Feeling a bit lost trying to figure out where mortgage rates are headed? You're not alone. The journey has been quite a rollercoaster lately, leaving many of us scratching our heads about buying a home or refinancing. But here's the scoop for Mortgage Rates Predictions for the Next 2 Years: most experts, and I agree, anticipate a gradual, modest decline, settling the average 30-year fixed rate somewhere in the low 6% to high 5% range by late 2027, driven primarily by expected Federal Reserve rate cuts and cooling inflation. A dramatic return to the super-low, sub-5% rates we saw a few years ago? Not likely without some major, unexpected economic shake-ups.

Mortgage Rates Predictions for the Next 2 Years: Expecting a Gradual Glide, Not a Plunge

My Perspective from the Current Vantage Point (End of 2025)

As we close out 2025, I’ve been keeping a close eye on the numbers, and they tell an interesting story. The average 30-year fixed mortgage rate has been hovering around 6.2%, according to the latest figures from reliable sources like Freddie Mac. From my perspective, this is a welcome, albeit slight, easing compared to the higher peaks we saw earlier this year, reaching near 7%.

It’s a bit of a mixed bag; while it’s down, it’s still significantly higher than the historically low rates below 3% that many of us enjoyed just a few years ago in 2020-2021. This current mid-6% range reflects a persistent, though hopefully softening, pressure from inflation, coupled with the Federal Reserve’s careful approach to monetary policy. It’s definitely a new normal compared to the past decade, and it means affordability remains a significant challenge for many aspiring homeowners.

A Look Back to Understand What's Ahead: The Historical Context

To truly grasp where we might be going, I always find it helpful to look at where we've been. Mortgage rates aren't just random numbers; they're deeply tied to decades of economic cycles. Since Freddie Mac started tracking in the early 70s, we've seen everything from eye-watering highs of over 16% in 1981 (talk about sticker shock!) to the pandemic-era lows below 3%.

The 2000s saw rates fluctuate around 6-8%, before the post-Great Recession era settled them below 5% for an extended period, pushed down by the Fed's efforts to stimulate the economy. Then came the surge in 2022-2023, as the Fed aggressively raised rates to combat inflation.

What this history teaches me is that volatility is the norm, not the exception. The median 30-year fixed rate since 1971 sits at 7.31%. So, while today's rates in the low to mid-6% range feel elevated compared to the recent past, historically speaking, they're actually below average. This perspective is crucial for managing expectations: we shouldn't necessarily expect to return to those “free money” rates of the early 2020s, but rather to operate in a more typical, albeit challenging, historical band.

The Big Movers and Shakers: What Truly Drives Rates?

Understanding what moves mortgage rates is like understanding the gears of a complex machine. They don't just shift on their own; they respond to powerful economic forces. From my experience watching the markets, there are primarily three big levers.

Federal Reserve Actions Explained

This is often the first thing people think of, and for good reason. The Federal Reserve's federal funds rate directly influences banks' short-term borrowing costs. While mortgage rates are more closely tied to longer-term debt, like the 10-year Treasury bond, what the Fed does ripples through the entire financial system. When the Fed raises rates, it generally makes all borrowing more expensive, pushing mortgage rates up. The good news? The data suggests the Fed's rate hikes might be largely behind us.

Projections show the federal funds rate potentially easing from 3.4% by end-2025 down to 2.9% in 2026. Each 0.25% cut by the Fed won't immediately drop mortgage rates by the same amount, but it could shave off 0.1-0.2% of mortgage rates, typically with a 3-6 month lag. This gradual easing is the primary reason I expect rates to trend downwards.

Inflation and Treasury Yields' Dance

This is probably the most crucial, yet often misunderstood, connection. Mortgage rates are intrinsically linked to the 10-year U.S. Treasury yield. Think of the 10-year Treasury as a baseline risk-free investment. If investors can get a good return there, mortgages (which carry more risk) have to offer an even better return to attract capital. Mortgage lenders then add a “spread” – usually 1.5% to 2% – on top of that yield to cover their costs, risk, and profit.

What influences this 10-year yield the most? Inflation. When inflation runs hot, investors demand higher yields to compensate for the eroding purchasing power of their money. The good news here is that inflation seems to be cooling, albeit slowly. The Fed's target for core inflation is 2%, and while we've been a bit above that (forecasted at 2.1-2.4% through 2026), the general trend is downward.

