Are you feeling a bit uneasy about the housing market lately? You're not alone. For years, it felt like home prices could only go up, up, up! But whispers of a potential slowdown, or even a downturn, are getting louder. If you're a homeowner or hoping to become one, understanding where the risks are highest is crucial. So, which areas should you be watching closely?

The latest data points to California, Illinois, and pockets of Florida and the New York City metropolitan area as the regions facing the most significant risk of a major housing market downturn. Let's dive into why these states are particularly vulnerable and what it could mean for you.

4 States Facing the Major Housing Market Correction Risk

Now, before you panic and start picturing tumbleweeds rolling down your street, it's important to understand what “housing market downturn or correction risk” actually means. It's not necessarily about prices crashing overnight everywhere. It's more nuanced than that. Think of it like this: certain areas have built up imbalances in their housing markets, making them more susceptible to shifts in the economic winds. These imbalances can show up in a few key ways:

- Unaffordable Homes: When house prices rise much faster than wages, it becomes harder and harder for people to afford to buy. This strains the market, as fewer buyers can enter, leading to potential price stagnation or declines.

- Underwater Mortgages: This happens when homeowners owe more on their mortgage than their house is actually worth. If prices drop, more people can find themselves in this situation, which can trigger foreclosures as people walk away from homes they can no longer afford and are worth less than their debt.

- Foreclosures on the Rise: An increase in foreclosures is a sign of distress in the housing market. It can indicate that people are struggling to make payments, often due to job losses, high housing costs, or other financial pressures. Foreclosures add supply to the market, which can further push prices down.

- Unemployment Spikes: Job losses directly impact housing. When people lose their jobs, they may struggle to pay their mortgages, leading to more foreclosures and less demand for housing overall.

Looking at these factors, recent data from ATTOM, a property data and analytics firm, sheds light on which areas are showing these warning signs most prominently. And honestly, as someone who's been observing real estate trends for a while, these findings aren't entirely surprising, but they are definitely concerning for specific regions.

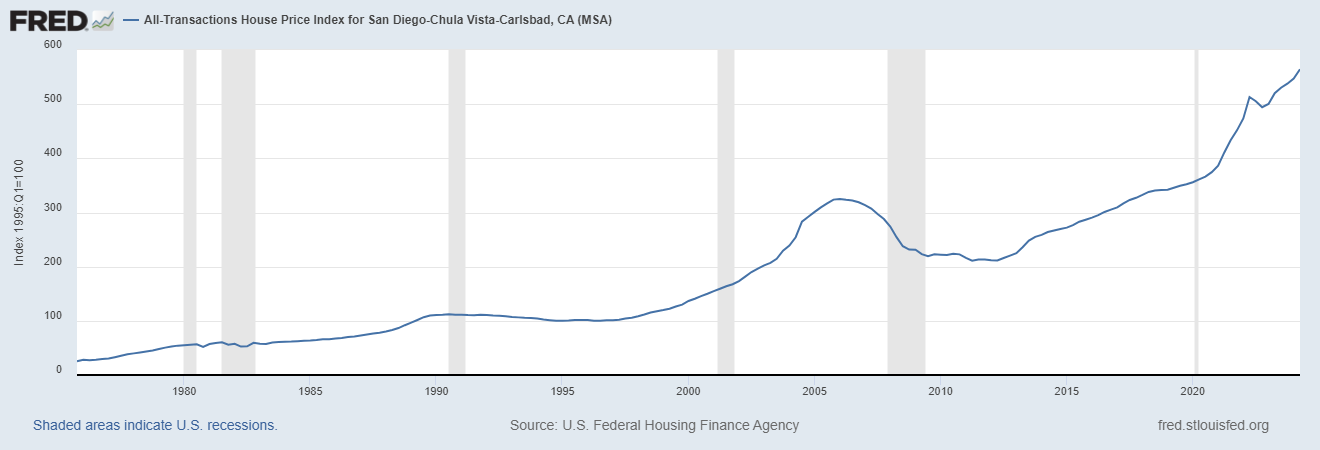

California: The Golden State's Housing Market Facing a Reality Check?

