Generally, for most conventional mortgages, a credit score of 620 or higher is considered the minimum to qualify, though scores of 700 or above offer you the best chance at competitive interest rates and terms. Understanding these typical credit score ranges for mortgage borrowers is a crucial first step in your homebuying journey, and can significantly impact how much you borrow, what you pay back over time, and even whether your loan gets approved at all. It's not just a number; it's a reflection of your financial habits, and lenders use it to gauge how risky it might be to lend you a large sum of money for your dream home.

What Are Typical Credit Score Ranges for Mortgage Borrowers?

Why Your Credit Score Matters for Mortgages

As someone who's been in the financial world for a while, I can tell you firsthand how vital a credit score is when it comes to mortgages. Think of it like this: when you apply for a loan to buy a house, you're asking a bank or lender to trust you with a massive amount of money. They need to be confident that you'll pay it back as promised. Your credit score is their primary tool for assessing that confidence.

The higher your score, the more it signals to lenders that you're a responsible borrower who pays bills on time and manages debt wisely. This translates into tangible benefits for you, like lower interest rates, which can save you tens of thousands of dollars over the life of your loan. Conversely, a lower score can mean higher interest rates, larger down payment requirements, or even denial of your loan application altogether. It’s a direct reflection of your financial health, and it plays a starring role in whether you can unlock the door to homeownership.

