It's a breath of fresh air for many aspiring homeowners: stable mortgage rates are starting to bring buyers back into the housing market in 2026, signaling a positive shift after a period of uncertainty. The good news is that rates have settled into a more predictable pattern, and this stability is encouraging more people to start looking for their dream homes.

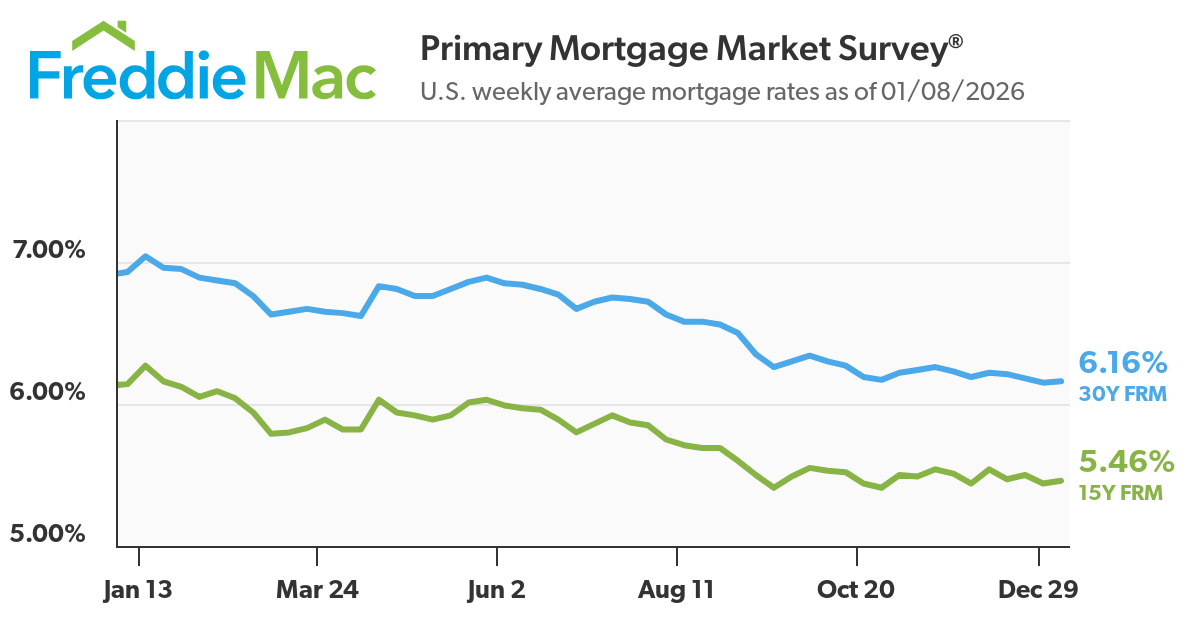

For what feels like ages, the housing market has been a bit of a rollercoaster. We saw rates skyrocket, making it tough for many to even consider buying a home. But as we've moved into 2026, things are starting to feel different. The numbers coming out from Freddie Mac's Primary Mortgage Market Survey® paint a promising picture.

Mortgage Rates Remain Stable Fueling Buyer Demand in 2026

What's Driving This Shift?

The main reason we're seeing this change is that mortgage rates have found a comfortable spot, hovering around the 6% mark. This isn't just a small dip; it's a significant drop from where we were just last year. For example, as of January 8, 2026, the 30-year fixed-rate mortgage averaged 6.16%. To put that into perspective, just a year ago, that same mortgage averaged a much higher 6.93%. That difference might not sound huge in daily talk, but over the life of a loan, it can mean tens of thousands of dollars in savings. And that’s enough to make a real difference for a family.

It's not just about the lower rates, though. We're also seeing the economy holding up pretty well. This combination of lower borrowing costs and solid economic growth is like a double shot of espresso for the housing market. It’s giving people the confidence and the means to start seriously considering a purchase.

The Numbers Don't Lie: A Look at the Data

Freddie Mac has been tracking these trends, and their data is eye-opening. In the first week of the new year, purchase applications – which are a good indicator of how many people are actively looking to buy a home – were up over 20% from this time last year. That's a significant jump and suggests that buyers who were sitting on the sidelines are now stepping back into the game.