If inflation continues to moderate, the 10-year Treasury yield, currently around 4.2%, is expected to fall to 4.1% by 2027, which would naturally pull mortgage rates lower. This dynamic interaction between inflation concerns and bond market reactions is something I pay very close attention to.

Economic Health and Housing Dynamics

Beyond the Fed and bonds, the overall health of the economy definitely plays a role. Strong GDP growth (around 2% is projected) generally means a healthy economy, which might allow the Fed to be less aggressive with rate cuts. However, a cooling labor market, meaning a slight uptick in unemployment or fewer job openings, could give the Fed more incentive to cut rates faster to prevent a deeper economic slowdown.

Housing supply is another angle; more homes on the market can temper price growth, making slightly higher rates more manageable. Conversely, tight supply can keep prices elevated, exacerbating affordability issues even if rates dip. It’s a delicate balancing act, and I see these factors acting more as modifiers to the primary drivers.

What the Experts and I See: Forecasting the Next Two Years

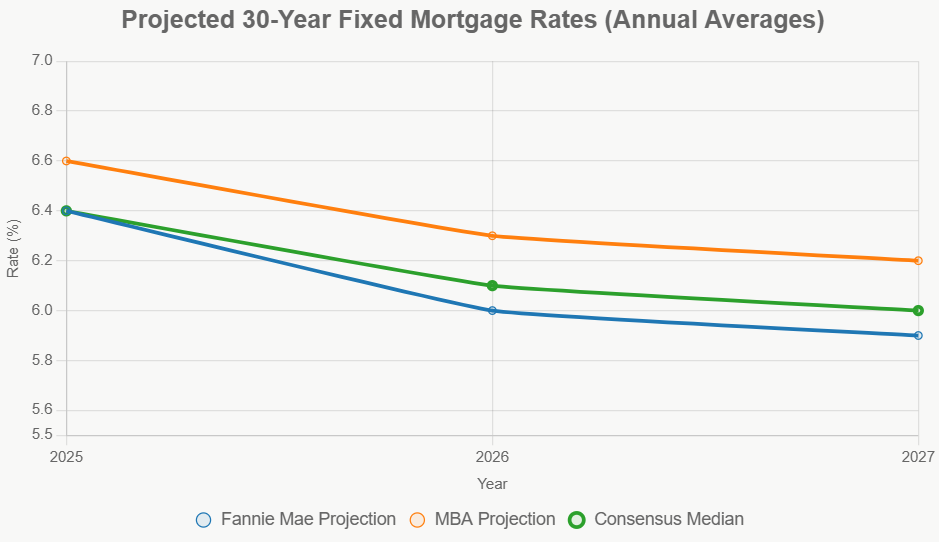

When I look at the predictions from major players like Fannie Mae and the Mortgage Bankers Association (MBA), I see a clear consensus emerging: a downward trajectory, but don't expect a free fall. Everyone seems to agree on gradual relief.

Here’s a quick summary of what the leading institutions are generally projecting for the 30-year fixed rate:

| Forecaster | 2025 Average/End | 2026 Average/End | 2027 Average/End | Key Assumptions |

|---|---|---|---|---|

| Fannie Mae | 6.4% (end) | 6.0% (avg); 5.9% (end; Q1:6.2%, Q2:6.1%, Q3:6.0%, Q4:5.9%) | 5.9% (stagnant) | Cooling inflation; 2% GDP growth |

| Mortgage Bankers Assoc. (MBA) | 6.6% (avg) | 6.3% (avg); 6.4-6.5% (end) | ~6.2% (est.) | Steady originations; low-6% range holds |

| Freddie Mac (implied) | ~6.2% (current) | 6.0-6.2% (est.) | Stable at ~6.0% | Resilient buyer activity; Treasury yield decline to 4.1% |

| Consensus Median | 6.4% | 6.1% | 6.0% |

This table really highlights the pattern for me. While the exact numbers vary slightly by a tenth or two of a percentage point, the direction is consistent. The Consensus Median provides a balanced view, suggesting we're looking at an average of 6.1% in 2026 and 6.0% in 2027.

The 2026 Outlook: A Bit of Breathing Room

For 2026, my takeaway is that we'll likely see rates trending downward, but probably staying above the 6% mark for most of the year. Fannie Mae, for example, paints a picture of a consistent descent by quarter, ending the year just under 6%. This suggests that homebuyers might find a bit more affordability by mid-year, potentially sparking an increase in home purchases and perhaps opening the door for some refinancing activity for those on the fence. It won't be a dramatic drop, but rather a gradual softening that should inject some life back into the housing market.