Understanding the Credit Score Spectrum for Homebuyers

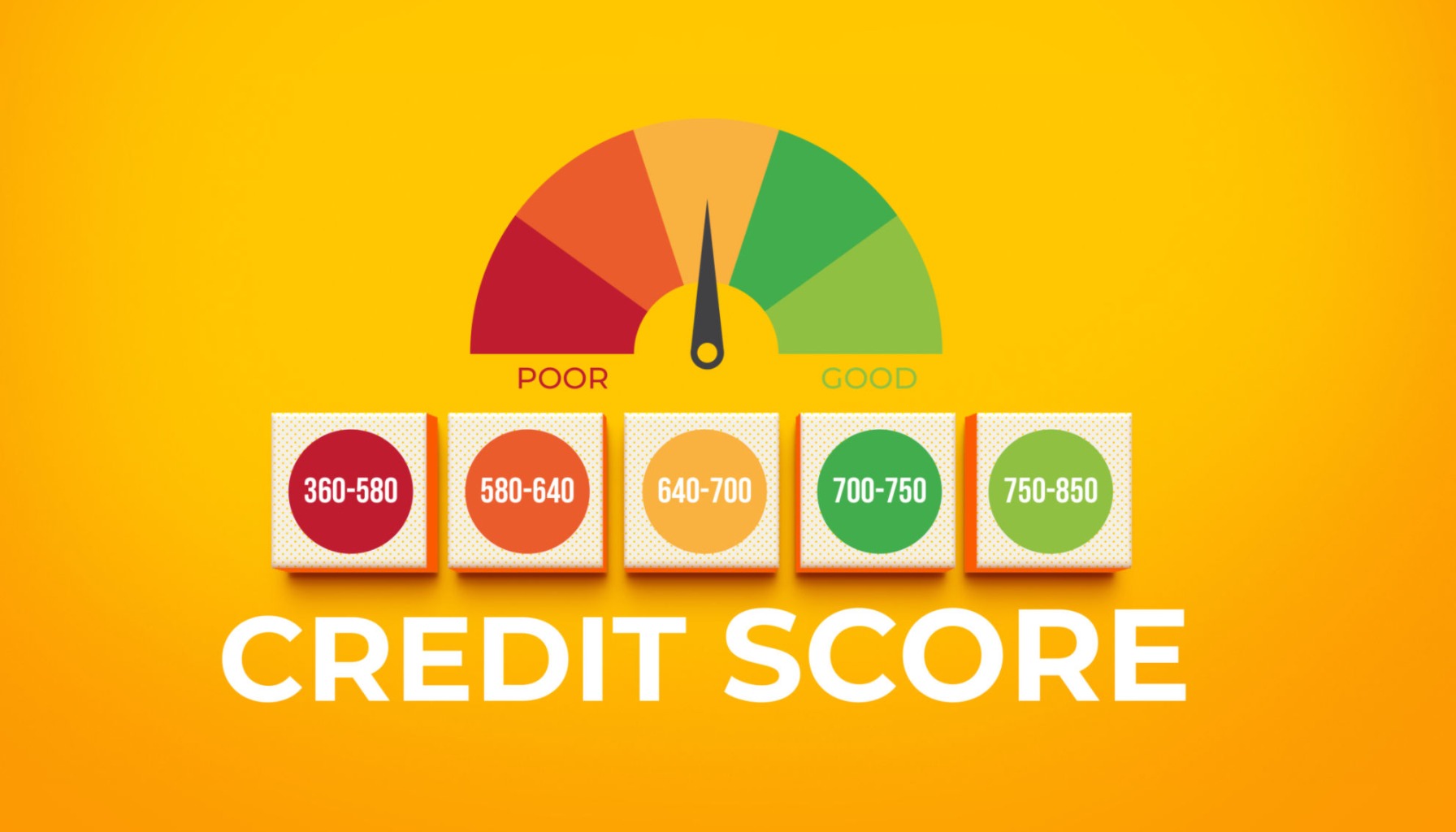

Credit scores typically range from 300 to 850, and lenders break this down into several categories to assess risk:

- Excellent Credit (740+): If your score falls into this range, you're practically a dream borrower in the eyes of lenders. You’ll likely qualify for the lowest interest rates and the most flexible loan terms. Lenders are eager to work with you because you represent the least risk.

- Very Good Credit (670-739): This is a strong range to be in. You'll still get access to very competitive interest rates and favorable loan conditions. You’re showing lenders you have a solid track record of financial responsibility.

- Good Credit (580-669): This is often considered the “average” range. While you can still qualify for a mortgage, the interest rates you're offered might be higher than those with excellent or very good credit. Some loan programs, like FHA loans, are specifically designed to help borrowers in this range.

- Fair/Poor Credit (Below 580): Borrowers in this category face more challenges. Qualifying for a conventional mortgage can be difficult, and if you do qualify, you'll likely see significantly higher interest rates and potentially need a larger down payment or a co-signer. Government-backed loans (like FHA) are often the path to homeownership for those in this bracket.

Minimum Credit Score Requirements: It's Not One-Size-Fits-All

It’s important to remember that there isn't a single, universal credit score requirement for all mortgages. Different loan types have different thresholds, and even within those types, individual lenders might have their own overlays or stricter standards.

Conventional Mortgages

For mortgages that aren't backed by the government (these are called conventional loans), the general guideline is that you'll need a credit score of 620 or higher. However, this is just the minimum threshold.

- Scores between 620-669: You might be approved, but expect higher interest rates and potentially a requirement for a larger down payment. You might also need to go through more rigorous underwriting.

- Scores from 670 upwards: As your score increases, you'll start seeing better interest rates and more favorable loan terms. Reaching the 700+ mark is often where you'll find the most competitive offers. According to my experience, many lenders look at 740 and above as the ‘gold standard’ for the absolute best rates and terms.

FHA Loans

The Federal Housing Administration (FHA) insures loans made by private lenders. This makes them a great option for borrowers who might not have perfect credit.

- Scores from 580-619: FHA loans often allow for a down payment as low as 3.5% for borrowers in this credit score range.

- Scores below 580: If your score is below 580 but still above 500, you might still qualify for an FHA loan, but the down payment requirement will be higher, typically 10%.

- Scores below 500: Unfortunately, most lenders will not offer FHA loans to borrowers with scores below 500.

FHA loans are fantastic for opening the door to homeownership for many, but it's worth noting that they come with mortgage insurance premiums (MIP), which are paid for the life of the loan if your down payment is less than 10%.

VA Loans

For eligible veterans, active-duty military personnel, and surviving spouses, VA loans offer incredible benefits. These loans are guaranteed by the U.S. Department of Veterans Affairs.

- No Minimum Credit Score (Officially): The VA itself doesn't set a minimum credit score requirement. However, most lenders who offer VA loans do have their own overlays, often requiring a score of 620 or higher. Some lenders might go lower, but it's less common. The great thing about VA loans is that if you have a lower credit score but a strong overall financial profile (stable income, no recent major credit issues), you might still have a good chance.

USDA Loans

These loans are for eligible rural and suburban homebuyers. They are guaranteed by the U.S. Department of Agriculture.

- No Official Minimum Credit Score: Similar to VA loans, the USDA doesn't set a hard minimum. However, lenders typically look for scores of 640 or higher for streamlined processing. For scores below 640, lenders will often perform a more thorough review of your financial history, similar to how they'd treat an FHA loan applicant.

