Big news for anyone dreaming of homeownership or looking to save on their existing mortgage: the 30-year fixed mortgage rate has seen a significant drop, plummeting by 84 basis points compared to this time last year. This substantial decrease, bringing the average rate down to 6.01% as of February 19, 2026, marks a crucial turning point, making homeownership more attainable and existing mortgages more affordable. Compared to last week, the 30‑year fixed rate is also lower, slipping by eight basis points.

30-Year Fixed Mortgage Rate Drops Steeply by 84 Basis Points

For years, rising rates have been a major hurdle for so many people. But now, with this steep decline, things are starting to feel more manageable. It's not just about buying a new home, either; it's a huge win for homeowners looking to refinance and shave thousands off their yearly payments. This move by Freddie Mac is definitely something to pay attention to.

Understanding the Drop: What's Behind This Big Shift?

A drop of 84 basis points isn't just a small tweak; it's a significant move. This means that for a typical borrower, their interest costs over the life of the loan could be thousands of dollars less. The average rate for a 30-year fixed mortgage is now 6.01%, down from 6.09% last week and a much more significant drop from the 6.85% seen a year ago.

Several factors have converged to create this more favorable environment. One of the biggest drivers has been the falling yield on 10-year Treasury bonds. Think of these bonds as a benchmark for interest rates across the economy, including mortgages. When their yields go down, mortgage rates often follow suit.

What's caused those Treasury yields to dip? Well, a cooler-than-expected inflation report in January certainly played a role. When inflation is under control, it signals to the Federal Reserve that it might not need to keep interest rates as high. On top of that, global uncertainties and geopolitical tensions have pushed investors into safer assets like bonds, which also helps drive down yields.

A Closer Look at the Numbers: What This Means for You

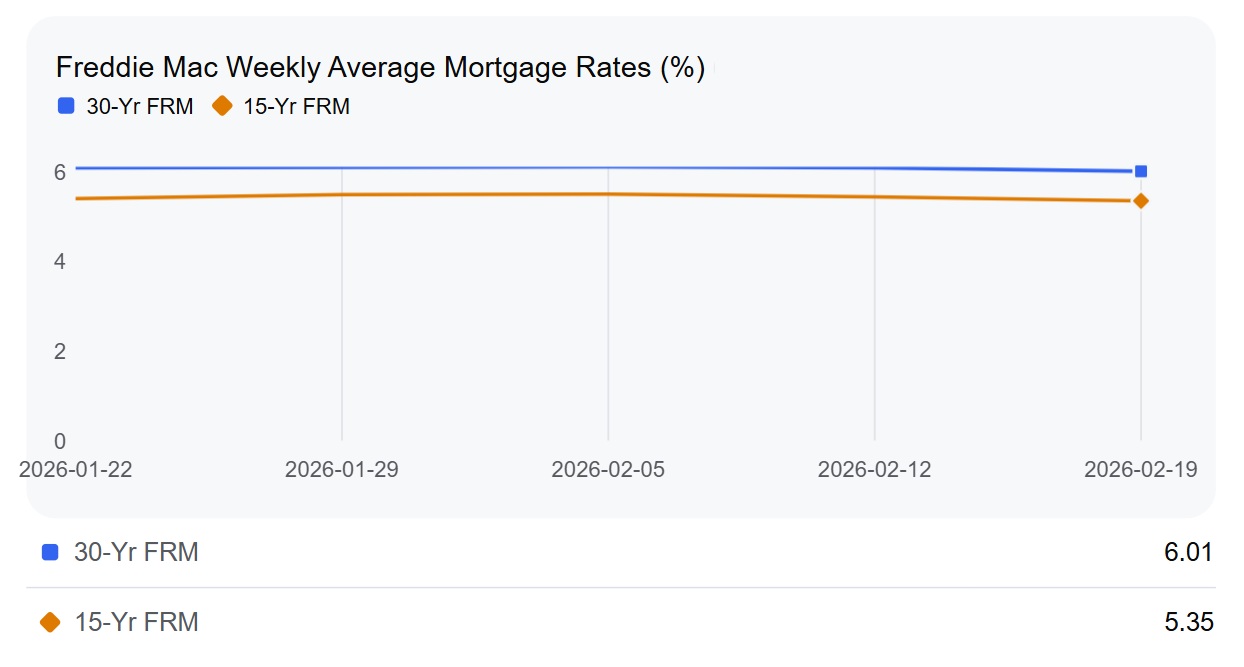

To really grasp the impact of this change, let's break down the numbers from Freddie Mac's Primary Mortgage Market Survey®.

| Mortgage Type | Average Rate (02/19/2026) | 1-Week Change | 1-Year Change | Monthly Average | 52-Week Average | 52-Week Range |

|---|---|---|---|---|---|---|

| 30-Yr Fixed FRM | 6.01% | -0.08% | -0.84% | 6.08% | 6.48% | 6.01% – 6.89% |

| 15-Yr Fixed FRM | 5.35% | -0.09% | -0.69% | 5.45% | 5.68% | 5.35% – 6.03% |

As you can see, the 30-year fixed-rate mortgage (FRM) is down a significant 0.84% from a year ago. The 15-year fixed-rate mortgage has also seen a nice drop, now averaging 5.35%, down from 5.44% last week and 6.04% a year ago.

