The housing market has been on an upward trajectory in recent years. However, rising interest rates, slowing sales, and slower home price rises indicate a cooling-off phase of the housing market.

Is the Housing Market Cooling Off in 2024?

The year 2023 witnessed a whirlwind in the housing market. Soaring prices fuelled by relentless demand and persistent inventory shortages left buyers baffled and hopeful for a reprieve. Now, as we tiptoe into 2024, whispers of a “cooling market” swirl in the air. But is this more than just wishful thinking?

The Rise and Fall of Mortgage Rates:

- 2023 saw historically high mortgage rates, effectively slamming the brakes on the red-hot housing market.

- As the Federal Reserve navigates inflation, recent cuts in interest rates offer a glimmer of hope for affordability.

- Experts predict a “seesaw” effect, with rates potentially increasing again later in the year, influencing overall market dynamics.

The Inventory Conundrum:

- The chronic lack of available homes continues to be a bottleneck, preventing a free-fall in prices.

- However, recent data suggests a slight uptick in new listings, potentially easing the pressure on demand.

- This, coupled with slower sales due to higher mortgage rates, could create a more balanced market in the long run.

Buyer Sentiment: From FOMO to Cautious Optimism:

- The euphoria of 2023 has given way to a more cautious approach among buyers.

- Affordability concerns and economic uncertainty are making buyers think twice before jumping into the fray.

- This shift in sentiment could lead to longer selling times and potentially, price adjustments in certain segments.

A Tale of Two Markets:

- The national narrative masks regional variations.

- Hot markets, particularly in coastal areas, might experience a gradual slowdown, while others could see modest price appreciation.

- Factors like job markets, local economies, and housing stock composition will play a key role in shaping individual market trajectories.

The Crystal Ball Remains Cloudy:

- Predicting the future of the housing market is an inherently tricky business.

- Geopolitical factors, unforeseen economic shocks, and policy changes can all throw a wrench into the best-laid plans.

- While a 2023-style frenzy seems unlikely, a controlled deceleration with modest price adjustments appears more probable.

Beyond the Headlines: What it Means for You:

- For buyers: Patience and research will be key. Be prepared to negotiate and wait for the right property.

