household with median income has more purchasing power relative to median home prices. |

This snapshot suggests a housing market that's continuing to move, but at a more sustainable pace.

VS

Two contrasting investments: St. Louis affordability with high cap rate vs Florida luxury with strong cash flow. Which fits YOUR strategy?

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060

Looking Beyond January-March 2026

While the first quarter is our focus, projections suggest that mortgage rates will likely continue their gradual descent throughout 2026. Fannie Mae, for example, anticipates rates ending the year closer to 5.9%. This ongoing trend could fuel even more activity in the housing market later in the year as affordability continues to improve. However, it's crucial to remember that fundamental issues, like the need for more housing and improvements to infrastructure, won't disappear overnight. This means we're unlikely to see rates plummet to 5% or below unless there's a significant economic shock, such as a deep recession.

So, think of January to March 2026 as a crucial transition period. It's a time to see how the economic shifts of late 2025 start to play out and set the stage for the rest of the year. Stay alert, keep an eye on those economic reports, and be ready to act when the time is right for you.

Want Stronger Returns? Invest Where the Housing Market’s Growing

Turnkey rental properties in fast-growing housing markets offer a powerful way to generate passive income with minimal hassle.

Work with Norada Real Estate to find stable, cash-flowing markets beyond the bubble zones—so you can build wealth without the risks of ultra-competitive areas.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rate Predictions for 2026: Insights from Leading Forecasters

- Will Mortgage Rates Go Down Below 6% in the Next 60 Days?

- Who Benefits Most from Today's Lower Mortgage Rates?

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?