Beyond the Rate: The Ripple Effect on Homeowners

This isn't just about a lower number on paper. This lower rate environment is having a tangible impact. Freddie Mac reports that refinance application activity has more than doubled over the past year. This means a lot of people who secured mortgages when rates were higher are now taking advantage of the current situation to lower their monthly payments.

Imagine a homeowner with a $300,000 mortgage. A drop from 6.85% to 6.01% could save them hundreds of dollars each month. Over the 30-year life of the loan, that's tens of thousands of dollars in savings! This frees up money that can be used for other important things, whether it's saving for retirement, investing, or simply improving their quality of life.

For prospective homebuyers, this is a welcome change. It directly improves affordability. When mortgage rates decrease, the monthly payment for the same loan amount goes down. This can allow buyers to qualify for larger loans or afford homes they might have previously been priced out of.

The Spring Outlook: A “Thawed” Housing Market?

Economists are viewing this trend as a very positive sign for the upcoming spring homebuying season. Often, when rates are high, many homeowners with existing low-rate mortgages are reluctant to sell, fearing they'll have to buy a new home at a much higher interest rate. This phenomenon is sometimes called the “rate-lock” effect, and it can limit the supply of homes on the market.

With rates dipping below the 6% mark, we might see some of that inventory “thaw.” Homeowners who have been on the fence about selling might feel more comfortable putting their homes on the market, knowing that potential buyers have better financing options. This could lead to a more balanced market, which is good news for everyone involved.

Expert Insights: What's Next for Mortgage Rates?

While this current decline is fantastic news, it's important to have realistic expectations. Freddie Mac's Chief Economist, Sam Khater, has indicated that while rates have reached a three-year low they may not see dramatic further drops. His economic outlook for 2026 suggests rates are likely to stay within a narrow range, perhaps hovering around or just below the 6% mark for a good portion of the year.

Several factors are keeping a lid on further steep declines. The labor market remains surprisingly resilient, which can be a double-edged sword. A strong economy is good, but it also gives the Federal Reserve less incentive to aggressively cut interest rates to stimulate growth. The Fed's approach to rate cuts is still cautious, and they'll be watching economic data closely.

From my perspective, this means that while we've seen a significant positive shift, jumping on a refinance or a home purchase sooner rather than later might be a good idea if you find a rate that works for your financial goals. Waiting for rates to plummet further might not align with the economic forecasts.

Final Thoughts

Think back to this time last year. Mortgage rates were much higher, making affordability a challenge for buyers and homeowners alike. Fast forward to today, and the picture looks far brighter. The 84 basis point drop in the 30‑year fixed rate has opened the door to lower monthly payments, greater purchasing power, and real long‑term savings.

For first‑time buyers, this shift means opportunities that may have felt out of reach just a year ago. For homeowners, it’s a chance to refinance and cut costs significantly. The difference from last year is clear—today’s market is offering a far more favorable environment, and it’s the right time to take advantage.

VS

Alabama’s new build with solid cash flow vs Texas’s established A‑rated rental. Which fits YOUR investment strategy?

We have much more inventory available than what you see on our website – Let us know about your requirement.

📈 Choose Your Winner & Contact Us Today!

Speak to a Norada Investment Counselor (No Obligation):

(800) 611-3060

Mortgage rates remain high in 2026, but rental properties continue to deliver strong cash flow and appreciation. Savvy investors know that turnkey real estate is the path to passive income and long‑term wealth.

Norada Real Estate helps you secure turnkey rental properties designed for immediate cash flow and appreciation—so you can invest smartly regardless of interest rate trends.

Also Read:

- How to Get the Lowest 30-Year Fixed Mortgage Rate in 2026?

- How to Get a 4% Interest Rate on a Mortgage in 2026?

- What Leading Housing Experts Predict for Mortgage Rates in 2026

- Mortgage Rate Predictions for 2026: What Leading Forecasters Expect

- Mortgage Rate Predictions for the Next 3 Years: 2026, 2027, 2028

- 30-Year Fixed Mortgage Rate Forecast for the Next 5 Years

- 15-Year Fixed Mortgage Rate Predictions for Next 5 Years: 2025-2029

- Will Mortgage Rates Ever Be 3% Again in the Future?

- Mortgage Rates Predictions for Next 2 Years

- Mortgage Rate Predictions for Next 5 Years

- Mortgage Rate Predictions: Why 2% and 3% Rates are Out of Reach

- How Lower Mortgage Rates Can Save You Thousands?

- How to Get a Low Mortgage Interest Rate?

- Will Mortgage Rates Ever Be 4% Again?