You see news headlines talking about rising inventory and slowing sales, and the ghost of 2008 starts to flicker in the back of your mind. So, the big question on everyone's lips, including mine, is: Will the California housing market crash like the Great Recession? In my opinion, while there are certainly worrying trends, a full-blown crash mirroring the severity of 2008 is unlikely, though a significant market correction is definitely on the table.

Let's dive into why I'm leaning this way. It's true, the data paints a picture that warrants a closer look.

Is the California Housing Market Heading for a Crash or Correction?

Echoes of the Past: Rising Inventory and Sluggish Sales

The numbers don't lie. We're seeing a significant jump in the number of homes available for sale in California. According to Realtor.com, active listings in April surged to a post-pandemic high, even surpassing levels seen in April 2020. What's even more striking is that this increase is more pronounced in California compared to the national average. Inventory in the Golden State is up a whopping 50% year-over-year, while the national rise is around 31%.

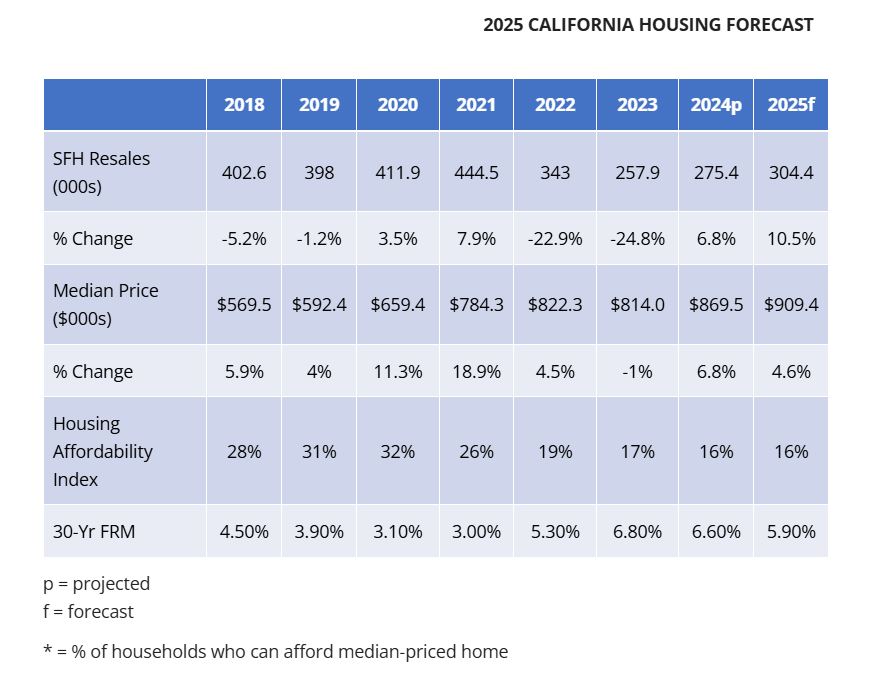

At the same time, the pace of home sales is undeniably slow. For the past several months, total sales of single-family homes and condos in California have been hovering below the lows we witnessed during the Great Recession on a 12-month rolling basis. That's a sobering statistic. Even the California Association of Realtors reported a further dip in existing home sales in March.

Why This Isn't 2008 (Yet)

While the rising inventory and slowing sales are reminiscent of the pre-crash days, there are fundamental differences that lead me to believe we won't see a repeat of the 2008 catastrophe.

- Stricter Lending Standards: This is arguably the biggest difference. Back in the mid-2000s, lending practices were… well, let's just say loose. Subprime mortgages were rampant, allowing people with shaky financial footing to take on loans they couldn't afford. When the housing market faltered, a wave of defaults and foreclosures followed, triggering a cascading effect. Today, lending standards are much tighter. Banks are far more rigorous in their approval processes, meaning the vast majority of current homeowners are more creditworthy and less likely to default.