Let's break down some of the key figures from Freddie Mac's Primary Mortgage Market Survey® for the U.S. weekly averages as of January 8, 2026:

| Mortgage Type | Average Rate (01/08/2026) | 1-Week Change | 1-Year Change | Estimated Monthly Savings (vs. 1 Yr Ago*) |

|---|---|---|---|---|

| 30-Yr Fixed FRM | 6.16% | +0.01% | -0.77% | Significant (Tens of Thousands) |

| 15-Yr Fixed FRM | 5.46% | +0.02% | -0.68% | Substantial (Thousands) |

*Note: This is a simplified illustration. Actual savings depend on loan amount and exact rate difference.

Looking at the year-over-year change is where you really see the impact. A drop of 0.77% for the 30-year fixed-rate mortgage and 0.68% for the 15-year fixed-rate mortgage means a lot more buying power for consumers. If you were looking to buy a $300,000 home, that 0.77% difference could translate to hundreds of dollars less each month. It’s like getting a bit of a discount that you didn't have before.

Market Momentum and the Return of Buyers

This stabilization of rates around the 6% mark isn't just a minor blip; it's a catalyst. It's providing the predictability that buyers crave. For a long time, there was so much uncertainty about where rates were headed. Now, seeing them stay relatively steady makes it easier for people to plan their finances and make big decisions.

I've talked to a lot of people in the real estate industry, and the general feeling is that the market is starting to breathe again. We're seeing more open houses, more inquiries, and just a general buzz of activity that we haven't felt as strongly in a while. The experts are pointing to a few key factors:

- Lower Borrowing Costs: As the numbers show, this is the most obvious driver. When your monthly mortgage payment goes down, you can afford more home or simply have more disposable income each month.

- Resilient Economic Growth: A strong economy means people are more secure in their jobs and more confident about taking on a mortgage. It’s a sign that the fundamentals are sound enough to support homeownership.

- Sidelined Buyers Returning: Many potential buyers had to put their plans on hold when rates were high. Now, with more favorable conditions, they're re-entering the market with renewed optimism.

Regional Differences and Future Outlook

While the national picture is encouraging, it's important to remember that real estate is local. We're hearing that areas in the Northeast, Midwest, and South are particularly showing improving conditions for first-time buyers. This could be due to slightly different local economic factors or housing inventory.

Looking ahead, forecasters from organizations like Fannie Mae and the Mortgage Bankers Association (MBA) are generally expecting these rates to stick around in the low 6% range for the first quarter of 2026. This suggests a period of sustained stability, which is music to the ears of anyone looking to buy.

Let's look at some expert projections for the average rate in 2026:

| Source | Projected Average Rate | Key Driver |

|---|---|---|

| Fannie Mae | 5.9% | Gradual inflation cooling |

| Bankrate | 6.1% | Balancing Fed cuts vs. inflation risk |

| Redfin | 6.3% | Avoiding recession while inflation lingers |

| Mortgage Bankers Association (MBA) | 6.4% | Expectations of a single Fed cut in 2026 |

These different projections highlight the ongoing economic dance between managing inflation and supporting growth. But the overall consensus is that rates are likely to remain in a range that's much more manageable than we've seen recently. The difference between, say, 6.1% and 6.4% might seem small, but it can impact affordability significantly.

My Take on the Market

From my perspective, this period of stable mortgage rates is a welcome development. It’s fostering a healthier balance between buyers and sellers. For years, we saw prices soar partly because of low rates and high demand, with limited supply. Now, with rates settling, we might see a more sustainable pace of price growth, which is good for the long-term health of the market.

What’s crucial for potential buyers right now is to get pre-approved for a mortgage. Knowing exactly what you can afford is the first step. Then, work with a good real estate agent who understands your local market. Don't forget to factor in all the costs of homeownership, not just the mortgage.

This is an excellent time for those who have been dreaming of buying to really explore their options. The market is responding to affordability, and that's a powerful force. It feels like the housing market is finally finding its footing, and that's something to be optimistic about.

VS

Tennessee’s balanced rental vs Texas’s larger home with lower cap rate. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Talk to a Norada investment counselor (No Obligation):

(800) 611-3060

Also Read:

- Mortgage Rates Predictions Backed by 7 Leading Experts: 2025–2026

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?