California, the land of sunshine and dreams, has long been synonymous with sky-high housing costs. For years, it seemed like prices could defy gravity. However, the latest data suggests that the Golden State might be losing some of its luster, at least in certain housing markets. A significant chunk of the counties deemed most at-risk nationwide are located in California – 14 out of the top 50, to be exact! And it's not just limited to one area; the risk is spread across different parts of the state:

- Inland California Hotspots: Places like Butte County (Chico), El Dorado County (outside Sacramento), Shasta County (Redding), and counties in the Central Valley like Fresno, Kern, Kings, Madera, San Joaquin, and Stanislaus are raising red flags. These are areas that have seen price growth, but perhaps without the underlying economic strength to sustain it.

- Why Inland California is Vulnerable: Think about it – coastal California has always been expensive, but the pandemic boom sent prices soaring in more affordable inland areas too. People fled crowded cities seeking space and cheaper living. But have wages in these inland areas kept pace with these massive housing price increases? Not really. This has led to a serious affordability crunch. Add to that the potential for job losses in certain sectors, and you have a recipe for a potential downturn. Furthermore, some of these inland markets saw rapid price appreciation during the boom, making them potentially more susceptible to a correction as the market cools.

- Southern California Concerns: Even Southern California isn't immune. Riverside and San Bernardino counties, often considered relatively more affordable compared to coastal LA or San Diego, are also on the high-risk list. This shows that affordability is becoming a statewide issue.

Let's look at some hard numbers from the report to understand why California is in this position:

| Risk Factor | California High-Risk Counties (Examples) | National Average |

|---|---|---|

| Unaffordability | Extremely High (e.g., Riverside County 70.4% of wages for homeownership costs) | 34% |

| Foreclosure Rates | Elevated (e.g., Madera County 1 in 631 properties) | 1 in 1,671 |

| Unemployment Rates | Higher than Average (e.g., Kern County 7.9%) | 4.2% |

These numbers paint a clear picture. California's high-risk markets are struggling with affordability, facing higher foreclosure rates and unemployment compared to the national average. This combination makes them particularly vulnerable if economic conditions worsen or if buyer demand cools off.

Illinois: Chicago and Its Suburbs Under Pressure

Illinois, and specifically the Chicago metropolitan area, is another region flashing warning signs. The report highlights five counties in and around Chicago as being at high risk: Cook, Kane, Kendall, McHenry, and Will counties. This isn't just about the city itself, but also the surrounding suburban areas.

- Chicago's Challenges: Chicago has faced a complex set of economic and demographic challenges in recent years. Population decline, high property taxes, and concerns about the state's financial health have weighed on the housing market. While there are still desirable neighborhoods and strong economic sectors, the overall picture is more mixed than in some other major metros.

- Suburban Strain: The inclusion of suburban counties like Kane, Kendall, McHenry, and Will suggests that the affordability issues and economic headwinds are spreading beyond the city limits. These areas, while once considered more affordable alternatives to Chicago, may now be feeling the pinch as well.

Here's a glimpse at how Illinois' high-risk counties compare:

| Risk Factor | Illinois High-Risk Counties (Examples) | National Average |

|---|---|---|

| Unaffordability | Elevated (Though not as extreme as California) | 34% |

| Foreclosure Rates | Elevated (Though not as extreme as some other areas) | 1 in 1,671 |

| Unemployment Rates | Around National Average or Slightly Higher | 4.2% |

While Illinois might not have the same extreme unaffordability as California, the combination of economic uncertainty, high property taxes, and potentially softening demand makes the Chicago area a region to watch closely.

Recommended Read:

Housing Market Predictions for the Next 4 Years Under Trump

Fannie Mae Lowers Housing Market Forecast and Projections for 2025

Housing Market Forecast 2025 by JP Morgan Research

Housing Predictions 2025 by Warren Buffett's Berkshire Hathaway

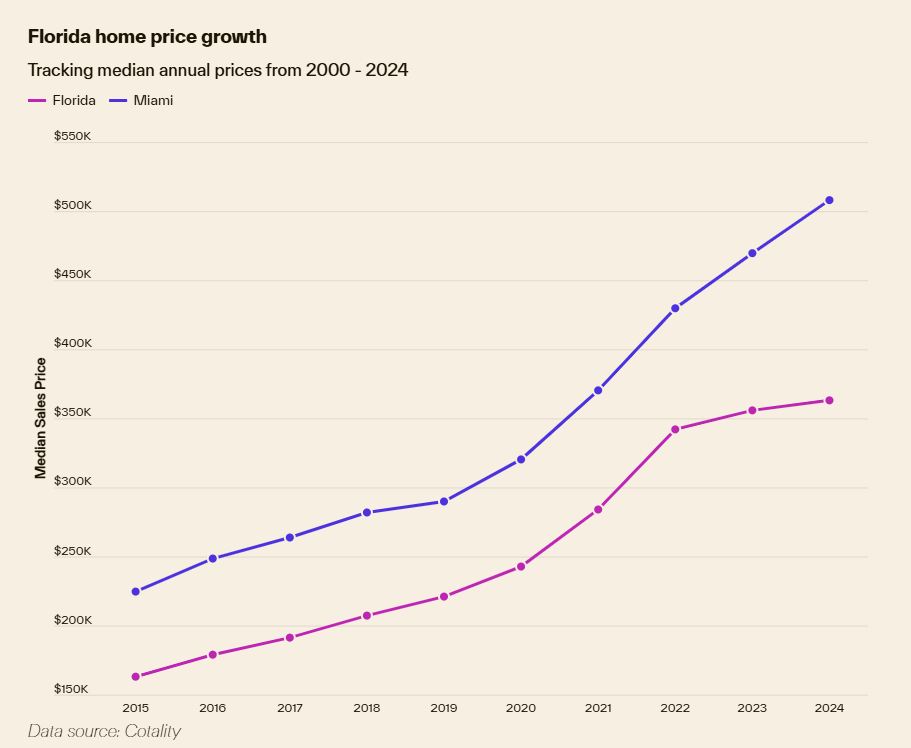

Florida and the New York City Metro Area: Two Coasts, Shared Vulnerabilities

Florida and the New York City metropolitan area might seem worlds apart, but the report flags them both as having concentrations of high-risk housing markets. This underscores that housing market vulnerabilities are not geographically limited.

- Florida's Mixed Bag: Seven counties in Florida are identified as high-risk, including Charlotte, Hernando, Lake, Marion, Pasco, Polk, and St. Lucie counties. These are spread across different parts of the state, suggesting the risks are not isolated to one particular area.

- Florida's Rapid Growth and Potential Overbuilding: Florida has been a magnet for people relocating from other states, drawn by warmer weather, lower taxes, and a perceived lower cost of living (compared to some Northeastern states, at least). This influx of people fueled a massive housing boom. However, rapid growth can sometimes lead to overbuilding. If demand cools off, areas that have seen a surge in new construction could face increased competition and potential price adjustments. Furthermore, certain parts of Florida are more exposed to risks like rising insurance costs due to climate change, which could also impact housing affordability and demand.

- New York City Metro Area's Persistent Unaffordability: The New York City metro area, including Kings (Brooklyn) and Richmond (Staten Island) counties in NYC itself, and Essex and Passaic counties in northern New Jersey, remains one of the most expensive housing markets in the country. While demand is typically strong in this region, the extreme level of unaffordability is a major concern.

- NYC Metro Affordability Crisis: Consider this: in Kings County (Brooklyn), a staggering 106.5% of average local wages is needed to cover major homeownership costs! In Richmond County (Staten Island), it's still a hefty 67.6%. This is simply unsustainable for many people. Even slight economic headwinds or interest rate increases could push this already stretched market to its limits.

Here's how Florida and NYC Metro compare on key risk factors:

| Risk Factor | Florida/NYC Metro High-Risk Counties (Examples) | National Average |

|---|---|---|

| Unaffordability | Extreme in NYC, Elevated in Florida (e.g., Kings County 106.5%, Riverside 70.4%) | 34% |

| Underwater Mortgages | Elevated in Florida (e.g., Pasco County 15.8%) | 5.7% |

| Foreclosure Rates | Elevated in Florida (e.g., Charlotte County 1 in 198) | 1 in 1,671 |

| Unemployment Rates | Around National Average or Slightly Higher | 4.2% |

Florida's vulnerability seems to stem more from potential overbuilding and elevated underwater mortgages and foreclosures in certain areas, while the NYC metro's risk is primarily driven by extreme unaffordability. Both represent different types of pressure on the housing market.