- Stronger Economy (for now): While there are concerns about a potential recession, the underlying economy, particularly the job market, has been relatively resilient. During the lead-up to the Great Recession, we saw significant job losses, further exacerbating the foreclosure crisis. While job growth may be slowing, we aren't currently experiencing the same level of widespread unemployment.

- Different Reasons for Inventory Increase: While rising inventory can signal slowing demand, the reasons behind the current increase aren't solely negative. Some of it is simply the market normalizing after the frantic buying frenzy during the pandemic. More sellers are entering the market, which, in a healthy market, is a good thing. The issue is that buyer demand hasn't kept pace.

The Affordability Crisis: A Major Headwind

However, to say everything is fine would be naive. California faces a significant challenge: affordability. The median home price in California is astronomically high, often more than eight times the typical household's annual income. This makes homeownership an increasingly distant dream for many, especially first-time buyers.

Rising mortgage rates over the past year have only compounded this problem, pushing monthly payments even further out of reach. As one analyst put it, “High home prices and rising mortgage rates put homeownership out of reach for many would-be buyers.” This lack of affordability is undoubtedly a major factor contributing to the slowdown in sales.

Will Prices Finally Budge?

Despite the sluggish sales, home prices in California have remained surprisingly firm. The median list price has been virtually unchanged year-over-year. This stickiness in prices has largely been attributed to a lingering supply shortage compared to pre-pandemic levels.

However, with the significant surge in inventory, I believe we are reaching a tipping point. As more homes sit on the market for longer, sellers will eventually be forced to adjust their expectations and lower their prices to attract buyers. Some experts are already predicting a slowing in home price growth, with the possibility of prices flattening or even seeing a slight decline in certain markets over the next year.

Areas of Concern: Vulnerable Markets

It's also important to note that not all parts of California are created equal. Some areas that experienced the most rapid price appreciation during the pandemic and are now seeing the biggest jump in inventory could be more vulnerable to price corrections. Reports have even identified several California counties as being among the most at-risk nationwide for a housing market downturn based on factors like affordability gaps, underwater mortgages, foreclosures, and unemployment. We need to keep a close eye on these specific regions.

My Final Thoughts: Correction, Not Catastrophe

So, to bring it all together, do I foresee a catastrophic crash in the California housing market akin to the Great Recession? No, not in the same way. The fundamental issues that triggered the 2008 crisis – widespread risky lending – are not as prevalent today.

However, I do believe we are heading towards a significant market correction. The unsustainable levels of price appreciation, coupled with the affordability crisis and rising inventory, will likely lead to price stagnation and even moderate price declines in some areas. This correction, while perhaps painful for some sellers, could ultimately be a healthy thing for the market in the long run, potentially making homeownership more accessible for a larger segment of the population.

The key difference, in my opinion, is the reason for the potential downturn. In 2008, it was a systemic collapse fueled by bad loans. Today, it's more of a market recalibration in response to affordability challenges and a cooling demand.

We need to stay vigilant, monitor the data closely, and understand the nuances of our local markets. The California housing market is complex, but by understanding the underlying factors, we can hopefully navigate this period with a realistic perspective.

Work with Norada, Your Trusted Source for

Investment Properties in the U.S.

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Related Articles:

- California Housing Market Predictions 2025

- California Housing Market Rebounds With Highest Sales in 2 Years

- The Great Recession and California's Housing Market Crash: A Retrospective

- California Housing Market Cools Down: Is it a Buyer's Market Yet?

- California Dominates Housing With 7 of Top 10 Priciest Markets

- Real Estate Forecast Next 5 Years California: Boom or Crash?

- Anaheim, California Joins Trillion-Dollar Club of Housing Markets

- California Housing Market: Nearly $174,000 Needed to Buy a Home

- Most Expensive Housing Markets in California

- Abandoned Houses for Free California: Can You Own Them?

- California Housing in High Demand: 19 Golden State Cities Sizzle

- Homes Under 50k in California: Where to Find Them?

- Will the California Housing Market Crash?

- California Housing Market Crash: Is a Correction Coming Up?