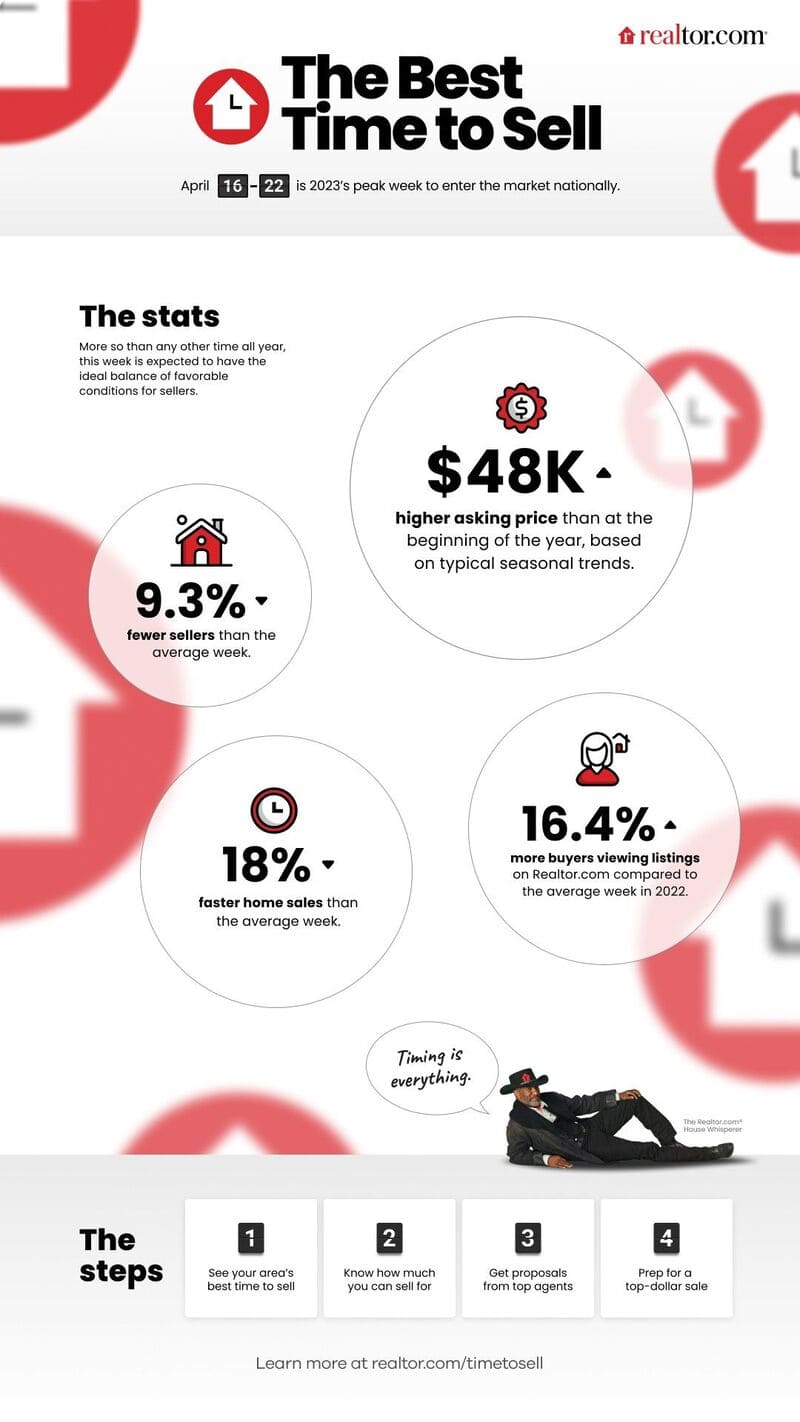

- For sellers: Pricing your home realistically and being flexible on negotiation terms might attract buyers in a shifting market.

- For investors: A wait-and-see approach might be prudent, with careful evaluation of specific regions and property types.

Strong Housing Markets to Watch in 2024

NAR Chief Economist Lawrence Yun, along with other leading housing analysts, shared insights during NAR's virtual Real Estate Forecast Summit. The consensus is that 2024 holds promise for a rebound in existing-home sales.

Mortgage rates, having peaked, are expected to decline from their recent high of nearly 8%. NAR predicts the 30-year fixed-rate mortgage to average 6.3% in 2024, while realtor.com® projects 6.5%. This shift is anticipated to enhance housing affordability, enticing more home buyers to re-enter the market.

NAR projects a significant 13.5% increase in existing-home sales and an impressive 19% potential rise in new-home sales by the end of the upcoming year. Despite a 5% increase in new-home sales this year, defying market trends, the real estate market appears poised for a positive shift.

Markets to Watch in 2024

Job growth is identified as a key determinant for long-term housing demand, and NAR has evaluated 100 of the largest U.S. metro areas to identify markets with the most potential. According to NAR, the following markets have the most pent-up housing demand for 2024:

- Austin-Round Rock-Georgetown, Texas

- Dallas-Fort Worth-Arlington, Texas

- Dayton-Kettering, Ohio

- Durham-Chapel Hill, N.C.

- Harrisburg-Carlisle, Pa.

- Houston-The Woodlands-Sugar Land, Texas

- Nashville-Davidson–Murfreesboro–Franklin, Tenn.

- Philadelphia-Camden-Wilmington, Pa.-N.J.-Del.-Md.

- Portland-South Portland, Maine

- Washington-Arlington-Alexandria, D.C.-Va.-Md.-W.V.

Inflation as a Wild Card

Danielle Hale, chief economist at realtor.com®, emphasizes optimism for the housing market in 2024 but highlights inflation as a potential disruptor. If inflation persists, it could lead to increased long-term interest rates, discouraging homeowners from selling and prolonging inventory bottlenecks. Younger generations may continue renting due to higher housing costs, impacting the overall housing market.

Despite an easing trend in overall inflation, “shelter inflation” continues to rise. The Consumer Price Index indicates a decrease to 3.1% in November, slightly above the Federal Reserve's 2% target. Lawrence Yun suggests that an oversupply of new apartment units may mitigate inflation, bringing rental rates down and potentially influencing the Fed's decisions regarding short-term rates.

Challenges and Opportunities in 2024

Despite potential improvements, the 2024 housing market is expected to remain challenging, especially for first-time buyers. Record-low inventory, reluctance among homeowners to sell, and historical underproduction by homebuilders contribute to the hurdles. However, existing homeowners stand to benefit, having accumulated substantial housing wealth over the past years. Home price appreciation, averaging 5% over the last year, has resulted in a typical homeowner gaining over $100,000 in housing wealth, according to NAR's data.

The wealth disparity between homeowners and renters remains significant, with homeowners holding an average of $396,200 in wealth compared to $10,400 for renters, as per Federal Reserve data. Lawrence Yun emphasizes the long-term wealth-building aspect for homeowners, providing a positive outlook amid the challenges of the real estate market.

The housing market in 2024 is poised for a transition. It won't be a dramatic crash, but rather a shift from breakneck speed to a more measured pace. While uncertainty lingers, understanding the underlying forces at play can help navigate these choppy waters. Remember, the decision to buy or sell is a deeply personal one, and seeking professional guidance remains crucial in securing your place in the ever-evolving landscape of the housing market.

ALSO READ:

- Housing Market Predictions for the Next 4 Years: 2024 to 2028

- Real Estate Forecast Next 5 Years: Top 5 Predictions for Future

- Is the Housing Market on the Brink in 2024: Crash or Boom?

- 2008 Forecaster Warns: Housing Market 2024 Needs This to Survive

- Housing Market Predictions for the Next 2 Years

- Real Estate Forecast Next 10 Years: Will Prices Skyrocket?

- Housing Market Predictions for Next 5 Years (2024-2028)

- Housing Market Predictions 2024: Will Real Estate Crash?

- Housing Market Predictions: 8 of Next 10 Years Poised for Gains

- Trump vs Harris: Which Candidate Holds the Key to the Housing Market (Prediction)