Beyond the Score: What Else Lenders Consider

While your credit score is a huge piece of the puzzle, it's not the only thing lenders look at. In my experience, a well-rounded application can sometimes help compensate for a slightly lower score. They want to see a complete picture of your financial stability.

- Debt-to-Income Ratio (DTI): This is a crucial metric. It compares how much you owe each month on debts (like car payments, student loans, credit cards) to your gross monthly income. A lower DTI shows you can comfortably handle mortgage payments. Lenders generally prefer a DTI of 43% or less, though some loan programs allow for higher.

- Employment History and Income Stability: Lenders want to see a consistent and reliable income. They'll usually ask for at least two years of employment history and proof of your income through pay stubs and tax returns.

- Down Payment: While some loans (like FHA and VA) allow for very low down payments, having a larger down payment can offset some risk for lenders, especially if your credit score is on the lower side. It shows you have skin in the game.

- Assets and Reserves: Lenders like to see that you have some savings or assets left over after closing, which can help you cover unexpected expenses. This is often referred to as having “reserves.”

Strategies to Improve Your Credit Score for a Mortgage

If you're looking at your credit score and thinking, “I need to do better,” don't despair! There are actionable steps you can take to boost it. This is where patience and consistent effort really pay off.

- Pay Bills On Time, Every Time: Payment history makes up the largest portion of your credit score. Even one late payment can significantly ding your score. Set up automatic payments or reminders to ensure you never miss a due date.

- Reduce Credit Card Balances: Credit utilization – how much credit you're using compared to your total available credit – is the second-biggest score factor. Aim to keep your utilization below 30%, and ideally below 10%, on each card and overall.

- Don't Close Old Credit Accounts: Closing an old account can lower your average age of accounts and increase your credit utilization ratio, both of which can hurt your score.

- Check Your Credit Reports for Errors: You're entitled to a free credit report from each of the three major bureaus (Equifax, Experian, and TransUnion) annually. Review them carefully for any inaccuracies and dispute them immediately. Mistakes can happen and cost you a higher interest rate if not corrected.

- Avoid Opening New Credit Accounts Unnecessarily: While it might be tempting to open new cards for rewards or discounts, doing so before a mortgage application can result in hard inquiries that temporarily lower your score. Wait until after your mortgage is funded.

- Consider a Secured Credit Card or Credit-Builder Loan: If you have a very limited credit history, these tools can help you build positive credit over time. They require a deposit or collateral, which the lender then uses to report your payment activity.

My Personal Take: It's About More Than Just the Number

From where I stand, a credit score is certainly a fundamental piece of the mortgage puzzle, but it’s not the whole picture. I’ve seen borrowers with scores in the mid-600s, who were meticulous about their DTI, had a stable job history, and were putting down a substantial down payment, get approved for excellent loans. Conversely, sometimes a borrower with a score in the low 700s but a high DTI might face more scrutiny.

Therefore, my advice is this: know your score, understand where you stand with different loan types, but also focus on building a strong overall financial profile. Lenders want to see reliability and stability. They want to be reassured that you can handle the long-term commitment of a mortgage. So, while chasing that higher credit score is undeniably important, don't neglect the other crucial financial habits that make you a low-risk, desirable borrower.

Credit Scores Matter—Here’s How to Qualify for Better Mortgage Terms

Most mortgage lenders favor borrowers with scores above 700, but turnkey rental investors can still qualify with mid-600s—especially when leveraging strong income, low debt, and strategic financing.

Norada Real Estate helps you navigate credit score thresholds and financing options—so you can invest in cash-flowing properties without letting your credit score hold you back.

🔥 HOT NEW LISTINGS JUST ADDED! 🔥

Talk to a Norada investment counselor today (No Obligation):

(800) 611-3060

Read More:

- FHA Mortgage Rates by Credit Score: 620, 700, 580, 640

- Does Wells Fargo Offer Home Loans with a 500 Credit Score?

- First Time Home Buyer Loans with Bad Credit and Zero Down

- Who Qualifies for Kamala Harris' $25,000 Homebuyer Program?

- Biden Administration's Bold Move for Affordable Housing Plan

- Biden's Student Debt Relief Plan: A Beacon of Hope for Borrowers

- What Credit Score Do You Need to Buy House With No Money Down?

- How Long Does It Take to Get a 700-800 Credit Score?

- How To Improve Your FICO Credit Score: A Guide

- FHA Credit Score Requirements for Homeownership

- 10 Proven Methods to Elevate Your FICO Credit Score

- Mortgages for Low Credit Scores: Your Complete Guide