Stabilizing into 2027: A New Normal?

Looking out to 2027, the projections suggest a period of stability. Rates are expected to generally hold steady in the low-6% to high-5% range. Unless we hit a major recession (which isn't the base case), I don't foresee significant further declines. This stability could be a good thing for the housing market, allowing for more predictable budgeting and potentially boosting transactions. However, it's worth remembering that high home prices will likely persist, meaning even stable rates in the 6% range will continue to make homeownership a stretch for many. This could truly define a “new normal” for mortgage rates after years of extraordinary lows and highs.

What These Predictions Mean for You

These numbers aren't just abstract figures; they have real-world implications for how you might plan your next steps in the housing market.

For the Aspiring Homebuyer

If you're looking to buy, this slow and steady decline is mostly good news. A drop from, say, 6.5% to 6.0% might save you hundreds of dollars a month on a typical $400,000 loan. This increased affordability could unlock some pent-up demand, meaning more competition for homes. The MBA projects a significant jump in mortgage originations for 2026, up 7.6% from 2025, which backs up this idea. My advice? Don't wait for the absolute bottom; trying to time the market perfectly is notoriously difficult. Instead, secure your finances, get pre-approved, and consider rate locks or even seller-funded buydowns if you find the right home now.

For Current Homeowners and Potential Refinancers

For those who bought or refinanced at higher rates recently, the forecast offers a glimmer of hope. While a return to 3% is off the table, if rates dip into the high 5s, refinancing could become a viable option, particularly for adjustable-rate mortgages (ARMs) that are nearing their adjustment period. And for those with significant equity, a “cash-out” refinance could be on the horizon. Over 20 million loans from the 2020-2021 period (under 4%) are still held by homeowners, and while they might not refi, the potential for others who bought at higher rates is substantial if 5.5% becomes achievable.

For Sellers Ready to Make a Move

Sellers should also pay attention. While lower rates generally mean more buyers, the projections also anticipate a slight increase in housing inventory – perhaps +10% in 2026. More homes on the market could temper rapid price growth, but the boost in buyer demand should still make it a healthy environment to sell. The National Association of Realtors (NAR) forecasts a rebound in home sales, which is always good news for those looking to list their property.

Navigating the Unexpected: Risks and Alternative Scenarios

Even with the best models, economic forecasting is an art, not an exact science. I always advise considering different scenarios because the future is rarely linear.

- Base Case (70% Likelihood): This is what we've largely discussed – gradual Federal Reserve cuts leading to rates in the 5.9-6.3% range. The housing market sees an uptick in activity, maybe 8% higher in volume. This is the most likely path, in my professional opinion.

- Optimistic Case (20% Likelihood): What if inflation cools faster than expected, or a mild, short-lived recession prompts more aggressive Fed action? We could see rates plunge below 5.5% by late 2027. This would significantly boost sales, potentially by 15%, making a much more favorable environment for buyers. However, the signs for this scenario aren't currently dominant.

- Pessimistic Case (10% Likelihood): On the flip side, persistent, “sticky” inflation could force the Fed to hold rates higher for longer or even to resume rate hikes if economic data takes an unexpected turn. In this scenario, rates could stay stubbornly at 6.5% or even higher, delaying any significant housing market recovery and further straining affordability. Geopolitical events or supply chain shocks could also push us into this uncomfortable territory.

Final Thoughts: Patience, Preparation, and Perspective

The journey of mortgage rates over the next two years promises to be a nuanced one, characterized by a slow, measured descent rather than a sharp plunge. As someone who has watched these markets for years, my strong belief is that patience and thorough preparation will be your greatest assets. We aren't returning to the pandemic lows, so resetting your expectations to a new historical norm in the low 6% to high 5% range is key. The housing market itself is resilient, and opportunities will undoubtedly emerge for those who are ready, financially sound, and well-informed.

Invest Smartly in Turnkey Rental Properties

With rates dipping to their lowest levels this year, investors are locking in financing to maximize cash flow and long-term returns.

Norada Real Estate helps you seize this rare opportunity with turnkey rental properties in strong markets—so you can build passive income while borrowing costs remain historically low.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rate Predictions for the Next 5 Years: 2026 to 2030

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?