It's Not All Doom and Gloom: Where the Housing Market is Holding Strong

Now, before you get too worried, it's essential to remember that the housing market is incredibly localized. While some areas are facing higher risks, many parts of the country are considered much less vulnerable. The report highlights counties in the Midwest, Northeast, and South as being relatively stable. States like Wisconsin, Virginia, Tennessee, and Pennsylvania are even pinpointed as having a significant concentration of the least at-risk markets.

- Midwest Stability: Wisconsin, in particular, stands out with eight counties on the least-at-risk list. This suggests that the Midwest, often characterized by more moderate price appreciation and steadier economies, is proving to be a bedrock of stability in the current housing market.

- Southern Strength: States like Tennessee and Virginia, especially around areas like Nashville and Richmond, are also showing resilience. These regions often benefit from growing economies, in-migration, and more balanced housing markets.

These less vulnerable areas generally exhibit healthier market metrics:

| Risk Factor | Least At-Risk Counties (Examples – Wisconsin, Virginia, Tennessee, Pennsylvania) | National Average |

|---|---|---|

| Unaffordability | Lower (e.g., Monongalia County, WV 23.8% of wages) | 34% |

| Underwater Mortgages | Very Low (e.g., Chittenden County, VT 0.9%) | 5.7% |

| Foreclosure Rates | Extremely Low (e.g., Cumberland County, PA 1 in 36,385 properties) | 1 in 1,671 |

| Unemployment Rates | Below National Average (e.g., Chittenden County, VT 2.1%) | 4.2% |

These figures demonstrate the stark contrast between the high-risk and low-risk areas. The less vulnerable markets are characterized by better affordability, fewer underwater mortgages, lower foreclosure rates, and lower unemployment – all signs of a healthier and more sustainable housing market.

What Does This Mean for You? Navigating the Uncertain Housing Landscape

So, what should you take away from all this?

- Location, Location, Location Matters More Than Ever: The housing market is not a monolith. These findings reinforce that your local market conditions are paramount. If you live in or are considering moving to California, Illinois, Florida, or the NYC metro area, especially in the counties highlighted, you need to be extra cautious and do your homework.

- Don't Panic, But Be Prepared: A “high-risk” designation doesn't guarantee a crash. It simply means these areas are more susceptible to a downturn if broader economic conditions weaken or if buyer demand pulls back. If you're in a high-risk area:

- Sellers: Be realistic about pricing your home. The days of easy bidding wars might be fading in these markets.

- Buyers: Don't rush into anything. Take your time, shop around, and make sure you're comfortable with your finances, especially if interest rates remain elevated. You might have more negotiating power than you think.

- Homeowners: Review your finances. If you have an adjustable-rate mortgage, understand how rate changes could impact your payments. Consider building up your emergency savings.

- Focus on Fundamentals: Whether you're in a high-risk or low-risk market, the fundamentals still matter. Affordability, job security, and responsible borrowing are always key to navigating the housing market, regardless of the current trends.

- Keep an Eye on Local Data: National reports provide a broad overview, but for your specific area, keep track of local housing market data, news, and expert analysis. Real estate is intensely local, and trends can vary significantly even within the same state.

The housing market is always evolving, and predicting the future with certainty is impossible. However, by understanding the areas facing the greatest risks and the factors driving those risks, we can all make more informed decisions, whether we're buying, selling, or simply watching from the sidelines. For now, keeping a close eye on these 4 states – California, Illinois, and Florida (along with the NYC metro region) – seems like a smart move as we navigate this potentially shifting housing landscape.

Work with Norada in 2025, Your Trusted Source for Investment

in the Top Housing Markets of the U.S.

Discover high-quality, ready-to-rent properties designed to deliver consistent returns.

Contact us today to expand your real estate portfolio with confidence.

Contact our investment counselors (No Obligation):

(800) 611-3060

Read More:

- 3 Big US Cities on the Brink of a Housing Bubble: Crash Alert

- Housing Market Predictions for the Next 4 Years: Steady Growth

- 5 Cities Where Home Prices Are Predicted To Crash in 2025

- New Tariffs Could Trigger Housing Market Slowdown in 2025

- NAR Predicts 6% Mortgage Rates in 2025 Will Boost Housing Market

- Housing Market Forecast for the Next 2 Years: 2024-2026

- Housing Market Predictions for Next Year: Prices to Rise by 4.4%

- Housing Market Predictions for 2025 and 2026 by NAR Chief

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- 2008 Forecaster Warns: Housing Market 2024 Needs This to Survive

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?